Monthly Flagship Smartphone Display Tracker

MonthlyThis report includes monthly panel shipment results and a rolling two-month forecast for all flexible and foldable OLED smartphones for all the major smartphone brands and models.

Read More

This report includes monthly panel shipment results and a rolling two-month forecast for all flexible and foldable OLED smartphones for all the major smartphone brands and models.

Read More

Although active matrix OLEDs have become a $40B market, they are far from a mature technology. OLEDs have significant potential for more growth and are still evolving in terms of cost and performance. In addition, now that MicroLEDs are emerging, OLEDs are under greater pressure to boost performance and lower cost and we are seeing a number of efforts in parallel to significantly improve OLED cost/performance to prevent MicroLEDs from taking share. OLEDs are also aggressively moving into new markets and are tailoring future performance and cost improvements to enter these new segments. This report will examine how OLED panel manufacturers and materials suppliers are looking to boost performance and lower cost and enter new markets, growing the OLED market to well over $50B.

Read More

This report tracks OLED and MicroLED smartwatch panel shipments by panel supplier, brand, form factor, display size, panel ASPs and panel revenues as well as forecasts for OLED and MicroLED smartwatches. In addition, it provides insight into technology and innovation trends in OLED and MicroLED display technologies, which are applicable to smartwatches. The report tracks more than 25 brands which includes Apple, Garmin, Google, Honor, Huawei, Oppo, Samsung, Vivo, Xiaomi and much more.

Read More

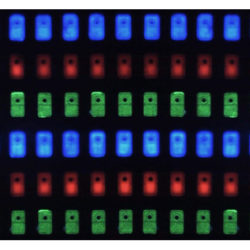

MicroLEDs have garnered a lot of interest because of the potential advantages over other flat-panel display technologies, most notably in high efficiency, high brightness, high color saturation, faster response rate, and longer lifetime. This unique combination of features would make MicroLED the superior display for many applications, ranging from super large TVs to microdisplays for use in AR/VR headsets. The ability to withstand harsh environmental conditions is also particularly attractive for the automotive industry.

Read More

This report tracks all OLED evaporation materials used in the production of AMOLED panels including Mobile/IT/TV & Other applications. it includes detailed stack diagrams for all the main configurations of AMOLED panels including White OLED/QD-OLED for TVs, RGB OLED for mobile devices, and tandem stacks for IT devices. Additionally, the report covers material suppliers and ASPs for these stack structures. OLED evaporation materials covered include small molecule and polymer emitter materials, and all common materials such as hole injection layers, hole transport layers, electron transport layers, block layers, and more. This report provides an overview of the current OLED evaporation materials market and offers insights into future trends based on this market information. It is combined with Counterpoint's deep knowledge of AMOLED capacity and panel shipments providing the industry's most accurate market size and market share results and forecasts. The report also includes a technology section that describes the main technologies behind AMOLED material performance, updates the latest developments and current technological issues. Furthermore, the report provides a scenario for the introduction of next-generation blue OLED emitters, covering the transition from fluorescent blue. In Excel format, market data for OLED evaporation materials (revenue and weight) is analyzed and simulated, providing market result and forecast data by materials, materials suppliers, panel makers, and configurations (applications and stack types) and more.

Read More

MiniLED backlights in LCDs can potentially offer numerous advantages over other flat panel display technologies, most notably in high brightness, high contrast ratio, lower power consumption than WOLED TV and higher efficiency. The superior performance makes MiniLED backlights attractive for use in a variety of applications, ranging from large TVs to IT applications. Automotive and industrial applications are also advantageously addressed by MiniLED backlight technologies due to their higher brightness and higher contrast ratio.

Read More

This quarterly report is critical for every company in the OLED supply/chain. It tracks OLED and Micro OLED fab schedules, OLED unyielded and yielded capacity, OLED demand by application and OLED supply/demand for rigid OLEDs, flexible OLEDs and OLED TVs.

Read More

Artificial intelligence (AI) semiconductors are becoming so complex and large that chip makers and packaging suppliers are turning to glass substrates. This trend could be a major boon to display makers, display equipment suppliers and display materials producers. It is also an ideal solution for under-utilized older a-Si TFT LCD fabs which could be converted or sold for this application. Advantages of glass substrates include superior flatness and better thermal and mechanical stability which will allow for higher density and higher performance chip packages to support AI. Glass substrates enable more transistors to be connected in a single package and also enable the ability to assemble larger configurations of chiplets. Organic materials used in packaging will likely reach their limit by 2030 , they consume more energy than glass and also have expansion and warpage limitations. A growing number of panel, equipment and materials suppliers have already announced programs in glass substrate packaging. TSMC announced CoWoS-R (organic interposer) for AI applications that glass substrate packaging will be adopted will be released in 2027. Intel has said it is targeting glass substrate package solutions in the second half of the decade. BOE has said they intend to start producing glass substrate packages in 2026 and JDI also mentioned they have started engaging in glass substrate packaging as an ASP (advanced semiconductor packaging) in its Q2’24 earnings call.

Read More

The Quarterly Automotive Display Shipment Report includes all the information from the Automotive Display Design Win and Specification Database, but also includes automotive display shipment data and automotive display revenues from passenger vehicles. The automotive shipment data by model comes from Counterpoint Research. This report reveals model shipment data back to Q1'23.

Read More

The Automotive Display Design Win and Specification Database, identifies the display specifications for nearly every car and truck model in the world covering the period Q1’23 to Q4’24 and is updated continuously.

Read More

This report covers the global TV market, including the most advanced TV technologies such as Mini/Micro LED, 8K LCD, QD-LCD, QD-OLED, White OLED, Rollable OLED. Utilizing a comprehensive global database, it offers historical data on shipments and revenues categorized by technology, region, brand, ASP, display size, and resolution.

Read More