Counterpoint Research

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 02/24/2025

Display Glass Revenues to Increase 14% YoY in H1 2025

-

- Display glass shipments increased 7% YoY in Q4 2024 and revenues increased 16%.

- Display glass revenues are expected to increase 14% YoY in the first half of 2025.

- Domestic Chinese glassmakers have added capacity and have gained share.

An increase in display glass prices combined with recovering demand will lead to a 14% YoY increase in display glass revenues in the first half of 2025, according to the latest update to Counterpoint Research’s Quarterly Display Glass Report, released last week. Corning continues to be the dominant supplier of display glass substrates, but its leadership on a price increase has led to some loss of market share, especially in China.

The display glass report covers all aspects of the market for this critical input for flat-panel displays. It provides a detailed review of glass capacity by glassmaker and by region, and a comprehensive view of display glass demand by panel maker, Gen size, backplane type, display technology and region. The report includes historical data by quarter from Q1 2018 to Q4 2024 and a forecast for Q1 2025 and Q2 2025.

Industry capacity for display glass decreased by 1% QoQ but increased 2% YoY in Q4 2024. Corning has shut down capacity in Japan after Sharp’s Gen 10 fab shutdown. On the other hand, domestic Chinese glass makers added Gen 8.5 capacity in 2023-2024. Capacity remains substantially higher than demand and some of it sits idle.

Glassmaker shipments of display glass decreased 2% QoQ but increased 7% YoY in Q4 2024. Shipments are expected to increase by 2% QoQ and 6% YoY in Q1 2025 and by 4% QoQ and 1% YoY in Q2 2025.

China is by far the most important region for display glass, accounting for 75% of glass demand in Q4 2024. We expect that glass demand in China will increase by 9% YoY in H1 2025 and by 5% YoY in Taiwan. Glass demand in South Korea will decrease by 13% YoY, while it will decrease in Japan by 74% due to the closure of Sharp’s Sakai Gen 10 fab. We expect that China’s share of the display glass market will reach an all-time high of 77% in Q2 2025.

Corning has been the leading supplier of display glass since the inception of the industry, but Corning’s share of display glass slipped in Q4 2024. Its shipments of display glass decreased 5% YoY in Q4 2024 whereas the total market increased by 5%. The biggest parties to gain were smaller glassmakers, primarily in China, including Irico and Tunghsu (aka Dongxu), as both companies have been increasing capacity in Gen 8.x sizes.

Corning stated in its recent earnings call that it had successfully implemented a double-digit % price increase for display glass in the second half of 2024. Display glass is priced in Japanese yen, and Corning justified the price increase by noting the substantial weakening of the yen in recent years. Corning’s Japanese competitors, AGC and NEG, have followed Corning’s lead and also increased prices, and we estimate that there is a rough price parity among the top three glassmakers. We estimate that prices increased 3% in Q3 2024 and 7% in Q4 2024, with flat prices expected in Q1 2025.

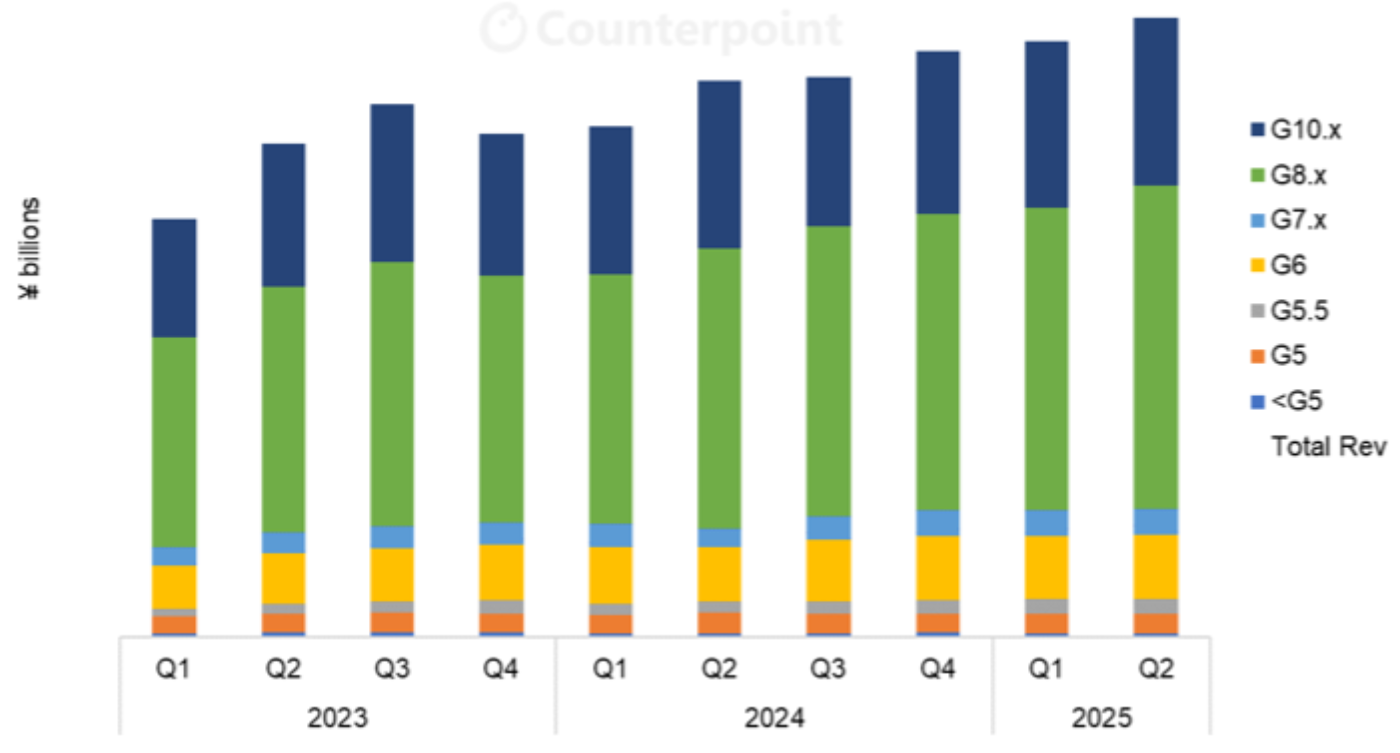

The higher prices mean that display glass revenues have been increasing, at least in JPY terms, and they will continue to increase in 2025. Display glass revenues increased by 5% QoQ and 16% YoY in Q4 2024, and we forecast revenues to increase 1% QoQ and 17% YoY in Q1 2025 and 4% QoQ and 11% YoY in Q2 2025.

Display Glass Revenues in JPY by Gen Size, 2023-2025

Readers interested in subscribing to Quarterly Display Glass Report can contact info@counterpointresearch.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.