Counterpoint Research

info@counterpointresearch.com

FOR IMMEDIATE RELEASE: 02/05/2025

Trump's Tariff Bomb Can Be a 'Direct Hit' on US Display Products

-

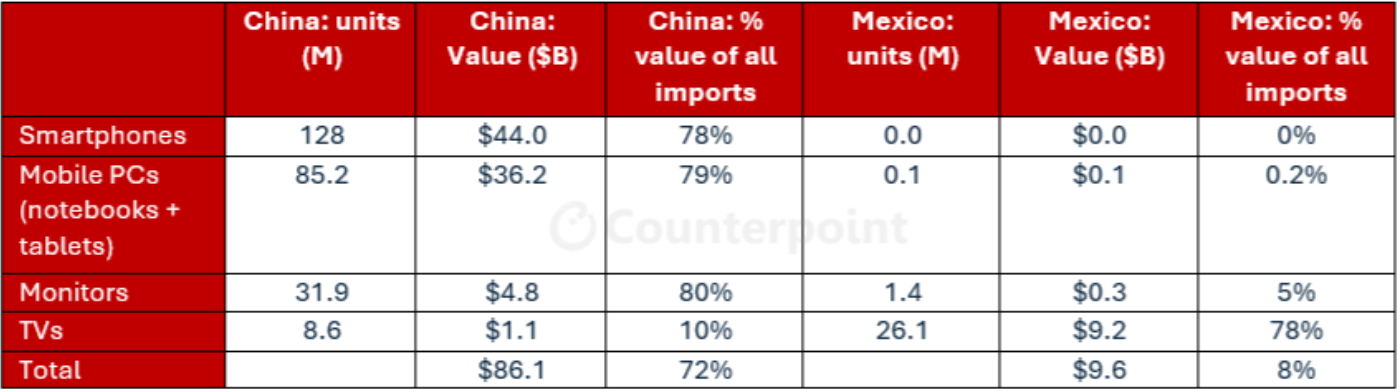

• Approximately 80% of US Smartphones, Mobile PCs, and Monitors Are Imported from China

• Approximately 80% of US TV Imports are from Mexico

• Possibility of China 'Subsidy Payment' in Response to US 'Tariff War' to Help Chinese Brands

• Korean Companies Concerned about Being 'Front-End' by US Tariff-China Subsidy War

Although President Trump delayed implementation of 25% tariffs for Mexico, the 10% tariffs on goods from China has taken effect, and the Mexico tariffs may still happen in one month. If the Trump administration's 'tariff bomb' becomes a reality, it is expected that the prices of smartphones, laptops, tablets, monitors and TVs will inevitably increase. According to the analysis of data from the US International Trade Commission (ITC) by global market research firm Counterpoint Research, if the US Trump tariff bomb policy becomes a reality, 80% of all finished products related to displays imported into the US are expected to be affected by tariffs. In addition, in the case of TVs, which account for a larger portion of imports through Mexico than direct imports from China, not only China but also Korea would have difficulty avoiding the negative impact of Mexico's 25% tariff.

2023 US Imports of Display End Products

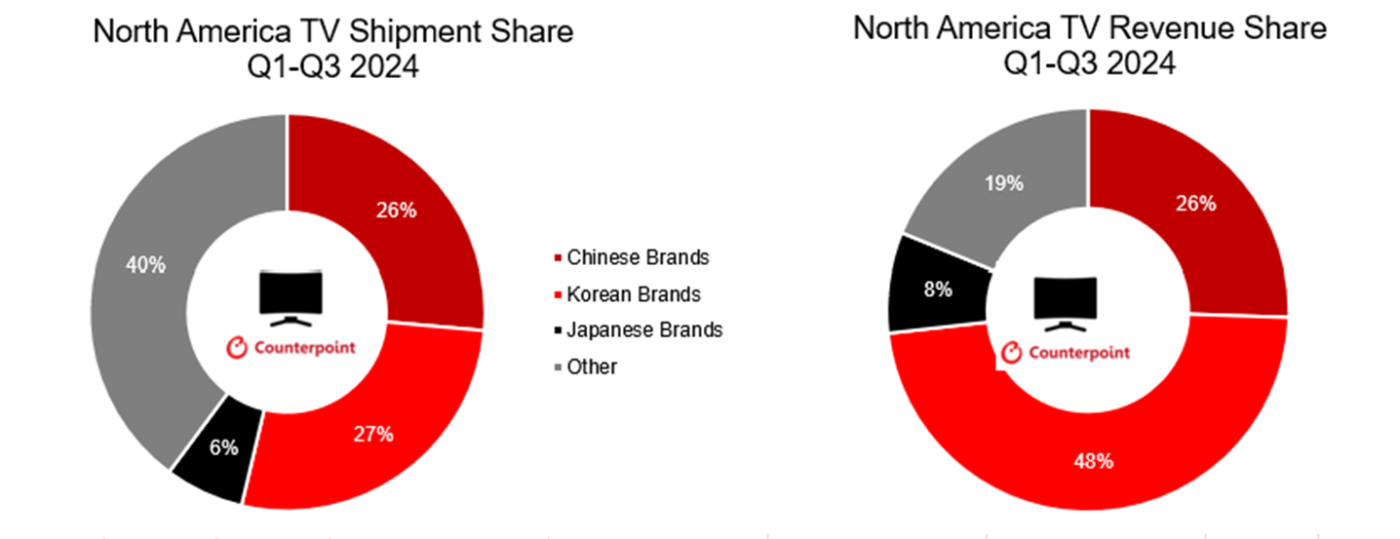

Counterpoint Research said, “If the tariffs are imposed on Mexico, Korean brands, which have a high proportion of premium TV sales in North America, will be more adversely affected by the tariffs than Chinese brands.” According to Counterpoint Research’s Global TV Tracker, the cumulative proportion of North American TV revenues in the first three quarters of 2024 was 48% for Korean brands and 27% for Chinese brands. It will be difficult for both Chinese and Korean companies to avoid the negative impact of the tariff bomb.

The cumulative market share based on shipments during the period was similar at 28% for Chinese brands and 27% for Korean brands, but the market share based on revenues was 48% for Korea and 27% for China. As Samsung Electronics and LG Electronics have established themselves in the North American market as trustworthy premium brands, their strategy of selling mainly high-definition and large-size premium products in the local market had an impact. TCL and Hisense are targeting the US premium market, but their revenue share is not as large as the Korean brands because they are focusing on low prices.

[Chart 1] North American TV Market Share by Country, Q1-Q3 2024

Country brands include the following companies, and other brands are included in ‘Others’.

Chinese Brands: Haier, Hisense, Skyworth, TCL, Toshiba

Korean Brands: Samsung, LG

Japanese Brands: Funai, Sharp, Sony

In this situation, the Chinese government announced a plan to procure a total of 1.3 trillion yuan in special long-term government bonds in the second half of last year, and it is known that some of this will be used as compensation for the sale of durable consumer goods such as automobiles and home appliances. If the Chinese government actually provides sales subsidies, this could serve as a basis for major manufacturers of Chinese TVs and smartphones to maintain their prices at the current level despite tariff increases in the United States. Therefore, if the effect of the Chinese import neutralization measures is weakened by such measures, it is possible that the tariff war between countries will worsen further, as the US government may further raise tariffs.

Major TV manufacturers are expected to respond to the initial Mexican tariff bomb policy with a supply chain diversification strategy. Chinese Hisense, which does not have a production base in Southeast Asia, could continue exporting to the US by utilizing its European factories, and TCL is expected to utilize its production bases in Europe and Southeast Asia to continue exporting to the US. Both Vietnam and India have been expanding TV manufacturing, but neither country could match the economies of scale established in Mexico.

In order to minimize the impact of Mexico's tariff hike, Korean companies are reviewing alternatives such as increasing production in Europe and Southeast Asia to supply to the US and direct production in the US. Counterpoint Research researcher Calvin Lee said, “Even if we respond by increasing production volumes at factories in Europe and Southeast Asia in the short term, it seems inevitable that global TV prices will rise due to the tariff war initiated by Trump,” and suggested, “The Trump administration’s tariff bomb policy could be another negotiation card, so we should continue to watch the rapidly changing policy changes.”

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.