DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 07/31/2023

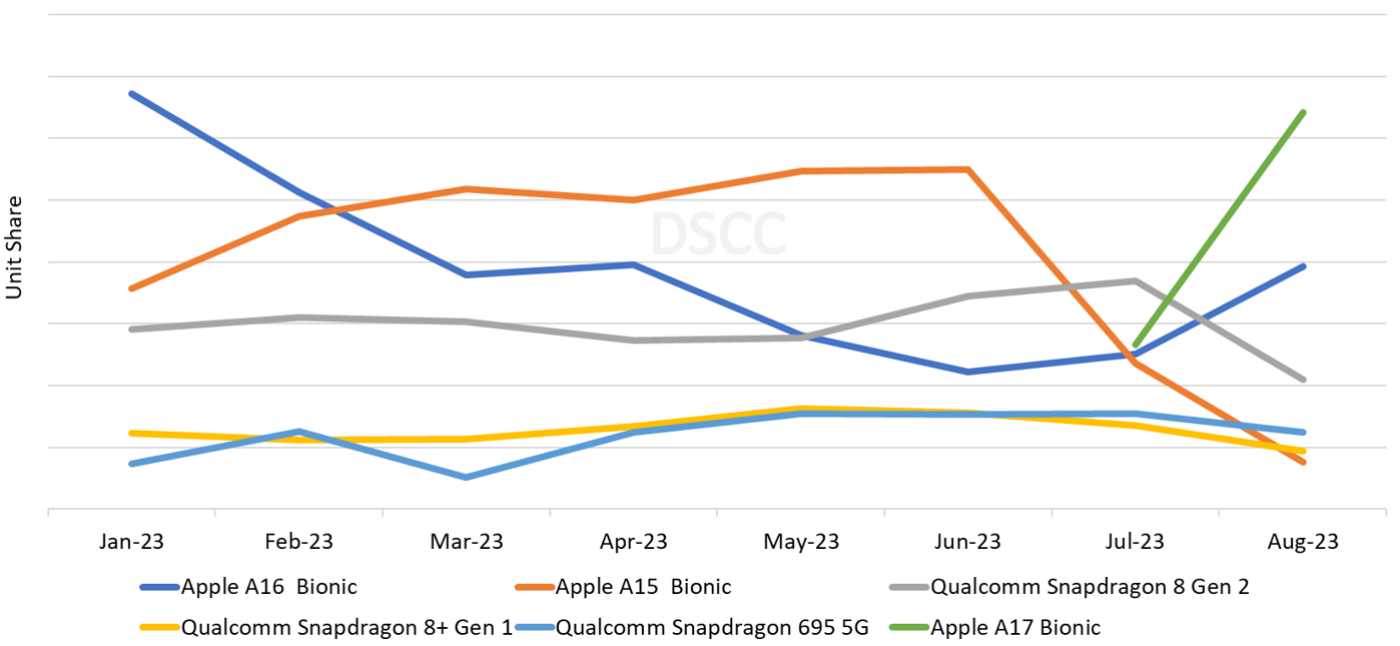

Snapdragon 8 Gen 2 Led Flagship Smartphone Chipsets in July – A17 Bionic Poised to Lead in August as Apple Ramps Up iPhone 15 Pro Models

La Jolla, CA -

As we highlighted in the Monthly Flagship Smartphone Tracker, the 5nm Apple A15 Bionic, the 4nm Qualcomm Snapdragon 8 Gen 2, and the 4nm Apple A16 Bionic chipset were the top three flagship (flexible and foldable OLED) smartphone chipsets in June. The continued share gains for the A15 Bionic chipset were the result of significant panel shipments for the iPhone 13, iPhone 13 Pro, iPhone 13 Pro Max and iPhone 14. In June, the iPhone 14 and iPhone 13 were the top two models on a panel shipment basis. For 2023, prior to June, the A15 Bionic led all chipsets, followed by the A16 Bionic chipset and the Snapdragon 8 Gen 2 chipset. The Qualcomm Snapdragon 8 Gen 2 chipset was introduced on November 15, 2022, and is used in 15 flagship smartphone models.

With last week’s announcement of the Samsung Galaxy Z Fold 5 and Galaxy Z Flip 5 and several recently announced new flagship smartphones from Honor and Vivo, the Snapdragon 8 Gen 2 chipset is expected to have the #1 chipset share for July. The Snapdragon 8 Gen 2, A17 Bionic and A16 Bionic chipsets are expected to be the top three chipsets in July.

In August, we expect the 3nm A17 Bionic, the 4nm A16 Bionic and the Snapdragon 8 Gen 2 chipsets to lead the flagship smartphone category. We expect the A17 Bionic chipset to be used in the iPhone 15 Pro and the iPhone 15 Pro Max. These two models are tracking to be the #1 and #2 models in August on a panel shipment basis. The ramp up of the iPhone 15 Pro models and the A17 Bionic chipset in August is tracking to be the largest majority of all iPhone panel shipments. The A16 Bionic chipset is expected to have the #2 position with strong panel shipments for the iPhone 15 and iPhone 15 Plus. The Snapdragon 8 Gen 2 is expected to have the #3 position as a result of significant panel shipments for the Galaxy Z Flip 5, Galaxy Z Fold 5 and Galaxy S23 Ultra.

Detailed chipset and chipset supplier share for all flagship smartphone brands and models can be found by subscribing to the Monthly Flagship Smartphone Tracker

Flagship Smartphone Chipset Unit Share, January 2023- August 2023

To see more of the Monthly Flagship Smartphone Tracker and to learn more about the trends for panel shipments, chipsets, TFT backplanes and much more for flagship smartphone brands and models, readers should contact info@displaysupplychain.com.

The monthly flagship smartphone tracker includes monthly panel shipment results and a rolling two-month forecast for all flexible and foldable OLED smartphones for all of the major smartphone brands and models.

The tracker covers all flagship models and shows monthly panel shipments by:

- Brand

- Model

- Display Size

- Form Factor

- Foldable Form Factor

- Panel Supplier

- TFT Backplane

- Resolution,

- Hole/Notch/UPC

- Refresh Rate

- Color on Encapsulation (CoE)

- Micro-Lens Array (MLA)

- Chipset Supplier

- Chipset

- Typical Brightness

- Peak Brightness

- Device Launch Date

The monthly flagship smartphone tracker serves as an excellent tool for all companies involved in the OLED smartphone supply chain: display material companies and manufacturers, panel suppliers, OEMs, technology developers, brands and telecom companies, financial analysts, etc.; by having the ability to see historical panel shipment results and near-term forecasts by brand, model, panel supplier along with upcoming models to be launched in the near future.

DSCC also provides quarterly panel shipments for all of the major smartphone brands along with detailed model specifications and trends in the Advanced Smartphone Display Shipment and Technology Report. This report includes all DSCC’s smartphone data from covering all OLED smartphone and panel shipments by brand, model, all display and major non-display parameters, panel and device revenues, regional forecasts for select models and forecasts by quarter and by year through 2027. In addition, it provides insights into technology and innovation trends in OLED display technology, which is applicable to smartphones. There are over 1,300 AMOLED smartphone configurations in our database including variations by substrate, TFT backplane, panel supplier, refresh rate, chipset supplier, design rules, 5G networks and much more.

To schedule a FREE DEMO, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.