Ross Young

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 02/28/2022

Samsung Dominated Q4’21 Foldable Smartphones with a 96% Share, DSCC Expects 86M Foldable/Rollable Panels in 2026 Across 4 Applications

Austin, TX -

DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report revealed that Q4’21 foldable smartphone shipments rose 65% Q/Q and 520% Y/Y to a record high 4.25M units.

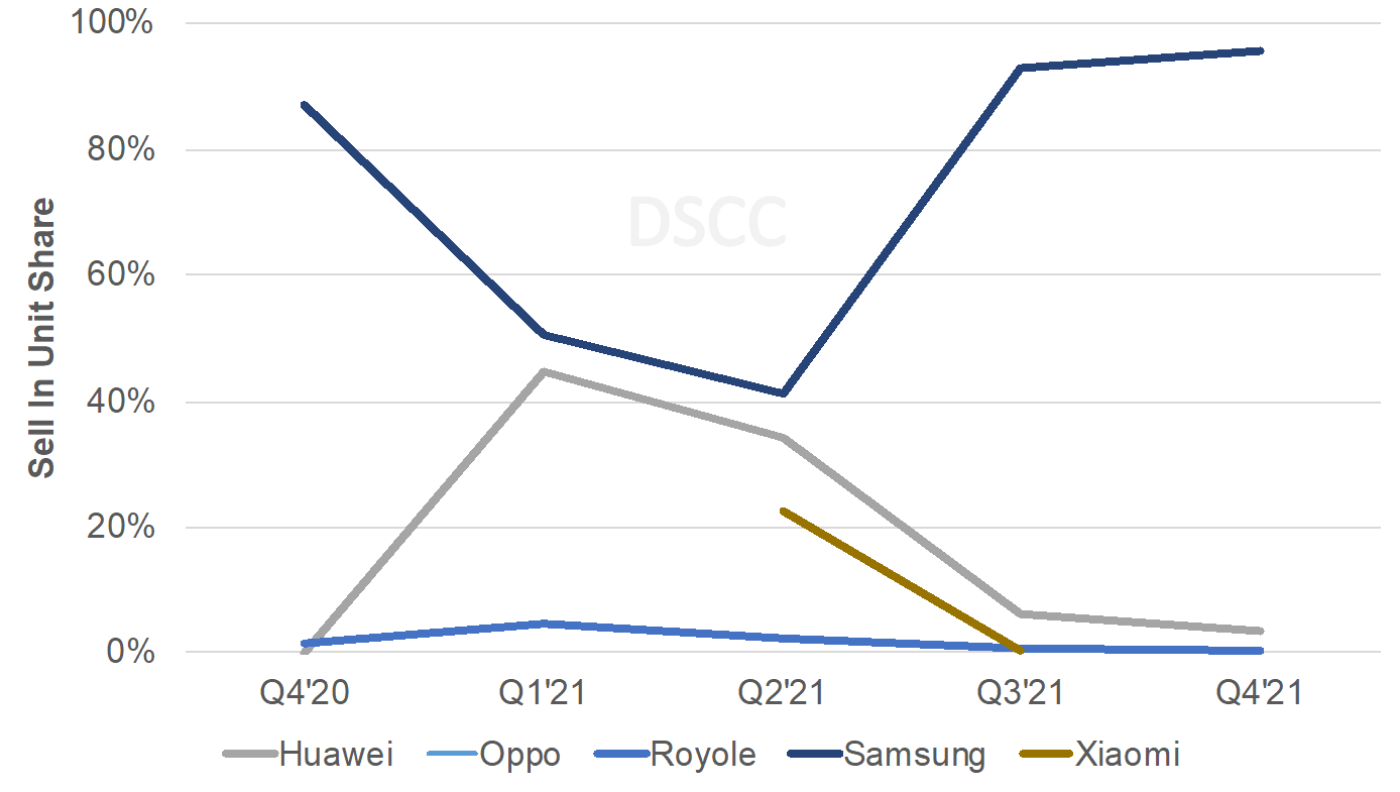

- Samsung led with a 96% share on shipments of 4.1M. Samsung has benefited from a strong focus on this category as it looks to grow its flagship share as well as a large technology and capacity lead in foldable displays from its panel business - Samsung Display (SDC). This has resulted not only in a large lead in displays, but ultra thin glass (UTG) as well. According to DSCC Co-Founder and CEO, Ross Young, “Samsung is fortunate that its largest likely competitor, Apple, is not in this market segment and its second largest potential competitor, Huawei, is facing numerous restrictions, which have prevented it from getting panels from Korea or 5G chips. Most of its other potential competitors (Google, Oppo, Vivo and Xiaomi) are all relying exclusively on Samsung Display in 2022 for panels and UTG, giving Samsung significant influence over the foldable display supply chain. Most of the Chinese brands’ foldable programs have been relatively small in volume and short-lived. Thus, we should expect Samsung to continue to dominate this market although they will inevitably lose some ground as more brands enter.”

- For all of 2021, Samsung had an 87% share of the 8.0M unit market, up from an 86% share of the 2.3M unit market in 2020. Huawei was #2 in 2021 with a 9% share.

- There were only four brands shipping products in Q4’21 – Huawei, Oppo, Royole and Samsung. DSCC expects this number to rise to six in Q1’22 with Honor and Vivo added and to reach 10 by Q4’22, with Google, Motorola, TCL and Xiaomi added.

- Foldable smartphone revenues rose 66% Q/Q and 342% Y/Y to $5.8B, a record high. Samsung’s Q4’21 revenue share was also dominant at 92%.

- By model in Q4’21 on a unit basis:

- The Galaxy Z Flip 3 led with a 59% share. For the year, it had a 51% share;

- The Galaxy Z Fold 3 was #2 with a 35% share. For the year, it had a 26% share;

- The Huawei Mate X2 was #3 in 2021 with a 6% unit share;

- The Z Flip 5G and Z Fold 2 were #4 and #5 for the year at 5% and 4% respectively.

- Samsung Display held a 92% unit and revenue share in Q4’21 with its unit share at 80% for all of 2021 and likely to expand in 2022 to 85% as it enjoys over 4000% growth in shipments outside of Samsung. Shipments outside of Samsung are forecasted to rise from 1% of its 2021 shipments to 13% of its 2022 shipments.

- The report also goes into great detail by product feature. In Q4’21:

- Clamshells led with a 60% share and this should rise in 2022 as more brands field clamshells.

- LTPO backplanes led with a 96% unit share and 120Hz also held a 96% unit share.

- UTG also led in Q4’21 with a 96% share and 87% for the year and we expect more UTG processing suppliers to ship products in 2022, which should enable UTG to gain more share in 2022.

- 5G networks led with a 96% share in Q4’21 and may fall in 2022 on Huawei’s limitations. mmWave solutions are expected to gain share in 2022.

- Qualcomm was the #1 chipset in Q4’21 with a 97% share and should gain share in 2022.

- The Snapdragon 888 led in 2021 with an 80% share and the Snapdragon 8 Gen 1 is likely to lead in 2022.

- Nitto Denko was the dominant polarizer supplier with over a 90% share in Q3’21 and Q4’21 and is expected to gain share in 2022.

- The report also reveals the film stack, thicknesses and materials suppliers for the Huawei P50 Pocket which has a similar thickness as the Samsung Z Flip 3 but many other differences.

Q4’20 – Q4’21 Quarterly Foldable Smartphone Sell-In Unit Market Share

Looking forward, DSCC forecasts foldable and rollable panel and product shipments by quarter through 2022 and by year through 2026. DSCC expects:

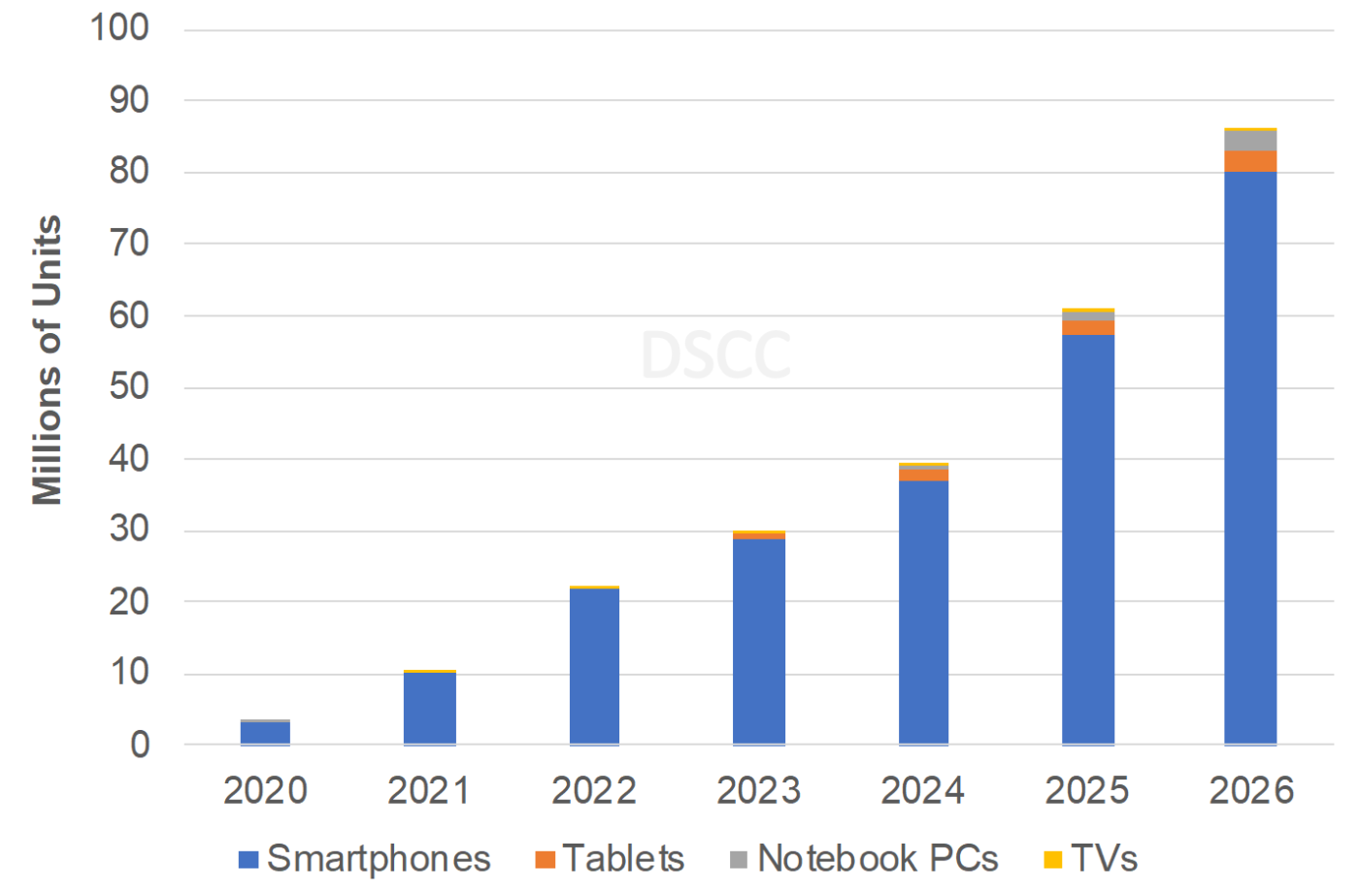

- Foldable/rollable panel volumes to grow at a 54% CAGR from 2021 to 2026 to 86M. Smartphones will dominate with at least a 93% share through the forecast and a 52% CAGR. Although notebooks still need to resolve their multi-screen support challenges, more brands are expected to field products, including Apple and DSCC shows notebooks growing at a 232% five-year CAGR. Tablets can benefit from multi-fold, improving their portability and should also enjoy significant growth. TVs will remain expensive until technical issues are resolved.

- DSCC expects foldable/rollable panel revenues to grow at a five-year CAGR of 49% from 2021 to 2026 to $11.8B with smartphone panels growing at a 43% CAGR to $9.8B and its share declining to 83% in 2026 as notebooks gain ground. Notebook panels are expected to grow at a 189% CAGR to $1.2B and a 10.2% share. Tablet panels are expected to grow to $744M and a 6% share.

- SDC is expected to lead the foldable/rollable market throughout the forecast reaching an 85% share in 2022 before declining to 69% in 2026 and $8.2B in revenues.

- Foldable/rollable panel area for all applications are expected to grow at a five-year CAGR of 66% to 1.74M square meters. Smartphones should fall from a 100% share in 2021 to a 75% share in 2026 on a 57% CAGR. Notebooks should grow at a 276% CAGR to a 17% share helped by larger size growth with tablets reaching an 8% share and TVs at a 1% share.

Foldable/Rollable Panel Forecast by Application

DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report includes monthly and quarterly data through 2022 and annual data through 2026 by brand, model, panel size, resolution, refresh rate, backplane technology, cover window material, UTG and CPI supplier, notch vs. hole vs. UPC, polarizer supplier, hardcoat supplier, touch sensor supplier, chipset, chipset supplier, number of cameras, network type, etc., and includes panel shipments, supply chain shipments, panel revenues, device shipments, device revenues, panel prices, device prices, panel bill of materials and much more. For more information, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.