DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 03/09/2023

Samsung and LG Continue to Dominate Advanced TV Market and Regained Share in Q4’22

La Jolla, CA -

The premium TV market continues to be dominated by the two Korean brands Samsung and LG, and both brands regained some market share in the fourth quarter of 2022, according to the latest update of DSCC’s Quarterly Advanced TV Shipment and Forecast Report, now available to subscribers. According to DSCC Co-Founder and Principal Analyst, Bob O’Brien, “Growth in the Advanced TV market slowed as the TV market overall struggles through a post-pandemic lull and as shipments in Europe continue to suffer from the impact of the war in Ukraine. Outside of Europe, the Advanced TV market continues healthy growth.”

In Q4’22:

- Samsung shipments were flat Y/Y and Samsung unit share decreased by 1% Y/Y. Samsung revenues decreased 3% Y/Y but revenue share increased to 42%. Compared to Q3’22, Samsung regained unit/$ share of Advanced LCD TV by 2%/3%.

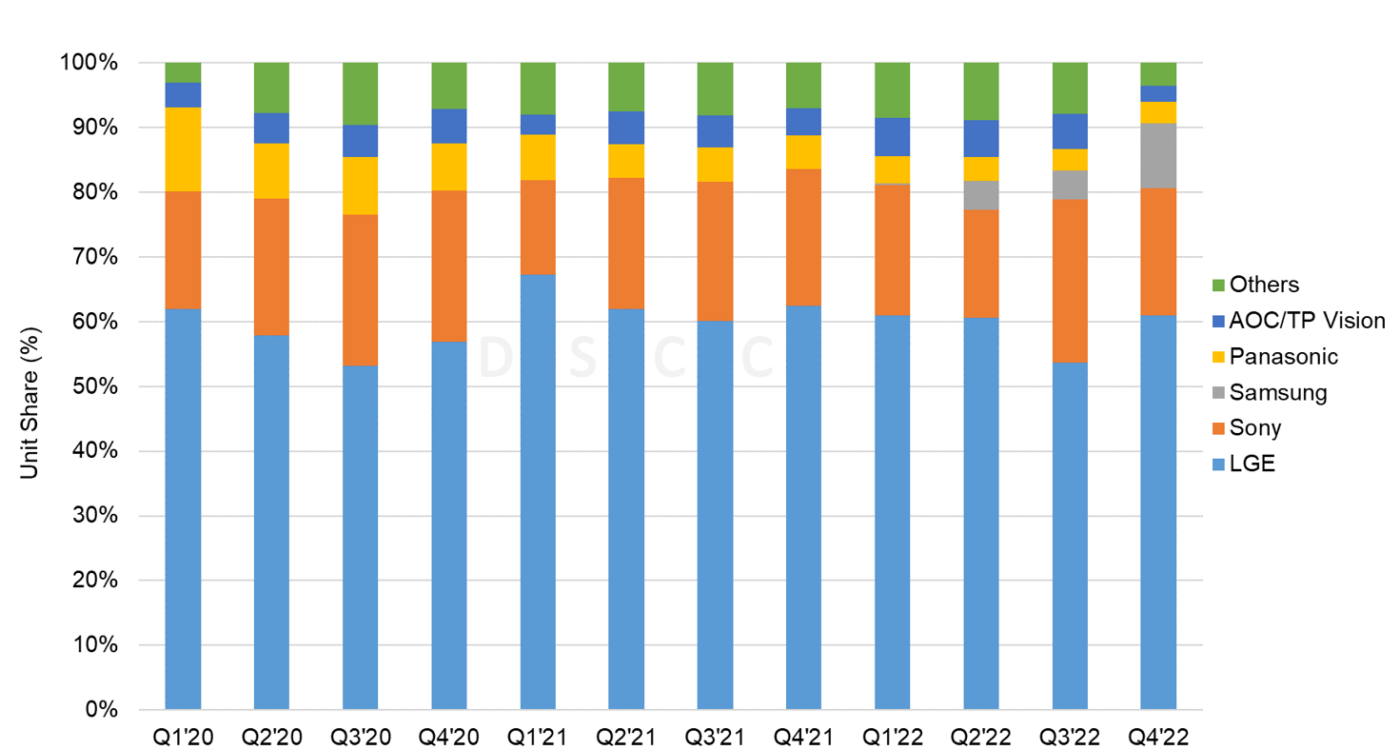

- LG shipments increased by 14% Y/Y and unit share increased from 23% in Q4’21 to 25% in Q4’22. LG revenues decreased 5% Y/Y and LG gained share to 30%. Compared to Q3’22, LG regained 7% unit and revenue share of OLED TV. LG continues to dominate OLED TV with 61%/60% unit/revenue share and has established a small position in MiniLED with 4%/4% share.

- Sony shipments were flat Y/Y and Sony unit share decreased from 8% to 7%. Sony revenues declined 17% Y/Y.

- TCL shipments increased 35% Y/Y and TCL gained share Y/Y from 6% to 7%. TCL revenues increased 6% Y/Y.

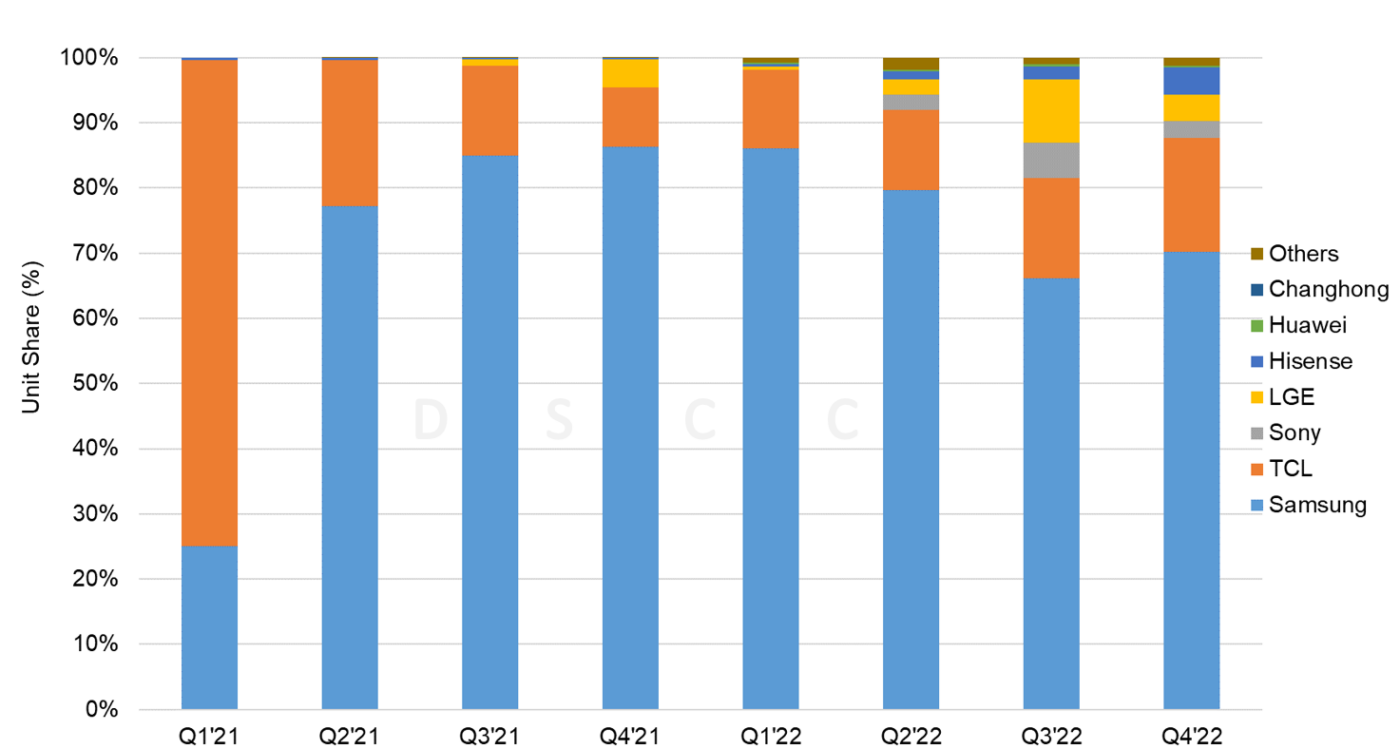

MiniLED LCD TV Shipments by Brand, 2021 to 2022

Growth accelerated for MiniLED TV shipments in Q4’22 with 40% growth Y/Y to 990k units but revenues increased only 7% as ASPs fell by 24% Y/Y. Samsung continues to dominate the MiniLED TV category with 69%/71% unit/revenue share even as the number of competitors in the space continues to increase. TCL managed to regain some of its share as shipments increased by 167% Y/Y and revenues increased by 113% Y/Y. TCL unit share recovered to 17% and its revenue share increased to 16%.

Despite strong growth in Q4’22, MiniLED remained much smaller than OLED in both units and revenues. Total MiniLED TV shipments in Q4’22 were 990K compared to 2.35M OLED TV shipments, while total MiniLED TV revenues in Q4’22 were $1.35B compared to $3.57B for OLED TV.

For the second time in 2022 and the second time ever, OLED TV shipments decreased Y/Y in Q4’22, falling 1% to 2.3M units. For the full year 2022, OLED TV shipments increased just 1% Y/Y to 6.9M units. Within the OLED TV category, QD-OLED grew from nothing in 2021 to represent 12% of OLED TV units and 15% of OLED TV revenue in Q4’22. With the increased competition from QD-OLED, White OLED TV shipments declined by 13% Y/Y in Q4’22, and revenues declined by 21% Y/Y. With a limited QD-OLED product portfolio, Samsung gained 10% of the OLED TV market in Q4.

OLED TV Shipments by Brand, 2020 to 2022

The report’s pivot tables allow an analysis of brand share by screen size, region, technology, resolution and other variables. In the brand battle, Samsung maintained the top spot in both units and revenue and regained some share in Q4 compared to Q3’22.

DSCC’s Quarterly Advanced TV Shipment and Forecast Report tracks the emergence of MiniLED LCD as a competitor to OLED TV in the premium space. While TCL introduced MiniLED in late 2019 and recorded some sales in 2020, the category remained tiny until Samsung and other brands introduced products with MiniLED technology in Q1’21. From less than 100K units in 2020, MiniLED TV shipments grew to more than 1.7M units in 2021, and revenue grew from $73M in 2020 to $3.5B in 2021. For the full year 2022, MiniLED TV shipments grew by 82% Y/Y to 3.15M units and revenues increased by 42% to $4.9B.

The report also includes technical descriptions of all major advanced TV display technologies, plus quarterly shipment results from Q1 2018 through Q4’22, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs and other metrics. The report includes DSCC’s quarterly forecast for five years across technology, region, resolution and size. Readers interested in subscribing to the DSCC Advanced TV Shipment Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.