DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 12/14/2022

Q3’22 Foldable Market Reaches Record High, But Will Decline in Q4’22 on US Market Weakness as iPhone 14 Series Dominates

La Jolla, CA -

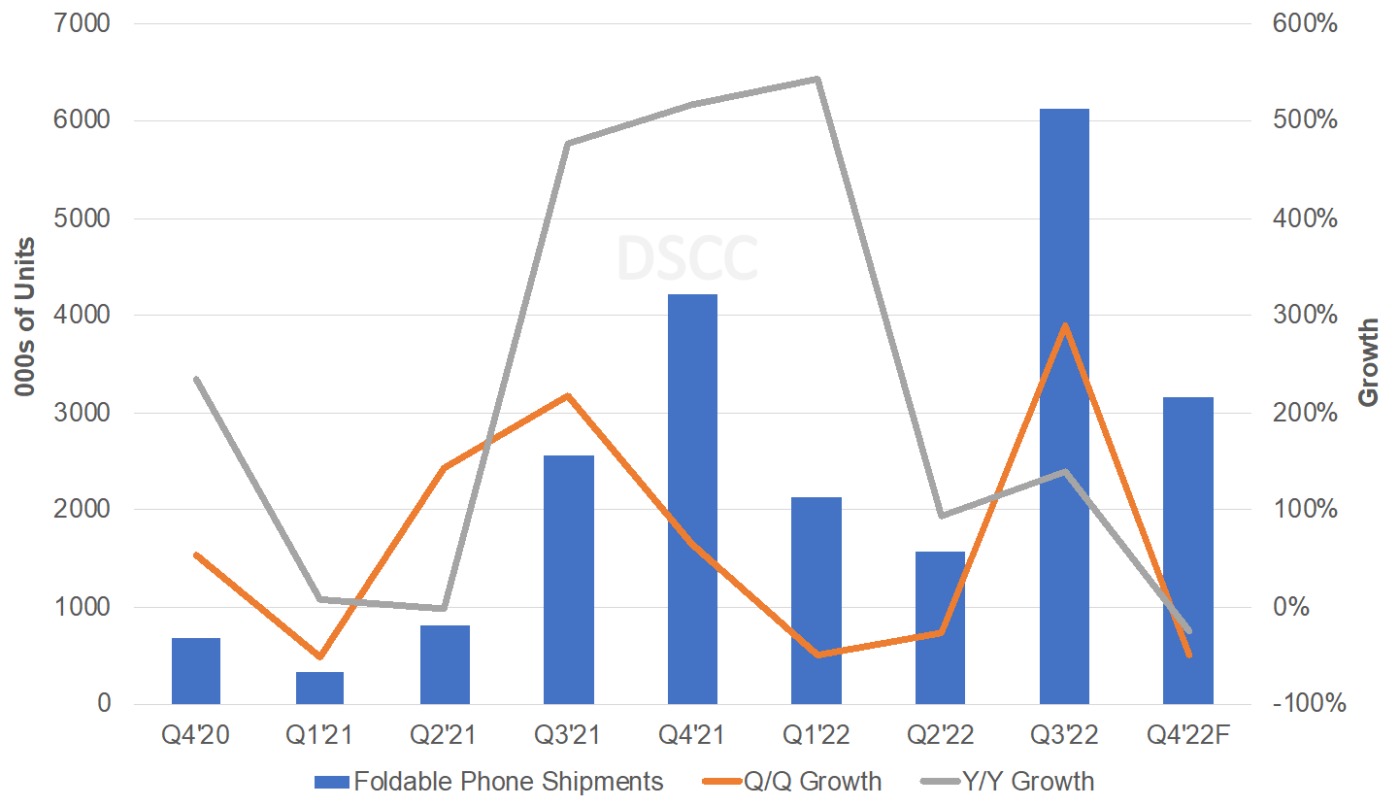

Although Q3’22 was a record quarter for foldable smartphone shipments, it won’t carry into Q4’22 with foldable phones suffering their first Y/Y decline according to DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report. What happened?

While Samsung’s Q3’22 foldable smartphone shipments were within 1% of expectations and the Korean giant dominated a record Q3’22 foldable smartphone market with an 85% share and 5.2M units on a sell-in basis, it lost its momentum in Q4’22 with its foldable smartphone shipments expected to fall 50% Q/Q and 36% Y/Y to 2.6M units with additional Q/Q declines expected in Q1’23 and Q2’23 and another Y/Y decline in Q1’23. Samsung’s share is only expected to fall to 82% in Q4’22, but the overall foldable smartphone market is expected to drop 48% Q/Q and 25% Y/Y to 3.2M units, its first ever decline on a Y/Y basis. Samsung’s share is expected to fall further in Q1’23 and Q2’23 and fall below 50% in Q2’23 on traditional seasonal weakness on the lack of new products while its competitors launch new devices.

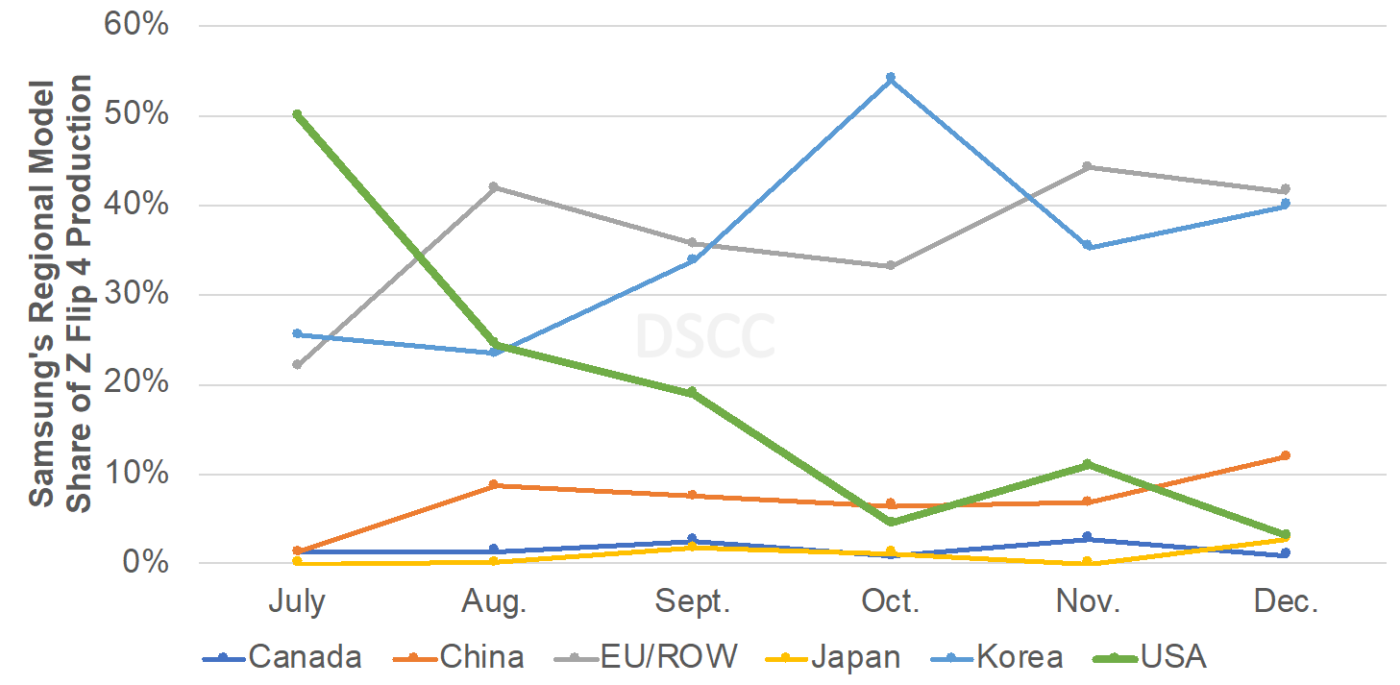

Worldwide Foldable Smartphone Shipments

If we look at the regional segmentation, it becomes quite clear that the US market was the problem for Samsung in Q4’22 and it happens right after the iPhone 14 Pro Series launch with its improved cameras and Dynamic Island. While the US accounted for a 29% share of Samsung’s foldable smartphone production in 2021 and a 29% share in Q3’22, it plummeted to just 7% in Q4’22. The US accounted for just 5% of Samsung’s Flip-type phone production in Q4’22, down from 28% in Q3’22, and 11% of its Fold-type phone production, down from 32% in Q3’22. Furthermore, the drop started in October, the month after the iPhone 14 Series launch with the US falling from nearly a 20% share of Z Flip 4 production in September to just a 5% share in October and expected to be even lower in December. Furthermore, Z Flip 4 phone shipments fell behind the pace of Z Flip 3 shipments in October of the previous year and are expected to remain below the pace of previous year’s Z Flip 3 shipments through February. The situation is similar with the Z Fold 4. As a result, Samsung’s Q4’22 shipments are expected to be 45% below our previous forecast with its 2022 shipments up 46% to 10.1M units vs. previous expectations of 77% growth to 12.3M units. As a result of Samsung’s Q4’22 decline, the overall 2022 foldable smartphone market is expected to rise 64% to 13M units vs. previous expectations of 94% growth to 15M units.

Regional Model Share of Samsung’s 2022 Z Flip 4 Phone Production

According to DSCC CEO Ross Young, “While the foldable market stalled in Q4’22, due in part to being steamrolled by the iPhone 14 launch as well as the weak global economy, it is still very much a bright spot for the smartphone and display markets reaching new highs and gaining share. In addition, we are seeing new entrants such as Google and existing entrants bringing more devices to market such as the Oppo Find N2 and Find N2 Flip which should increase competition, give consumers more choice and bring down prices. As a result, we see 33% growth in 2023 to 17M units. Samsung’s share is expected to fall from 88% in 2021 to 78% in 2022 and 72% in 2023. Six different smartphone brands are expected to have at least a 3% share and we see 10 brands shipping foldable devices in 2023 including a new entrant from China. On the other hand, Samsung’s panel business, Samsung Display, is expected to gain share in 2023 as other brands increasingly rely on Samsung’s panel business rising from an 83% share in 2022 to 88% in 2023. BOE is the next closest supplier with its share expected to fall from 12% to 10%.”

For Q3’22, the Samsung Galaxy Z Flip 4 was the best seller with a 52% share followed by the Z Fold 4 at 27%, Huawei P50 Pocket at #3 with an 8.6% share and the Z Flip 3 #4 with a 4.5% share. In Q4’22, the Z Flip 4 is expected to lead followed by the Z Fold 4 with the Huawei Pocket S rising to #3 followed by the Z Flip 3 and P50 Pocket. In Q1’23, the Oppo Find N2 Flip is expected to rise to #4.

For monthly, quarterly and annual shipments on a foldable panel shipment, production and device shipment basis through 2023, as well as panel price and cost forecasts, company roadmaps, UTG developments, forecasts by feature and more, please learn about the Quarterly Display Supply Chain Financial Health Report online or contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.