DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 08/12/2024

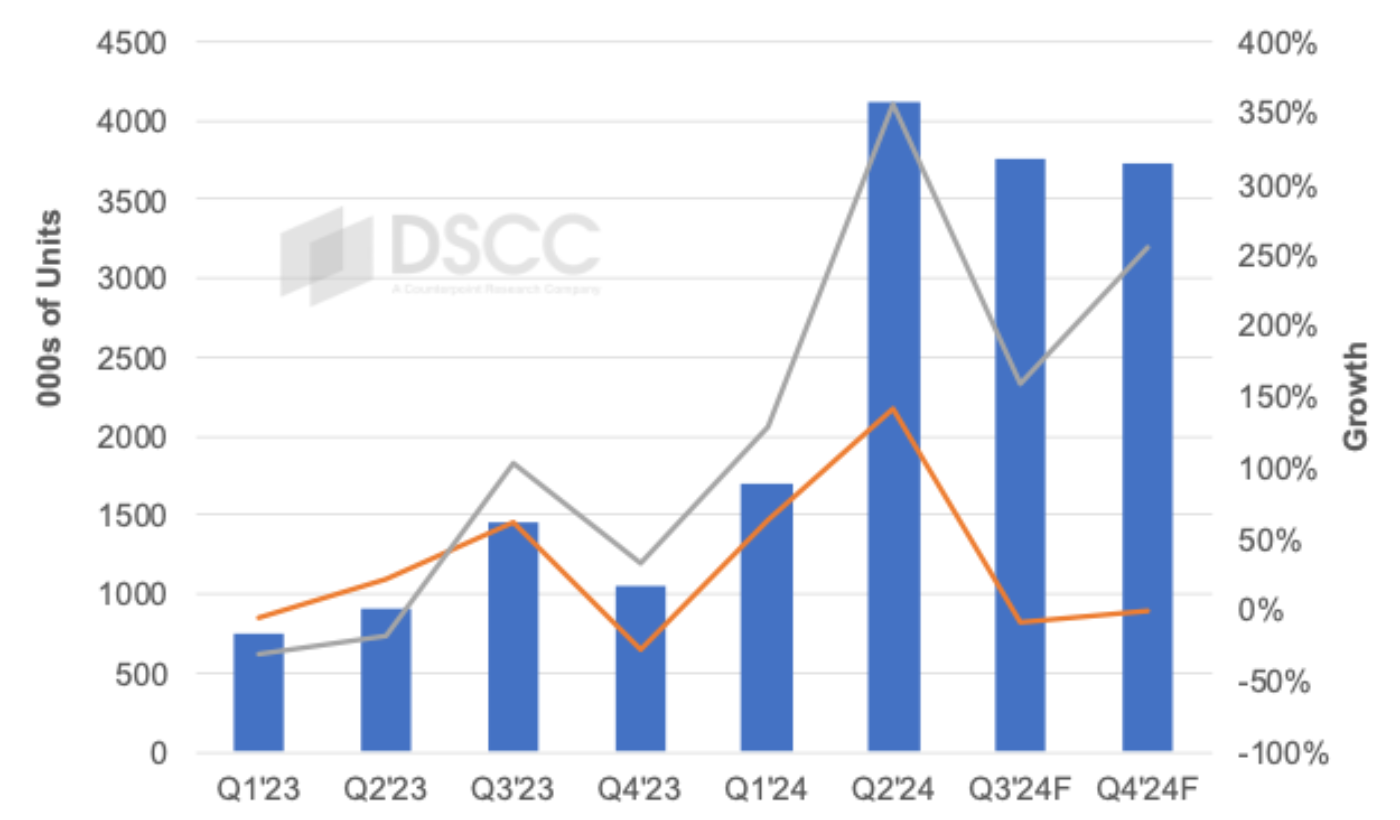

OLED Tablet Panel Shipments Surge in Q2’24, 2024 Volumes Expected to More than Triple to Over 13M Panels

La Jolla, CA -

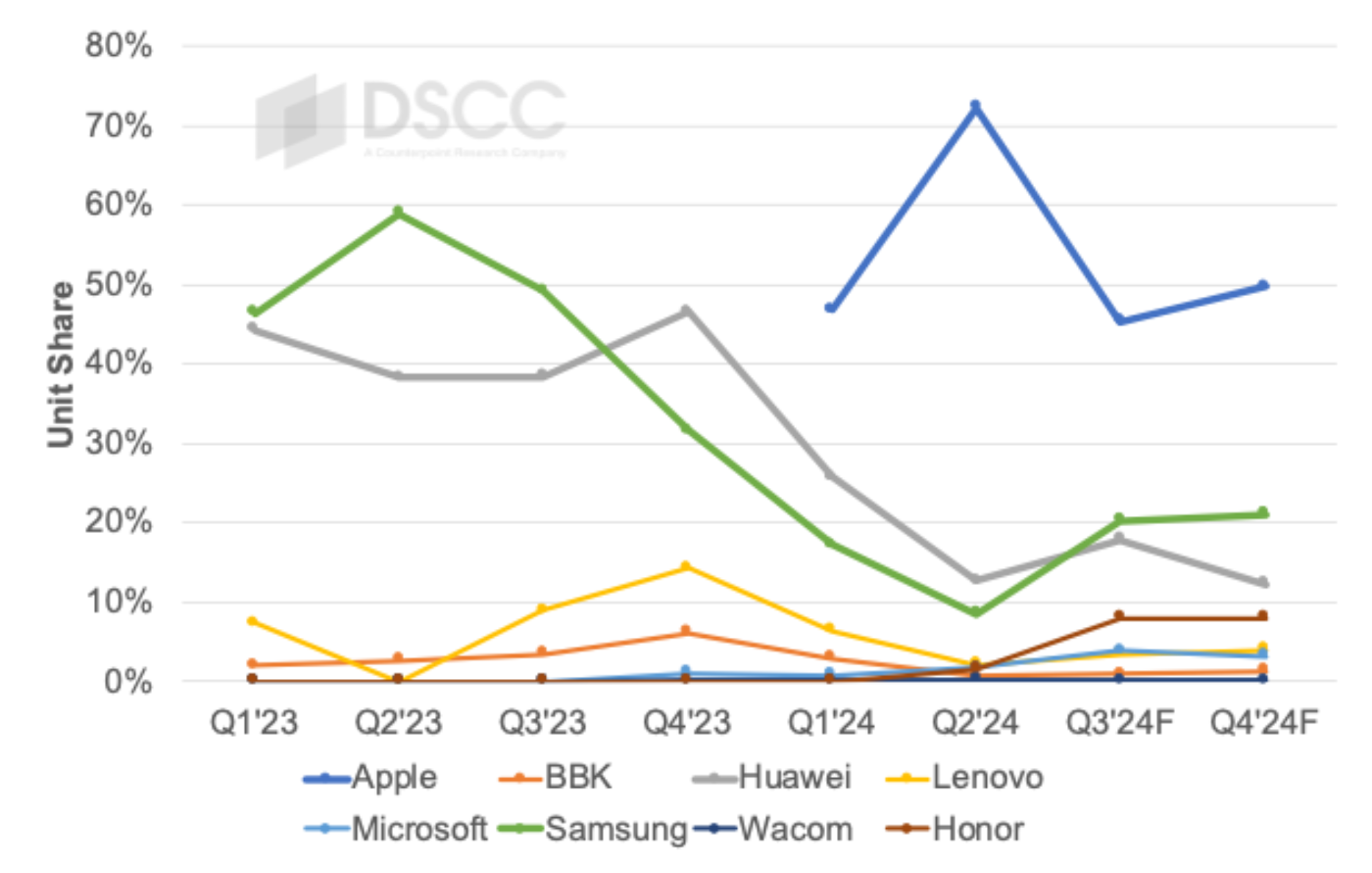

- OLED tablet panel shipments reached a new record high in Q2’24 as Apple launched its highly anticipated 11.1” and 13” OLED iPad Pro’s. Apple dominated the OLED tablet panel market in Q2’24 with a 72% share followed by Huawei at 13% and Samsung at 9%.

- The 13” OLED iPad Pro led the market on a panel procurement basis for the second straight quarter with a slight edge over the 11.1” OLED iPad Pro followed by the Huawei Mate Pad Pro 13.2” with just a 5% share. LG Display and Samsung Display split the Q2’24 market on a panel supplier basis with a 41% share each.

- In Q3’24, OLED tablet panel growth is expected to fall 9% Q/Q while rising 153% Y/Y. A sizable drop at Apple after a robust Q2’24 is not expected to offset gains at new entrants Honor and Microsoft and from higher volumes at existing players Huawei, Lenovo and Samsung with Samsung ramping panel production in Q3’24 for the upcoming Galaxy Tab S10 Plus and S10 Ultra to be launched in Q4’24.

OLED tablet panel shipments rose 142% Q/Q and 356% Y/Y in Q2’24 as Apple launched its highly anticipated 11.1” and 13” iPad Pro’s which feature the tablet industry’s first tandem OLED stack panels along with the thinnest tablets produced to date. Apple dominated the OLED tablet panel market in Q2’24 with a 72% share followed by Huawei at 13% and Samsung at 9%. The 13” OLED iPad Pro led the market on a panel procurement basis for the second straight quarter with a slight edge over the 11.1” OLED iPad Pro. Each model had a 36% share in Q2’24. The #3 model on a panel procurement basis was the Huawei Mate Pad Pro 13.2” at 5%. LG Display and Samsung Display split the Q2’24 market on a panel supplier basis with a 41% share each.

In Q3’24, OLED tablet panel growth is expected to pause sequentially, falling 9% Q/Q, but rising 153% Y/Y. A sizable drop at Apple is not expected to offset gains at new entrants Honor and Microsoft and from higher volumes at existing players Huawei, Lenovo and Samsung. Huawei recently launched the first tandem stack OLED tablet outside of Apple and Samsung’s volume should more than double Q/Q as it prepares to launch the Galaxy Tab S10 Plus and S10 Ultra. Apple’s share is expected to fall to 45% with Samsung’s share rising to 20% and Huawei’s share rising to 18%. The 11.1” OLED iPad Pro is expected to be the #1 OLED tablet on a panel procurement basis in Q3’24 with a slight 28% to 17% advantage over the 13” iPad Pro with the new Honor Magic Pad2 slipping into the #3 spot with an 8% share. Samsung Display is expected to lead the Q3’24 market on a panel supplier basis with a 47% share followed by EDO at 24% and LG Display at 23%. 19 OLED tablet models are expected to purchase panels in Q3’24 vs. 10 in Q3’23.

According to DSCC CEO Ross Young, “2024 will likely be the year of the OLED tablet with over 200% growth projected. OLED tablet panels are seeing significant improvements in availability, performance, cost/price, form factors, size and more. Users are demanding the same excellent display performance found in smartphones and panel suppliers are now delivering the same impressive display experience to the tablet market. OLED tablets are now available with rigid, hybrid or flexible form factors. Weight and thickness are being significantly reduced as the top glass has been eliminated on flexible and hybrid models and the bottom glass is being thinned in some models. Brightness, power efficiency and lifetime have been improved with tandem stacks. In addition, while only two suppliers delivered OLED tablet panels in 1H’23, five different panel suppliers delivered panels in 1H’24. It is exciting to see such growth.”

OLED Tablet Panel Shipments/Growth

OLED Tablet Brand Panel Procurement Share

For more information on DSCC’s OLED tablet reporting, please see its Quarterly Advanced IT Display Shipment and Technology Report.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.