DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 07/08/2024

OLED Supply/Demand – Oversupply to Slowly Decline but No Sign of Shortage

La Jolla, CA -

- Oversupply of OLED for mobile and IT applications persists in 2024 but will gradually decline to 2028.

- The fastest growing segment of OLED supply utilizes a rigid glass substrate with thin-firm encapsulation (Rigid+TFE).

- OLED TV will continue to be in oversupply through 2028 despite no capacity additions.

DSCC, a Counterpoint Research Company has updated its Quarterly OLED Supply/Demand and Capital Spending Report for Q2’24, with DSCC’s latest capacity outlook for the industry and the forecast for OLED panel demand. DSCC now sees demand growth for OLED for mobile and IT applications exceeding supply growth, and oversupply gradually declining throughout the five-year forecast period.

For OLED TV panels, while DSCC expects utilization to improve gradually, it does not expect that OLED TV panels will be constrained by supply through the duration of the forecast period to 2028.

In flexible OLED panels (which include panels for foldable and rollable devices), Samsung’s leading share of capacity will decline throughout the forecast as Chinese panel makers continue to aggressively add capacity, declining from 40% in 2021 to 31% in 2028. BOE is the #2 supplier by capacity and will grow its share of capacity to 25% by 2028, while LGD will be passed by Tianma in 2026 to fall to the #4 position.

Within the larger category of OLED for mobile and IT applications, the fastest growing portion of capacity utilizes a rigid glass substrate with thin-film encapsulation (TFE) and is generally directed at IT applications. Samsung has the largest capacity for Rigid+TFE and will remain the largest supplier, but LGD, BOE, Visionox and Japan Display are also expected to compete in this segment.

OLED demand area declined in 2022 for the first time ever and then declined further in 2023, as the increase in other applications was insufficient to overcome the soft demand and the inventory correction in TVs. Although DSCC expects that OLED TVs will recover starting in 2024 and will resume growth, TV’s share of overall OLED demand area will not recover, and by 2028 TV will be only 39% of all OLED area. The area demand for “all other” applications will climb to 21% of the total by 2028, driven by IT applications (monitors, notebooks and tablets), while smartphones fall to 40% of OLED area demand.

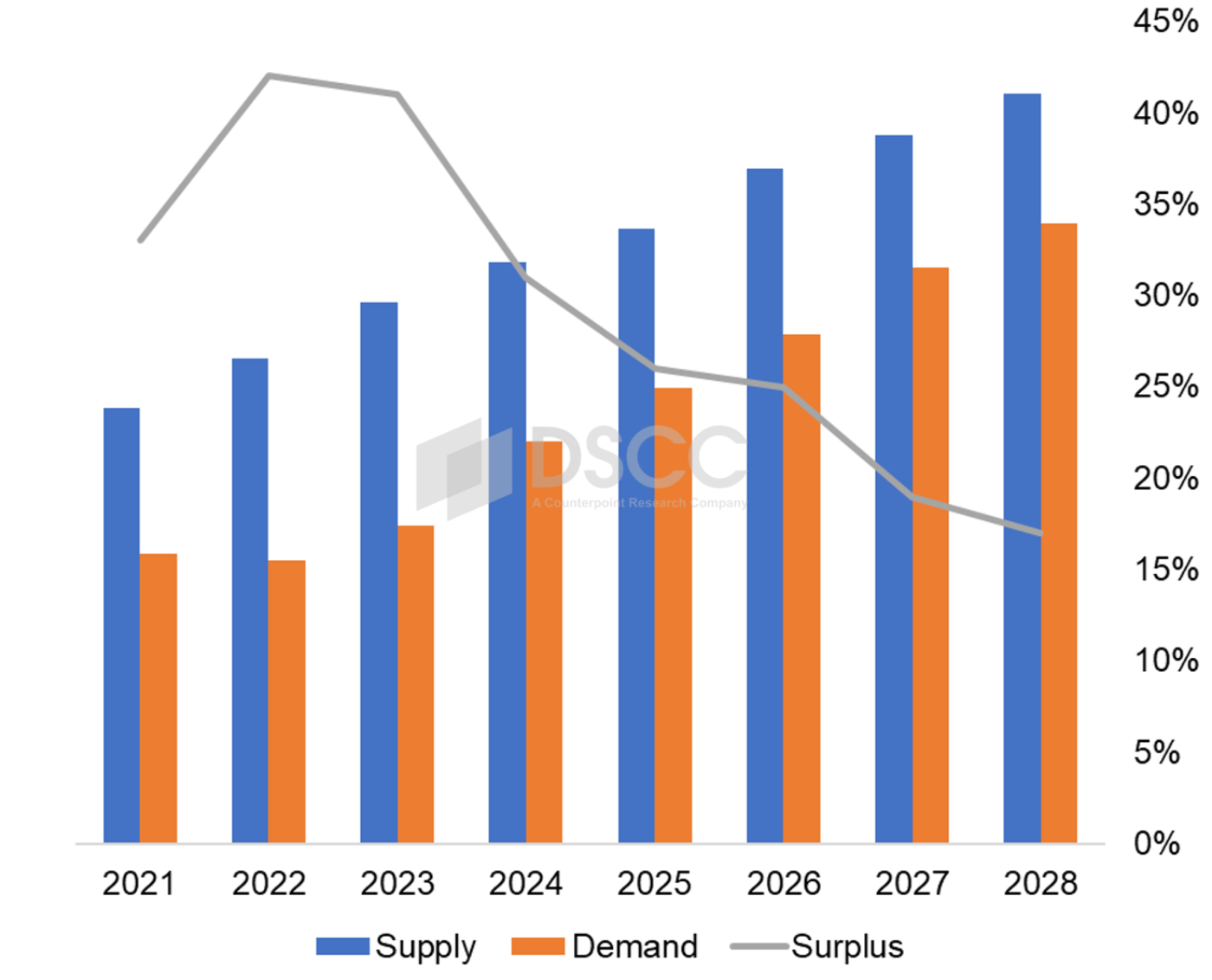

The chart below shows DSCC’s outlook for OLED panels for mobile & IT applications. While overall mobile OLED overcapacity was reduced in 2021 with demand growth outpacing supply growth, the sharp decrease in demand for rigid OLED panels for smartphones resulted in increased oversupply in 2022 and 2023. Steady growth in demand combined with more restrained growth in supply will reduce the oversupply steadily through 2028.

OLED Supply/Demand for Mobile Panels 2021-2028

On the larger screen side, TV/Monitor panel demand in 2023 declined for the second straight year with a precipitous 24% Y/Y drop. With increased capacity for both LGD and SDC, the result is that the capacity surplus has ballooned from 9% in 2021 (effectively, supply constrained) to 50% in 2023. While DSCC expects that demand growth for OLED TV and monitor panels will exceed supply growth throughout the forecast period, the surplus is expected to be 22% in 2028.

The DSCC Quarterly OLED Supply/Demand and Capital Spending Report gives a comprehensive perspective on the OLED industry. For more information about the report, please e-mail info@displaysupplychain.com or contact your regional DSCC office in China, Japan or Korea.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.