DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 01/08/2024

OLED Smartphone Panel Revenues Expected to Decline 4% Y/Y in 2024 as Units Increase 7% Y/Y

La Jolla, CA -

In the recently released Advanced Smartphone Display Shipment and Technology Report, DSCC revealed additional granularity and insights for the expected panel revenue declines for OLED smartphones. OLED smartphone panel revenue is expected to decline to $30B in 2023 from $32B in 2022 and to $29B in 2024.

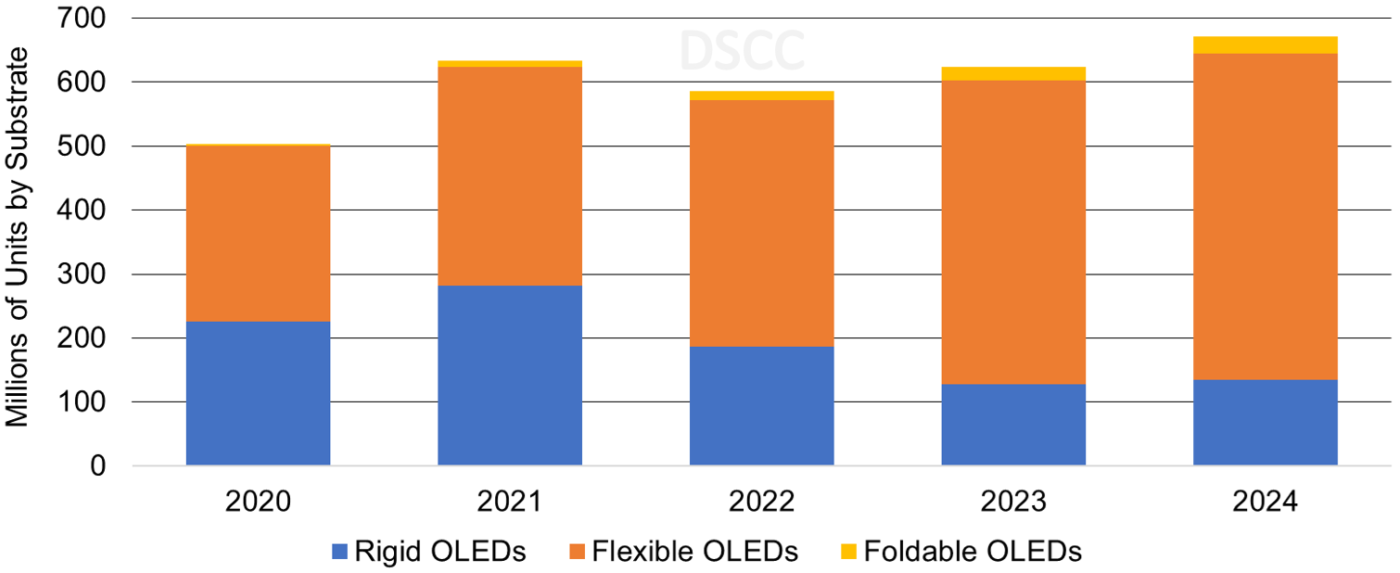

For 2023, DSCC expects OLED smartphone panel shipments to increase 6% Y/Y to 624M panels. Flexible OLED smartphone panels are expected to increase 23% Y/Y and account for a 76% unit share, up from 66% in 2022. Foldable OLED smartphone panels are expected to increase 46% Y/Y and account for a 4% unit share, up from 3% in 2022. Rigid OLED smartphone panels are expected to decline 32% Y/Y and account for a 20% unit share, down from 32% in 2022. According to DSCC Senior Director David Naranjo, "Rigid OLED smartphone panels continue to decline rapidly as a result of several Chinese panel suppliers pricing flexible OLED smartphone panels very close to rigid OLED smartphone panels and excess rigid OLED capacity being used for IT applications."

For 2024, we expect OLED smartphone panels to increase 7% Y/Y with flexible OLED smartphone panels increasing 7% Y/Y to maintain a 76% unit share. Foldable OLED smartphone panels are expected to increase by 20% Y/Y for a 4% unit share and rigid OLED smartphone panels are expected to increase 6% Y/Y for a 20% unit share, as a result of several brands increasing rigid OLED volume to drive lower price points in order to continue to spur the market in addition to 7% Y/Y rigid OLED blended panel ASP declines. In 2024, for flexible OLED smartphone panels, we expect the majority of brands to increase panel procurements by single- and double-digit percentages as a result of flexible OLED panel ASPs declining 12% Y/Y.

For 2024, we expect smartphone panel revenues to decline 4% Y/Y (after falling 8% Y/Y in 2023), with flexible smartphone panel revenues declining 6% Y/Y (after falling 5% Y/Y in 2023) followed by an 8% Y/Y increase for foldable smartphone panel revenues (after increasing 34% Y/Y in 2023). For rigid OLED smartphone panel revenue, we expect panel revenues to decline 1% Y/Y (after falling 48% Y/Y in 2023).

Annual OLED Smartphone Panels by Substrate, 2020 -2024

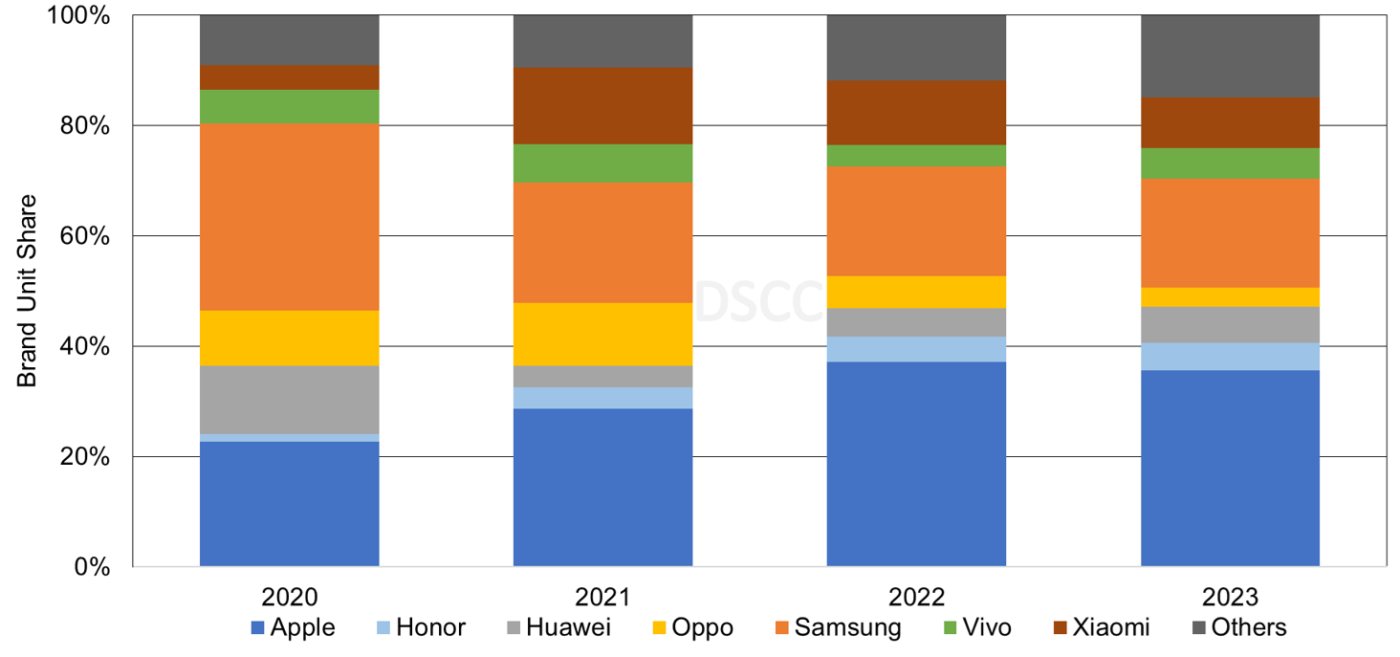

For smartphone OLED brand share in 2023, we expect Apple to have a 36% unit share and a 49% smartphone device revenue share, slightly down from 37% and 51% in 2022 as a result of gains from Honor, Huawei, Vivo and Others. Huawei is expected to increase to a 7% unit share, up from 5% in 2022, fueled by the Mate 60 series, Nova 12 series and other models. We also show the latest chipset supplier share along with specific chipsets. HiSilicon is expected to have significant Y/Y growth.

Annual OLED Smartphone Panel Shipment Share by Brand, 2020-2023

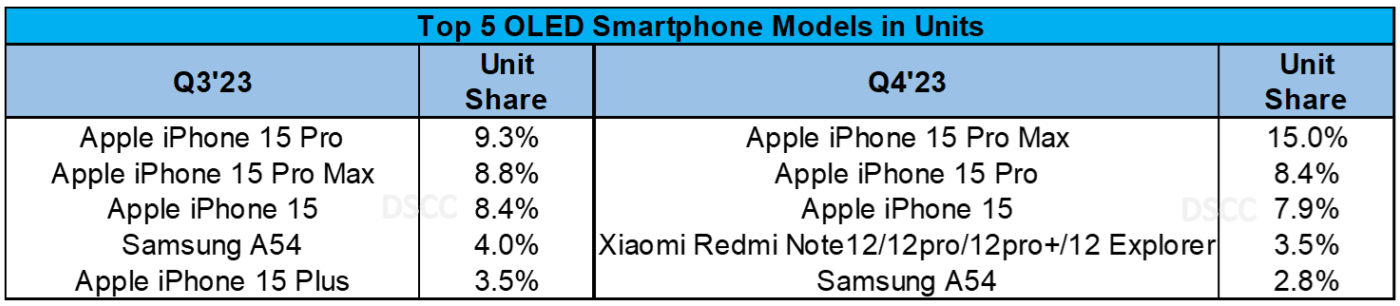

For Q4’23, DSCC expects the top five models to be the Apple iPhone 15 Pro Max, iPhone 15 Pro, iPhone 15, Xiaomi Redmi 12 series and the Samsung A54. These five models are expected to account for a 38% unit share and 51% smartphone device revenue share. For 2023, based on current panel shipments, DSCC expects the Apple iPhone 15 series to account for a 18% unit share of all AMOLED smartphone panels.

Q3’23 and Q4’23 Top 5 Rigid and Flexible OLED Smartphone Panel Procurement by Brand

Readers interested in subscribing to the Advanced Smartphone Display Shipment and Technology Report should contact info@displaysupplychain.com. This report includes all DSCC’s smartphone data covering all OLED smartphone and panel shipments by brand, model, all display and major non-display parameters, panel and device revenues and forecasts by quarter and by year through 2027. In addition, it provides insights into technology and innovation trends in OLED display technology, which is applicable to smartphones. There are over 1,400 AMOLED smartphone configurations in our database including variations by substrate, TFT backplane, panel supplier, refresh rate, chipset supplier, 5G networks and much more.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.