DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 02/19/2024

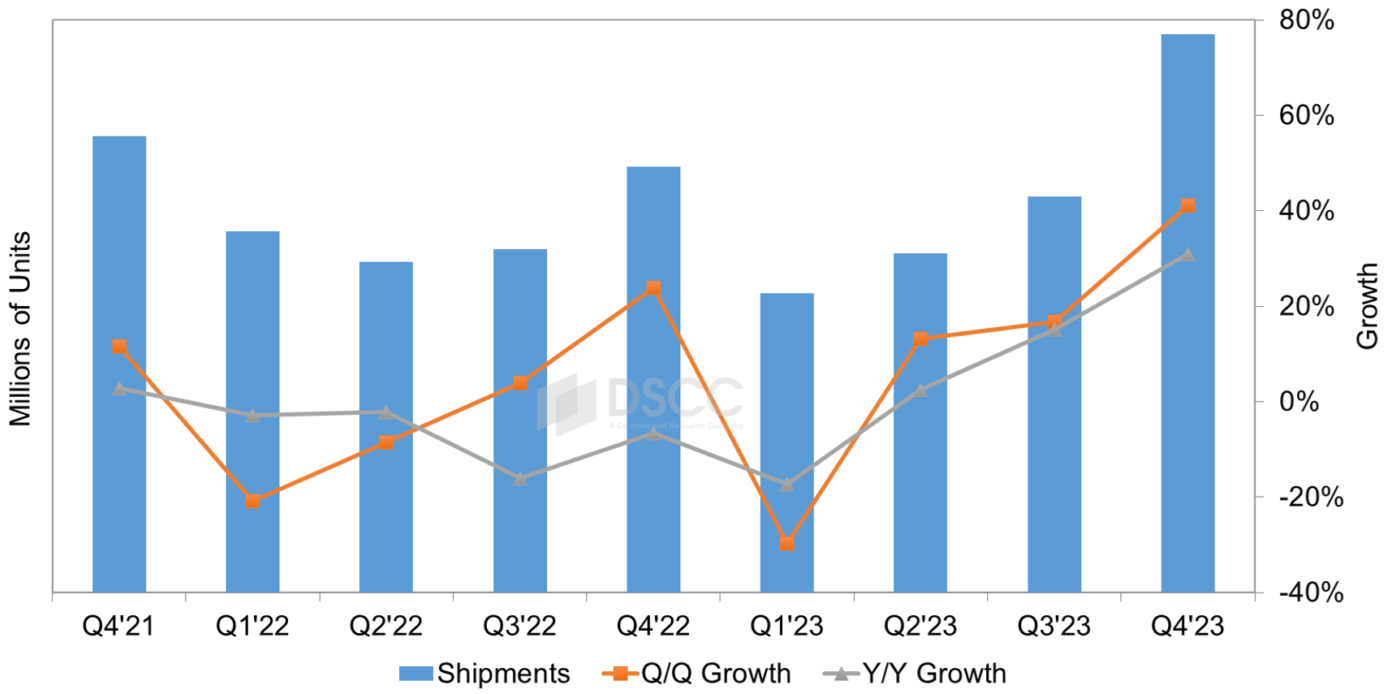

OLED Panel Shipments Increased 9% Y/Y in 2023 on 2H’23 Growth for Smartphones, Smartwatches, Tablets and Notebook PCs

La Jolla, CA -

As revealed in DSCC’s latest release of the OLED Shipment Report – Flash Edition, OLED panel shipments increased 41% Q/Q and 31% Y/Y in Q4’23 to 292M units after increasing 18% Q/Q and 14% Y/Y in Q3’23. According to DSCC Senior Director David Naranjo, “The continued Y/Y growth for several applications is welcomed news that the 2H’23 recovery materialized as a result of inventories normalizing after Y/Y declines in 2022 and in the first half of 2023. In 2H’23, OLED smartphones increased 42% vs. 1H’23 and increased 12% for the year. OLED smartwatches increased 101% vs. 1H’23 and increased 1% for the year. OLED tablets increased 58% vs. 1H’23 and increased 15% for the year. OLED notebook PCs increased 64% vs. 1H’23 and decreased 25% for the year. Several other applications also had 2H’23 and Y/Y growth. More categories and details can be found in the report.”

In Q4’23, by select OLED applications, OLED smartphone panel shipments increased 51% Q/Q and 27% Y/Y after a 12% Q/Q and 25% Y/Y increase in Q3’23 and OLED notebook PC panel shipments increased 58% Q/Q and 36% Y/Y after increasing 20% Q/Q and decreasing 18% Y/Y in Q3’23. More categories and details can be found in the report.

OLED Panel Shipments and Y/Y Growth, Q4’21 – Q4’23

In Q4’23, smartphones remained the largest OLED application with a 79% unit share, up from 74% in Q3’23 as a result of 60% Q/Q growth for flexible OLED smartphones and 46% Q/Q growth for rigid OLED smartphones. In 2023, OLED smartphones had a 79% share, up from 77% in 2022.

For OLED smartphones, Apple had 77% Q/Q unit growth as a result of triple-digit Q/Q increases for the iPhone 14 and iPhone 15 Pro Max and double-digit Q/Q increases for the iPhone 15 Pro, iPhone 15, iPhone 13 and iPhone 12 Pro Max. Samsung had a 25% Q/Q unit growth as a result of growth for the S24 series, S23 series and A-series models. Several other brands had double-digit Q/Q unit growth as a result of new flagship models being launched in Q4’23 and in Q1’24. In the Monthly Flagship Smartphone Tracker, we show panel shipments for models launched since 2021 with the latest release showing January 2024 actuals and a February – March estimate.

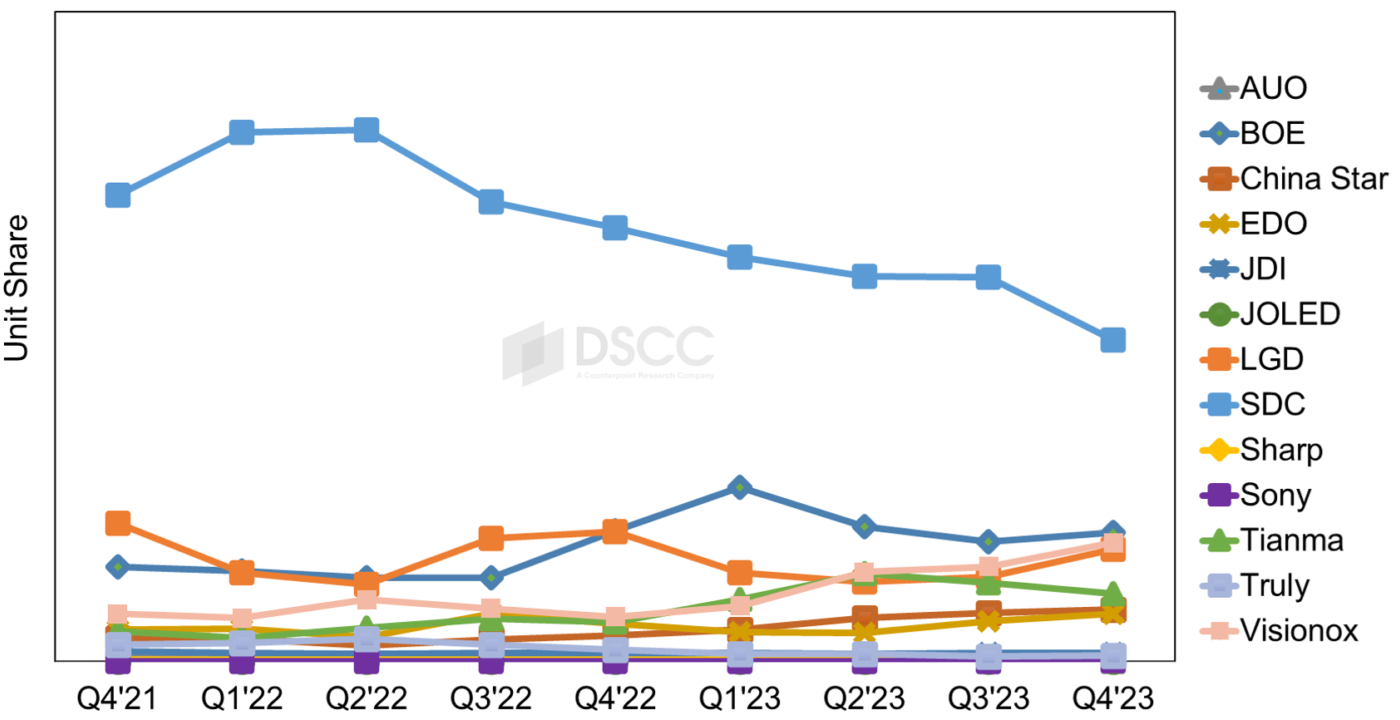

By OLED panel supplier, SDC continues to lead in OLED panel shipments with a 37% overall share, down from 44% in Q3’23, on gains from BOE, China Star, EDO, LGD and Visionox. For SDC, OLED smartphone units were up 26% Q/Q with significant increases from Apple, Samsung and others. For BOE, OLED smartphones were up 57% Q/Q for a 15% overall share, up from 14% in Q3’23, fueled by Apple with triple-digit Q/Q growth for the iPhone 13, iPhone 14 and the start of panel shipments for the iPhone 15. For LGD, OLED smartphones units were up 313% Q/Q for a 13% overall share, up from 10% in Q3’23 as a result triple-digit growth from Apple. The iPhone 15 Pro Max had substantial Q/Q growth and the iPhone 15 Pro had 83% Q/Q growth.

OLED Panel Shipments by Panel Supplier, Q4’21 – Q4’23

DSCC’s long-term forecast for OLED units, revenues, area, panel supplier share, form factor share, brand share, etc., will be available next month. For more information, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.