DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 01/02/2024

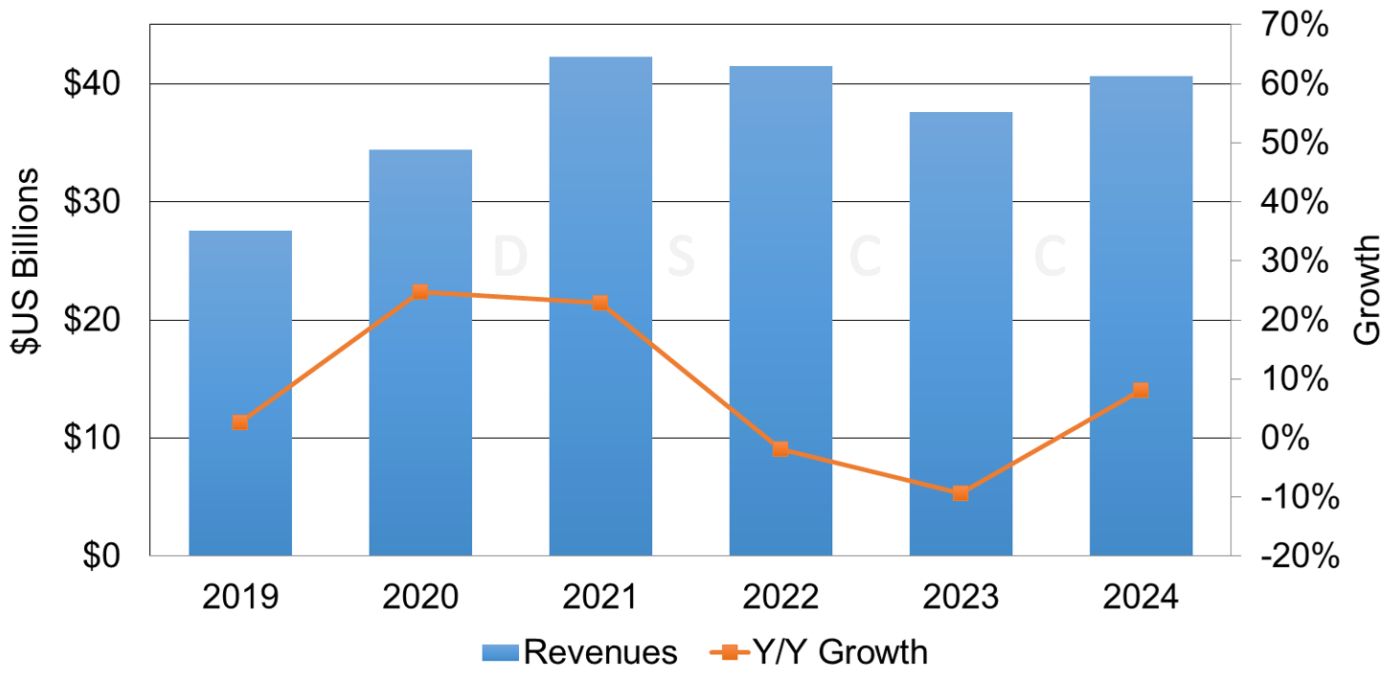

OLED Revenues to Decline 9% Y/Y in 2023 – Recovery in IT Categories and Smartphones Expected to Continue in 2024

La Jolla, CA -

As revealed in DSCC’s latest release of the OLED Shipment Report, OLED panel revenues are expected to fall by 9% Y/Y in 2023 to $37.6B versus our prior estimate of a 13% Y/Y decline. The improvement to panel revenues is the 2% Y/Y increase for units as a result of the 2H’23 inventory and demand improvement for several applications. According to DSCC Senior Director David Naranjo, "In Q3’23, OLED smartphones increased 9% Q/Q and 22% Y/Y and OLED tablets increased 61% Q/Q and 103% Y/Y. Several other applications had Q/Q and Y/Y increases. Please refer to the report for more details. As a result of the increases, 2H’23 is expected to be up 37% versus 2H’22, which was up 11%."

In 2023, by select OLED applications:

- We expect OLED smartphone units to increase 6% Y/Y and decline 9% Y/Y in revenues on 23% Y/Y unit increases for flexible and 46% Y/Y unit increases for foldable OLED smartphones with double-digit panel ASP declines;

- We expect OLED TVs to decline 29% Y/Y in units and 26% Y/Y in revenues;

- We expect OLED notebook PCs to decline 26% Y/Y in units and 33% Y/Y in revenues as a result of the 1H’23 inventory issues and macroeconomic environment. The 2H’23 has seen improvements as a result of the rebalancing of brand and channel inventories as well as increased demand from back-to-school and holiday seasonality. We show OLED notebook PCs tracking 61% higher in the 2H’23 versus the 1H’23.

We expect other OLED applications to have unit and revenue growth in 2023. These include AR/VR, automotive, monitors and tablets. In 2024, we expect 11% Y/Y unit and 8% Y/Y revenue growth, fueled by AR / VR with triple-digit Y/Y growth, IT applications with triple digit Y/Y growth for tablets as a result of Apple entering the OLED tablet category and double-digit Y/Y growth for monitors and notebook PCs. For OLED smartphones, we expect single-digit Y/Y growth fueled by growth for flexible and foldable OLED smartphones on lower panel ASPs. Further details can be found in the report.

AMOLED Panel Revenue and Y/Y Growth, 2019 – 2024

In 2023, smartphones are expected to remain the dominant application with an 80% unit and 79% revenue share. OLED smartwatches are expected to remain the #2 application with a 14% unit share, down from 16% in 2022 and a 5% revenue share, down from 6% in 2022. In 2027, on a panel revenue basis, we expect OLED smartphones to decline to a 55% revenue share as a result of gains from OLED notebook PCs, monitors, tablets, AR/VR and automotive applications.

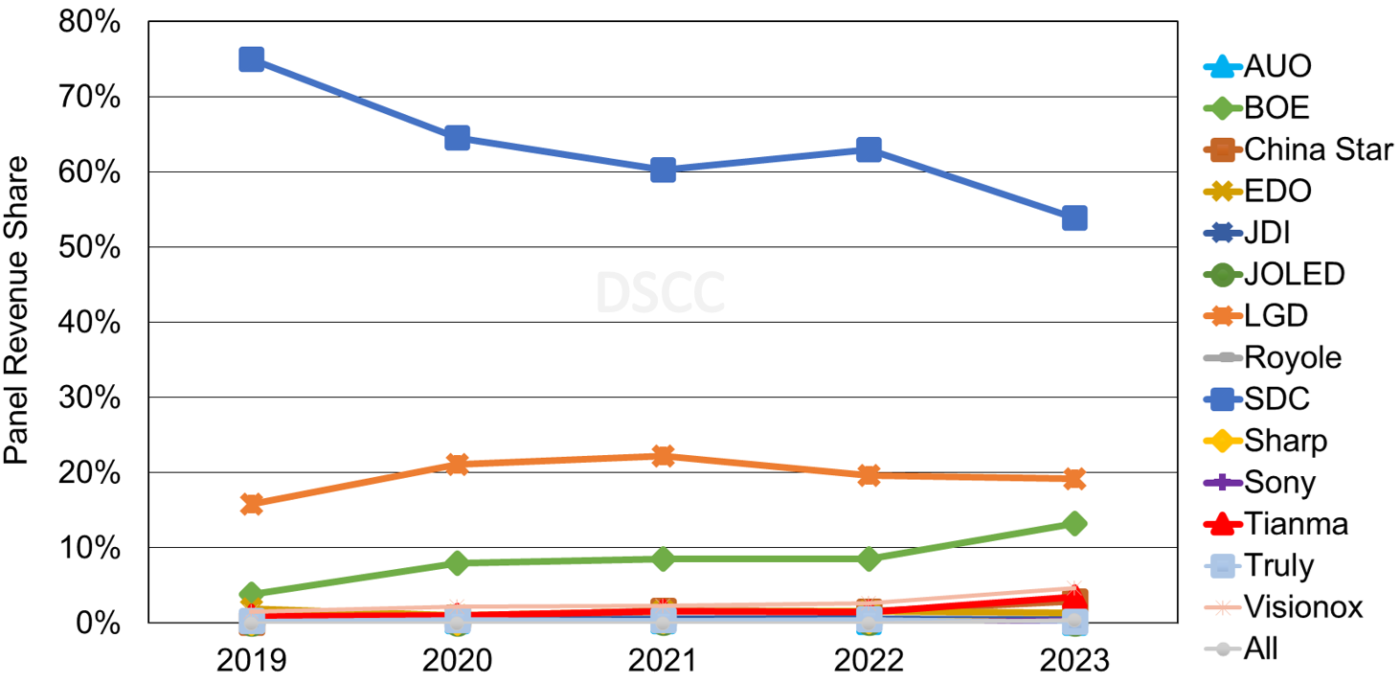

In 2023 for panel revenue by panel supplier for all applications:

- We expect SDC to have the majority panel revenue share as a result of triple-digit Y/Y growth for monitors and double-digit growth for automotive and tablets. As a result of SDC being the only panel supplier providing all four iPhone 15 panels in 2023, we expect SDC to have a 76% share of the iPhone 15 series panel shipments in 2023.

- We expect LGD’s revenue share to be 19%, down from 20% in 2022. LGD is the panel supplier for the iPhone 13, iPhone 13 Mini, iPhone 14, iPhone 14 Pro Max, iPhone 15 Pro and iPhone 15 Pro Max. We expect LGD to account for 22% of the iPhone 15 series panel shipments in 2023 as a result of LGD supplying panels for only the LTPO OLED panels for the iPhone 15 Pro and iPhone 15 Pro Max. LGD is also a key panel supplier for the growth areas of monitors and automotive applications. For OLED monitors, LGD is expected to have a 38% unit share, up from 34% in 2022 and a 33% revenue share, up from 30% in 2022. For OLED TVs, LGD is expected to have an 82% unit share and 76% revenue share.

- We expect BOE to be the #3 panel supplier with a 13% revenue share in 2023, up from 9% in 2022. The increase in panel revenue share is the result of a 47% Y/Y unit increase for smartphones and triple-digit growth for automotive applications. For Apple OLED smartphones, BOE provides panels for the iPhone 12, iPhone 13, iPhone 14 and supplies panels for the iPhone 15 and iPhone 15 Plus. In 2023, BOE is expected to have a 16% share of iPhone panel shipments, up from 14% in 2022.

AMOLED Panel Revenue Share by Panel Supplier, 2019 - 2023

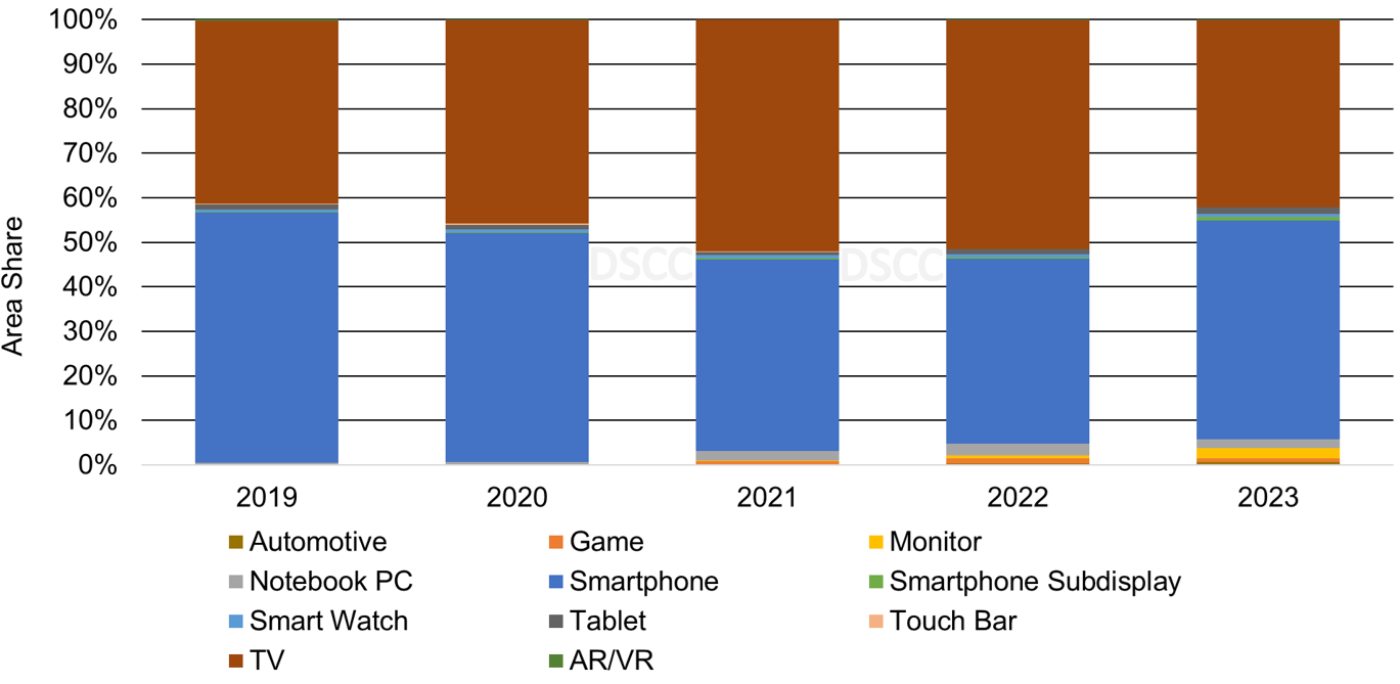

On an area basis, OLED TVs are expected to have a 42% area share in 2023, down from 51% in 2022 as a result of gains from smartphones, tablets, automotive applications and monitors. In 2023, we expect OLED smartphones to grow to a 48% area share, up from 42% in 2022 as a result of a 43% Y/Y unit increase for the 6.6” to 8” category.

Annual OLED Area Share by Application, 2019-2023

Readers interested in subscribing to the Quarterly OLED Shipment Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.