DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/20/2023

New MicroLED Forecast Shows Smart Watches Taking the Lead

La Jolla, CA -

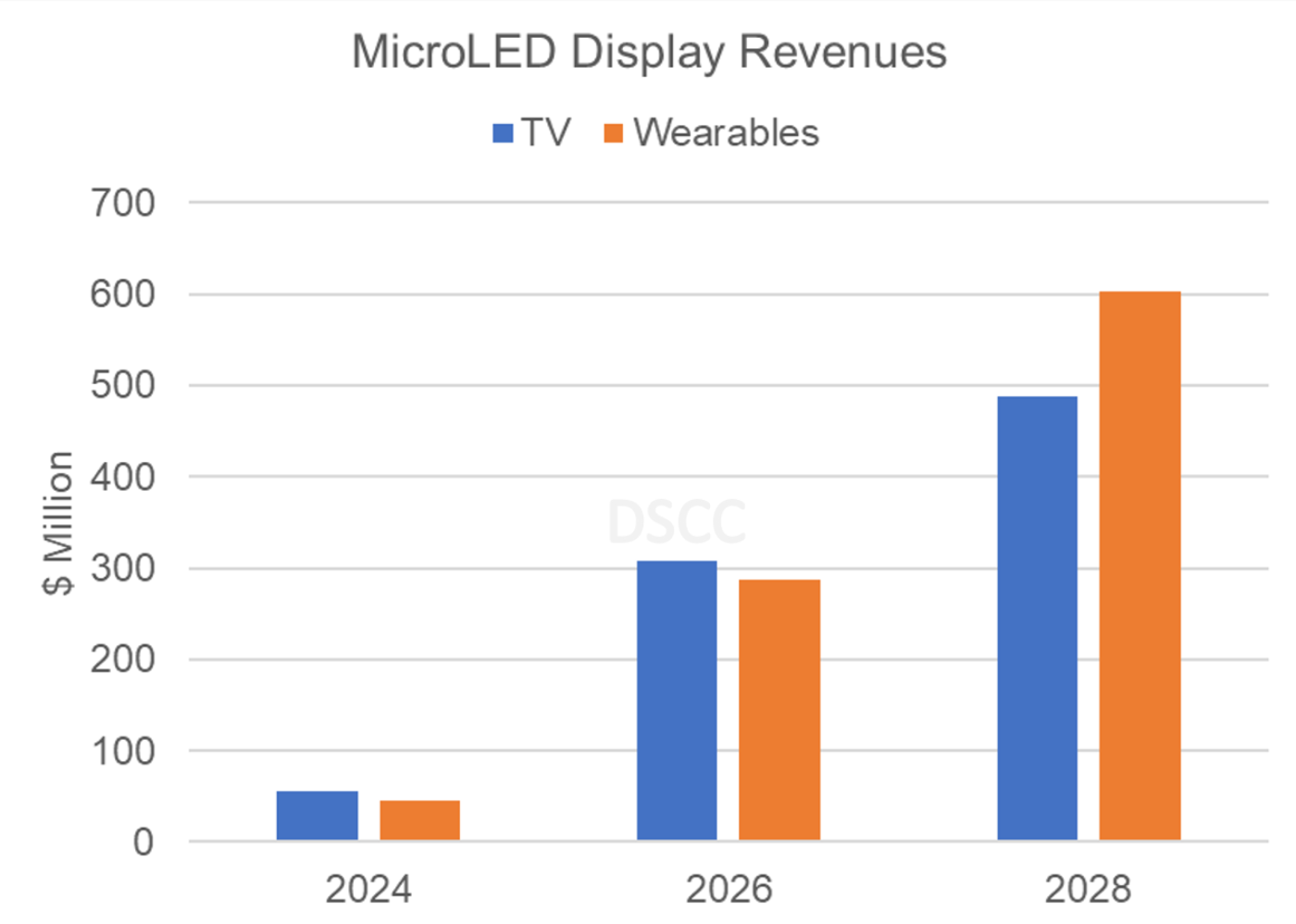

The market for MicroLED displays is expected to surpass $1.4B by 2028, according to DSCC’s latest MicroLED Display Technology and Market Outlook Report. MicroLED will slowly appear in a few applications, such as smart watches, AR glasses and automotive displays, where superior performance can justify a higher price for the display.

“Although there are some products available right now, MicroLED is still far from being mainstream technology,” notes Guillaume Chansin, Director of Display Research at DSCC. “The first MicroLED smart watch is scheduled to launch next year, but even this will be targeted at the high end of the market.”

Wearable devices such as smart watches can benefit from the high brightness and high efficiency of MicroLED displays. For display manufacturers, the small form factor and low pixel count of smart watches can initially mitigate low yields of production processes. DSCC predicts that wearables will eventually overtake TV as the largest market segment for MicroLED display.

Samsung has so far been the leading brand pursuing MicroLED TVs. At CES 2023, Samsung demonstrated seven different sizes, ranging from 50” to 140”. However, only an 89” model was made available this year, with a price tag around $100K. While prices will decrease over time, DSCC expects that MicroLED TVs will remain on the luxury end of the market. Samsung has also adopted the new QD-OLED technology, which is much more affordable than MicroLED. Samsung has positioned itself as the only TV brand offering MiniLED LCD, QD-OLED and MicroLED.

For AR/VR, MicroLED displays are manufactured as monolithic LED arrays on silicon CMOS backplanes to achieve the required high pixel density. MicroLED is seen as an enabling technology for future smart glasses and large companies such as Meta, Google and Snap are developing their own display in-house. However, making full color displays has been a challenge. Several solutions have been proposed, including quantum dot color conversion, epilayer stacking and dynamic wavelength tuning. All these approaches are described in the report.

The DSCC report includes market forecasts by application to 2028 and addresses all the important topics on MicroLED, including:

- Epitaxy and efficiency challenges;

- Mass transfer technologies;

- Yield and defect management strategies;

- Color conversion with quantum dots;

- Backplanes and driving schemes;

- Monolithic displays (LEDoS);

- Cost analysis (epiwafers, backplanes, QD color conversion);

- Competitive landscape.

Companies covered in the report include:

- Aledia

- Ams OSRAM

- Apple

- Applied Materials

- AUO

- Coherent

- eLux

- Ennostar

- Foxconn / Sharp

- Jade Bird Display

- K&S

- Lumileds

- Meta

- MICLEDI Microdisplays

- Mojo Vision

- NS Nanotech

- PlayNitride

- Porotech

- Samsung

- Saphlux

- Seoul Viosys

- Snap

- Sony

- TCL

- Toray

- VueReal

- Vuzix

- X Display

This report will be valuable to anyone in the display supply chain and end users who need to stay up to date with the latest developments in MicroLED. It lists the OEMs currently developing products incorporating MicroLED displays and provides shipment and revenue forecasts for each application.

For more information on DSCC’s MicroLED Display Technology and Market Outlook Report, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.