DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/06/2024

New DSCC Report Shows How MicroLED Market Can Grow After Apple’s Exit

La Jolla, CA -

- Revised forecast shows impact of Apple’s decision to cancel MicroLED watch.

- DSCC increases estimates for AUO’s panel shipments after reports of improving yields.

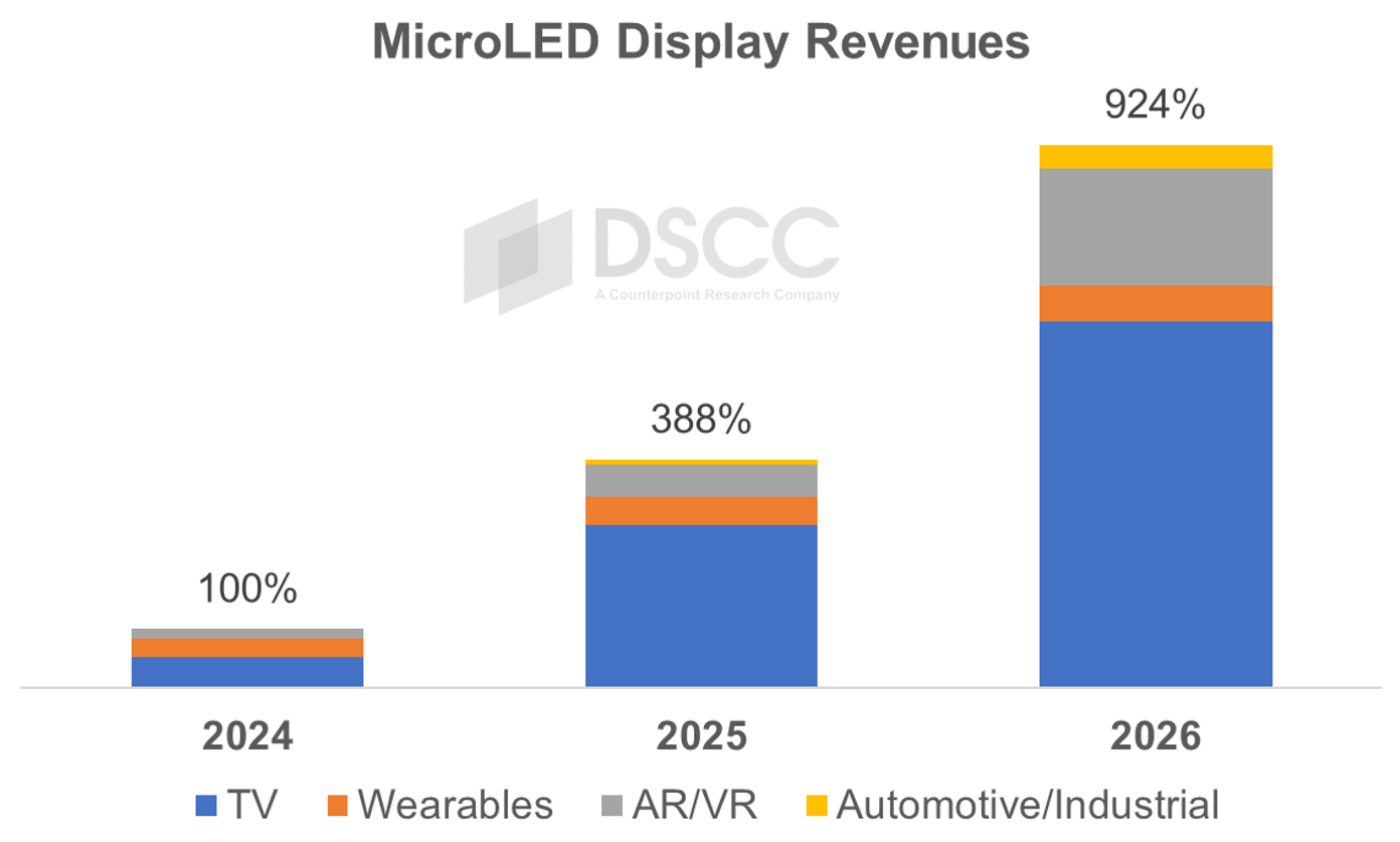

- Total revenues for MicroLED displays could be nine times bigger by 2026.

DSCC has released the latest edition of its MicroLED Display Technology and Market Outlook Report. The revised forecast is significantly different from last year’s due to Apple’s decision to cancel the launch of the MicroLED Apple Watch. While Wearables were previously expected to be the largest segment for MicroLED displays, it now comes third after TV and AR/VR.

Apple’s exit has not completely destabilized the industry. AUO has effectively become the new champion for MicroLED smartwatches and is shipping panels to Tag Heuer and Garmin. AUO has successfully managed to improve yield in 2024 and plans to further reduce costs next year. While the price of MicroLED is still expected to be much higher than OLED, MicroLED can be a viable option in high-end or professional devices. DSCC has increased the forecast for AUO’s panel shipments.

AUO and other panel makers are also targeting automotive applications. MicroLED has been demonstrated either as a superior alternative to LCD/OLED, or as a transparent display that can enable innovative designs. Recent demos have been included in the report.

For AR/VR, there are already some smart glasses available with MicroLED displays. These displays are sometimes labelled as LED on Silicon (LEDoS) because they are manufactured on silicon CMOS backplanes. Meta has unveiled its Orion smart glasses based on MicroLED displays and silicon carbide waveguides. However, Orion is a concept device and will not be mass produced. MicroLED is still seen as an enabling technology for future smart glasses but making full color displays remains a challenge.

Samsung is the leading brand for MicroLED TVs and is now offering three models in the US, with prices starting from $110,000. While the price is not competitive against OLED TVs, MicroLED can be available in larger sizes than OLED. Therefore, MicroLED can be positioned as the premium solution for home theaters. TCL has also entered this market, and the competition will likely put some pressure on prices. Assuming prices can decrease significantly year on year, the TV segment will be the main driver for revenue growth. Based on this scenario, total revenues for MicroLED displays are expected to be nine times bigger in 2026, compared to 2024.

The DSCC report includes market forecasts by application to 2028 and addresses all the important topics on MicroLED, including:

- Epitaxy and efficiency challenges;

- Mass transfer technologies;

- Yield and defect management strategies;

- Color conversion with quantum dots;

- Backplanes and driving schemes;

- Monolithic displays (LEDoS);

- Cost analysis (epiwafers, backplanes, QD color conversion);

- Competitive landscape.

This report will be valuable to anyone in the display supply chain and end users who need to stay up to date with the latest developments in MicroLED. It lists the OEMs currently developing products incorporating MicroLED displays and provides shipment and revenue forecasts for each application.

For more information on DSCC’s MicroLED Display Technology and Market Outlook Report, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.