Ross Young

ross.young@displaysupplychain.com

FOR IMMEDIATE RELEASE: 05/03/2021

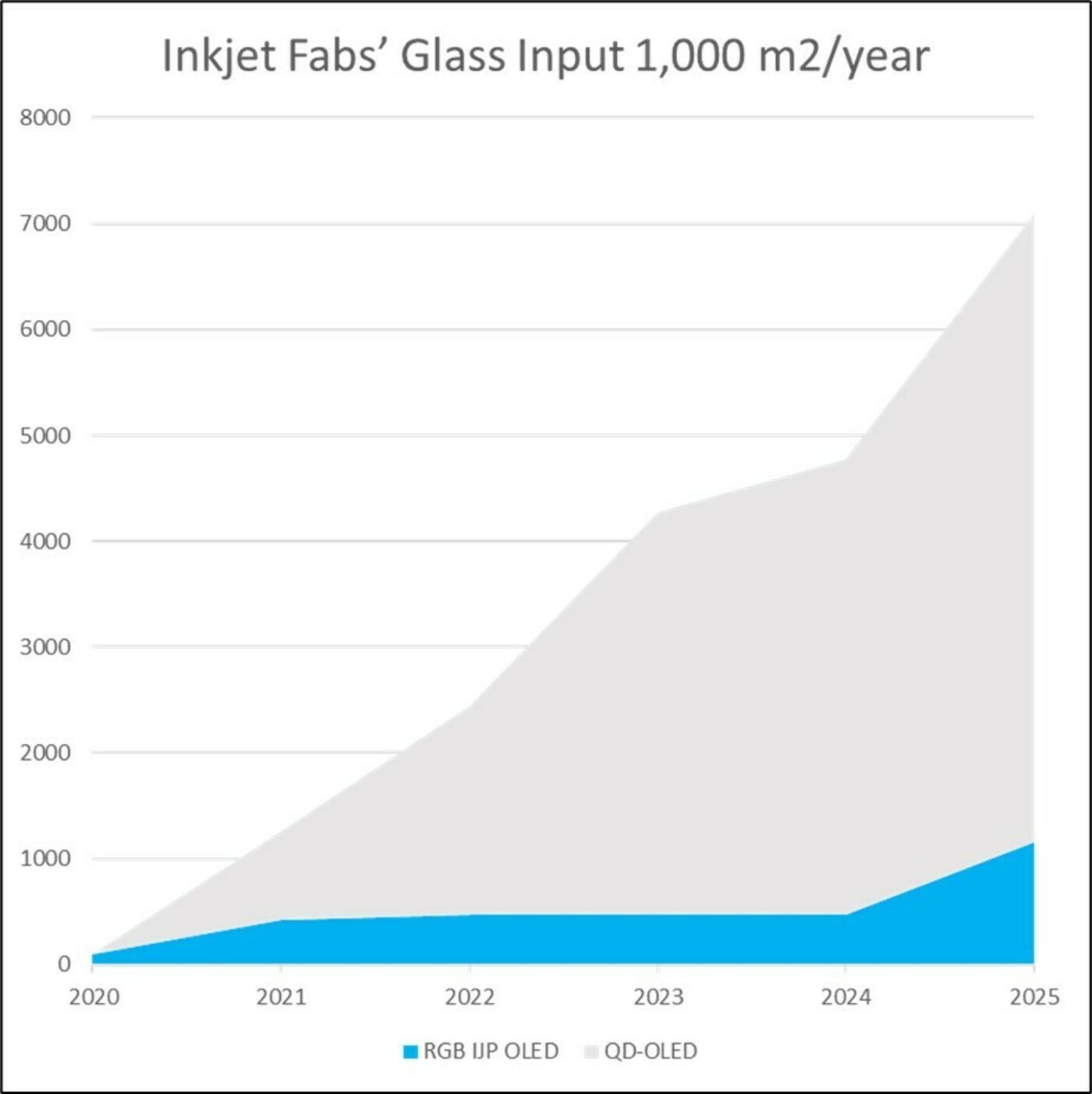

New DSCC Report Reveals Challenges, Status and Promise of Inkjet Printing OLED and QD Displays – Annual Capacity to Reach Over 7M Square Meters by 2025

Austin, TX -

Display Supply Chain Consultants (DSCC) has released a new report offering a deep dive into the status and outlook for producing displays using inkjet printing (IJP) for the emitter or color conversion steps.

The report is authored by DSCC Senior Analyst Chase Li who previously worked on IJP development lines at TCL. The Inkjet Printing Technology Report will allow the reader to:

- Understand the performance benefits of RGB IJP OLEDs versus other technologies;

- Gain an understanding of the pros and cons of each type of IJP tool, including detailed specifications;

- Learn the status and challenges related to soluble OLED and QD materials and the status of each suppliers’ offerings;

- Discover how panel suppliers and IJP suppliers are implementing IJP and how JOLED’s solution and SDC’s differs from others;

- Find out the status of IJP adoption at each panel supplier and what panel suppliers and OLED and QD material and equipment suppliers need to do to improve their competitiveness;

- See the IJP equipment and material supply chains by panel supplier by layer;

- Examine the cost differences between WOLEDs and RGB IJP OLEDs in multiple applications at different sizes and how RGB IJP OLEDs can further improve their competitiveness;

- Get the latest IJP OLED and QD fab schedules and forecasts.

Although displays with inkjet printer OLED emitters and inkjet printer color conversion layers have started mass production later than anticipated, they will both be in mass production in 2021. From 2020 to 2025, IJP display capacity is expected to rise at a 137% CAGR to 7.1M m2 in 2025 as seen in the chart below. The market will be made by JOLED, Samsung Display and China Star. In fact, IJP fab equipment spending in 2023 alone will exceed $3B on new fabs at China Star and Samsung Display.

According to Li, “Although IJP is still early in its development, problems are being solved and performance and yields are improving. Limitations in conventional vacuum-based AMOLED production processes not only increase the production cost for TV panels slow penetration into the high-end market, but technology constraints also limit the expansion of AMOLED technology into IT products such as desktop monitors. Inkjet printing has the potential to become a game-changer and enable AMOLEDs to boost penetration into new markets.”

DSCC defines inkjet printing technology as using printing technology to make light emitting layers as well as color conversion layers. JOLED is the first company to mass produce RGB IJP OLEDs targeting medium displays and China Star has announced a new fab, T8, to bring this technology to TV panel production. In addition, Samsung Display will begin mass production of QD-OLEDs using inkjet printing for the color conversion layers later this year.

The core competitiveness of inkjet printing is higher utilization of expensive OLED and QD materials, lower frontplane equipment costs and better performance enabled by top emission structures resulting in higher resolution and brightness with potential for a better lifetime and burn-in performance. IJP also can be used on a wide resolution and panel size range compared to existing technologies.

However, there are many challenges related to inkjet printing covering various mura defects to material challenges. This 140+ page report delves into these constraints in great detail and is segmented into:

- Basic Introduction of Inkjet Printing

- Inkjet Printing Technology in Action

- Challenges and Potential Solutions

- Supply Chain Analysis

- Analysis, Forecasts and Conclusions

For more information on this Inkjet Printing Technology Report, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.