DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 07/29/2024

MiniLEDs Expected to Enjoy Highest Penetration in Automotive from 2026

La Jolla, CA -

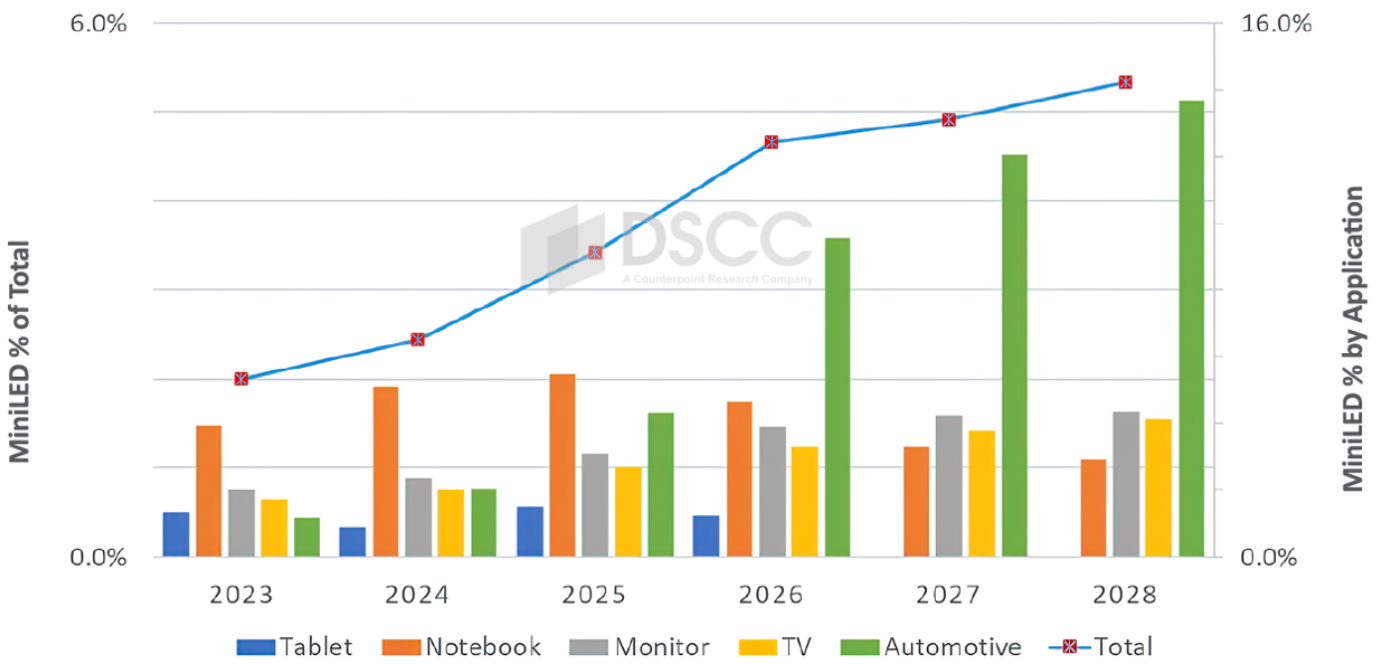

- In 2024, the total penetration rate for MiniLED is expected to be 2.5%.

- MiniLED penetration in automotive is expected to reach 10% in 2026.

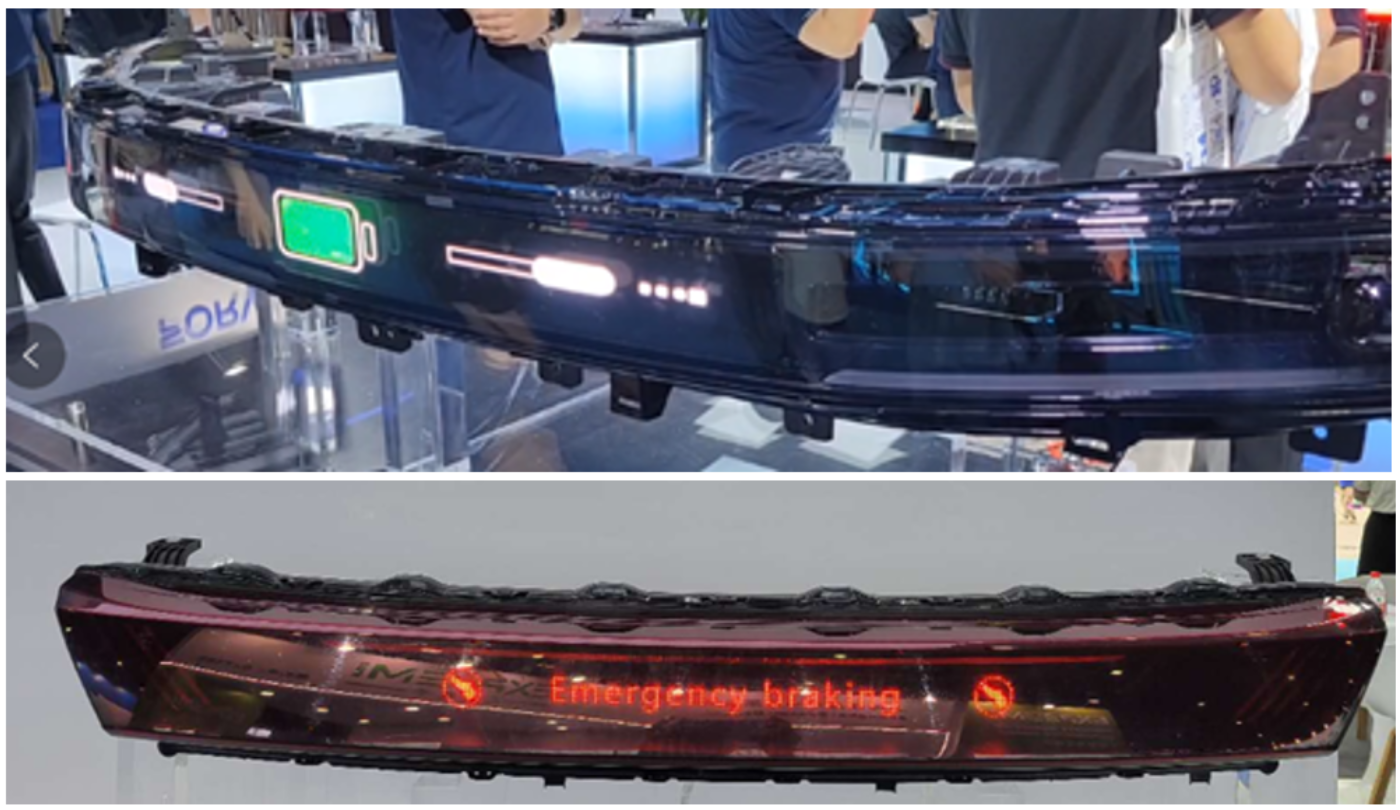

- In addition to being used in displays, MiniLEDs can also be adopted into other applications such as headlights, taillights and graphic displays.

DSCC’s latest Quarterly MiniLED Backlight Technologies, Cost and Shipment Report revealed that MiniLED has become an important role and a strategic resource in both the display and LED industries. MiniLED shipments were 4.45M units in Q1’24 and are expected to remain flat in Q2’24. Total shipments for MiniLED panels are expected to reach more than 19M units in 2024.

Highlights from the latest report include:

- The total penetration of MiniLED continues to steadily increase. Most key players are very aggressive in adopting MiniLED backlight to interior displays, especially in the automotive industry. MiniLED penetration is expected to reach 9.6% in automotive displays in 2026 and is expected to reach 13.7% in 2028.

MiniLED Penetration by Application

- Korean auto brands plan to adopt MiniLED in mainstream models in 2026 and this will boost MiniLED penetration in automotive.

According to DSCC Analyst, Leo Liu, “In Q2’24, Apple replaced MiniLEDs with OLEDs in the iPad Pro. This had a significant impact on MiniLED, and although it may have failed in tablets, its penetration in other applications continues to grow, especially in TV and automotive. Sony and other Chinese TV brands are very aggressive on MiniLED adoption. Most new models have adopted a POB MiniLED design due to good-enough performance and affordable costs. As for automotive, MiniLED has more irreplaceable advantages, such as high brightness, good contrast and robustness, compared with other display technologies. It perfectly matched requirements for automotive displays. Meanwhile, the price sensitivity in automotive is much less than in consumer electronics. Both irreplaceable performance and less price sensitivity help MiniLED to have higher penetration in automotive than other applications. “

The latest Quarterly MiniLED Backlight Technologies, Cost and Shipment Report has been updated with the latest market dynamics and provides a comprehensive analysis on shipments, technology updates, the supply chain and forecast.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.