DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 01/30/2023

MiniLED Panel Shipments Grew in 2022, Rapid Growth Expected in 2023 and 2024

La Jolla, CA -

While the display industry is suffering through one of its worst downturns in its history and the tough situation will last the next two or three quarters, DSCC’s Quarterly MiniLED Backlight Technologies, Cost and Shipment Report revealed that MiniLEDs are still a bright spot. Q4’22 MiniLED backlight shipments reached 5.6M units with 1% Y/Y growth.

Highlights from the latest report include:

- At the 2023 CES, many new MiniLED IT products were released.

- MSI: Taitan G177 embedded with 17” MiniLED display;

- Asus: ROG Strix Scar embedded with 16” & 18” MiniLED display;

- Lenovo: Thinkbook 16p Gen 4 embedded with 16” display;

- New products from Acer, Razer, Samsung, etc.

- As expected, Apple still dominates MiniLED IT panel shipments. MiniLED iPad panel shipments amounted to 1.6M units in Q4’22 with the MacBook Pro at 2.2M panels.

- We saw a new concept of adaptive drive beam (ADB) that leverages MiniLED technology for the automotive market, MiniLED embedded local dimming, which was launched by Porsche recently. Samsung, Seoul Semiconductor and ams Osram are promoting MiniLED ADB to the automotive industry.

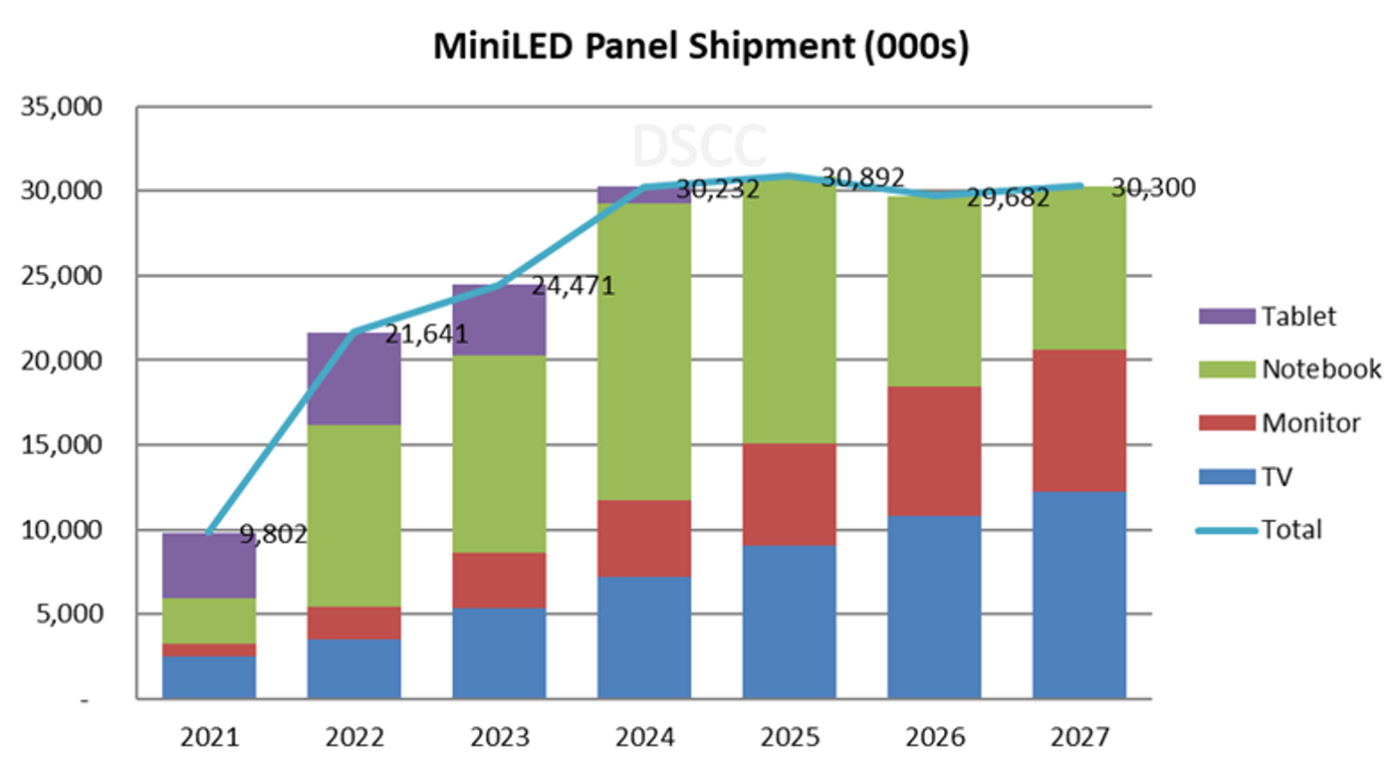

- MiniLED panel shipments for all applications were 21.6M panels in 2022, up 121%, and are expected to reach 30.3M panels in 2027 after eventually losing share in tablets and notebooks to OLEDs.

- Notebooks will be the main driving force for MiniLED growth before 2026. TVs and monitors will become the main driving force after 2026.

- 12.9” iPad Pro and 14”/16” MacBook Pro will maintain large contributions to MiniLED tablet & notebook shipments before 2025.

- OLED will be adopted in the iPad in 2024 and in the MacBook Pro in 2025. This will have a big impact on MiniLED.

- MiniLED shipments from tablets will drop to zero from 2025 due to the adoption of OLEDs.

- Korea, Japan and main TV brands in China released new MiniLED TVs at CES. Key TV brands remain aggressive in promoting MiniLED TVs. This will drive TV to become the largest application for MiniLED shipments after 2026.

- Apart from IT and TV displays, MiniLED is starting to penetrate more and more applications, such as AR/VR, automotive, medical, etc.

- MiniLEDs are also being widely adopted in direct-view displays, serving as the display itself, not the backlight.

According to DSCC Director of Taiwan Operations, Leo Liu, “Shipments of MiniLED products will keep growing steadily in display backlights. Apart from backlights, we expect to see more and more applications to adopt MiniLED technology. The development of MiniLED is really beyond imagination.”

The latest MiniLED report provides a comprehensive analysis on shipments, the supply chain, a forecast and includes a technology update. With this valuable information, users can deepen their understanding about MiniLED development and its future as it penetrates more applications.

DSCC’s Quarterly Quarterly MiniLED Backlight Technologies, Cost and Shipment Report includes quarterly shipments through 2023 with annual data through 2027 by brand, model, panel size, resolution, refresh rate, backplane technology, number of LEDs, dimming zones, etc. and includes panel shipments, supply chain shipments, panel revenues, backlight revenues, panel prices, backlight prices, backlight bill of materials and much more. For more information, please contact info@displaysupplychain.com

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.