DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 12/18/2023

LCD Panels to Capture 67% Share of AR/VR Display Shipments in 2024

La Jolla, CA -

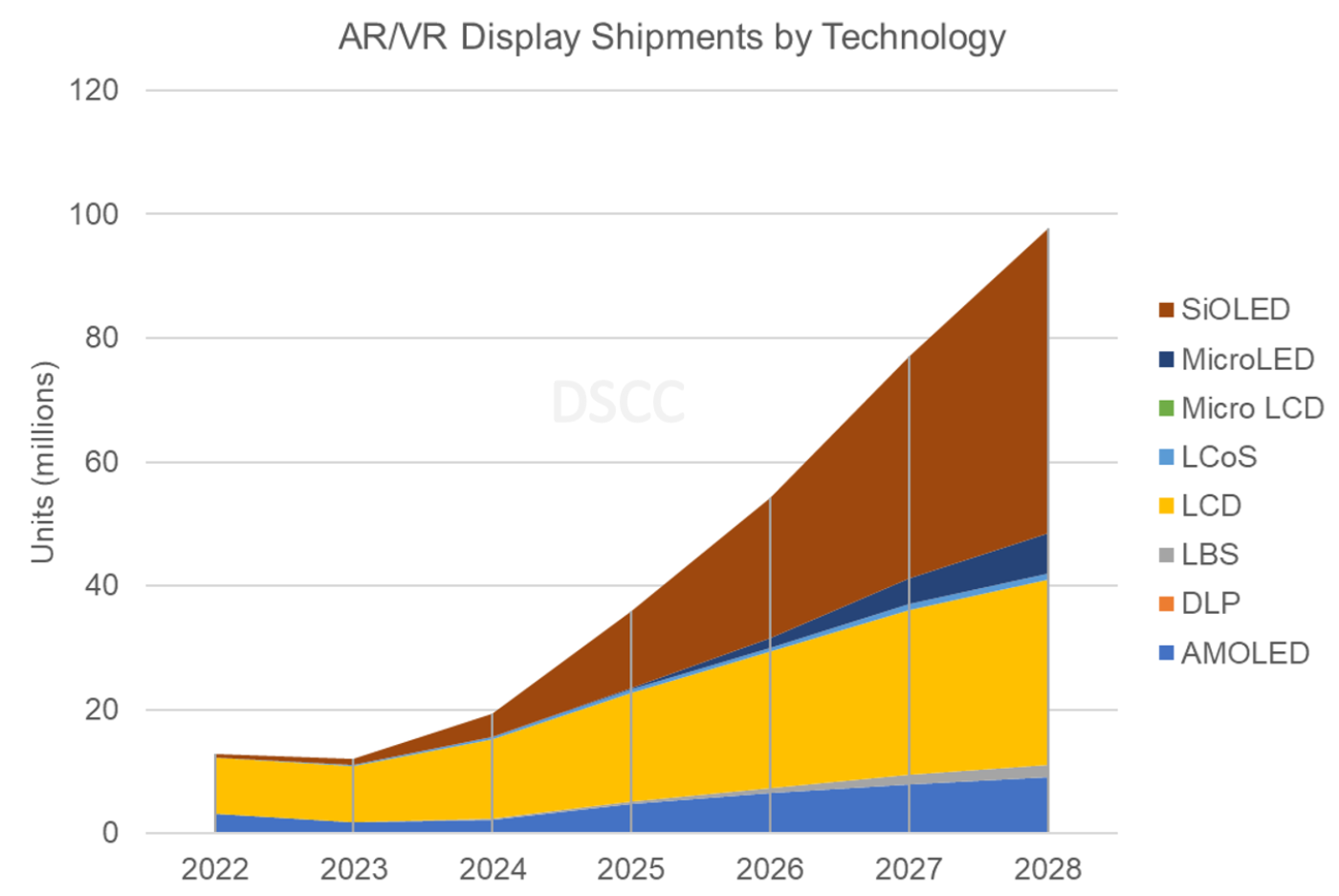

Display shipments for AR/VR devices are only expected to reach 19M units in 2024, according to the latest update of DSCC's Biannual Augmented and Virtual Reality Display Technologies and Market Report. LCD will have the biggest share of shipments, with nearly 13M panels. DSCC, a Counterpoint Research Company, also expects that SiOLED (a.k.a. Micro OLED) will take second place for the first time.

According to DSCC Director of Display Research Dr. Guillaume Chansin, "The new estimate for next year’s shipments is significantly lower than what we previously forecasted. This is mostly due to lower sales expectations for VR headsets launched in 2023 such as the Sony PSVR2 and the Meta Quest 3. Despite getting favorable reviews, these headsets have so far failed to boost demand. In particular, AMOLED panel shipments for the PSVR2 are almost 50% lower this year, compared to shipments in 2022."

The PSVR2 is currently the only headset using AMOLED for the primary displays. AMOLED offers high contrast, but pixel density on the PSVR2 is only 850 PPI, which is much lower than what can be achieved with LCD. With Apple adopting SiOLED for the Vision Pro, we can expect other brands will follow. However, the cost of SiOLED is still much higher than LCD and AMOLED panels.

Smaller and cheaper SiOLED displays are also commonly used in so-called Smart Viewers. These devices use AR see-through optics to overlap virtual screens with the real world. Several Chinese brands including XREAL, Lenovo, TCL and Rokid are now selling in the US for under $400.

Overall, demand for SiOLED displays is expected to grow quickly, eventually surpassing LCD demand after 2026. Samsung Display is investing in a production line for SiOLED while Chinese suppliers are also increasing capacity. Samsung Display also completed the acquisition of eMagin earlier this year for $218M. Although eMagin has a relatively small production capacity, eMagin’s IP includes a direct patterning technology that enables brightness levels above 15,000 nits on SiOLED displays.

For lightweight smart glasses, OEMs are still betting on MicroLED with diffractive waveguides. MicroLED displays can offer high brightness in a small package but manufacturing full color displays remains a challenge. This year, Jade Bird Display launched its full color MicroLED projector combining three monochrome displays. TCL and Meizu have already announced smart glasses with this projector. However, the Holy Grail for many is to implement full color on a single chip. Several tech giants, including Meta, Google and Snap, are developing full color MicroLED technology internally.

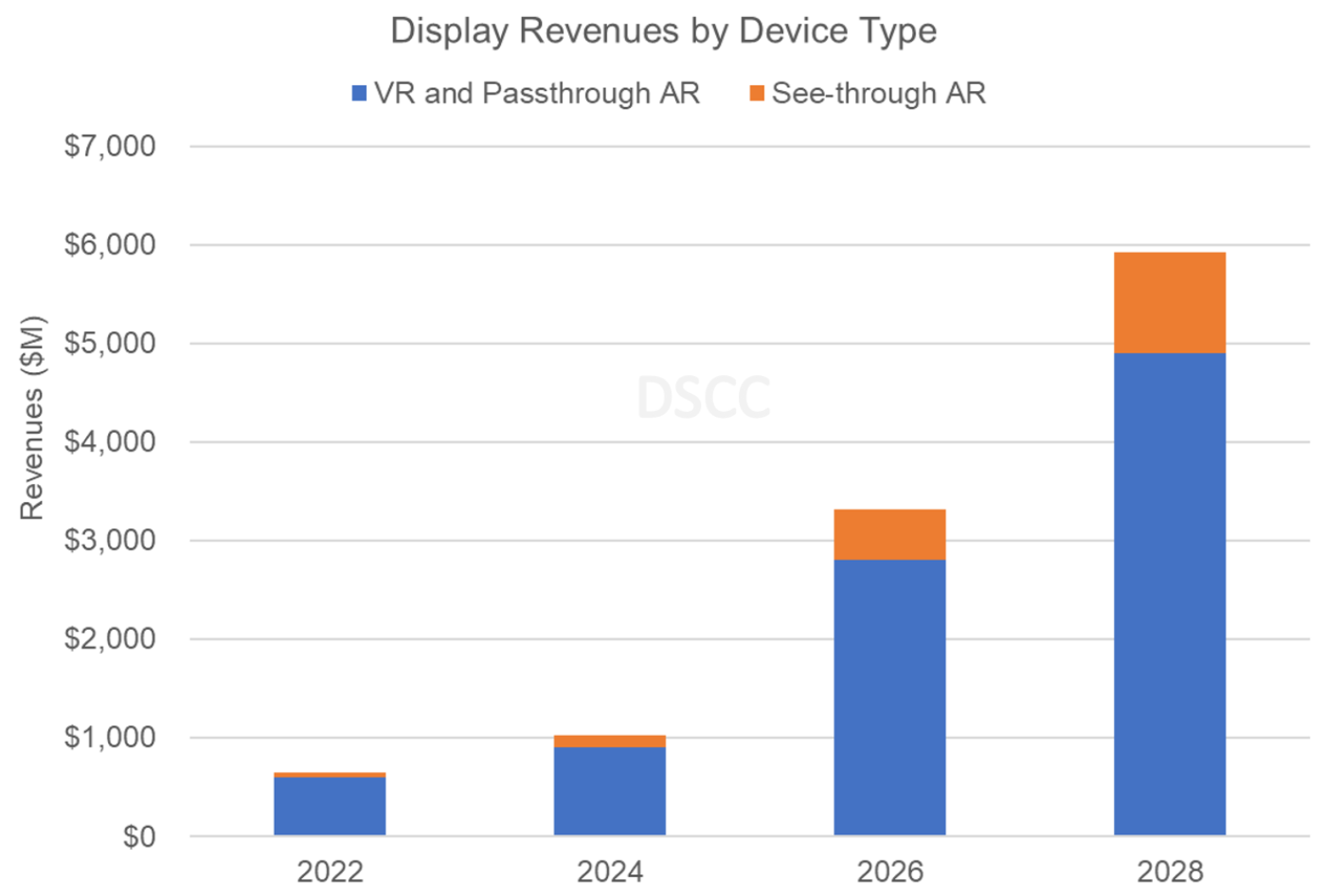

Based on the revised shipment forecast, revenues for AR/VR displays will reach $5.9B in 2028. VR and Mixed Reality (passthrough AR) will still dominate over see-through AR, capturing 83% of display revenues.

DSCC, a Counterpoint Research Company, provides comprehensive display supply chain research. This latest report gives a full update on the progress in MicroLED and SiOLED. It also profiles key suppliers and their roadmaps. Market forecasts for both AR and VR are segmented by display types and show the technologies that will generate the most revenues. For inquiries, please email info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.