DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 10/28/2024

iPhone 16 Series Panel Procurement Projected to be 1% Higher than the iPhone 15 Series Through October

La Jolla, CA -

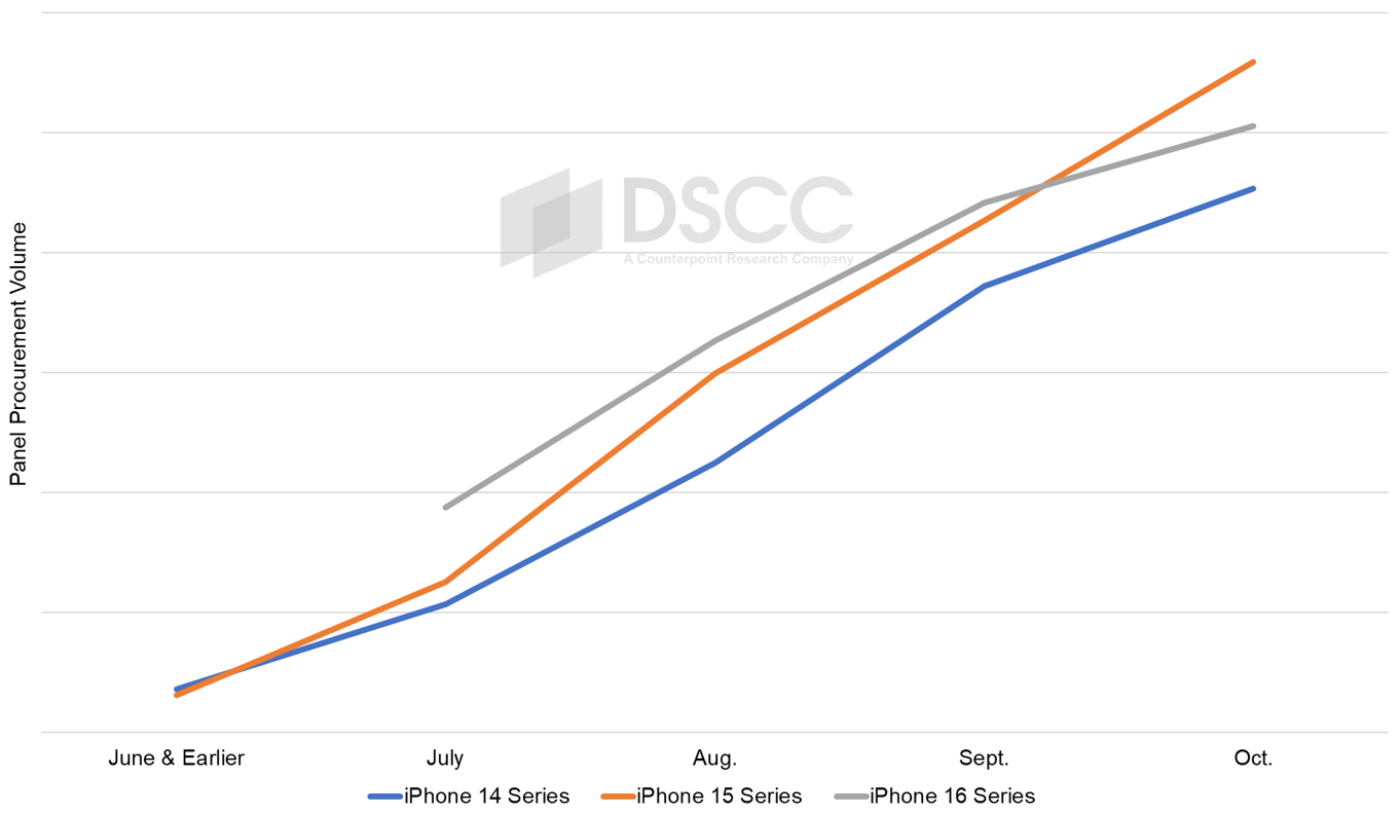

- Through September, the cumulative iPhone 16 series panel procurement was 8% higher than the iPhone 15 series.

- For the iPhone 16 series, iPhone 16 Pro models accounted for a 66% cumulative share in September.

- Through October, the iPhone 16 series panel procurement is expected to be 1% higher versus iPhone 15 series.

As we approach the end of October and with the iPhone 16 series being available since September 20th, our latest release of the Monthly Flagship Smartphone Display Tracker shows that cumulative panel procurement through October for the iPhone 16 Series is tracking 1% higher versus the iPhone 15 series during the same period in 2023. Panel procurement for the iPhone 15 series started in June 2023, while panel procurement for the iPhone 16 series started in July 2024.

In addition, similar to previous years during the months of January – October, we see more panel procurement for entry level models such as the iPhone 13, iPhone 14 and iPhone 15 as Apple continues to target emerging markets. Apple is expected to announce their FY Q4’24 earnings on October 31st.

With the current mix of panel procurement volume for the iPhone 16 series, the iPhone 16 Pro models accounted for a 66% cumulative share in September versus a 60% cumulative share for the iPhone 15 Pro models during the same time period in 2023.

The chart here represents historical panel procurement for the iPhone 14 and iPhone 15 series during their respective months of June – October leading up to their launch and our historical panel procurement for the iPhone 16 series through September and our estimate for October 2024.

iPhone Panel Procurement by Series by Month: June - October

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.