DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/25/2024

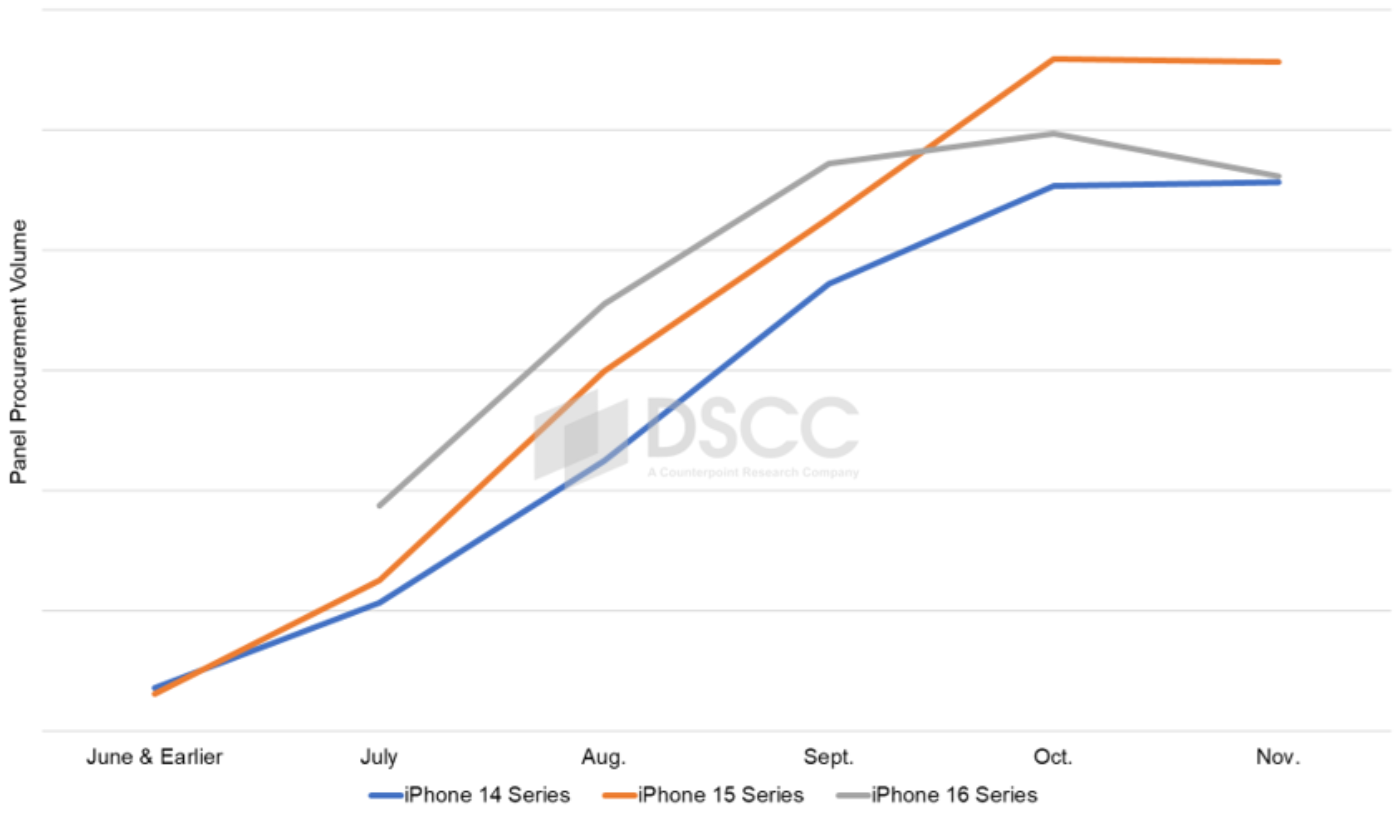

iPhone 16 Series Cumulative Panel Procurement Projected to be 1% Lower than the iPhone 15 Series Through November

La Jolla, CA -

- Through October, cumulative iPhone 16 series panel procurement was 5% higher than iPhone 15 series.

- For the iPhone 16 series, iPhone 16 Pro models accounted for a 66% cumulative share through October.

- Through November, cumulative iPhone 16 series panel procurement is expected to be 1% lower versus the iPhone 15 series during the same time period in 2023.

As we approach the end of November and with the iPhone 16 series being available since September 20th, our latest release of the Monthly Flagship Smartphone Display Tracker shows that cumulative panel procurement through November for the iPhone 16 Series is tracking 1% lower versus the iPhone 15 series during the same period in 2023. Panel procurement for the iPhone 15 series started in June 2023, while panel procurement for the iPhone 16 series started in July 2024. In October, iPhone 16 series panel procurement was 11% lower than the iPhone 15 series during the same time period in 2023.

In addition, similar to previous years during the months of January – November, we see more panel procurement for older models such as the iPhone 13 Pro Max, iPhone 14, iPhone 14 Pro Max and iPhone 15 Pro as Apple continues to target emerging markets. Apple noted during its October earnings call that FY Q4’24 revenues in emerging markets were up double-digits Q/Q and Y/Y.

The below chart represents historical panel procurement for the iPhone 14 and iPhone 15 series during their respective months of June – November leading up to their launch and our historical panel procurement for the iPhone 16 series through October and our estimate for November 2024.

iPhone Panel Procurement by Series: June - November

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.