DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 12/18/2023

Hisense and TCL Gaining Share in Sluggish Advanced TV Market with MiniLED TVs Surging and OLED TVs Sinking

La Jolla, CA -

The Advanced TV market has been sluggish throughout 2023, but Chinese brands are gaining share by advancing in their domestic market and with exports, according to the latest update of DSCC’s Quarterly Advanced TV Shipment and Forecast Report, now available to subscribers. The top three brands outside of China – Samsung, LG and Sony – all fared poorly while TCL and Hisense gained share in the premium segment.

This report covers the worldwide premium TV market, including the most advanced TV technologies: WOLED, QD-OLED, QDEF (which Samsung and TCL call QLED) and MiniLED with 4K and 8K resolution. The report looks at current and future TV shipments and revenues by technology, region, brand, resolution and size, and forecasts the growth of all these technologies. The Q4’23 update includes the shipment results for Q3’23 and an updated forecast out to 2027. In this article, we will review the historical results of Q3’23; in another article in a few weeks, we will review the updated forecast.

We define an “Advanced TV” (capitalized) as any TV with an advanced display technology feature, including all OLED TVs, 8K LCD TVs and all LCD TVs with quantum dot technology. The historical data in the report allows analysis by feature, for Advanced LCD TVs. The historical data through 2021 for OLED TV includes only one product configuration, LGD’s White-OLED (WOLED) technology, but starting in 2022 we saw the first volumes for QD-OLED TVs sold by Samsung and Sony and the first sales of MicroLED TVs in very small volumes.

After a small Y/Y increase in Q2’23, Advanced TV shipments were flat Y/Y in Q3’23 at 5.1M units. OLED TV shipments declined 19% Y/Y to 1.4M while Advanced LCD TV shipments increased 9% Y/Y to 3.7M. Advanced TV revenues decreased by 5% Y/Y to $6.1B. OLED TV revenues decreased by 16% Y/Y to $2.2B while Advanced LCD TV revenues increased by 3% Y/Y to $3.9B as the increase in units and a richer mix more than offset price declines.

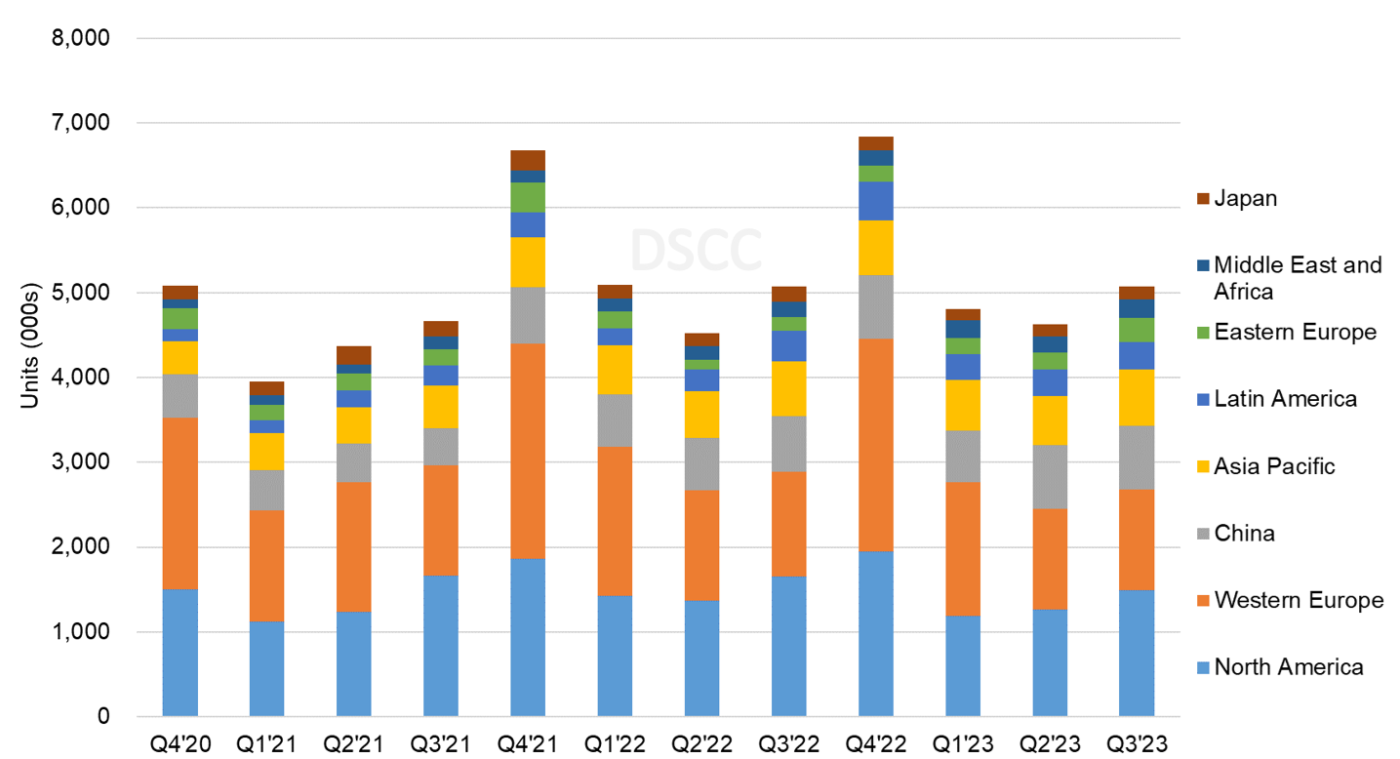

In shipments by region, developed regions continued to be weak. Shipments to Western Europe declined 4% Y/Y and revenues decreased 10% Y/Y. Shipments to North America declined by 10% and revenues declined by 14% Y/Y. Shipments to China increased by 14% Y/Y and revenues increased 15%. Shipments to Asia Pacific increased 3% Y/Y and revenues decreased 1%.

Advanced TV Shipments by Region, 2020 to 2023

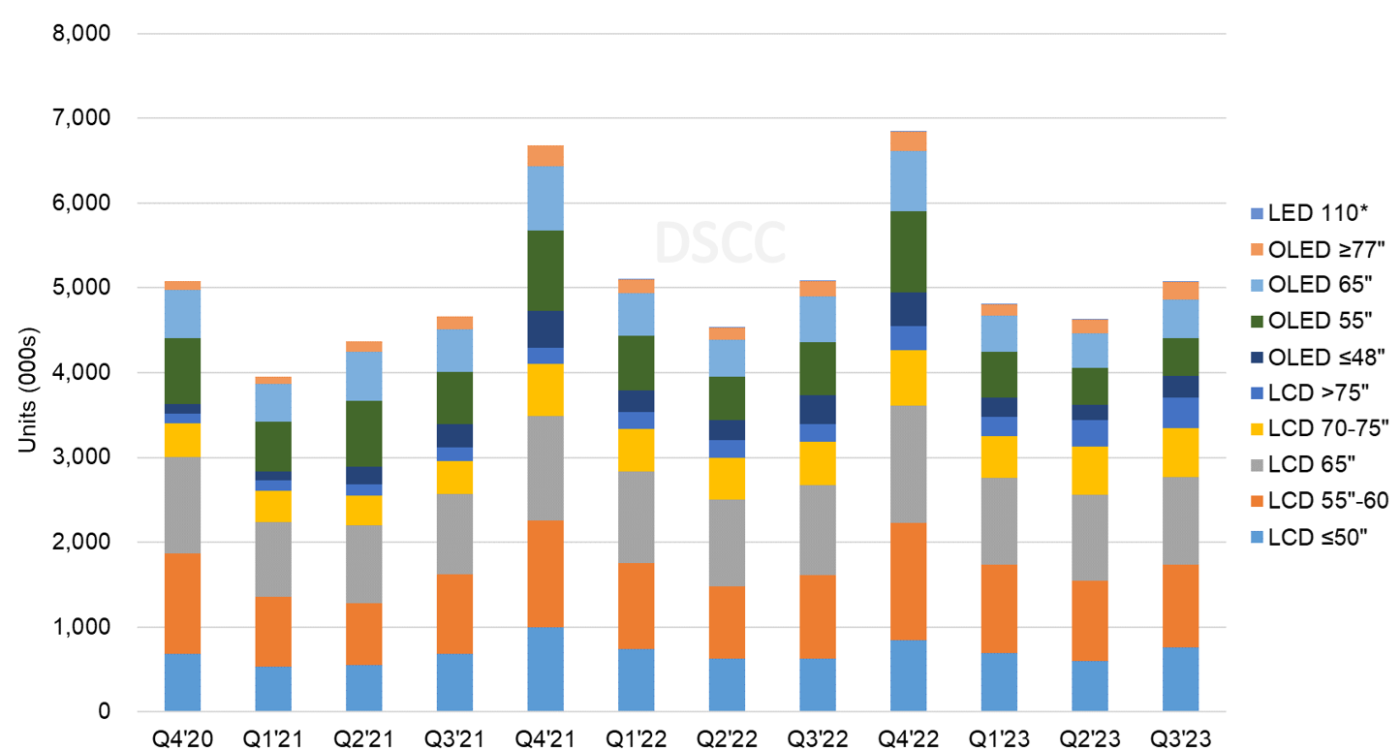

In Q3’23, with total Advanced TV shipments flat Y/Y, OLED TV share increased by 1% Q/Q but declined by 6% Y/Y to 27%. All sizes of OLED TV decreased Y/Y except 77” and larger sizes. 48” decreased by 26% Y/Y and 55” OLED decreased 28% Y/Y, while 65” OLED decreased by 15% and 77”+ increased by 18% Y/Y.

Advanced LCD TV shipments were up 9% Y/Y, with small and large sizes showing gains but mainstream 55”/65” sizes decreasing Y/Y. Advanced LCD TVs with 55” screens declined 1% Y/Y and 65” declined 4% Y/Y, while ≤50” shipments increased 21% Y/Y, 75” increased 13% Y/Y and >75” shipments increased 68% Y/Y.

Advanced TV Shipments by Size and Display Technology, 2020 to 2023

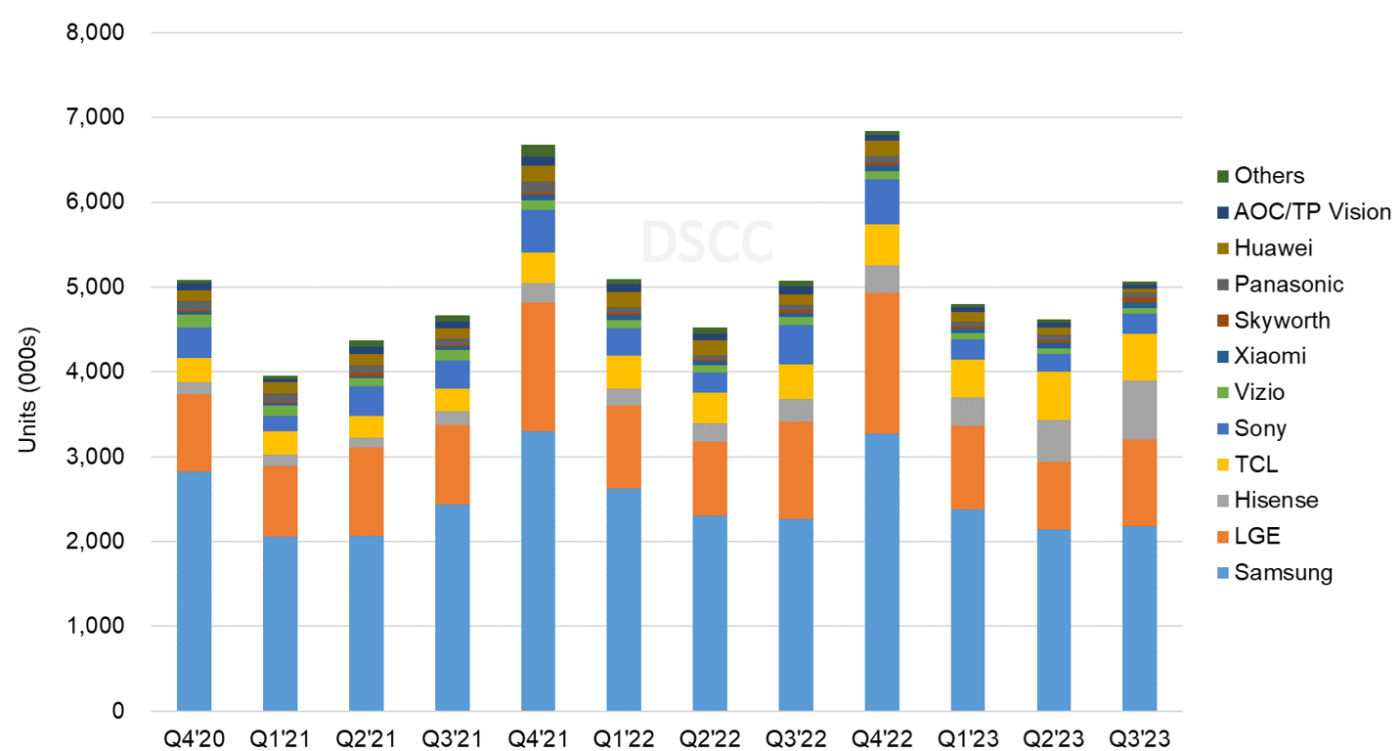

The report’s pivot tables allow an analysis of brand share by screen size, region, technology, resolution and other variables. In the brand battle, Samsung maintained the top spot in both units and revenue and gained revenue share even while losing unit share, while its rivals in China gained in both categories. In Q3’23, among all Advanced TV products:

- Samsung shipments declined 4% Y/Y and Samsung unit share decreased by 3% Y/Y to 42%. Samsung revenues increased 8% Y/Y and revenue share increased 3% to 42%. Samsung continues to lead MiniLED TV but share in that segment decreased to 39% as Hisense and TCL surged. Samsung units/revenue share of OLED TV increased to 21%/28% and Samsung passed Sony for the #2 spot in both units and revenue.

- LG shipments decreased by 10% Y/Y and unit share decreased 3% Y/Y to 20% in Q3’23. LG revenues decreased 19% Y/Y and LG lost 3% share to 23%. LG continues to dominate OLED TV with 54%/49% unit/revenue share, but the share of OLED is decreasing and LG has faltered in MiniLED with only 1% share.

- Hisense took the #3 position in units as shipments increased 159% Y/Y and revenues increased 130% Y/Y, the second consecutive quarter of triple digit % gains. Hisense unit/revenue share grew to 14%/11%.

- TCL shipments increased 34% Y/Y and TCL gained share Y/Y from 8% to 11%. TCL revenues increased 32% Y/Y and its share increased Y/Y from 7% to 10%. TCL’s MiniLED business gained as units/revenue increased 112%/135% Y/Y and share increased to 27%/28%.

- Sony shipments declined 50% Y/Y and Sony dropped from #3 to #5 in both unit and revenue share. Sony revenues declined 51% Y/Y.

Advanced TV Shipments by Brand, 2020 to 2023

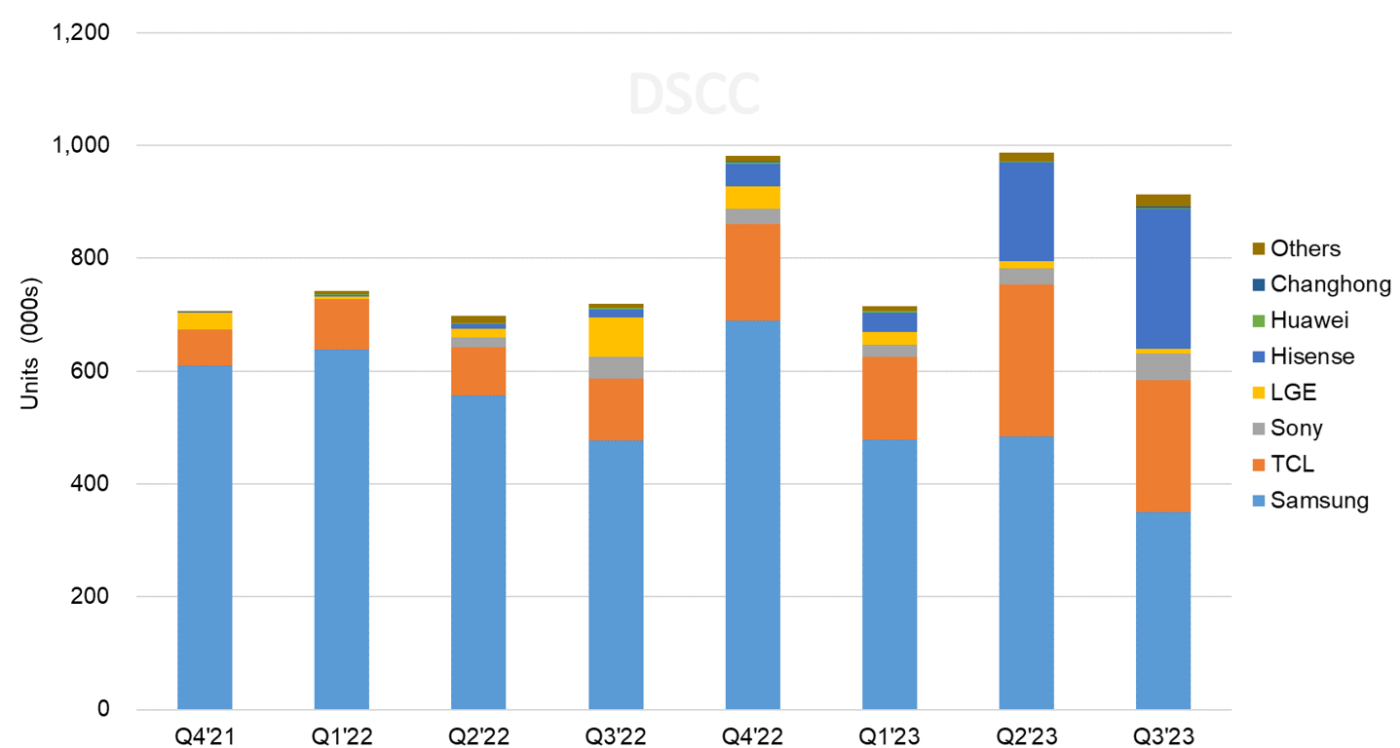

The report tracks the emergence of MiniLED as a competitor to OLED TV in the premium space. The next chart here shows MiniLED TV shipments by brand. While TCL introduced MiniLED in late 2019 and recorded some sales in 2020, the category remained tiny until Samsung and other brands introduced products with MiniLED technology in Q1 2021.

MiniLED TV shipments are having a great 2023 led by big increases from TCL and Hisense. MiniLED TV shipments increased 26% Y/Y and revenues increased 14% Y/Y. Samsung continues to lead this category, but it no longer dominates as the Chinese brands are accelerating. Samsung shipments decreased 26% Y/Y and Samsung unit share declined to 39%. Hisense shipments increased by 18x and Hisense jumped to the #2 position and captured 27% of MiniLED share. TCL continues to gain share but fell to the #3 position as shipments increased 112% Y/Y and MiniLED share increased to 26%. LG shipments decreased by 86% Y/Y in Q2’23 and LG fell to the #5 brand with only 1% share. Sony MiniLED shipments were flat Y/Y, but Sony share declined from 5% to 4%.

MiniLED TV shipments have grown Y/Y in 2023 while OLED shipments declined. Total MiniLED TV shipments in Q3’23 were 905K compared to 1.36M OLED TV shipments. Total MiniLED TV revenues in Q3’23 were $1.26B compared to $2.22B for OLED TV. If seen as a single “top of class” category of MiniLED + OLED, OLED has 60% unit share and 64% revenue share.

MiniLED TV Shipments by Brand, 2021-2023

In North America, Samsung enjoys a dominant position on the strength of its large-screen product portfolio and has managed to maintain about 50% of the market. Samsung gained share Y/Y as shipments declined 2% and revenues increased 3% while the overall market declined by 10%/14% in units/revenue. Samsung gained four points of unit share and nine points of revenue share. LG lost eight points of share in units and six points in revenue as units/revenue declined by 38%/36%. TCL increased its share Y/Y by four points in units and by three points in revenue as shipments increased by 34% and revenue increased by 20%. Hisense share in units/revenue surged from 3%/2% in Q3’22 to 10%/7% in Q3’23 as a result of a 179%/205% increase in units/revenue. Sony share declined six points Y/Y in units as shipments declined 63%.

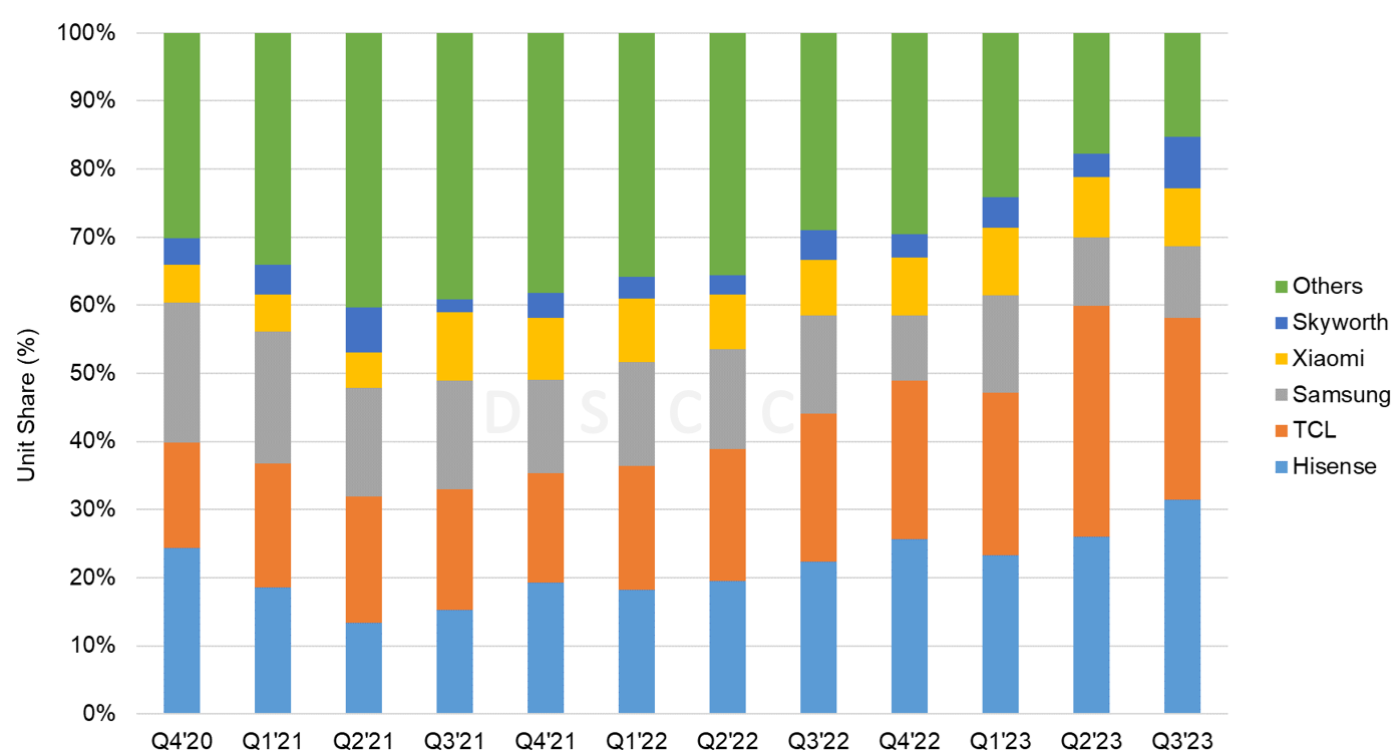

The brand battle continues to be heated in China, but the top two domestic brands are pulling ahead of the pack. TCL retained the #1 spot in revenue but fell to #2 in units as unit shipments increased 42% Y/Y and revenues increased 50% Y/Y. Hisense shipments increased 63% Y/Y and revenues increased 62% Y/Y and Hisense claimed the top spot in units and #2 in revenue. Samsung share fell Y/Y as shipments decreased by 15% and revenues decreased by 6%.

Advanced TV Unit Share – China, 2020 to 2023

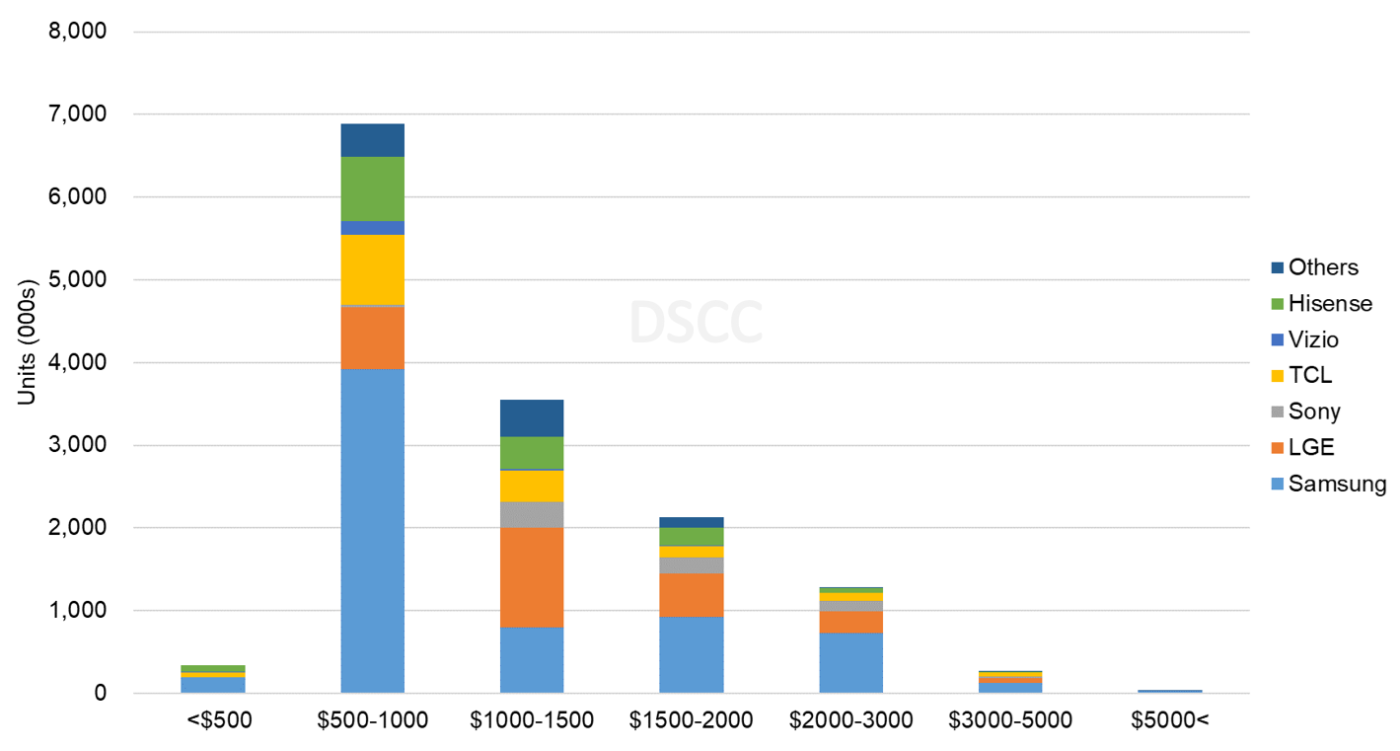

The last chart here shows one last valuable cut of the data, units by brand by price band. The pivot tables allow for this analysis by any time period, and the chart here shows the market by price band for the first three quarters of 2023. The chart shows that Samsung’s leading position in Advanced TV is mostly a function of its dominance in Advanced TVs under $1000. Samsung’s strategy of pushing its QLED product line toward mainstream price points has allowed it to lead, but other brands, especially TCL and Hisense, are increasing their Advanced TV offerings at these lower prices. LG’s OLED TVs give it the leading position in the range of $1000-$1500, and Hisense and TCL have passed Sony for the #3 and #4 positions in price points above $1000. Sales volumes at price points over $5000 form only a tiny slice of the market.

Worldwide Advanced TV Units by Price Band for Q1’23-Q3’23

DSCC’s Quarterly Advanced TV Shipment and Forecast Report includes technical descriptions of all major advanced TV display technologies, plus quarterly shipment results from Q1’18 through Q2’23, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs and other metrics. The report includes DSCC’s quarterly forecast for five years across technology, region, resolution and size. Readers interested in subscribing to the DSCC Advanced TV Shipment Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.