DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/20/2024

Global TV Shipments Increased 11% Y/Y in Q3’24, Second Consecutive Quarter of Y/Y Growth

La Jolla, CA -

- Global TV shipments in Q3’24 grew 11% Y/Y, signaling a rebound for two consecutive quarters.

- Premium TV shipments grew 51% Y/Y, QD LCD and MiniLED LCD TVs continue to increase.

- The premium TV market's duopoly of Samsung and LG collapses amid rapid growth of Chinese brands.

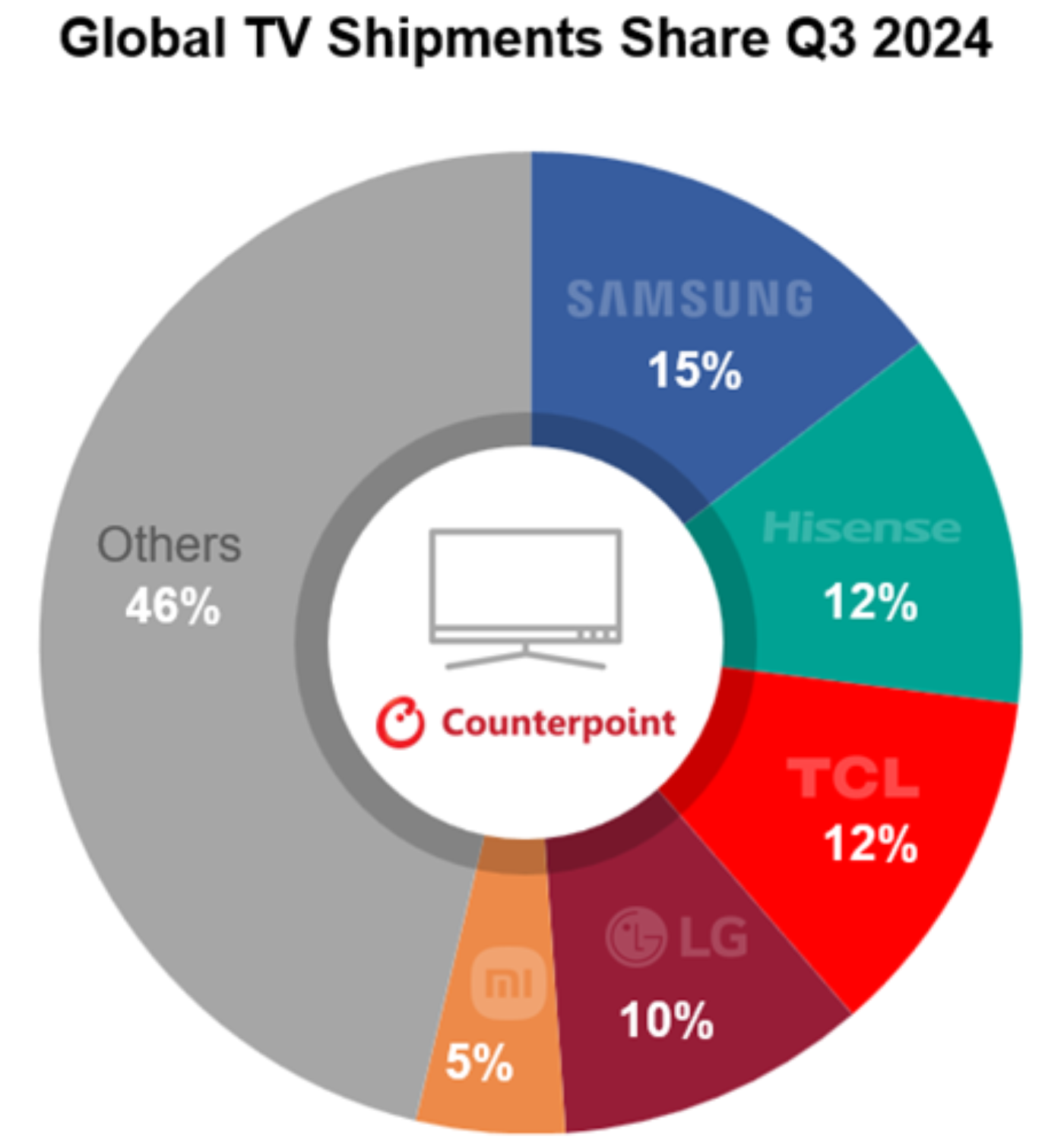

According to global market research firm Counterpoint Research, global TV shipments in Q3’24 grew 11% Y/Y to 62M units, showing Y/Y growth for two consecutive quarters and raising expectations for a continued rebound. By region, growth was evenly distributed across all regions except Japan, with Eastern Europe in particular leading the growth with a 24% increase, and advanced markets in North America and Western Europe also showing high growth. Samsung Electronics maintained its top spot with a 15% market share, but its market share decreased slightly compared to the previous quarter. On the other hand, Hisense, which narrowly overtook third-place TCL to reclaim second place, gained share by shipping 19% more TVs than in the same period last year. LG, which ranked fourth, recorded a 7% increase in shipments Y/Y thanks to the favorable European market, and recovered its market share to the 10% range.

Figure 1: Market Share by Global TV Company in the Third Quarter of 2024

Counterpoint Research researcher Lim Soo-jung said, “In the TV market where replacement demand is the main issue, the fact that there has been Y/Y growth for two consecutive quarters can be interpreted as a shortened replacement cycle,” adding, “As TV companies continue to release new high-definition, large-screen models, it stimulates consumer purchases for users who want to enjoy videos on a larger screen at home.”

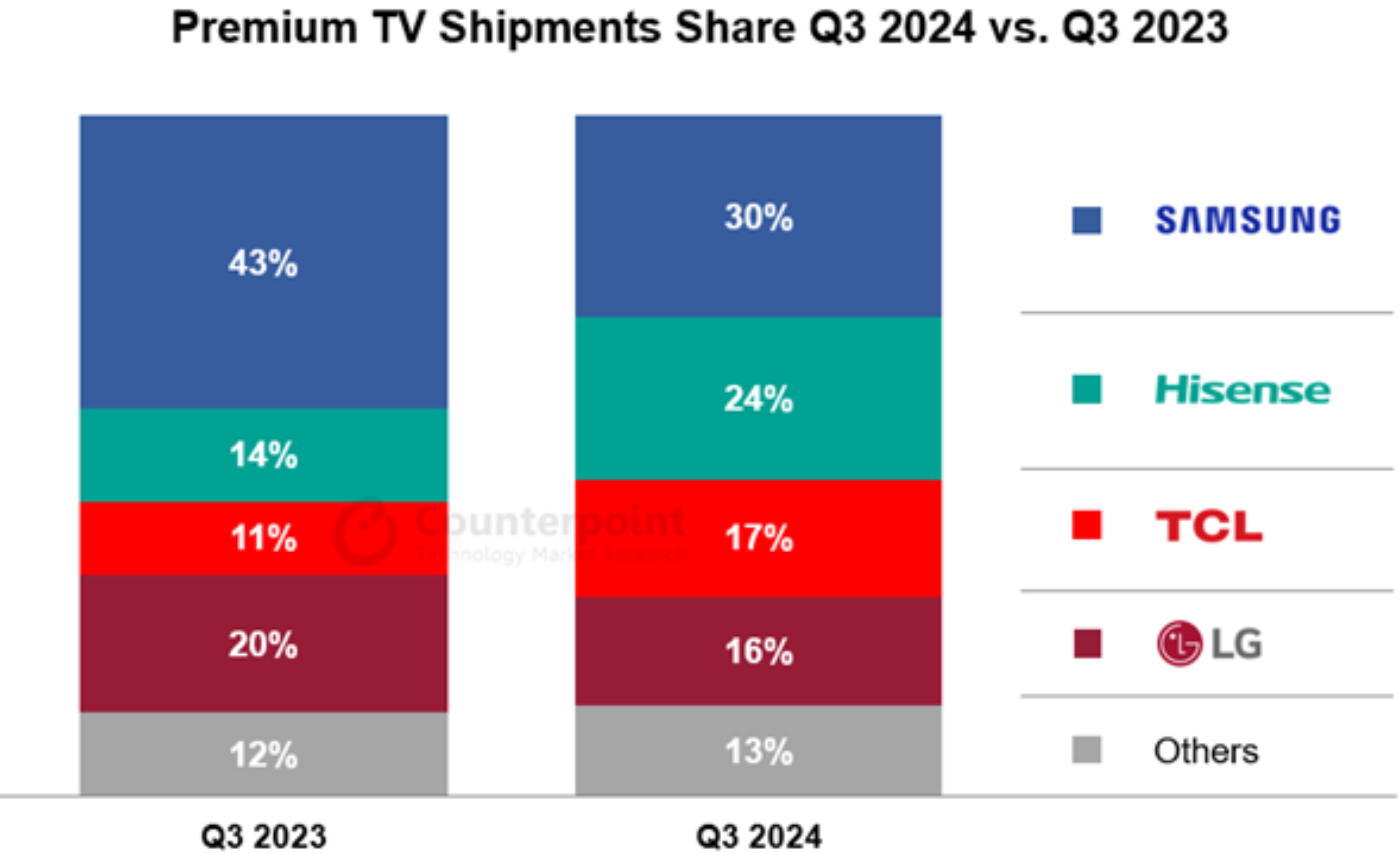

Premium TV models consisting of OLED, QD LCD, and MiniLED LCD increased by 51% Y/Y, recording an all-time high. As this is a market expected to grow rapidly in the future, Chinese brands are increasingly attacking the market to gain control, and as a result the market leader Samsung lost 13 percentage points of share in one year, falling to 30%. On the other hand, Hisense and TCL shipped more than double the number of premium TVs Y/Y, pushing LG to fourth place and taking second and third place, respectively. This has reversed the landscape of the premium TV market, which used to be dominated by Samsung and LG.

In the premium TV market, shipments of MiniLED LCD TVs increased by 102% Y/Y, surpassing OLED shipments, and QD LCD also grew by more than 50%, exceeding 4M units in quarterly shipments for the first time. OLED TV shipments increased by 13% Y/Y.

Counterpoint Research researcher Lee Je-hyeok said, "Chinese companies are already leading the market in standard LCD, and now they are focusing on the premium TV group that was dominated by Korean and Japanese companies. They are improving profits by adjusting their product portfolios and expanding their presence in all regions by enhancing their brand image."

Figure 2: Global Premium TV Shipment Share in the Third Quarter of 2024 Compared to 2023

(** Premium TV: Including QD-MiniLED, QD-LCD, LCD 8K, QD-OLED, WOLED, and Micro-LED TV)

About Counterpoint Research:

Counterpoint Research is a global research institute specializing in the technology, media, and telecommunications industries, providing performance and market outlook data and trend analysis reports by manufacturers such as Apple. It provides various forms of services such as monthly reports called MarketPulse, quarterly reports, custom-made reports according to client requests, model-by-model shipment data by brand, and consulting services.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.