Counterpoint Research

info@counterpointresearch.com

FOR IMMEDIATE RELEASE: 03/03/2025

Global Premium TV Market Grew 51% YoY in Q4 2024; Samsung Leads, TCL Surpasses LG to Take Second Spot

Seoul, Beijing, Buenos Aires, Hong Kong, London, New Delhi, San Diego, Taipei, Tokyo -

- Global TV shipments in Q4 2024 grew 2% YoY, the third consecutive quarters of YoY increases.

- Premium TV shipments grew 51% YoY, QD LCD and Mini LED LCD TVs continued to rise.

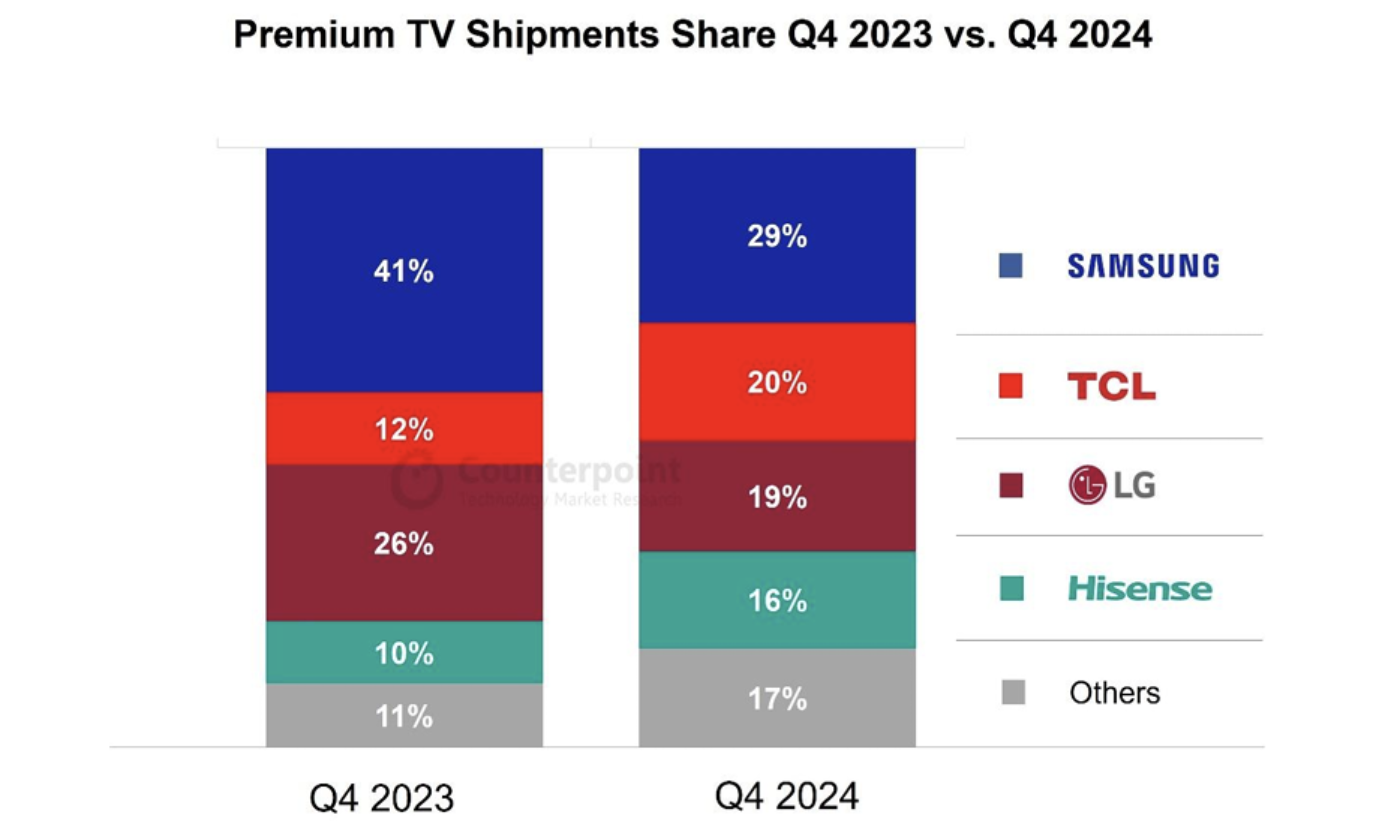

- TCL grew rapidly in the premium sector, surpassing LG to take 2nd place with 20% market share.

- Concerns about negative impact on TV makers with large sales of premium TVs in North America due to ‘Trump tariffs’.

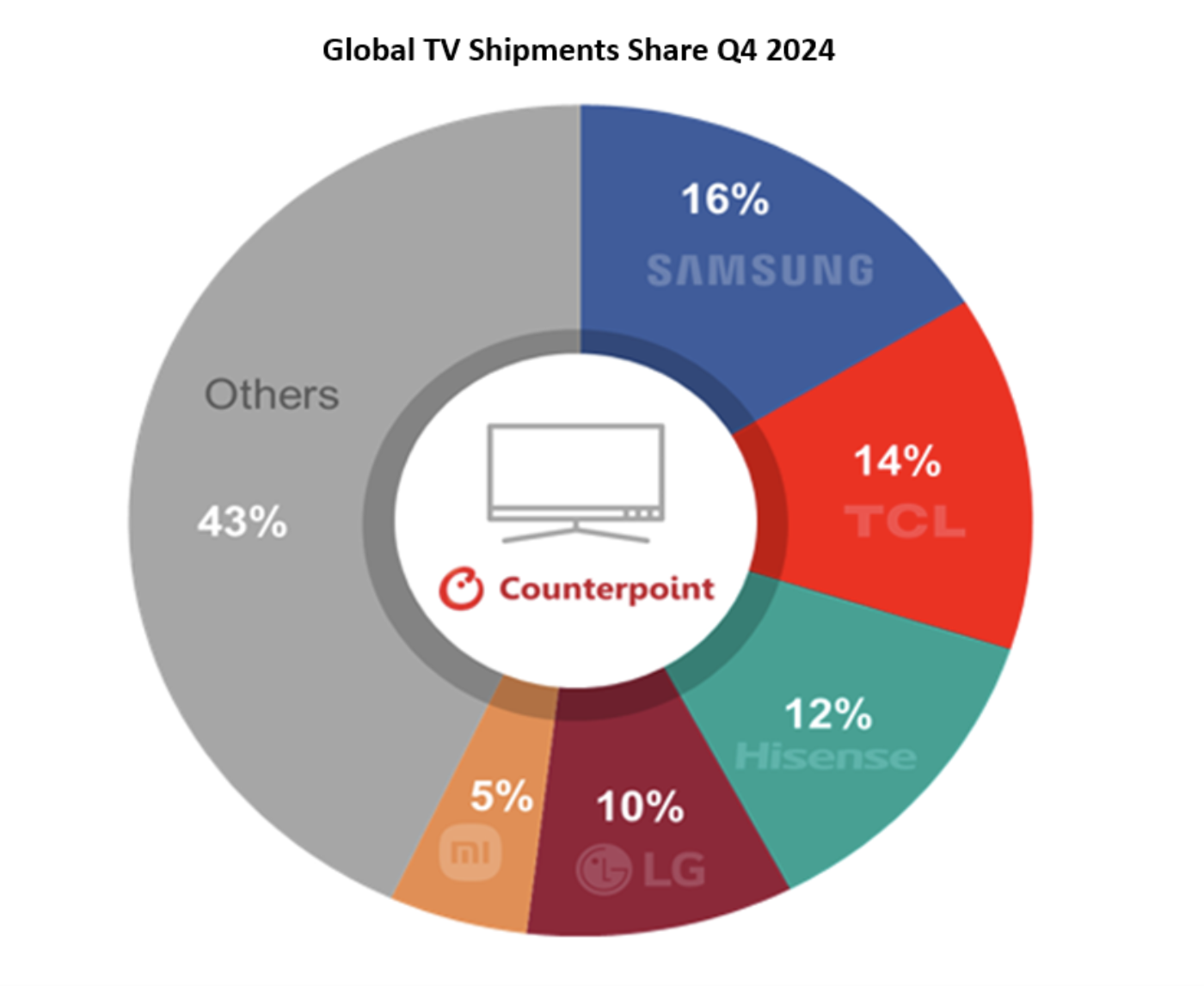

Global TV shipments in Q4 2024 grew 2% YoY to reach 61 million units, according to the Global TV Shipments Quarterly Tracker released by Counterpoint Research recently. Annual TV shipments in 2024 reached 230 million units, also up 2% YoY. Most regions showed growth, but Japan and Asia showed a shrinking TV market, declining 15% and 4% YoY, respectively. Samsung maintained its top spot in the market with a 16% share in Q4 2024, but TCL was in hot pursuit of Samsung, taking second place with a 14% share. Hisense took third place with a 12% share while LG maintained its fourth place with a 10% share, similar to the same period last year.

Shipments of premium TV models, consisting of QD-MiniLED, QD-LCD, NanoCell, LCD 8K, QD-OLED, WOLED and MicroLED TVs, grew 51% YoY to reach a record high. For the full year 2024, the shipments were up 38% YoY.

As Chinese brands intensified their attacks on the premium market, which is expected to show high growth, Samsung's market share fell to 29%, down 12 percentage points YoY. On the other hand, TCL shipped more than twice as many premium TVs YoY, surpassing LG to take second place in the premium market.

In the premium TV market, shipments of MiniLED LCD TVs grew by more than 170% YoY, surpassing OLED TV shipments since the second quarter. QD-LCD TVs also grew by more than 46%, exceeding 5 million units for the first time in terms of quarterly shipments. Counterpoint Research researcher Calvin Lee said, “If the Trump administration’s ‘tariff bomb’ is implemented, Mexican-produced TVs will also be affected by the 25% tariff on Mexico. In particular, South Korean companies that account for a large portion of the North American premium TV market are expected to be affected more. Therefore, countermeasures are urgently needed to prepare for each situation.” According to Counterpoint Research’s Global TV Shipments Quarterly Tracker, South Korean companies held an overwhelming position in the North American premium TV market in 2024, recording a 53% share in terms of sales.

About DSCC

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.