DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 12/06/2023

Foldable Smartphones and Displays Reach Record High in Q3’23 on Samsung Strength, But Samsung and Samsung Display Expected to Lose Significant Share in Q4’23

La Jolla, CA -

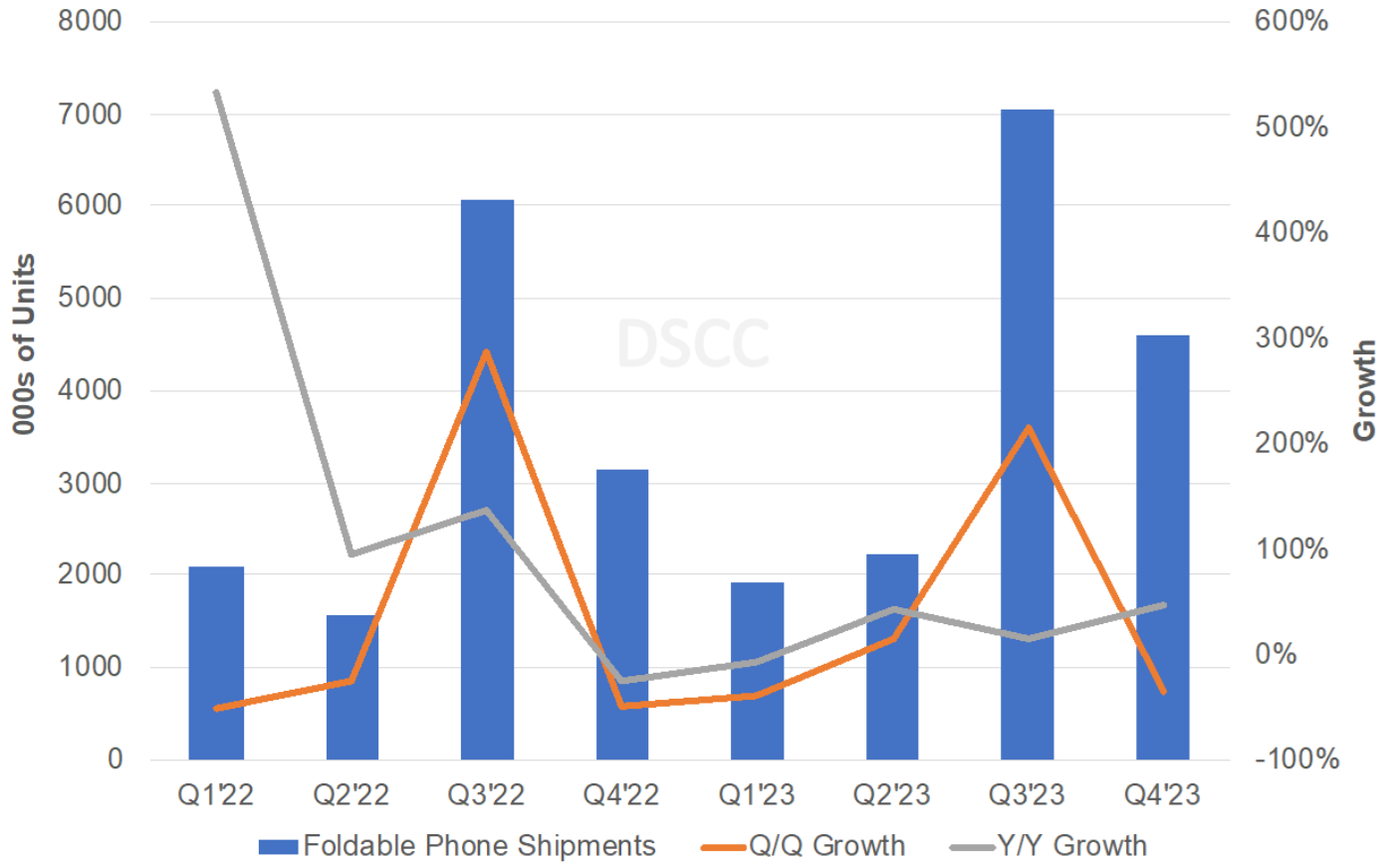

Q3’23 was a record quarter for foldable smartphones and panels helped by the launch of the Samsung Z Flip 5 and Z Fold 5 as well as the launch and continued ramp of a number of other foldable smartphones, mostly in China.

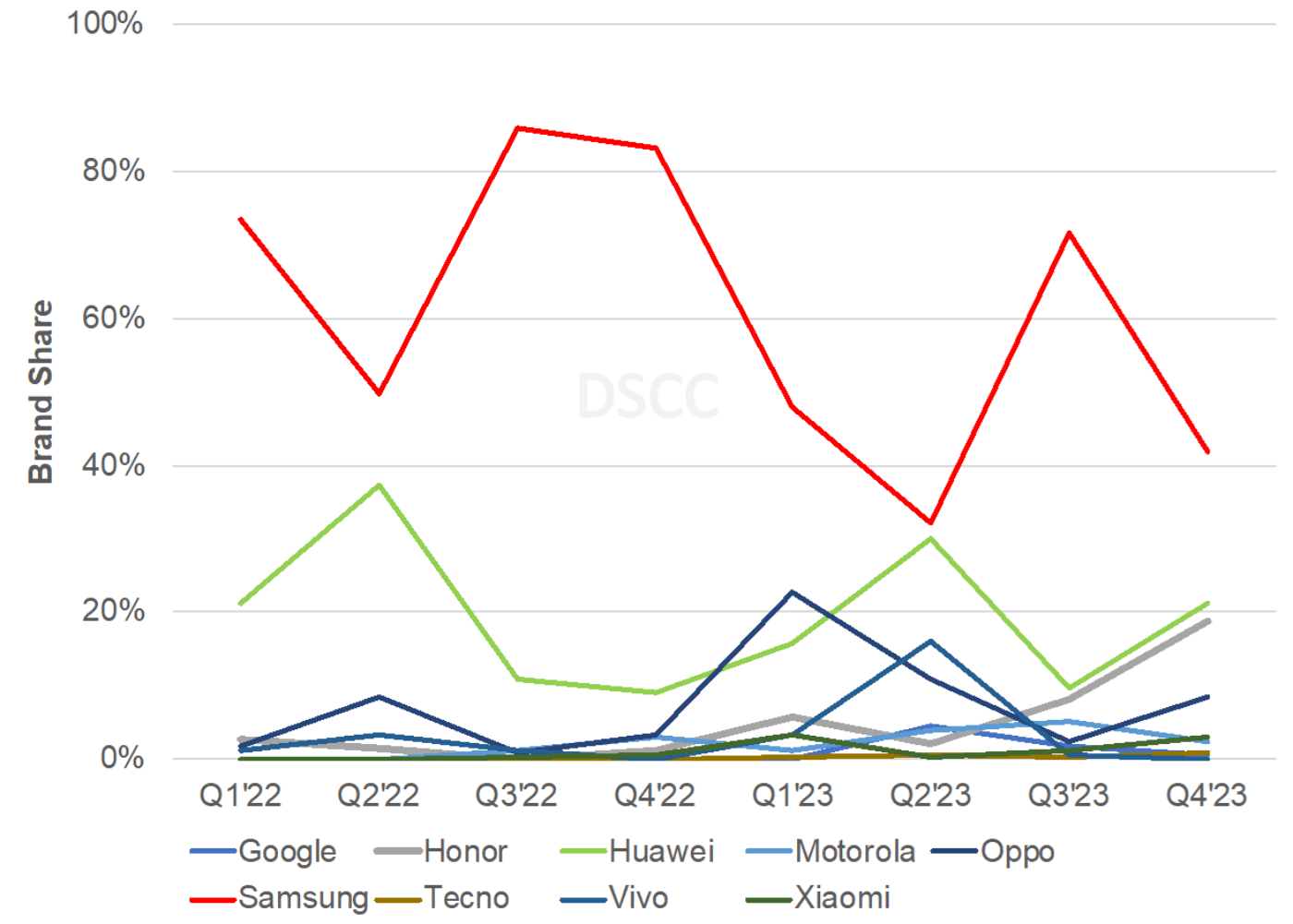

Foldable smartphones surged 215% Q/Q and 16% Y/Y in Q3’23 to 7.0M units, 1% above expectations and eclipsing the previous high in Q3’22 of 6.1M by 16%. Samsung enjoyed its traditional peak market share in Q3’23 with European demand dominating, reaching 72% which was down from last year’s 86% as its competitors launch more models and aim for higher volumes. Huawei was #2 with a 9% share followed by Honor at 8%. As expected, Samsung had the top two best-selling models with the Galaxy Z Flip 5 earning a 45% share and the Galaxy Z Fold 5 accounting for a 24% share. Huawei and Honor accounted for the next best-selling models with the Mate X3 and Magic V2 each earning a 6% share.

In Q4’23, DSCC expects foldable phones to fall 35% Q/Q while rising 47% Y/Y to 3.6M, 12% below previous expectations on lower than expected shipments for Samsung and some delays in new product launches to late Q4’23 and Q1’24. Samsung’s brand share is expected to fall to 42%, well below last year’s 83% on lower than expected shipments for the Z Flip 5 and Z Fold 5. Huawei and Honor are expected to take significant share in Q4’23, with Huawei’s share surging to 21% and Honor at 19%. The Mate X5 is expected to rise to the #2 model with a 15% share after the Z Flip 5, with a 22% share. The Honor Magic V2 is expected to rise to the #3 best-selling model with the Samsung Z Fold 5 falling to #4 with a 12% share. For all of 2023, foldable phones are expected to rise 23% to 15.8M units. The top five models for all of 2023 are expected to be the Samsung Galaxy Z Flip 5, the Z Fold 5, the Z Flip 4, the Honor Magic V2 and the Huawei Mate X5.

Foldable phone shipments are forecasted out to 2027 by brand, model, panel supplier, form factor, refresh rate, TFT backplane, cover window, chipset supplier, number of cameras, hole vs. UPC, price, etc. Foldable notebook and tablet volumes are also forecasted out to 2027 by brand, size, panel supplier, etc.

According to DSCC CEO Ross Young, “2023 has been a mixed year for foldables. It has benefited from Huawei regaining its footing and gaining significant share, a number of new entrants such as Google, OnePlus and Tecno, and some impressive improvements in device thickness, weight and reductions in seam visibility. We have also seen Chinese panel suppliers ramp up their volumes, take share from Samsung Display and introduce a number of innovations previously only available from Samsung Display such as LTPO, POL-LESS and UTG. However, 2023 foldable phone volumes ended up 15% below our Q1’23 forecast as the high end of the Android smartphone market remains sluggish.”

Foldable Smartphone Shipments

Foldable Smartphone Brand Share

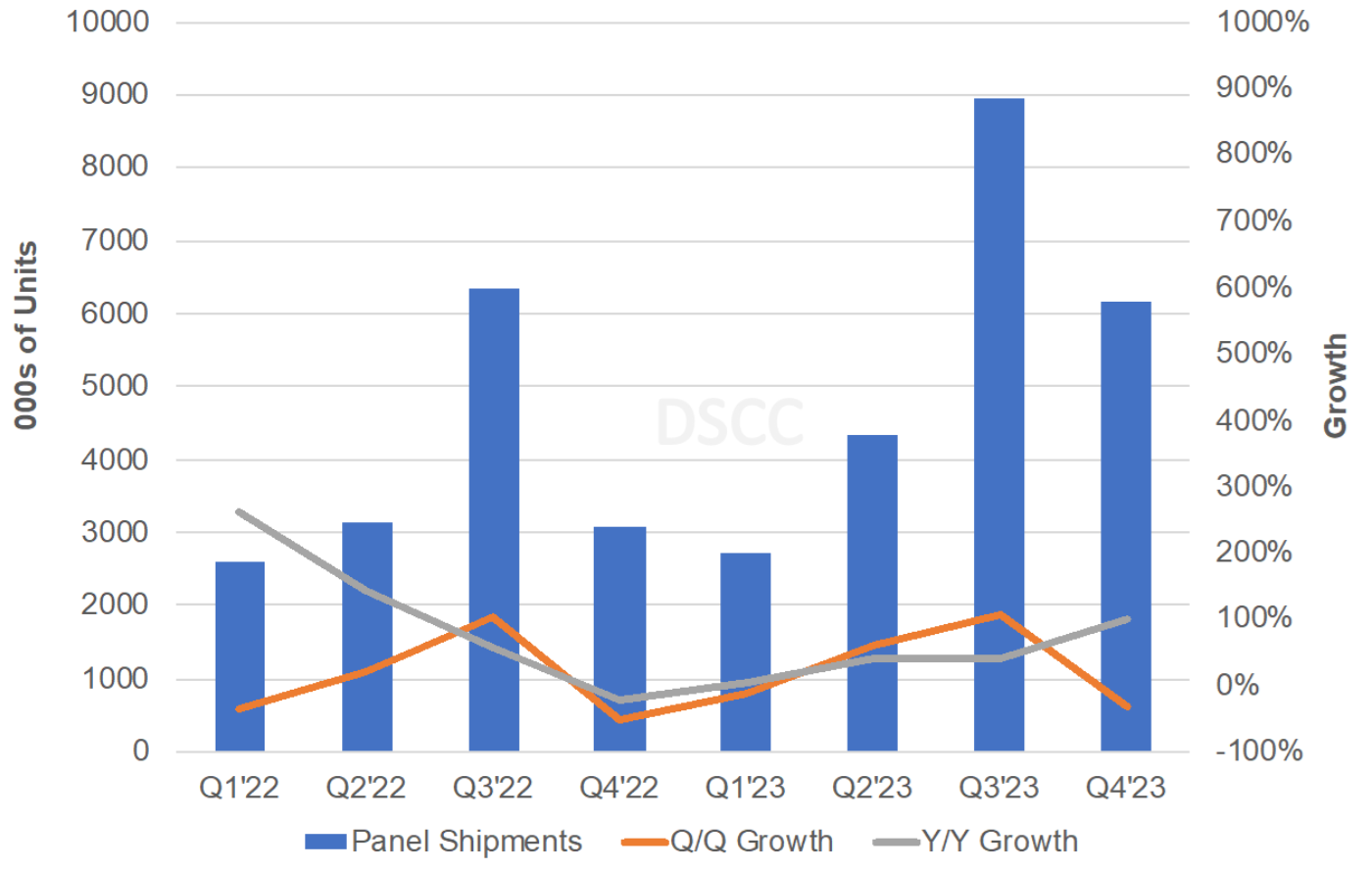

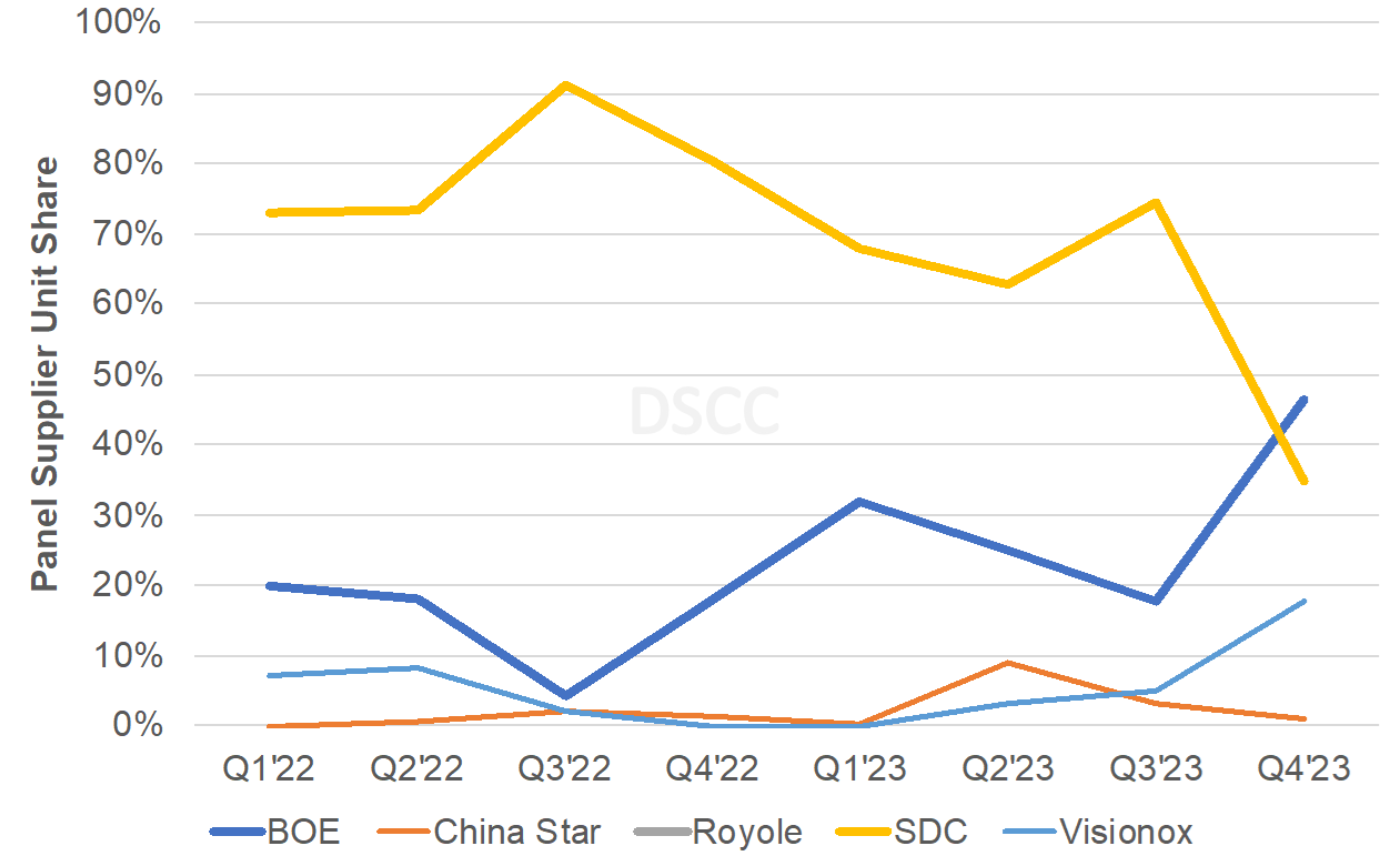

Foldable panel shipments rose 106% Q/Q and 41% Y/Y in Q3’23 to 8.9M, also a record high. It benefited from Samsung’s launch as well as a significant number of other new models launching in Q3’23 and Q4’23. Q3’23 results are 3% above previous expectations. Samsung Display led the way with a dominant 74% share, up from 63% in Q2’23 but down from 91% in Q3’22. BOE was #2 with an 18% share, down from 25% in Q2’23 but up from 4% in Q3’22. In Q4’23, we see BOE overtaking SDC on significant volume at Huawei, Honor and Oppo. Huawei’s panel procurement is expected to be larger than Samsung’s for the first time as it doubles down on the foldable market now that it has a 5G chip solution. As a result, Huawei is likely to overtake Samsung in foldable phone shipments in Q1'24. Visionox is also gaining share on higher volumes at Huawei and Honor and is expected to reach its highest share to date at 18% in Q4’23.

Foldable smartphone panel shipments are forecasted out to 2027 by brand, model, size, refresh rate, TFT backplane, cover window, chipset, hole vs. UPC, price, etc., with foldable display manufacturing costs for major models also provided along with insight into cover window developments.

Foldable Smartphone Panel Shipments

Foldable Smartphone Panel Supplier Unit Share

For more insight into the foldable market, please visit DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report or contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.