DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 08/12/2024

Foldable Smartphone Panels Set New Record High in Q2’24 Helped by Earlier Launch of Samsung Foldables

La Jolla, CA -

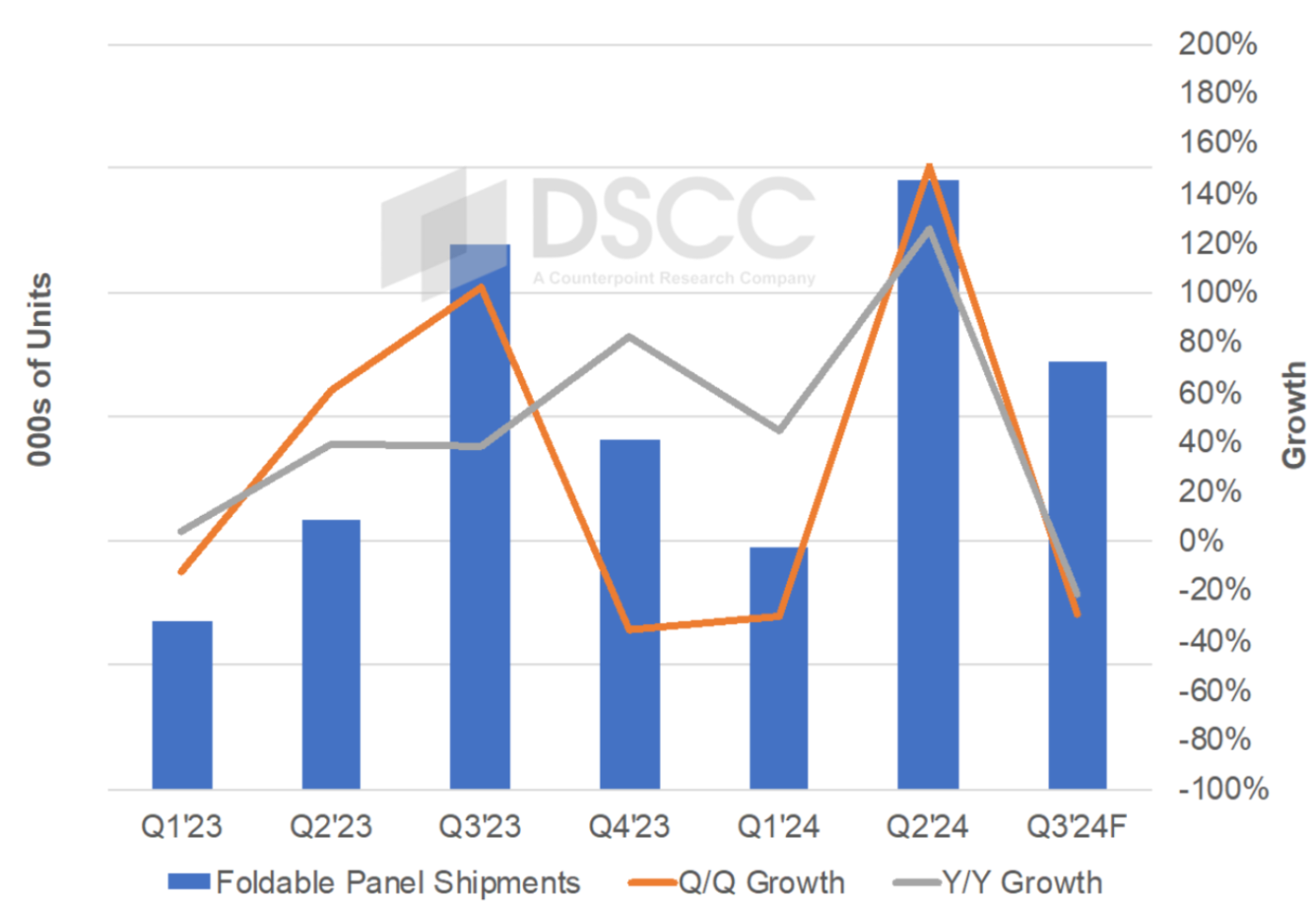

- Foldable panel shipments reached a new high in Q2’24 rising 151% Q/Q and 126% Y/Y to nearly 10M panels, helped by the earlier launch of the latest Samsung foldables, the Galaxy Z Flip 6 and Z Fold 6. Q2’24 is expected to be the peak quarter for 2024 foldable panel shipments.

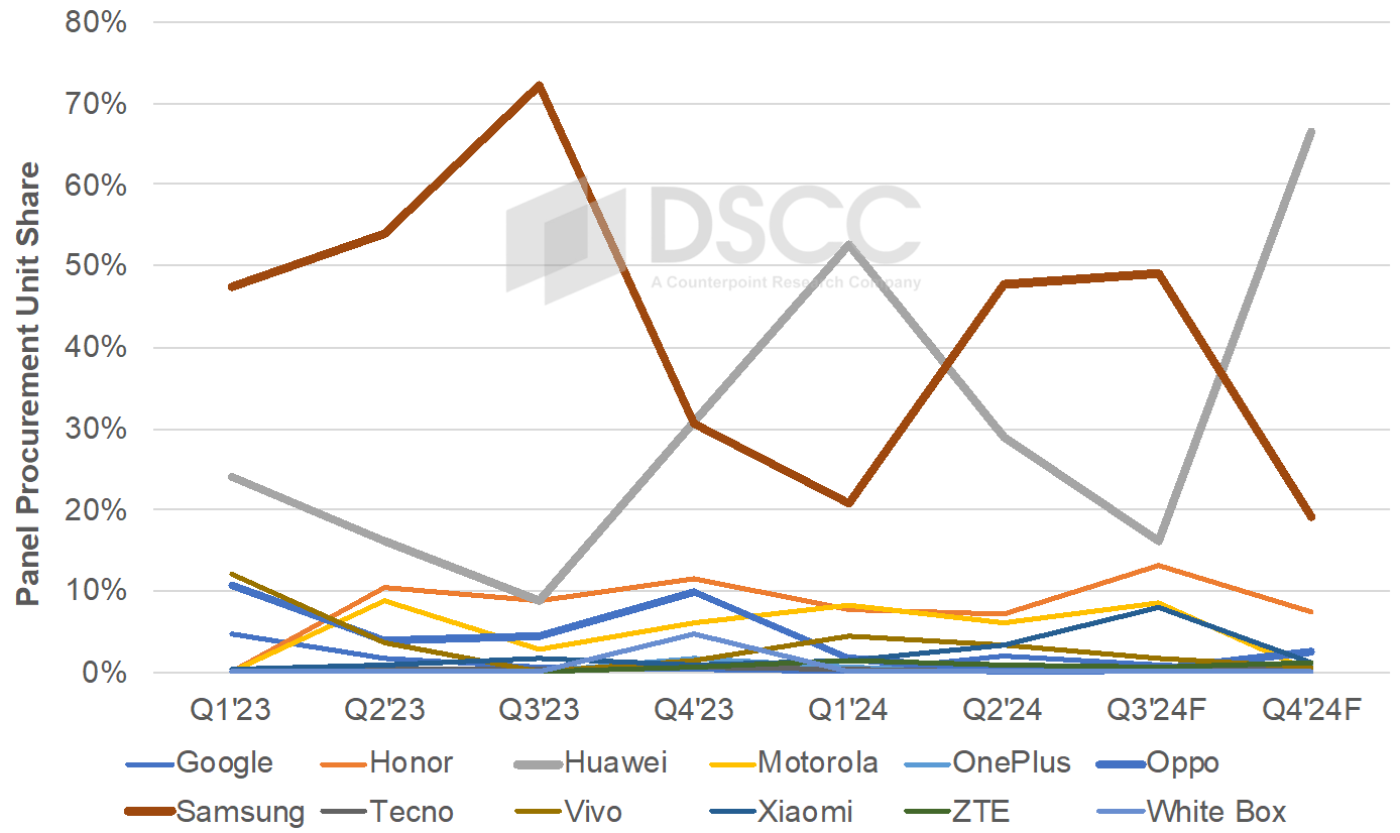

- Samsung dominated Q2’24 foldable panel procurement in Q2’24 with a 48% share followed by Huawei at 29%, reversing positions vs. Q1’24 when Huawei held a 53% to 21% advantage. Samsung accounted for the top two models in Q2’24 on panel procurement basis followed by two models from Huawei and one model from Honor.

- Q3’24 foldable smartphone panel shipments are expected to fall 30% Q/Q and 21% Y/Y to under 7M, the third best quarter to date but the first Q3 to decline Y/Y due to the change in Samsung’s timing. Samsung is expected to gain share in Q3’24 to 49% with Huawei slipping to 16%.

Q2’24 was a record quarter for foldable smartphone panel shipments, rising 151% Q/Q and 126% Y/Y. Panel shipments were 12% higher than the previous high recorded in Q3’23. The primary cause of the surge was the earlier launch of the latest Samsung foldables, the Galaxy Z Flip 6 and Z Fold 6, which started panel production and shipments one month earlier than last year. Samsung accounted for 48% of all foldable smartphone panel procurement in Q2’24, well ahead of Huawei’s Q2’24 share of 29%. Samsung and Huawei reversed positions in Q2’24 with Huawei leading Samsung in foldable panel procurement in Q1’24 with a 53% to 21% advantage. By model, the Samsung Galaxy Z Flip 6 led in foldable panel procurement with a 32% share followed by the Z Fold 6 at 15%. Huawei had the next two highest volume models, the Pocket 2 and Mate X5, each with a double digit share. The Honor Magic V Flip was the #5 foldable in Q2’24 on a panel procurement basis with a 4% share. Clamshells accounted for a 63% share, up from 53% in Q1’24. Samsung Display regained the #1 position in foldable panel share with a 53% to 27% advantage over BOE in Q2’24 after trailing BOE in Q1’24 at 29% to 48%.

In Q3’24, the foldable smartphone panel market is expected to fall 30% Q/Q and 21% Y/Y, the third best quarter to date but the first Q3 to decline Y/Y due to the change in Samsung’s timing. Samsung’s share is expected to rise slightly to 49% with Huawei’s share falling to 16% on a sharp decline in procurement despite the recent launch of the Nova Flip, which has modest expectations. Honor is expected to earn a 13% share as it closes the gap with Huawei on gains by the Magic V3/Vs3. The Galaxy Z Flip 6 is expected to remain the #1 model on a panel procurement basis with a 32% share followed by the Z Fold 6 at 13%. Huawei, Honor and Xiaomi are expected to account for the #3, #4 and #5 models. The clamshell share is expected to fall to 54% as both in-folding and multi-folds gain ground with Huawei beginning panel procurement for its upcoming multi-fold in Q2’24 with volumes surging in Q3’24. Samsung Display’s panel share is expected to rise slightly to 54% in Q3’24 with BOE’s share also rising slightly to 28% and China Star overtaking Visionox for #3. In Q4’24, however, BOE is expected to regain the lead as a result of the seasonality of their customers with Huawei also regaining leadership. For all of 2024, however, Samsung is expected to enjoy a 39% to 36% lead over Huawei on a panel procurement basis with Honor #3 at 9%.

Quarterly Foldable Smartphone Panel Shipments and Growth

Quarterly Foldable Smartphone Panel Procurement Share by Brand

For more insight into the foldable smartphone, laptop and tablet markets, please see DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report or contact info@displaysupplychain.com for more information.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.