DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 12/02/2024

Foldable Smartphone Market Stalls in 2024 and 2025

La Jolla, CA -

- Foldable smartphone displays declined Y/Y for the first time in Q3’24. 2025 is also expected to be down.

- Adoption below expectations as Samsung remains regionally concentrated, Chinese brands are pulling back and it remains dominated by just two brands.

- There is reason for optimism however with Apple expected to enter in 2H’26. In addition, we expect more multi-fold models coming in 2026 and the first slidable laptop in 2025.

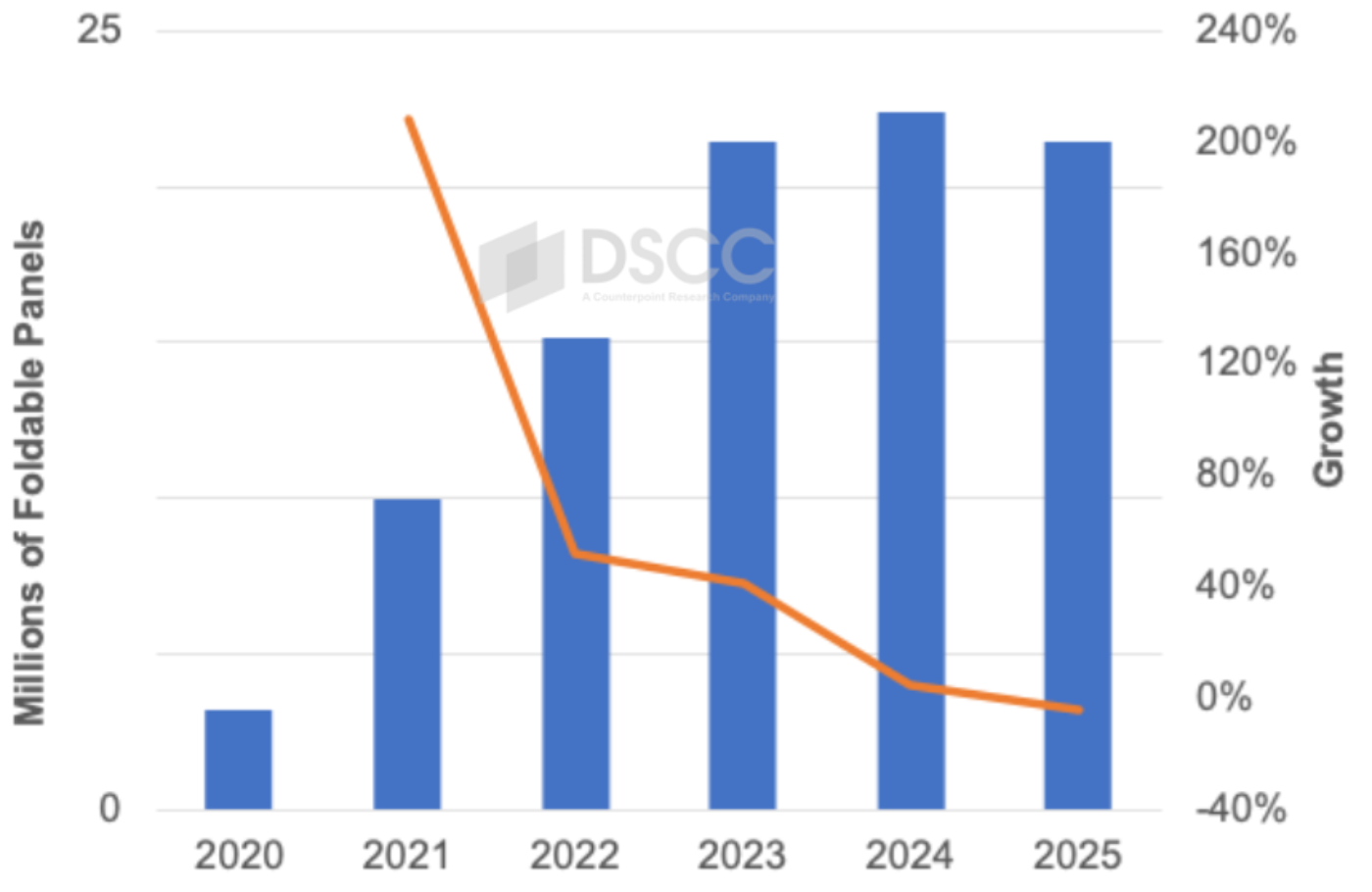

DSCC’s latest report on the foldable and rollable/slidable display market for all display applications shows that the foldable smartphone market has stalled. After enjoying at least 40% growth per year from 2019-2023, DSCC now believes the foldable smartphone display market will rise just 5% in 2024 and fall by 4% in 2025. Demand has stalled at around 22M panels. Foldable smartphone display procurement was down 38% Y/Y in Q3’24 and is expected to be down Y/Y in four of the next five quarters. There are a few reasons for this.

Foldable Smartphone Panel Shipments

First, market leader Samsung is seeing slower than expected adoption of its Galaxy Z Flip 6 clamshell smartphone as well as older foldables. Panel shipments for Z Flip 6 in 2024 are expected to be more than 10% below Z Flip 5 smartphone panel shipments in 2023. Demand remains highly concentrated on Korea and Europe and this product has struggled to gain adoption in the US and China. This shortfall carries a lot of weight since it will still be the industry’s most popular foldable in 2024 as was the Z Flip 5 in 2023. Although the Z Fold 6 is expected to outperform the Z Fold 5 by mid-single digits in 2024 vs. 2023, Samsung’s total foldable panel procurement is expected to be down over 20% to the lowest level since 2021 with older models not performing well either. In fact, Samsung’s decline could have been worse if not for taking panels in Q4’24 for a model to be launched well into 2025. Samsung is still expected to lead in foldable smartphone panel procurement in 2024 however with a 40% share, down from 52% and it led the Q3’24 market with a 51% share.

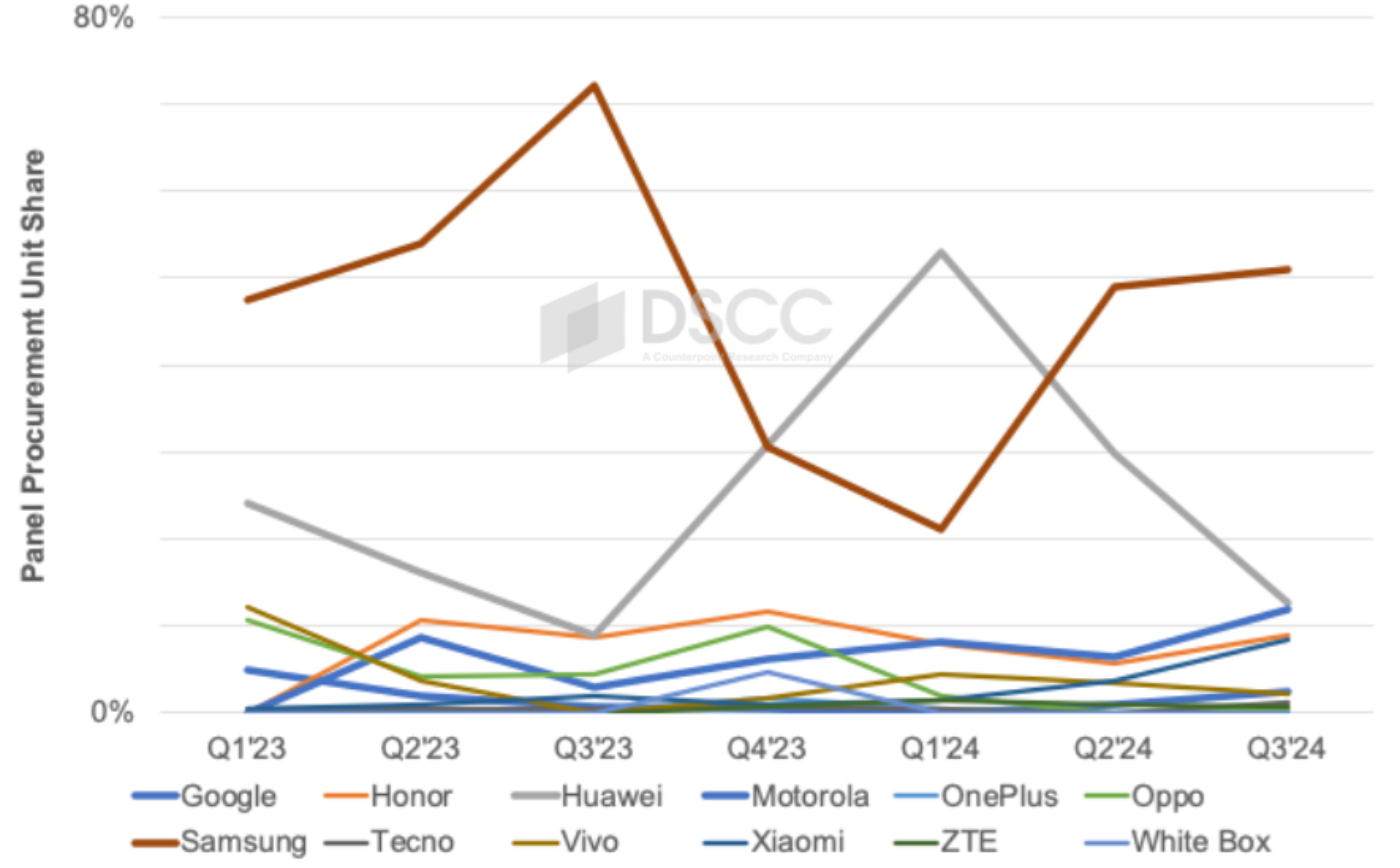

Second, Huawei’s 2H’24 panel procurement has also disappointed, with its share slipping from 30% in Q2’24 to 13% in Q3’24. A large reason for this is later introductions of the Mate X6 and Pocket 3 than their predecessors which delayed panel shipments. Another reason is that Mate XT panel procurement is lower than expected. For these reasons, Huawei’s 2024 demand was downgraded by over 20% vs. our last issue. Despite the reduction, Huawei will still enjoy over 90% growth in foldable panel procurement in 2024 with its market share growing from 18% to 33%. However, the restrictions on importing advanced processors in China and on the most advanced semiconductor equipment has put Huawei at a significant disadvantage in flagship smartphones and we see Huawei scaling back its foldable volume expectations as well as the number of models going forward until this situation is resolved.

Foldable Smartphone Display Procurement Market Share by Brand

Third, no third player has emerged to take on Huawei and Samsung. The two companies have combined for a 70% share of panel procurement in 2023 and 2024, and that share is likely going to increase in 2025 as a number of Chinese brands scale back their foldable efforts. Motorola and Honor are well behind with shares in high single digits. In addition, some smartphone brands are discontinuing their clamshell efforts due to lack of price elasticity, limited margins, modest sales and overheating concerns while some smartphone brands are exiting the infolding market due to lack of demand from the high price points. Given the excitement and opportunity in incorporating AI capabilities, several brands are focusing on that opportunity rather than alternative form factors.

Looking into 2025, it is expected that Samsung will take share back growing its share to over 50% on over 20% growth, but its volume will remain below 2022 and 2023 levels. Samsung is expected to introduce a second clamshell model in 2025 more aggressively priced as well as a larger infolding model that resembles its recently introduced Z Fold 6 Special Edition. On the other hand, we see Huawei releasing fewer models in 2025 with one less clamshell model and losing share. Other brands are also dropping models in 2025. In fact, we expect to see 32 different models shipping in 2025 vs. 41 in 2024.

Although the market has stalled and will decline for the first time on a panel procurement basis in 2025, there is reason for optimism. Apple is expected to enter the foldable market in 2H’26 and given their dominant position in flagship smartphones could generate significant growth for the foldable smartphone market. Any improvement in form factor, functionality, use cases, durability, etc. could drive new demand for this market. As a result, 2026 is expected to be a record year for foldables with over 30% growth and with over 20% growth projected for 2027 and 2028 as well. In addition, we expect at least one other brand to adopt a tri-fold in 2026 and expect to see the first slidable laptop in 2025 with more models coming in 2026.

In Q3’24, the top 10 foldable smartphones on a panel procurement basis included:

- Three models from Samsung including the top 2 with the Z Flip 6 leading with a 31% share.

- Two models each from Huawei and Motorola.

- One model each from Google, Honor and Xiaomi.

DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report not only tracks historical model and panel supplier share but also forecasts model share out to 2028 as well as tracking and forecasting panel costs and prices. In addition, the latest issue reveals details on how panel structures and thickness are changing with insights into how the Z Flip 6, Fold 6 and Fold 6 SE changed vs. prior models and how the film stacks and thickness of the Flip 7 and Fold 7 are expected to change with the thickness of each expected to decline by more than 10%. The report also tracks the latest outlook for foldable and rollable tablets and laptops with the first rollable/slidable devices expected in 2025.

For more insight into the foldable smartphone, laptop and tablet markets, please see DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report or contact info@displaysupplychain.com for more information.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.