DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/27/2023

Flat Panel Display Oversupply Will Continue Into 2024

La Jolla, CA -

The challenging oversupply environment for the display industry in 2023 will continue into 2024, according to DSCC’s Quarterly FPD Supply/Demand Report, released last week. According to DSCC Principal Analyst and CFO Bob O'Brien, “Although we expect a modest recovery in demand for display products, and this recovery in demand will reduce the gap between supply and demand, there will continue to be excess capacity for both OLED and LCD in 2024.”

The FPD Supply/Demand Report gives a comprehensive view of the display industry because it covers both the demand and supply sides. The demand forecast, which is the same forecast in DSCC’s Quarterly Flat Panel Display Forecast Report, covers flat panel display shipments across eight different applications, with technology split between LCD and OLED. The report includes units, area and revenue history and forecasts for all applications from 2018 to 2027.

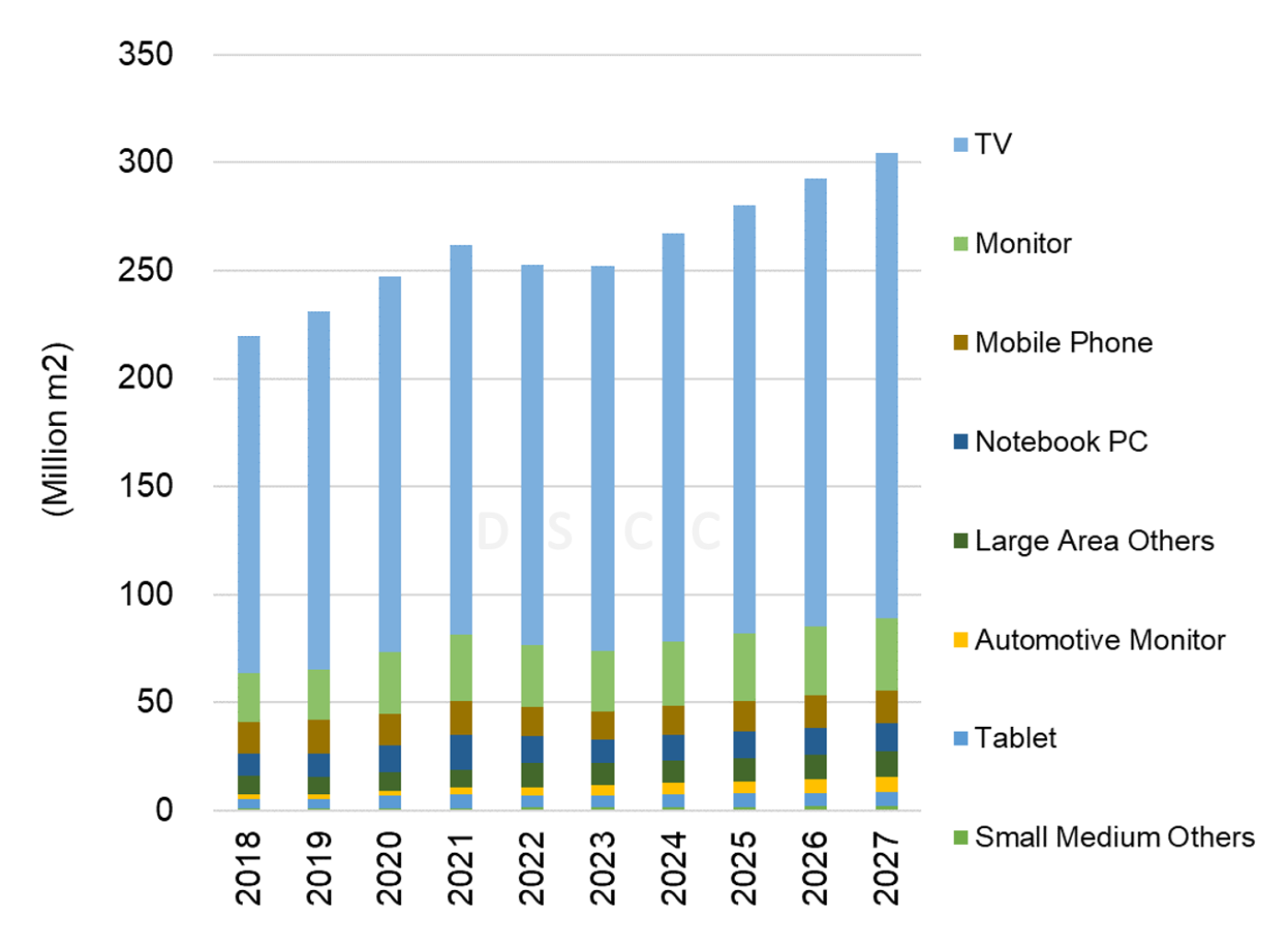

While units and revenue are important to understanding the display industry, the most meaningful metric for supply/demand is area. The first chart here shows our long-term forecast for display demand area by application. After two consecutive years where FPD demand area decreased in 2022-2023, we expect growth to resume in 2024 and continue through 2027 with a CAGR of 5% to reach 305M m2 in 2027.

TVs will continue to represent a dominant share of FPD demand, and area demand for TVs will grow from incremental unit growth and increasing average screen size. DSCC expects unit growth of 1%-2% per year and expects that the average size for TV panels will increase from 48.2” in 2023 to 51.6” in 2027. DSCC also expects area growth from IT applications (Monitor, Notebook, Tablet) as the IT market recovers from its post-pandemic slump.

Flat Panel Display Demand Area by Application, 2018 - 2027

Although DSCC expects OLED to gain share across all applications and expect OLED demand area to grow faster than the FPD market as a whole, there is enough demand growth to allow LCD to grow. DSCC expects LCD demand area to grow by a 4% CAGR from 2023-2027 to reach 280M m2, while OLED demand area will grow by an 18% CAGR to reach 24M m2.

Whereas demand for LCD panel area will remain dominated by TV, OLED demand area will be more diverse with TV, smartphones and IT products all contributing to growth. By 2027, DSCC expects TV to represent 44% of OLED area, while smartphones will make up 37% of OLED area and IT products another 15%.

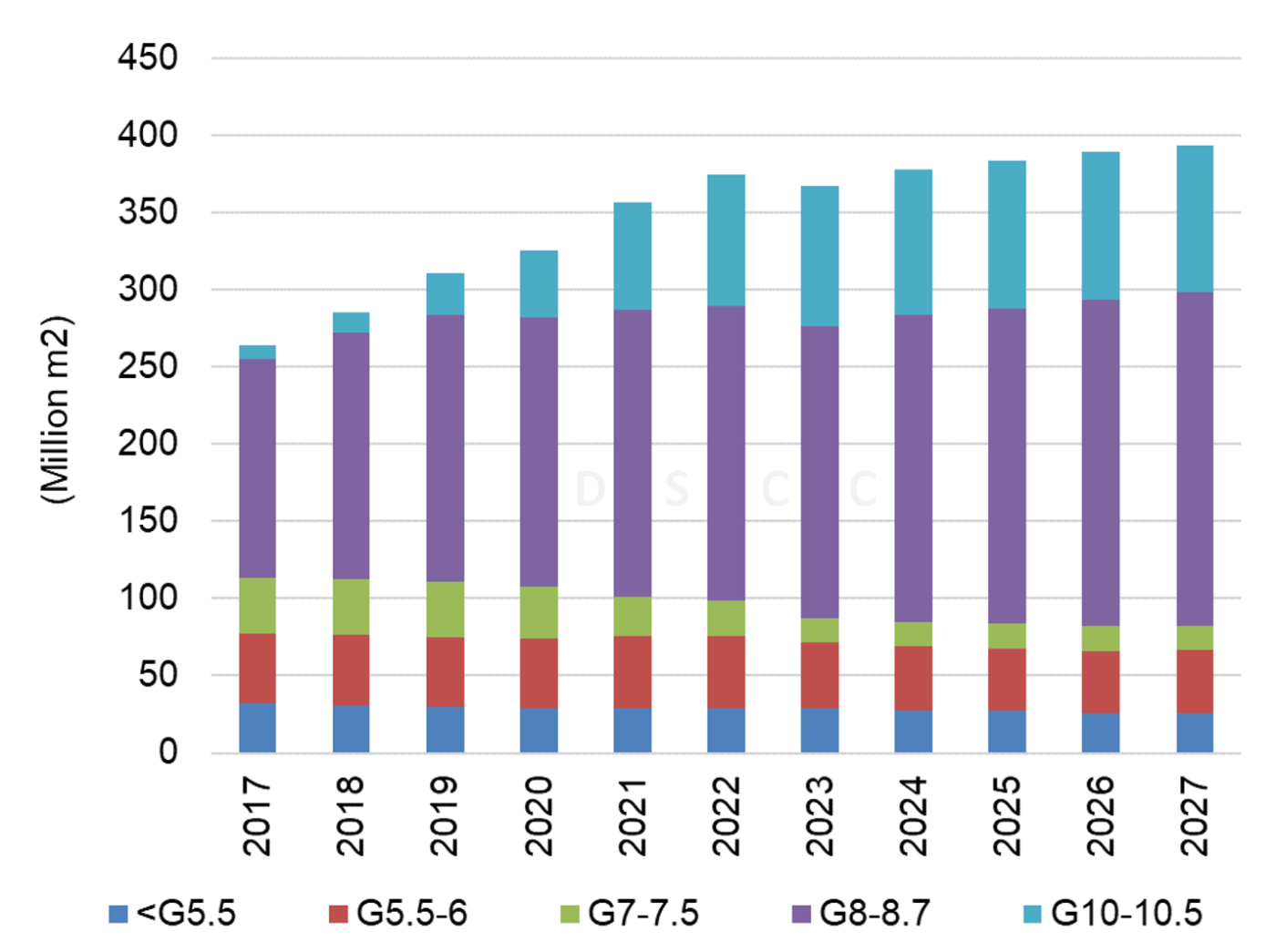

Now turning to the supply side of the industry, the Quarterly FPD Supply/Demand Report covers DSCC’s detailed capacity forecast, giving views of LCD and OLED capacity by Gen Size, by supplier and by production region. The next chart here shows our forecast for LCD capacity by Gen size. Overall, DSCC expects minimal growth in LCD capacity, and as shown on the chart DSCC expects capacity of smaller Gen fabs to decrease as some older fabs close. DSCC expects that LCD capacity in Gen 5 and smaller fabs to decrease by 11% over the span 2023-2027 (11% in total, not a CAGR) and expect that LCD capacity in Gen 5.5-6 will decrease by 5%. The much larger capacity in Gen 8-8.7 will grow by 14% over the forecast period and the capacity for Gen 10-10.5 will grow by 5%, so the overall LCD capacity of the industry will grow by 7% from 367M m2 to 394M m2.

LCD Capacity by Gen Size, 2017 - 2027

While LCD capacity will be close to flat over the next four years, DSCC expects OLED capacity to continue to increase substantially. OLED capacity will grow by a 4% CAGR in Korea and by a 7% CAGR in China over the forecast period, with total OLED capacity growing at a 5% CAGR from 36M m2 in 2023 to 44M m2 in 2027. Almost all of that growth will come on flexible OLED lines for mobile/IT applications or on rigid OLED lines with thin-film encapsulation for mobile/IT applications.

Now putting the supply and demand pieces together, DSCC calculates the expected capacity utilization for the display industry. While the report includes a view on FPD utilization as a whole, the global picture is really just the sum of several different supply/demand segments. Where the supply side can be fungible across applications, such as in LCD, there can be a single supply/demand picture, but when the supply side cannot be fungible (for example, WOLED TV production cannot make tablets or smartphones) the supply/demand picture becomes more fragmented. The report includes separate Supply/Demand views for the following segments:

- · LCD in aggregate across all Gen sizes

- · FPD in aggregate including LCD and OLED

- · Mobile/IT OLED

- · TV/Monitor OLED

- · Mobile/IT Rigid OLED

- · Mobile/IT Flexible OLED

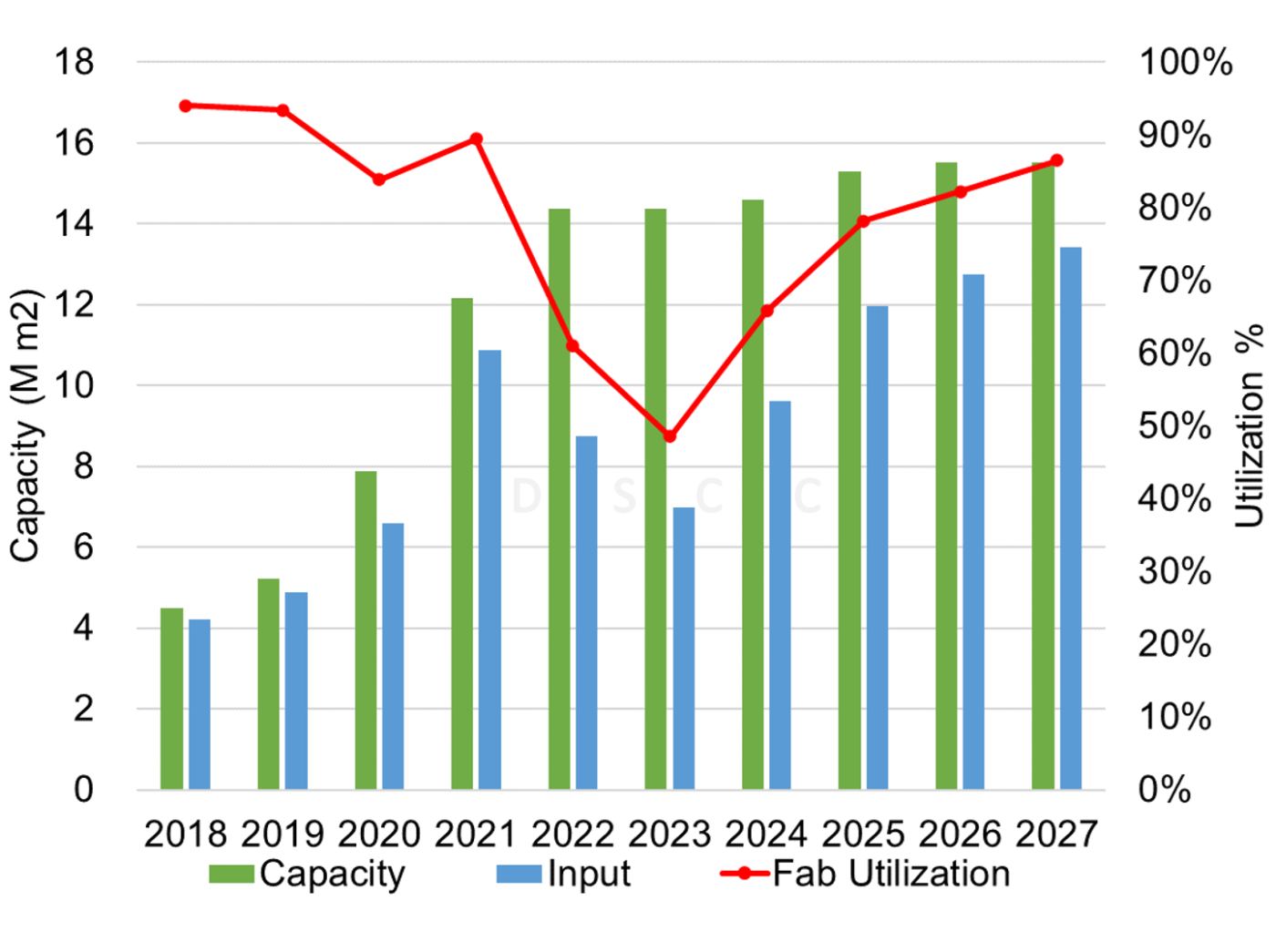

An example is included as the next chart here, showing the supply/demand picture for large-screen OLEDs for TVs and Monitors, including both White OLED by LGD and QD-OLED by Samsung. Excess inventory from 2022 has combined with weak demand to drive fab utilization in this sector below 50% for 2023. DSCC expects demand to recover in 2024 but to remain below the 2021 peak, and DSCC expects fab utilization to average 66% for 2024. As demand continues to grow in the out years of the forecast, DSCC expects utilization to exceed 80% and there will likely be some pressure to add new capacity after 2027.

Supply/Demand for TV/Monitor OLED, 2018 - 2027

Across all of the supply/demand segments mentioned above DSCC expects oversupply to persist in 2024. In LCD, DSCC expects utilization to improve from 76% in 2023 to 80% in 2024, but this remains much lower than the 85%-88% levels seen from 2018-2021. In Mobile/IT OLED DSCC expects UT% to improve from 61% in 2023 to 66% in 2024, but this remains lower than the 71% seen in 2021. The Mobile/IT segment shows a strong seasonality oriented toward the second half of each year, and the report gives quarterly detail for 2024.

As noted above, the DSCC’s Quarterly FPD Supply/Demand Report provides a comprehensive listing of historical panel demand in LCD and OLED for eight different applications, plus a forecast of units, area and revenues for each application. The report gives a view of industry capacity by display technology, region and Gen size, and gives a comparison of supply and demand across segments of the industry. Readers interested in subscribing to this report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.