DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/25/2024

Flat Panel Display Fab Utilization Restrained in 2H’24

La Jolla, CA -

- Display fab utilization at flat panel makers peaked in Q2’24 and declined slightly in Q3’24.

- OLED fab utilization increased sequentially in Q3’24 with demand recovering in smartphones and TVs.

- Utilization for both LCD and OLED fabs is expected to decline in Q4’24 as the industry manages oversupply.

After a modest increase in the spring and summer months, flat panel display fab utilization started to decrease in the third quarter of 2024 and is decreasing further in the fourth quarter, according to the latest release of DSCC’s Quarterly All Display Fab Utilization Report, issued earlier this month. Panel makers appear to be managing utilization to avoid oversupply and inventory build-up.

We saw a modest recovery in utilization in Q2’24 based on filling the supply chain in anticipation of TV demand driven by summer sports events (Euro Cup and Paris Olympics) and IT demand from a PC refresh cycle assisted by AI PCs. After the summer sports events were finished, utilization sagged in Q3 and in October Chinese LCD makers took an extended shutdown period surrounding the National Day holiday, closing for one to two weeks instead of the typical one to two days in prior years.

Worldwide fab utilization dropped slightly Q/Q in Q3’24 despite sequential increases in utilization in Korea and Taiwan, as utilization in China. We expect Q4’24 utilization to be lower in all regions except Japan, where the regional figure is distorted by the closure of Sharp’s troubled Gen 10 Sakai Display Products fab, which shut down in Q3 and is removed from our capacity estimates (the denominator) starting in Q4’24.

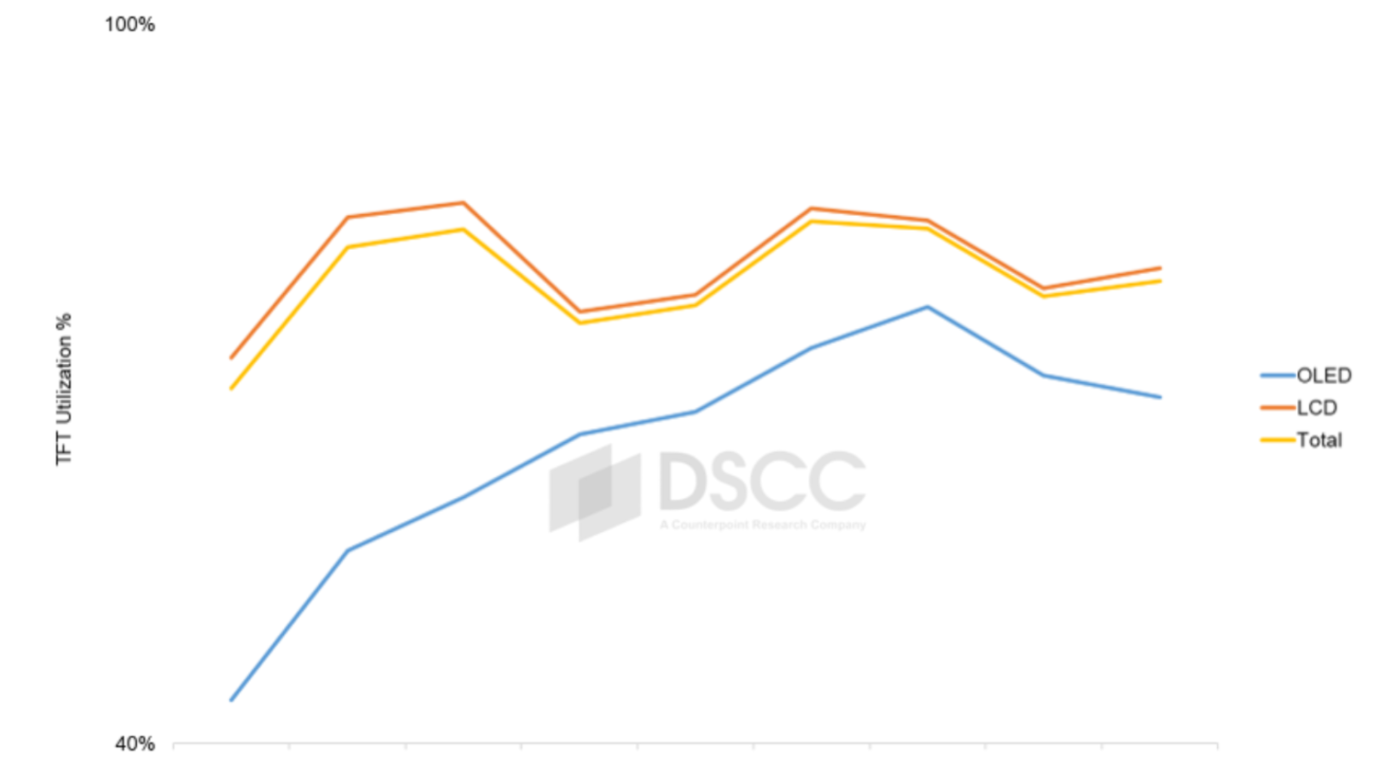

Korea has a dramatically higher share of its capacity as OLED, while all other regions are dominated by LCD. The slowdown in utilization in Q3 was largely confined to LCD as shown on the next chart, as OLED line utilization increased with seasonal demand for smartphones and improvement in OLED TV demand. The industry’s total utilization closely follows the LCD line as OLED capacity represents only 10% of total FPD capacity.

TFT Quarterly Fab Utilization by Frontplane, 2022-2024

Turning to mobile displays, rigid OLED increased from low levels in 2023 to reach the 80% range since Q2’24 as demand for rigid OLED panels for notebook PCs continues to increase and demand for rigid OLED smartphone panels has increased at the expense of LTPS LCD. Both rigid OLED and LTPS LCD serve the lower and mid tiers of the smartphone market which exhibit less seasonality than the premium segment. Higher-end smartphones use flexible OLED panels, and flexible OLED has settled into a consistent seasonal pattern of lower UT% in the first half and higher UT% in the second half of each year, driven primarily by Apple’s product introduction cycle and holiday sales. The new Rigid+TFE OLED lines for LGD and SDC were running at high utilization in Q2’24 and Q3’24 to supply OLED panels for the OLED iPad Pro, but utilization has plummeted in Q4’24 as iPad Pro demand has been surprisingly weak.

After a modest increase in the first half of 2024, display fab utilization is slowing down in the second half. Total industry capacity continues to far outstrip demand for displays, and the industry will need to continue to restrain utilization to avoid shifting the supply/demand balance into oversupply. Panel prices have stabilized in Q4’24, so the industry appears to have achieved a “soft landing”.

DSCC’s Quarterly All Display Fab Utilization Report covers capacity, TFT Input and utilization by month for every flat panel display fab in the industry, with pivot tables to allow segmentation by supplier, country, TFT fab generation, backplane, frontplane or substrate type. The report provides historical utilization back to Q1’19 and a forecast by month for 2024 and the first three months of 2025. DSCC Weekly readers interested in subscribing to the Quarterly All Display Fab Utilization Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.