DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 04/22/2024

Flat Panel Display Fab Utilization Increasing in Q2’24

La Jolla, CA -

- Worldwide fab utilization held steady in Q1’24 despite reduced input as capacity declined with fab closures.

- Utilization started increasing in March 2024 and Q2 TFT input expected to increase >10% sequentially.

- The three big Chinese LCD makers slowed sharply in Q4’23 through February 2024 but increased input starting in March 2024.

After a seasonal slowdown and restrained production during the winter months, flat panel display fab utilization started to increase in March 2024 and is increasing further in the second quarter, according to the latest release of DSCC’s Quarterly All Display Fab Utilization Report, issued last week.

“Panel makers appear to have managed a ‘soft landing’ and avoided an oversupply and are now increasing production to serve demand for TV and IT products,” said Bob O’Brien, Co-Founder of DSCC. “The supply chain is ramping in anticipation of TV demand driven by summer sports events (Euro Cup and Paris Olympics) and IT demand from a PC refresh cycle assisted by AI PCs.”

Worldwide fab utilization held steady in Q1’24 despite reduced input as capacity declined with fab closures. AUO shuttered its small-gen LCD and OLED fab in Singapore, and Innolux closed down its Gen 5.5 Fab 4 and Gen 3.5 Fab 1. As a result, Taiwan’s capacity was reduced 7% Q/Q, so utilization increased even with lower input. We expect Q2 utilization to be higher in all regions except Japan, where the regional total is dominated by Sharp’s troubled Gen 10 Sakai Display Products fab which is slowing down input.

Even with the increased utilization in Q2, UT% will not reach the high levels seen during the pandemic boom. We expect worldwide utilization to increase to 83% in Q2’24 from 75% in Q1’24, but for comparison UT% exceeded 85% for seven consecutive quarters from Q3’20 to Q1’22.

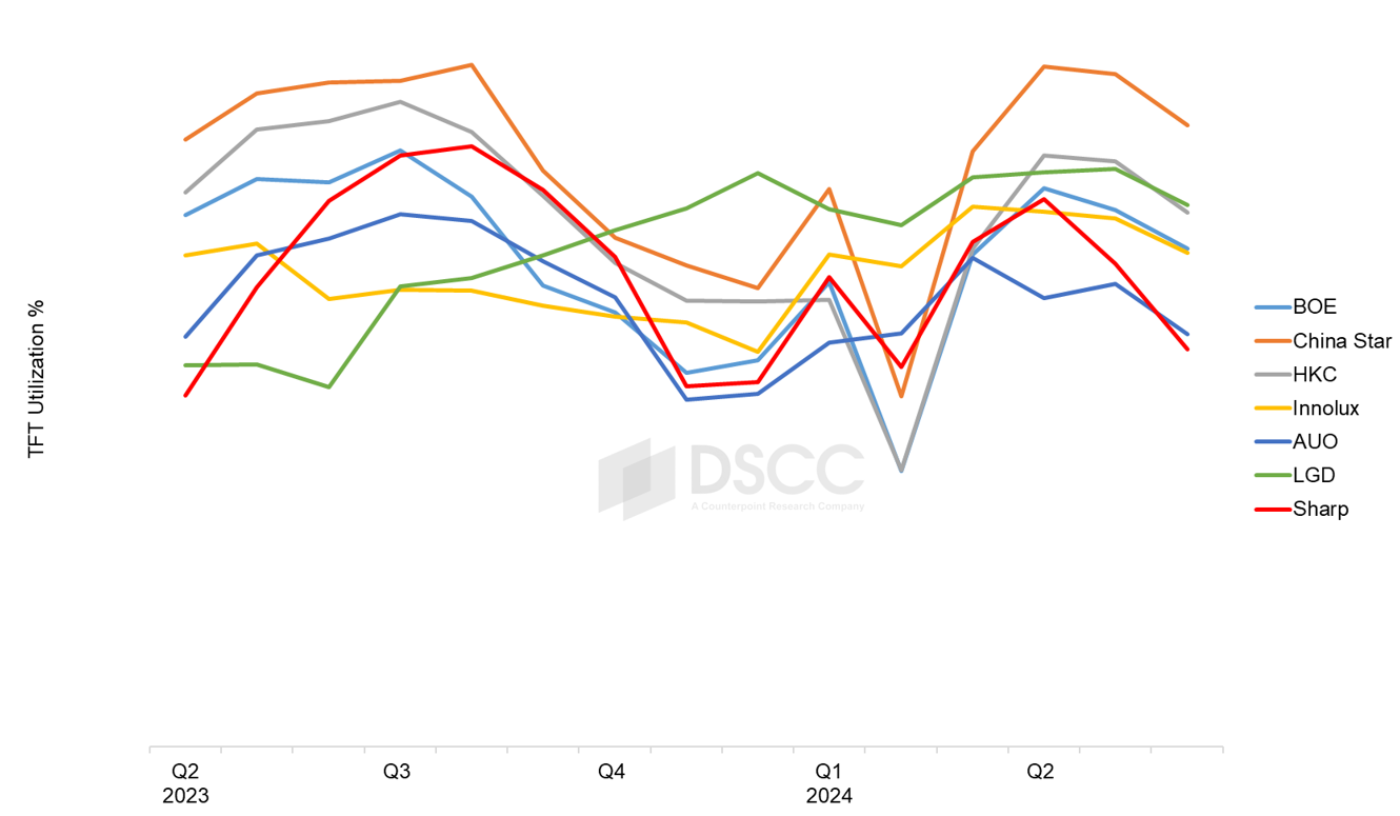

Looking more closely at LCD, a view of utilization by manufacturer by month shows the slowdown in Q4’23 and Q1’24 for the top seven LCD makers. The three big Chinese panel makers each had a dramatic drop in utilization in February 2024 with the Lunar New Year holiday but recovered in March and are increasing further in Q2.

TFT LCD Monthly Fab Utilization by Manufacturer, 2023-2024

After two quarters of restrained production, display fab utilization is increasing in Q2’24. However, total industry capacity continues to far outstrip demand for displays, and the industry’s push for higher utilization risks shifting the supply/demand balance into oversupply. Panel makers in 2023 achieved a “soft landing”, leading to only modest price reductions. They may try the same thing again in 2024.

DSCC’s Quarterly All Display Fab Utilization Report covers capacity, TFT Input and utilization by month for every flat panel display fab in the industry, with pivot tables to allow segmentation by supplier, country, TFT fab generation, backplane, frontplane or substrate type. The report provides historical utilization back to Q1’19 and a forecast by month for the first three quarters of 2024. DSCC Weekly readers interested in subscribing to the Quarterly All Display Fab Utilization Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.