DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 07/26/2023

Fab Utilization Increases Further in Q3’23, Industry Risks Oversupply

La Jolla, CA -

The increase in display fab utilization that started in Q1’23 accelerated in the second quarter and continues in the third quarter, according to the latest release of DSCC’s Quarterly All Display Fab Utilization Report issued last week. Inventory in the display supply chain has been trimmed to normal levels, and restocking is leading to increased demand. However, big increases in utilization by LCD makers hold the risk of overshooting demand and stifling the rally in panel prices.

The report details monthly capacity, TFT input and utilization for every flat panel display fab in the industry, more than 100 fabs in all, and includes pivot tables to allow segmentation by supplier, country, TFT fab generation, backplane, frontplane or substrate type. The report provides historical utilization back to Q1’19 and a forecast by month for the full year 2023.

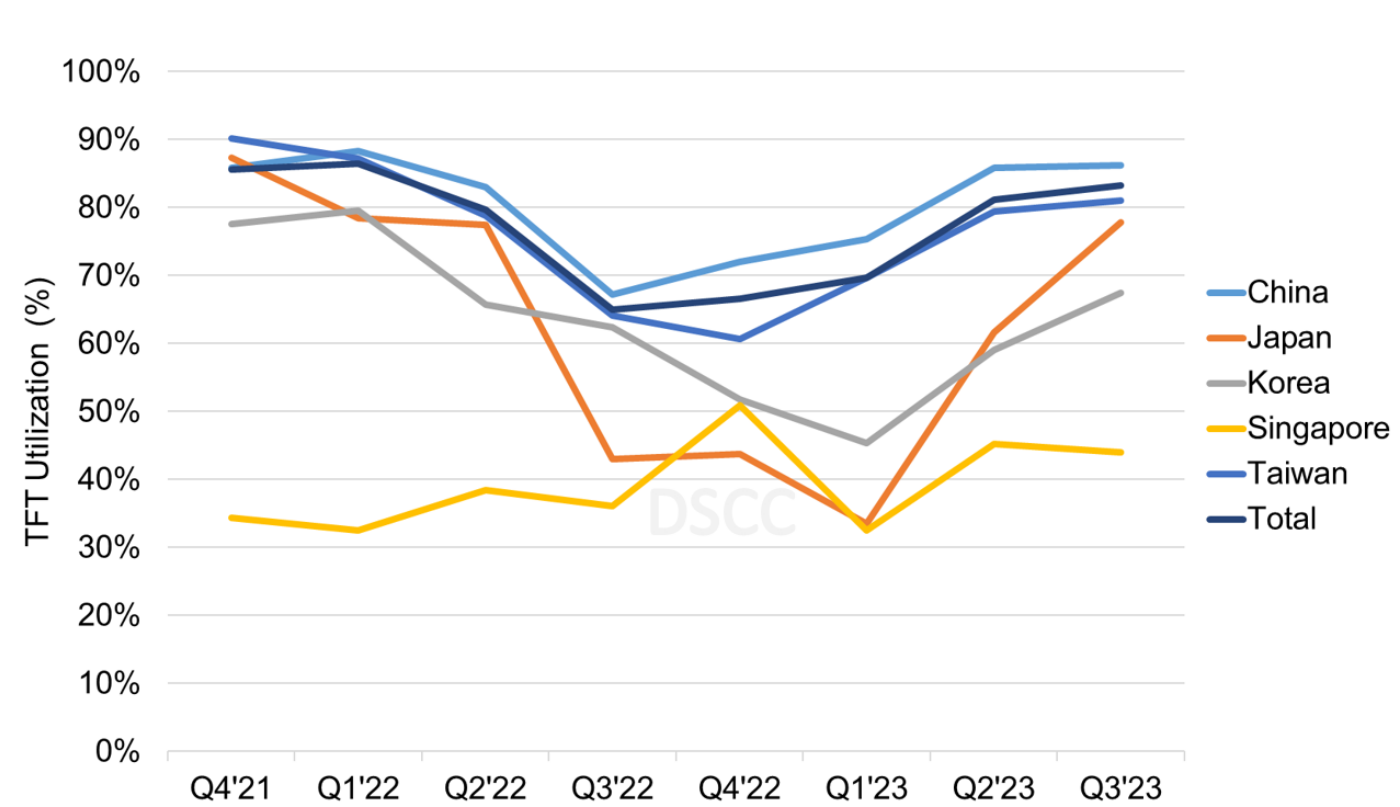

Fed by the pandemic demand surge, fab utilization was particularly strong in Taiwan and China in 2021 and through Q1’22, as shown in the first chart. Meanwhile macroeconomic and geopolitical shocks caused demand to plunge. Utilization fell 6% in Q2’22 and another 15% in Q3’22 to 65%, the lowest point since the financial crisis of 2008-2009. Utilization recovered slightly to 67% in Q4’22 and recovered further to 70% in Q1’23, then jumped up to 81% in Q2’23. Based on the latest update, DSCC expects utilization to increase in Q3’23 to 83% but to edge down to 79% in Q4’23.

TFT Quarterly Fab Utilization by Region, 2021-2023

According to DSCC Co-Founder and CFO Bob O’Brien, “The slowdown was broad-based across all regions of production, but the recovery has been fastest in China. The slowdown affected OLED production as well as LCD but was more severe and has persisted longer for OLED lines. Korea has a dramatically higher share of its capacity as OLED, while all other regions are dominated by LCD. With the shutdown of SDC’s T8 fab and LGD’s P5 and P7 fabs in 2022, in Q3’23, 59% of Korea capacity produces OLED panels, while the percentage of OLED in China is only 6% and it is negligible in all other regions.”

The downturn for LCD fabs had a common cause – the sharp reduction in LCD panel prices and the inventory build-up. Although LCD capacity is not completely interchangeable, it is largely fungible, so a shortage in one gen size of capacity can be made up with another gen size, and similarly an oversupply in one area spills over onto other areas. OLED capacity is different in that there are five distinct classes of OLED capacity with little overlap between them:

- White OLED capacity for LGD, on Gen 8.5 lines with oxide TFT backplanes for OLED TV and monitor panels;

- QD-OLED capacity for SDC, also on Gen 8.5 lines with oxide TFT backplanes for OLED TV and monitor panels;

- Rigid OLED capacity, mostly for SDC but a few others, on Gen 5.5 and smaller lines with LTPS backplanes for smartphone, tablet and notebook panels;

- RGB OLED capacity on rigid substrates with thin film encapsulation (Rigid + TFE) on LGD’s E7 line in Paju, for IT applications;

- Flexible OLED capacity for many suppliers, primarily on Gen 6 lines with LPTS or LTPO backplanes for smartphone panels.

While the causes for the downturn vary for each class of capacity, they all share one factor – the slowdown of demand in electronic devices.

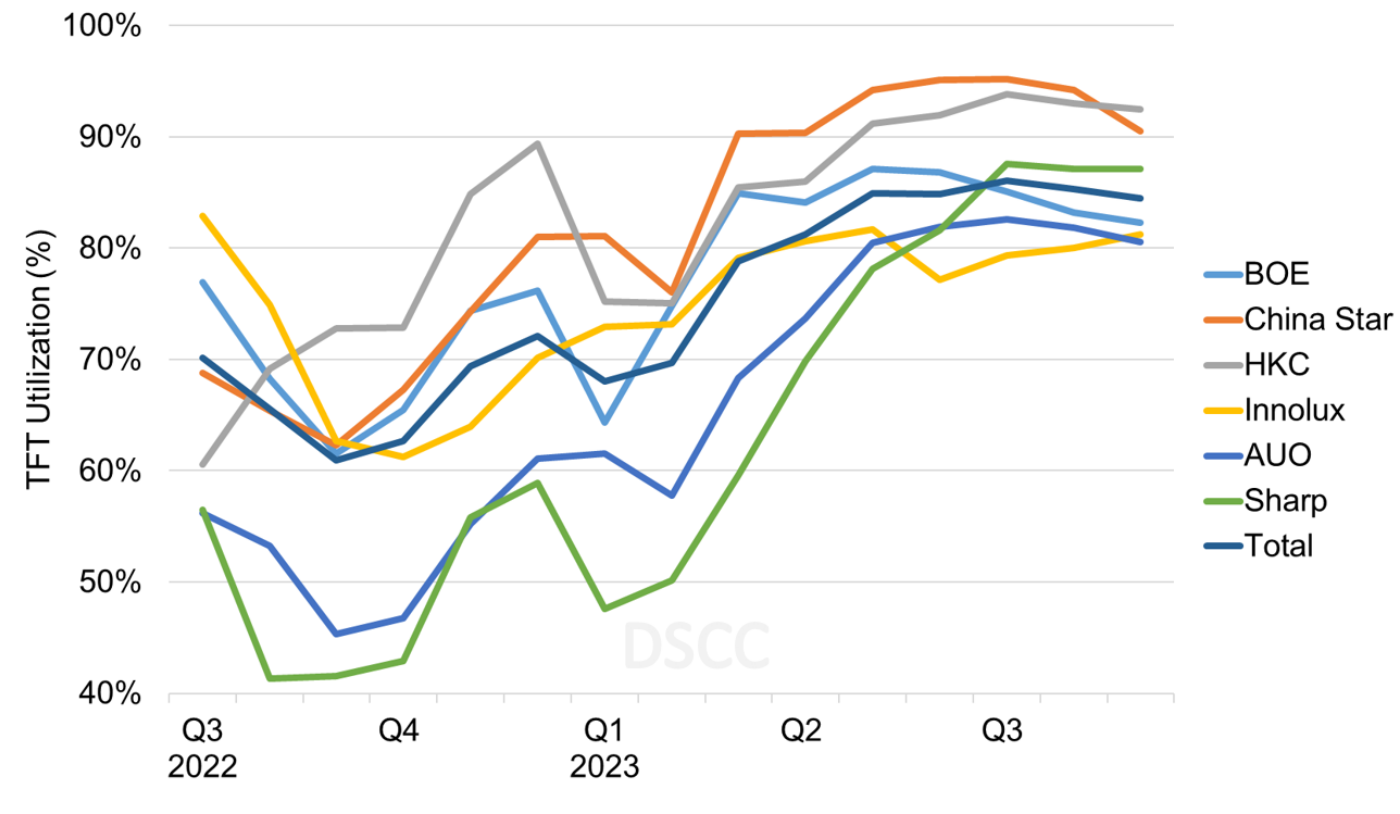

Looking more closely at LCD, a view of utilization by manufacturer by month shows the dramatic recovery in Q2’23 for each of the top seven LCD makers, which have a combined 87% of the industry’s LCD input by area. The chart also shows that while all companies are recovering from the downturn, some are recovering faster than others.

The companies with the deepest downturn and slowest recovery have been AUO and Sharp. AUO apparently made the decision to hold the line on prices and turn away business rather than competing for sales below cost. With LCD TV panel prices increasing in Q2’23, AUO was able to increase its utilization.

TFT LCD Monthly Fab Utilization by Manufacturer, 2022-2023

Like AUO, Sharp saw its utilization plummet in the second half of 2022, and lags behind the Chinese panel makers in 2023. Sharp’s capacity is dominated by its two G10+ lines, the original Gen 10 fab in Sakai City, Japan and the more recent Gen 10.5 fab in Guangzhou, China. The Sakai fab struggled through three quarters of extremely low utilization from Q3’22 through Q1’23, with UT under 30% for nine months. Utilization at the Sakai fab jumped in Q2’23, from 35% in March 2023 to 81% in June, and we forecast Sakai to have 95% utilization in Q3.

After suffering its worst downturn in more than a decade, the display industry started to recover in the first half of 2023. However, industry capacity continues to far outstrip demand for displays, and the industry’s push for higher utilization risks shifting the supply/demand balance into oversupply in the second half of the year.

DSCC’s Quarterly All Display Fab Utilization Report covers capacity, TFT Input and utilization by month for every flat panel display fab in the industry, with pivot tables to allow segmentation by supplier, country, TFT fab generation, backplane, frontplane or substrate type. The report provides historical utilization back to Q1’19 and a forecast by month for the full year 2023. Readers interested in subscribing to the Quarterly All Display Fab Utilization Report should contact info@displaysupplychain.com.

If you're interested in free expert insights, subscribe to our email list here: EXPERT INSIGHTS, FREE DELIVERY.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.