DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 04/18/2022

DSCC Upgrades Long-Term Forecast for AR/VR Displays

Austin, TX -

This article was updated on May, 4th with revised figures for revenue forecast and growth rate.

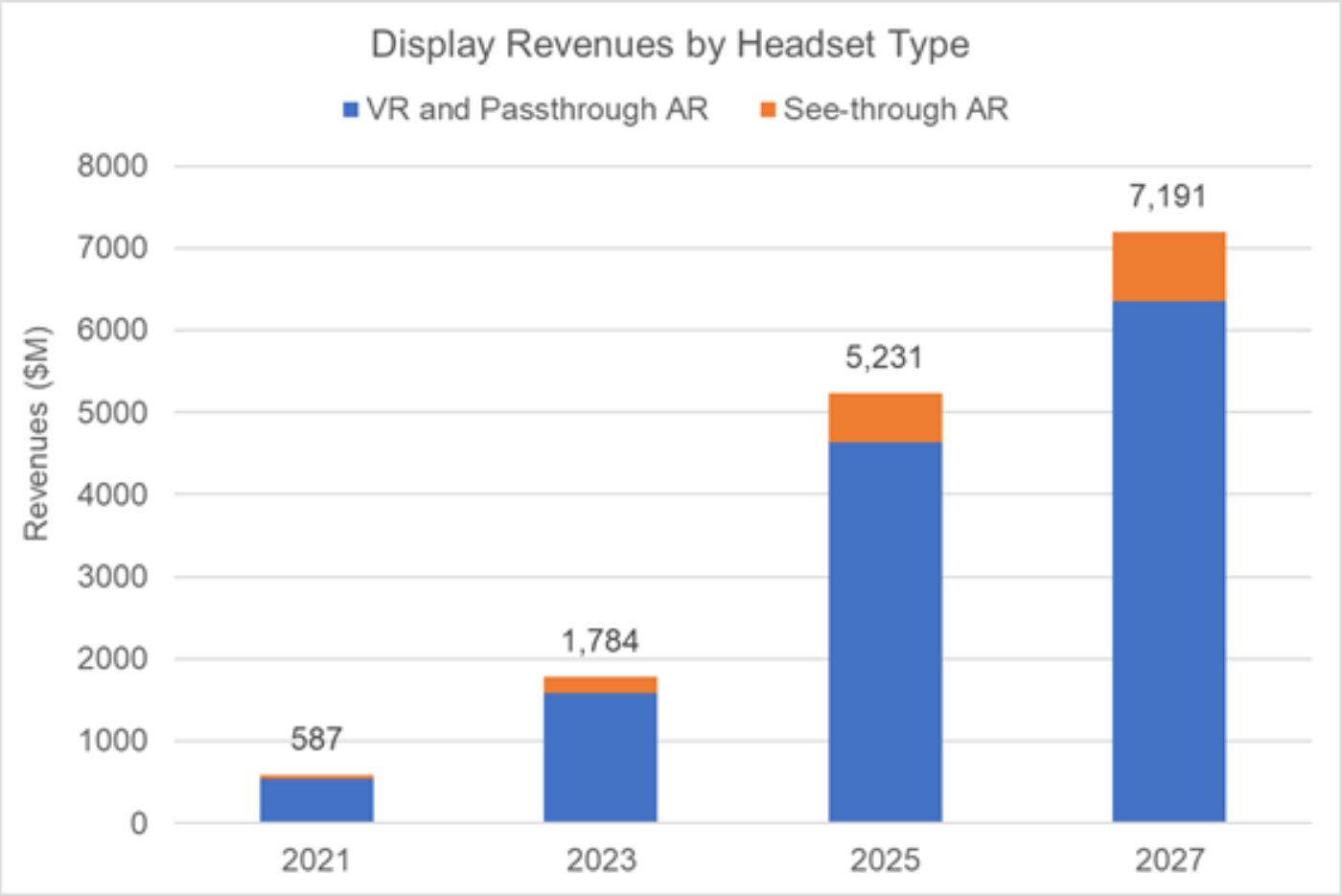

Annual revenues for AR/VR displays will reach $7.2B in 2027, according to DSCC. The updated forecast has been published in the new Biannual Augmented and Virtual Reality Display Technologies and Market Report. The report includes a breakdown by display technologies and predicts that LCD will have the largest share of shipments until 2025. After that, OLED on Silicon (SiOLED) will become the dominant technology.

“A lot has happened in a year, including several high-profile acquisitions and Facebook changing its name to Meta,” says Guillaume Chansin, Director of Display Research at DSCC and lead author of the report. “Considering the expected growth in shipments for 2022 and 2023, we decided to upgrade our long-term outlook to better reflect the current trajectory.”

The latest forecast corresponds to a compound annual growth rate (CAGR) of 51.8% for the AR/VR display market. DSCC still expects that VR and passthrough AR will generate more display shipments and revenues than see-through AR. Meta has added some support for passthrough AR on the Quest 2 and more headsets will offer this feature in the near future.

Shipments of display panels for VR will reach double-digits for the first time in 2022, according to the report. LCD is currently used in most VR headsets, including the bestselling Meta Quest 2 or the freshly announced Pico Neo 3 Link. One advantage of LCD is that it can reach high pixel density well above 1000 PPI. Even at 773 PPI, the 5.5” panel in the Pico Neo 3 Link packs more pixels per inch than a high-end AMOLED smartphone.

AMOLED had all but disappeared from VR headsets in the past two years as its 615 PPI pixel density could not compete against the current generation of high-resolution LCD panels. However, AMOLED will make a return with the launch of Sony’s PlayStation VR2. DSCC expects these AMOLED panels to have a pixel density well above 800 PPI, which will be a record high for mass-produced AMOLED.

Another benefit of using LCD is that it gives a relatively easy way to implement a short duty cycle, with the backlight on only about 10% of the time. This is an important consideration for VR, as it helps reduce motion blur and the associated motion sickness that some users can experience. Panel manufacturers have successfully implemented a global blinking method that can refresh the display at 120Hz.

The next evolution is to use MiniLED backlight to improve contrast. Some high-end VR headsets are already taking advantage of MiniLED. Meta is also expected to launch a new VR headset with two MiniLED LCD panels later this year. It will feature pancake optics that are lighter and smaller than the typical Fresnel lenses found on most headsets today.

To miniaturize the optics even further, OEMs are looking at Micro OLED. Although the term is not well-defined, Micro OLED usually refers to small OLED displays with a very high pixel density, beyond 2000 PPI. At present, the only way to make such displays is to use SiOLED technology, which combines OLED emitters with a CMOS silicon backplane.

Apple is planning to use SiOLED in its upcoming AR/VR headset. It was initially scheduled to be released in 2022 but is now believed to have been delayed until next year. SiOLED has also been adopted in smart viewers with birdbath optical combiners, such as the Nreal Light or the Lenovo ThinkReality A3.

The key challenges for SiOLED are to increase brightness and reduce cost. There have been significant investments in China to increase capacity, which will help lower cost. Brightness is also being tackled by several companies, including eMagin who demonstrated 10,000 nits on full color display last year. Given that SiOLED is currently the only technology used for both VR and see-through AR, DSCC expects that SiOLED will represent 48% of all AR/VR display shipments by 2027.

DSCC provides the most comprehensive market research for the display industry. DSCC offers market reports for smartphones and TVs, and covers all the emerging display technologies, including MicroLED, MiniLED and foldable OLED. The Biannual Augmented and Virtual Reality Display Technologies and Market Report gives a complete picture of the various display technologies used in AR/VR, including LCD, AMOLED, LCoS, DLP, LBS, MicroLED and SiOLED. It profiles the key suppliers and their roadmaps. A description of the various optical configurations and waveguide types is also included. Market forecasts for both AR and VR are segmented by display types and show the technologies that will generate the most revenues.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.