Ross Young

ross.young@displaysupplychain.com

FOR IMMEDIATE RELEASE: 09/13/2021

DSCC Sees Progress in Foldable Display Market Demand and Display Cost Reduction, Raises Forecasts Out to 2026

Austin, TX -

DSCC has released its latest Quarterly Foldable/Rollable Display Shipment and Technology Report which now forecasts both foldable and rollable display shipments along with device production and device shipments out to 2026 for the smartphone, tablet, notebook PC and TV markets across a wide number of parameters. The latest report points to encouraging results from both the demand side and the cost/price outlook for foldable smartphones, resulting in a higher forecast for that segment.

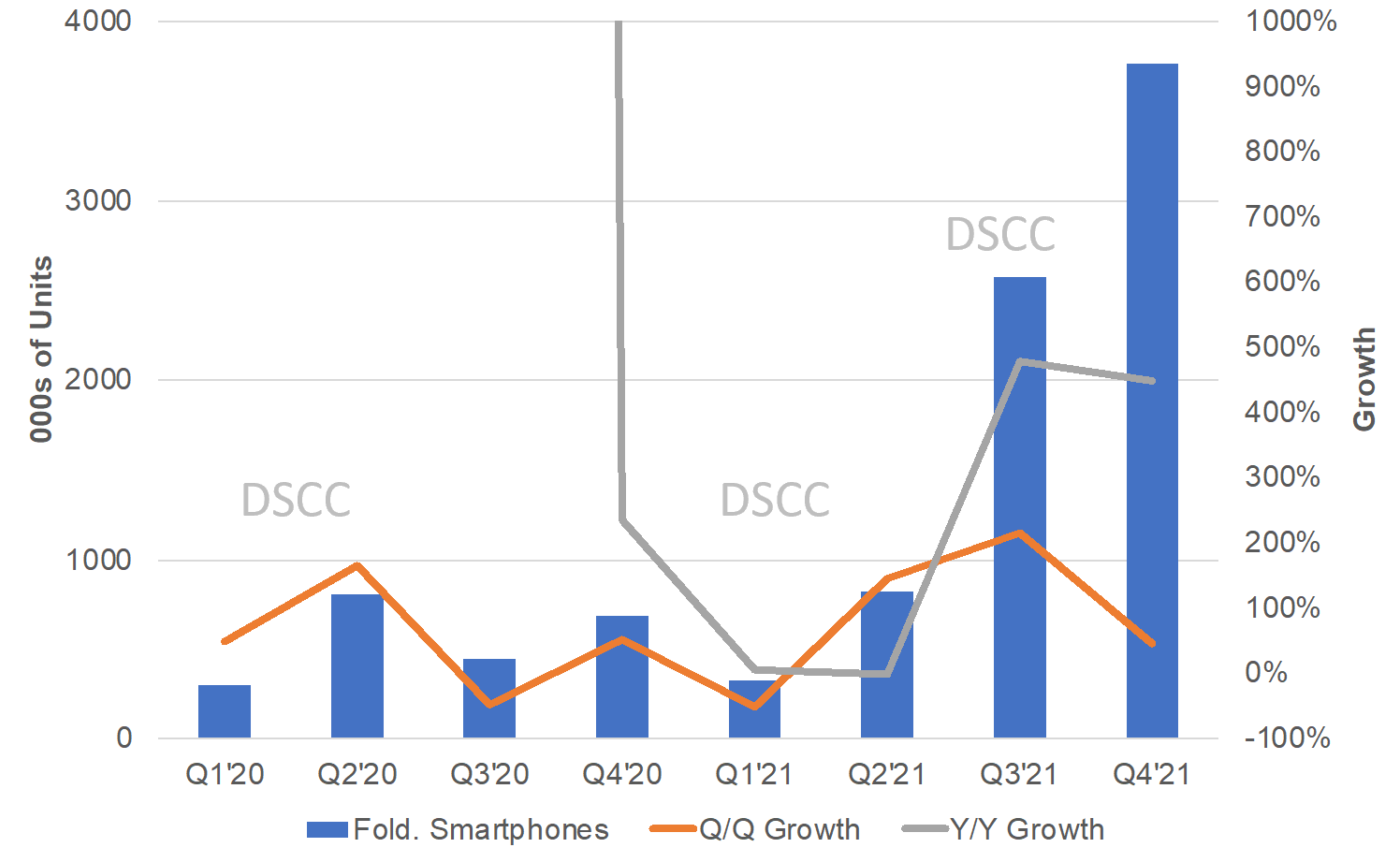

The latest issue revealed that a record 819K foldable smartphones were sold in Q2’21, up 147% Q/Q and 0.3% Y/Y. However, much larger growth is expected in Q3’21 with 215% Q/Q and 480% Y/Y growth to 2.6M units and 46% Q/Q and 450% Y/Y growth in Q4’21 to 3.8M units. According to DSCC CEO Ross Young, “This enormous growth is a result of the launch of Samsung’s aggressively priced $999 Z Flip 3 and full featured/multi-functional $1799 Z Fold 3 both of which are the first foldable devices with water-proofing and with the Z Fold 3 the first foldable device with pen input and an under-panel camera (UPC). These attractive products are backed by a reported $2B spend by Samsung in promotions and marketing which are significantly increasing consumer awareness of foldable smartphones.”

Furthermore, in Q4’21 and in Q1’22, new foldable devices are expected from Google, Honor, Huawei, Oppo, Vivo and Xiaomi to drive growth into 2022. Also contributing to the higher outlook is the chip shortage causing brands and panel suppliers to prioritize more expensive devices to maximize revenues.

DSCC’s Quarterly Foldable Smartphone Results and Forecasts

At the same time, we are seeing progress on foldable display costs in a number of areas which are also quantified in the report with both display costs and prices forecasted out to 2026. One example is 15% better panelization for producing the Z Fold 3 display vs. the Z Fold 2 display as the result of a small change in the panel size, reducing costs per panel. Another example is an increase in the UTG substrate size being processed by Dowoo Insys which can increase the number of UTG cells per substrate by as much as 25%, leading to both higher capacity and lower costs. We also see more companies coming online in UTG processing which should help end this constraint currently limiting the size of the foldable market.

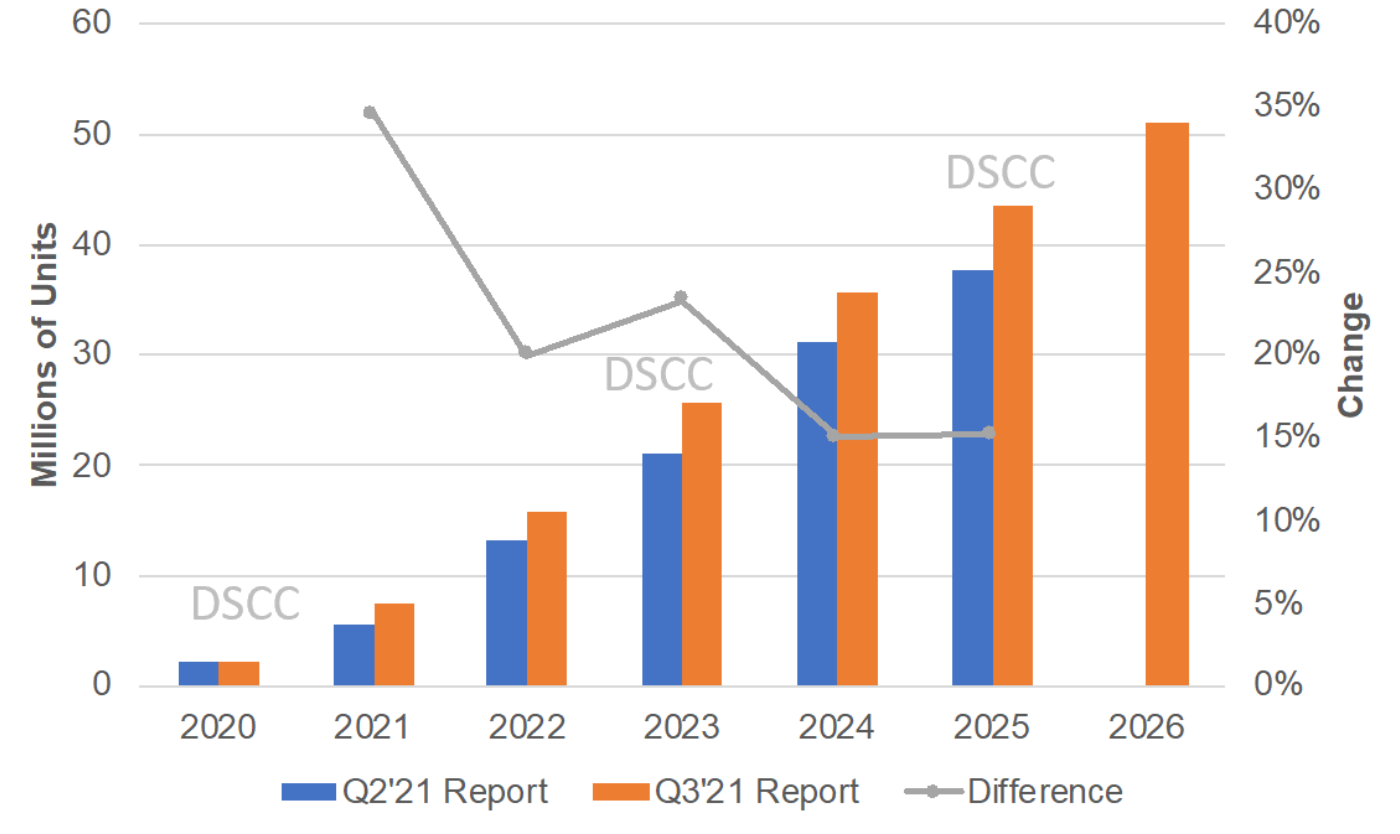

As a result of the improved outlook for demand and cost reduction, DSCC has upgraded its outlook for foldable smartphone shipments by 35% in 2021 to 7.5M units which is up 232% in 2021. In addition, it has increased its 2022 outlook by 20% to 15.9M units, a 112% increase. In 2026, DSCC sees foldable smartphone shipments of 51.0M.

Upgraded DSCC Foldable Smartphone Shipment Forecast

Other highlights of the report include:

- Samsung’s share of the foldable smartphone market is expected to hold steady in 2021 at 85% with Huawei #2 at 10%. The Z Flip 3 will be the best-selling foldable smartphone in 2021.

- Samsung Display’s share of the foldable display market is expected to rise from 83.5% to 83.9% with the number of foldable panels rising from 3.2M in 2020 to 10.4M in 2021.

- Detailed reviews of all the foldable devices on the market and insight into new products coming.

- The structure of each foldable display on the market including film type, thicknesses and material suppliers.

- Regional segmentation by quarter through Q4’21 for the Z Flip 3, the Z Fold 3 and Samsung’s combined shipments.

- Extensive analysis of all the UPC smartphones shown to date, the pros and cons of each and the remaining challenges. UPC penetration is forecasted through 2026.

- The latest outlook for LTPO fab capacity, LTPO fab schedules LTPO demand/share, LTPO process flows and the LTPO share of industry capacity.

- Forecasts for foldable and rollable panel shipments by application, panel supplier, UTG vs. CPI, numerous features, etc.

- Latest timing for the first shipments of rollable smartphones, multi-fold devices, the next foldable notebook and more.

- Price forecasts for all foldable and rollable displays for all applications and detailed cost forecasts by line items for 6.67”, 6.70”, 7.55” and 7.59” foldable displays with and without LTPO and with and without color on encapsulation (CoE).

- Profile of a new dedicated UTG processing company in China who is planning to build the world’s largest UTG manufacturing base with Korean technology. Analysis of LG Chem’s new hard coat.

- And much more.

For more information on the Quarterly Foldable/Rollable Display Shipment and Technology Report, please contact info@displaysupplychain.com. For media inquiries, please contact ashton@displaysupplychain.com

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.