Ross Young

Ross.Young@DisplaySupplyChain.com

FOR IMMEDIATE RELEASE: 12/12/2019

DSCC Reveals Quarterly Display Equipment Revenues/Market Share for Over 130 Different Companies in New Report - Downgrades 2019-2020 Equipment Spending on LCD Weakness

Austin, TX -

Display Supply Chain Consultants (DSCC) has released the first issue of its newly developed Quarterly Display Capex and Equipment Market Share Report which delivers quarterly equipment supplier market share for all major display segments in a highly sortable pivot table along with fab schedules, display equipment spending and display fab capacity.

According to DSCC CEO Ross Young, “In my 25 years in the display industry, this is the most ambitious and most useful report I have ever produced or seen on display equipment as it:

- Segments the market into 76 different and unique market segments.

- Provides equipment supplier market share for 66 different segments which can be sorted by quarter, year, units or revenues, bookings or billings, frontplane technology, backplane technology, fab generation, country, manufacturer, application and substrate type. This information is critical for equipment suppliers and their component suppliers to track the health of their businesses. It should also be of interest to hedge funds, traditional VCs, strategic VCs and private equity companies looking to invest in the display equipment companies expected to outperform.

- Reveals which equipment companies are gaining and losing share and which segments and suppliers have the brightest outlook. Design wins are identified for future fabs based on Chinese and Korean filings, revealing accurate forward market share and revenues out at least one year which should be of great interest to companies in the space and investors tracking these companies. It should also be helpful for equipment companies looking to expand into new segments or acquiring/partnering with other players.

- How the change to oxide, LTPO or Y-OCTA impacts equipment spending and which suppliers they are using for critical steps, etc.

- How Chinese equipment suppliers are changing the landscape and where they are taking share.

- Helps procurement managers with their equipment decisions in allowing them to see who their competitors are using for every process step and which suppliers have the highest market share.”

You can see the complete list of segments covered at: https://www.displaysupplychain.com/quarterly-capexequipment-service.html.

In terms of the latest results in display equipment spending:

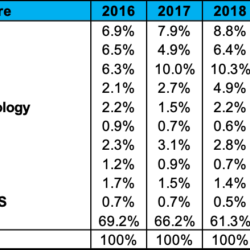

- Despite starting from scratch, the latest report shows 2016-2018 equipment spending results within 0.2% of our previous report with some segments rising and some falling as more granularity and actual shipments rather than fab modeling was implemented. We did find more TFT backplane and module tools and fewer cell, color filter and OLED frontplane tools.

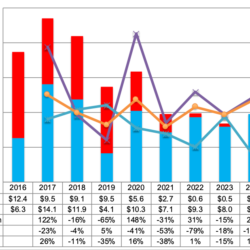

- For 2019, we have downgraded the market by 12% to $13.7B as LCD spending was reduced by 15% on cancellations at Infintech and Sharp SIO and downsizing at HKC H2 on excessive supply growth, poor fab utilization and the lack of profitability in LCD TV panels today with commodity panels now priced below cash cost. Despite the reduction in LCD spending, we still show LCDs accounting for 70% of total display capex in an off year for mobile OLED spending which has also struggled with fab utilization. TFT backplane equipment accounts for 55% of the 2019 market. Exposure tools are the largest segment of the total display equipment market with a 15% share. BOE is spending the most accounting for a 27% share, followed by HKC, China Star, LG Display and Sharp SIO. China is accounting for 92% of spending and G10.5 fabs are accounting for a 50% share of all spending. Bookings are expected to be up 1% for the year from $17.4B to $17.5B. a-Si backplane fabs are expected to lead with a 69% share as TVs dominate spending with an 89% share. The top 10 suppliers for 2019 are led Applied Materials (AMAT) with its 3rd straight year of share gains followed by Nikon, Canon, TEL, V Technology, Invenia, ULVAC, LG PRI, SCREEN and Wonik IPS. AMAT also led in just the TFT backplane segment with a 15% share and was the revenue market leader in 4 different display equipment segments and held the #2 spot in 2 other segments.

- For 2020, DSCC reduced its forecasts vs. last quarter by 22% to $15.9B due to downsizing and cancellations at HKC H4 and Sharp SIO and delays at BOE B17 and CSOT T7. LCD spending was reduced by 45% while OLED spending was increased by 2%. We now show OLEDs accounting for 65% of spending at $10.3B with LCDs at 35% and $5.6B. Mobile spending jumps 331% to $6.8B and a 43% share with TV spending falling 25% to $9.1B and a 57% share. HKC and Visionox are expected to lead in spending with a 17% share each followed by China Star at 15% and BOE and Samsung at 14% each. China’s share of total display equipment spending is expected to fall from 92% to 85% while Korea’s rises from 4% to 15%. LTPS is expected to lead by backplane technology with a 42% share while the flexible substrate share of spending is expected to rise from 11% to 36%. Exposure is expected to maintain the top spot. Canon is expected to reclaim the #1 position on 187% growth followed by AMAT at #2 despite gaining more share, Nikon, TEL, Kateeva (on nearly 1000% growth), Invenia, ULVAC, AP Systems, LG PRI and V Technology.

- For 2021, DSCC cut spending by 7% vs. its prior forecast to $9.8B, down 38% Y/Y, on continued LCD fab delays with OLEDs accounting for a 73% to 27% advantage. Mobile will account for a majority of spending with a 56% share, its highest since 2018. BOE is expected to lead in spending with a 40% share followed by China Star at 30%.

- In 2022, the delays from prior years lead to a 5% increase vs. last quarter’s report and a 1% Y/Y increase to $9.9B with OLEDs accounting for a 94% share. Mobile spending is expected to account for a majority share of 63%. Samsung Display is expected to lead in spending with a 41% share followed by BOE at 27% and LG Display and Tianma at 12%.

- The latest report extends all equipment spending forecasts to 2024 and capacity forecasts to 2025.

Gerry@displaysupplychain.com or +1 (770) 503-6381.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.