DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 09/09/2024

DSCC Reveals Latest Display Capacity Outlook - China Expected to Overtake Korea in OLEDs in 2028, BOE Overtaking SDC in Flexible OLED Capacity

La Jolla, CA -

- Display capacity revised up slightly, still growing at less than a 2% CAGR from 2023 to 2028.

- China continues to gain share, expected to reach 74% from 2026. China expected to overtake Korea in OLED capacity in 2028.

- BOE expected to overtake SDC in flexible OLED capacity in 2028 helped by B16.

DSCC’s highly popular Quarterly Display Capex and Equipment Market Share Report reveals the latest display equipment spending and capacity results and forecasts based on the latest fab schedules. DSCC expects display capacity to rise at a 1.4% CAGR from 2023 to 2028, with LCDs growing at just a 1% CAGR and OLEDs growing at a 4.8% CAGR. Both numbers are up slightly vs. last quarter.

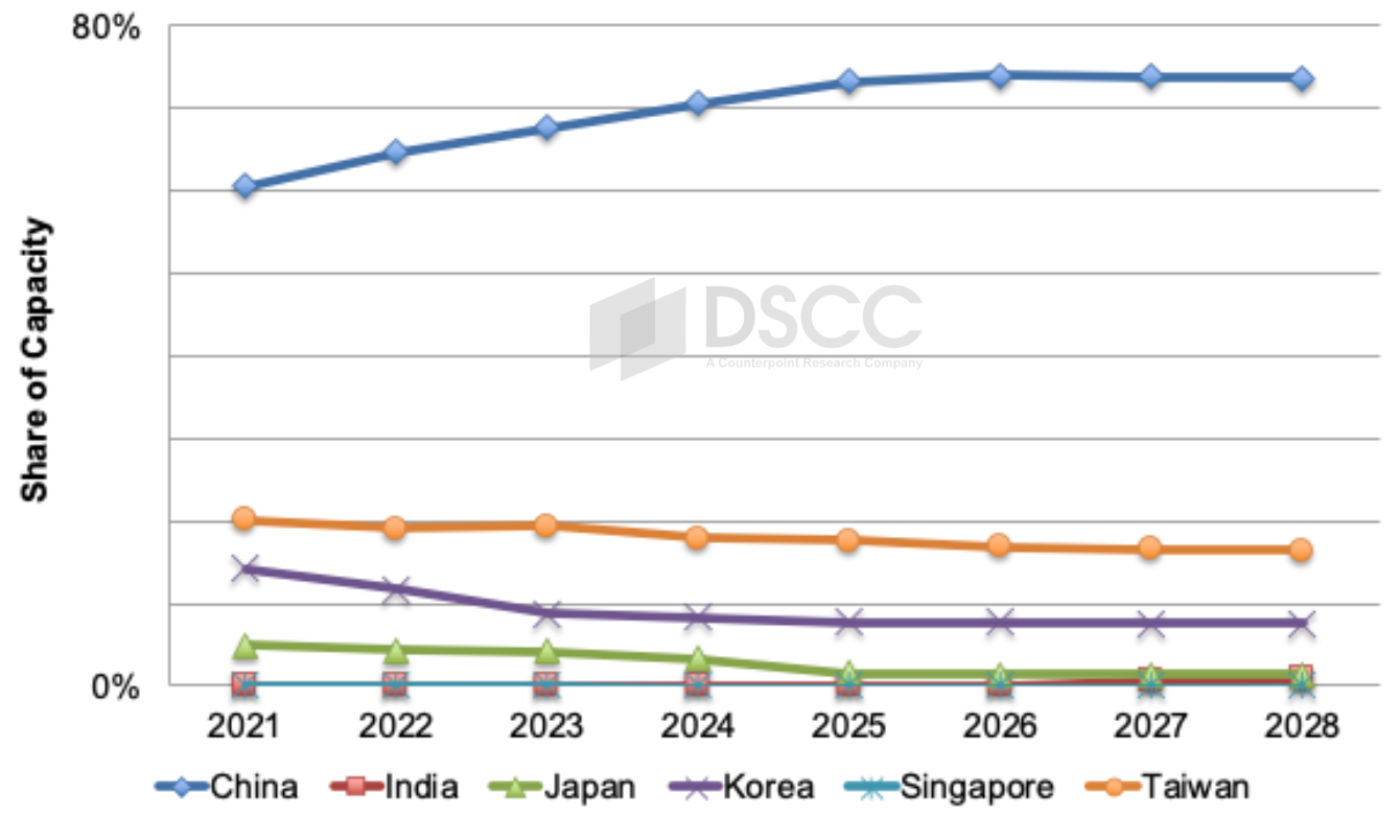

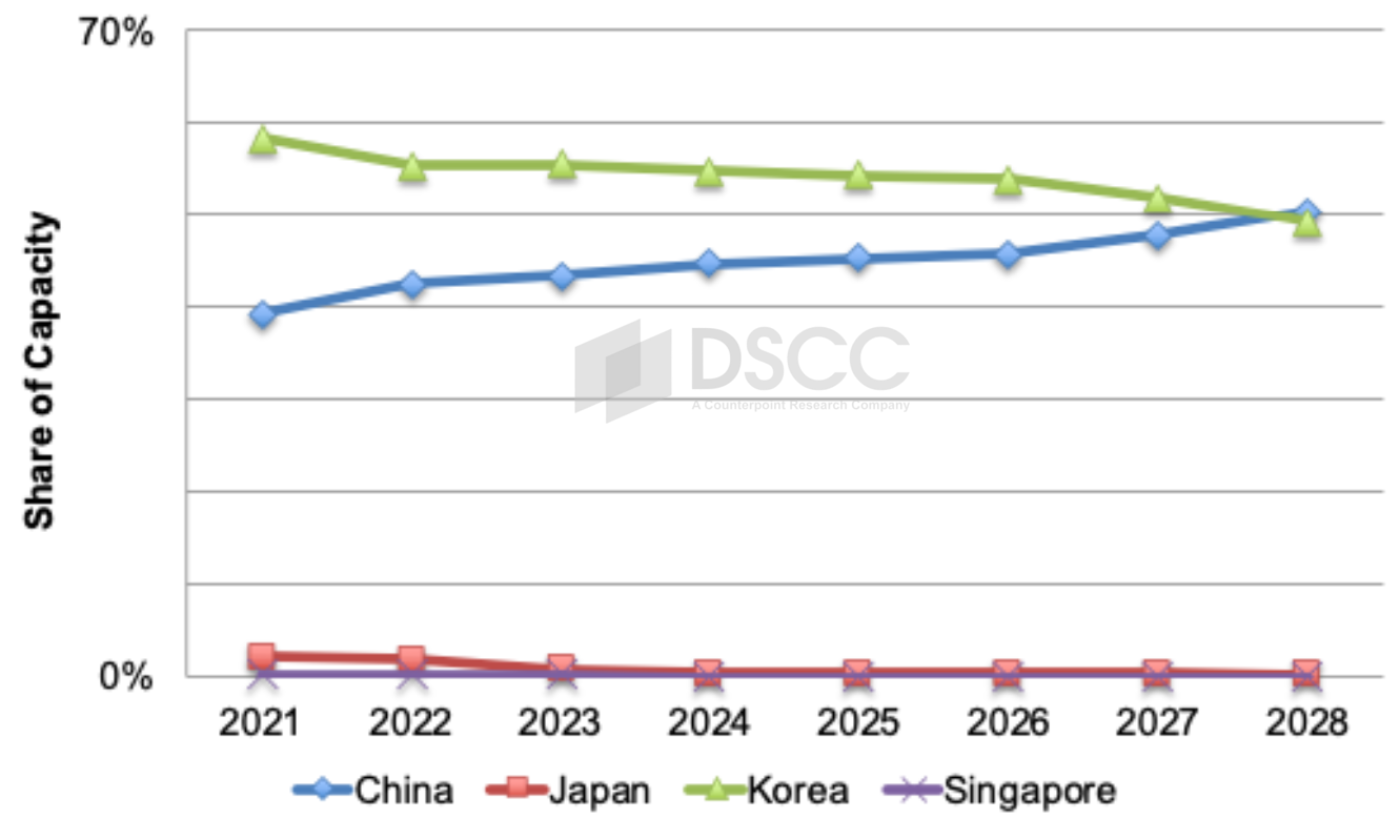

We continue to see China gaining ground with their share of total display capacity rising from 68% in 2023 to 74% in 2028, growing at a 3% CAGR. Japan, Korea and Taiwan are all expected to see their capacity shrink in absolute terms with India seeing some growth if a fab eventually comes online. Looking just at LCDs, we see China with a 76% share in 2028, up from 70% in 2023. In OLEDs, we now see China overtaking Korea in OLED capacity in 2028, growing at a 4x faster growth rate at an 8% CAGR from 2023 to 2028 vs. Korea at a 2% CAGR.

Display Capacity by Region

OLED Capacity by Region

Looking just at larger panel capacity, G7+ capacity is only expected to rise at a 2% CAGR from 2023 to 2028. After at least 7% growth annually from 2018 to 2022, capacity declined by 1% in 2023 on fab delays and closures on weak market conditions. 3% growth is expected in 2024 despite SDP’s closure followed by 1-3% growth from 2026-2028. Given the limited capacity growth, a surge in TV demand along with the continued increase in average size could result in a significant shortage. If China tried to stimulate TV demand through some sort of subsidy program, this could become a reality. As demand approaches supply in the future and only Chinese and Taiwan suppliers making LCD TV panels, brands could be at a significant disadvantage resulting in a healthier environment for panel suppliers.

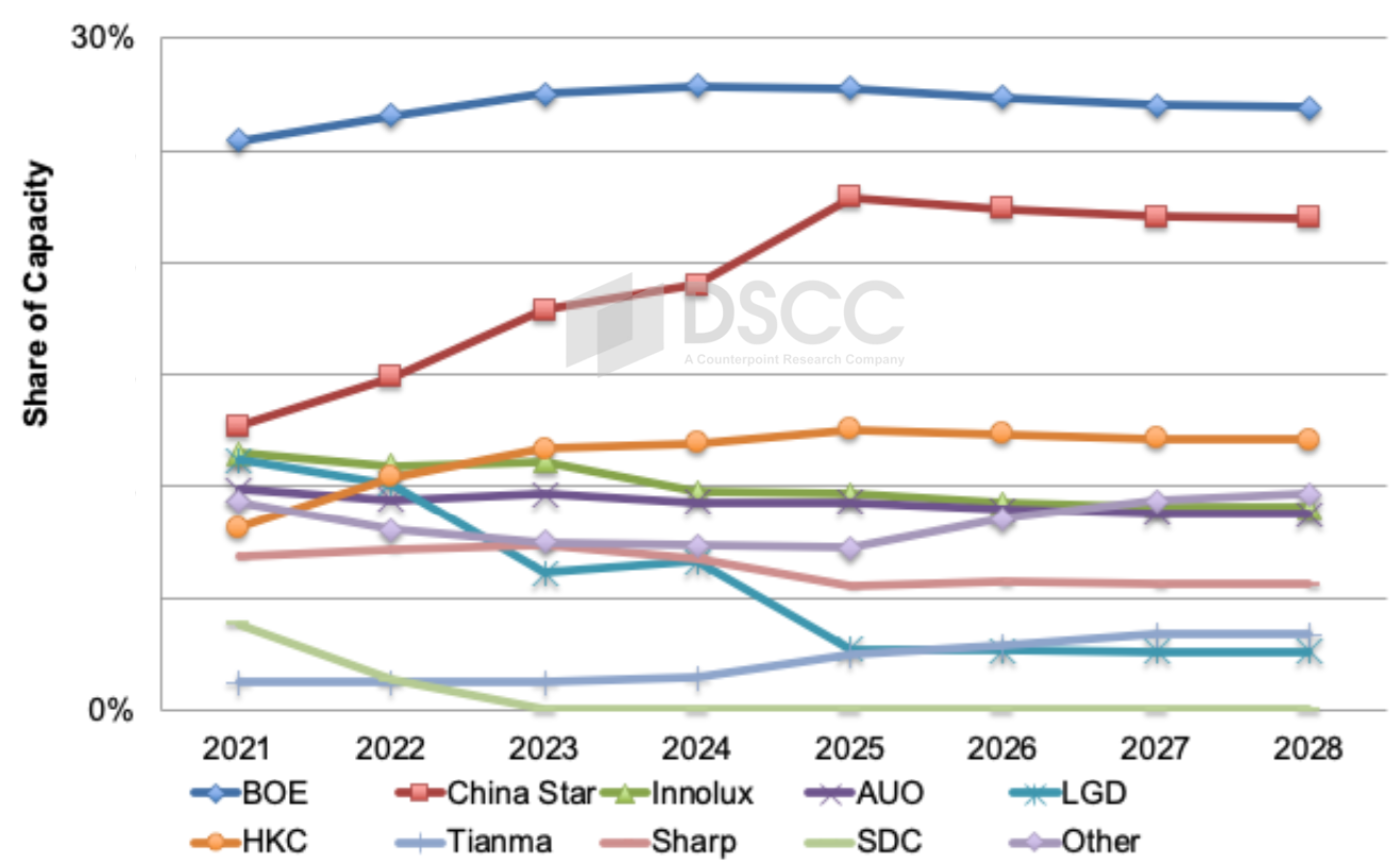

In terms of display capacity share, we still see BOE with a significant lead followed by China Star. The lead currently narrows from a 26% share for BOE and a 17% share for China Star in 2023 to 25% for BOE and 18% for China Star in 2028. Looking at LCD capacity share, it is a similar story with BOE’s advantage over China Star shrinking slightly from 28% to 18% in 2023 to 27% to 20% in 2028. However, if China Star ends up buying LGD’s LCD fab in China as expected, then China Star’s LCD capacity share surges to 23% in 2025 and BOE’s advantage holds at just five points from 2025-2028 vs. seven to eight points otherwise.

LCD Capacity Share If China Star Acquires LGD’s China Fab

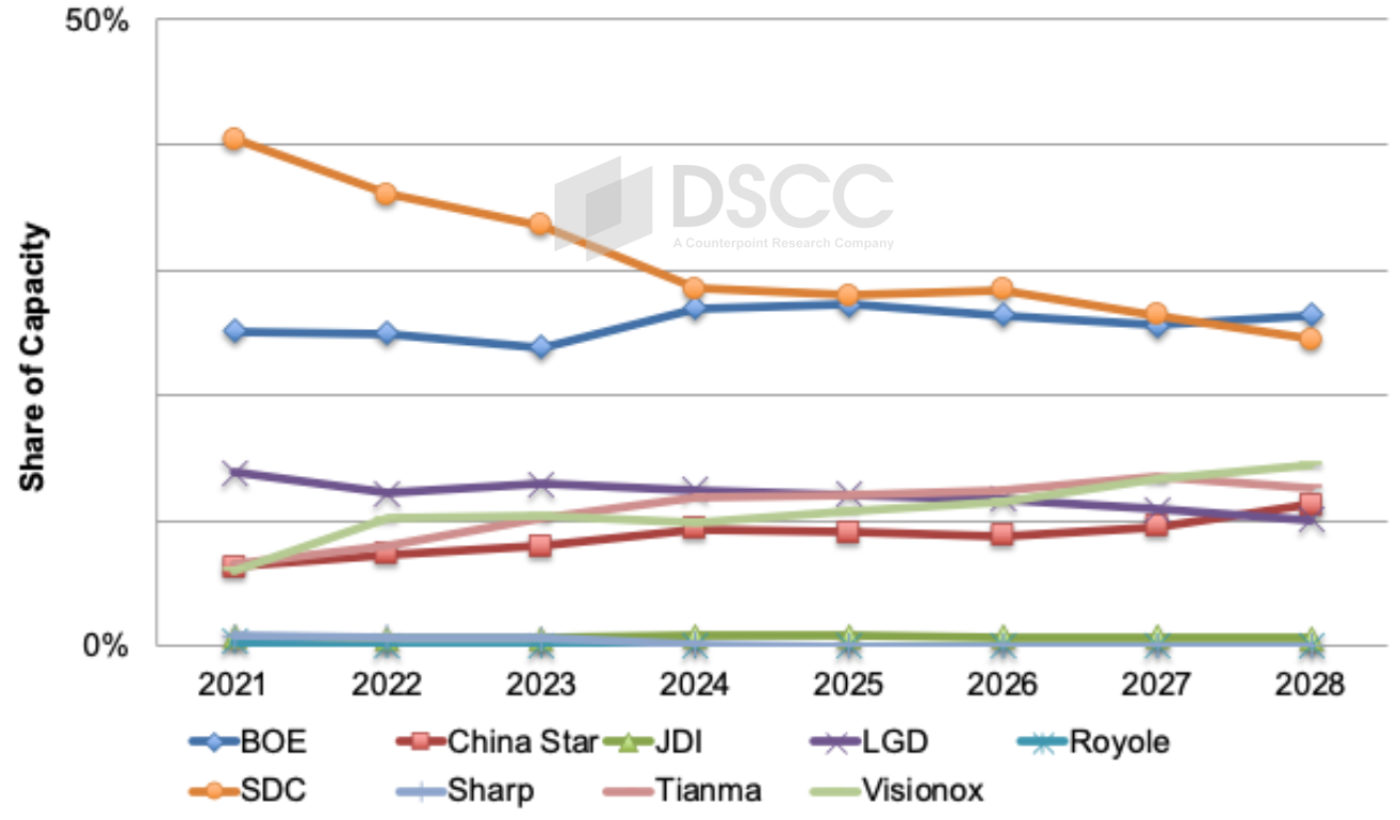

In the case of OLED capacity, it is a two-horse race between SDC and LGD with LGD holding a two-to-five-point advantage from 2023 to 2028. Looking at mobile/IT capacity, SDC holds a wide advantage over BOE due to the inclusion of A2. In flexible OLED capacity, BOE is expected to overtake SDC in 2028 with a 26% to 24% advantage helped by B16 allocating some of its G8.7 capacity to flexible substrates. Visionox is expected to rise to #3 in flexible OLED capacity in 2028 with a 14% share.

Flexible OLED Capacity Share

The report also highlights the latest and projected fab closures in Japan, Korea and Taiwan and reveals breakouts by application, substrate, fab generation and more. For more information on display capacity, please see our Quarterly Display Capex and Equipment Market Share Report or contact info@display- supplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.