David Naranjo

dave@displaysupplychain.com

FOR IMMEDIATE RELEASE: 10/04/2021

DSCC Reveals Faster Growth in OLED Notebook PCs and $61B in OLED Revenues in 2026

Austin, TX -

DSCC has released its latest Quarterly OLED Shipment Report and extended shipment and revenue forecasts to 2026.

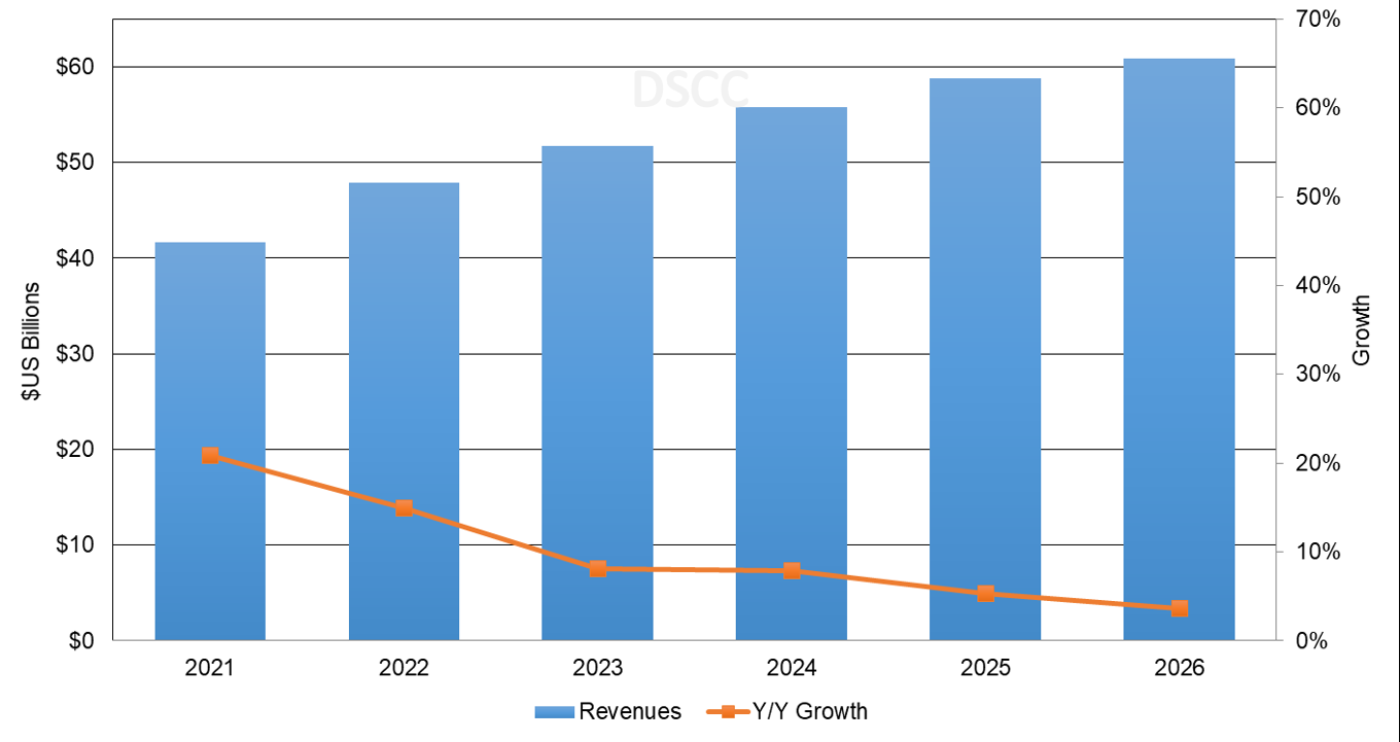

DSCC forecasts $61B in OLED panel revenue through 2026, fueled by double-digit unit and revenue CAGR growth for notebook PCs, monitors and tablets.

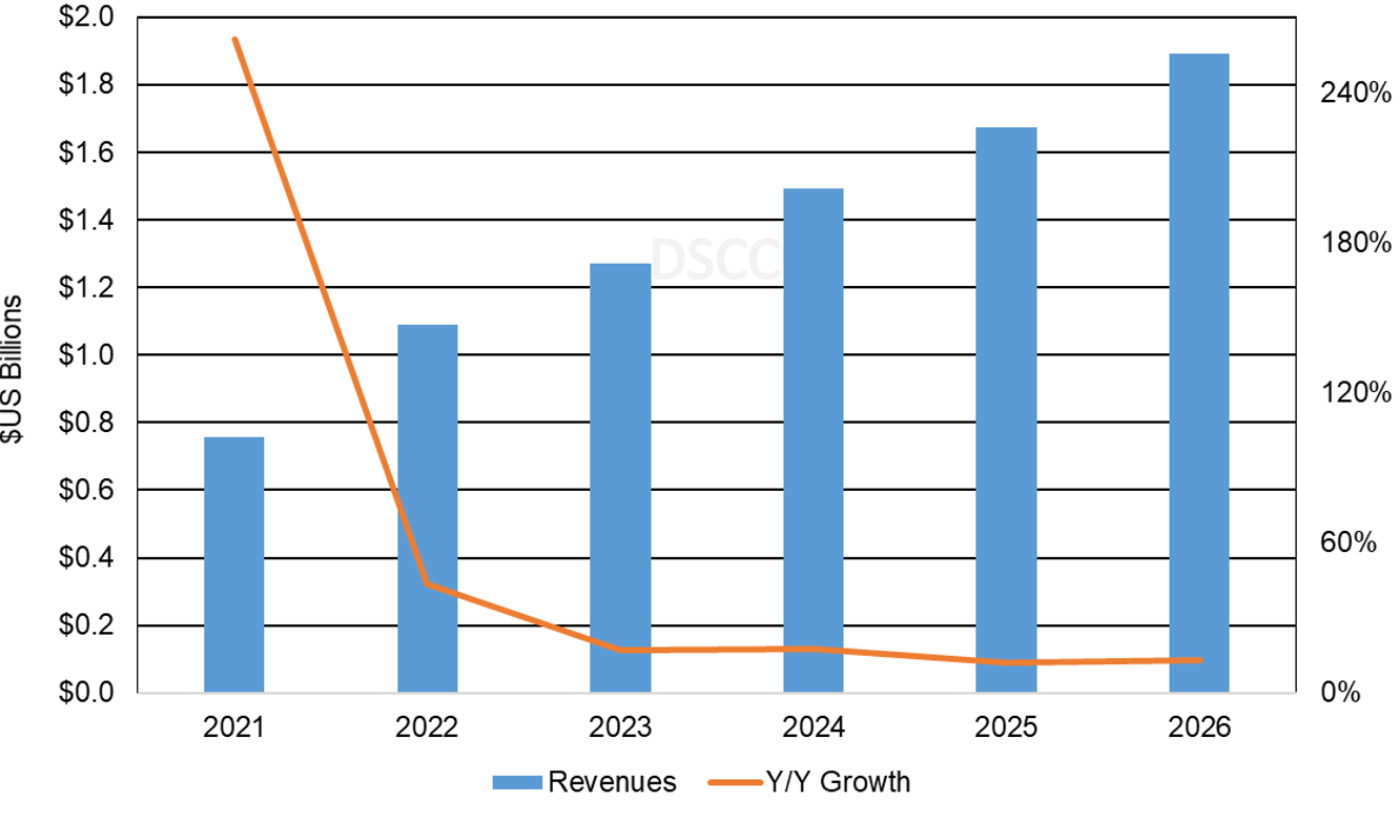

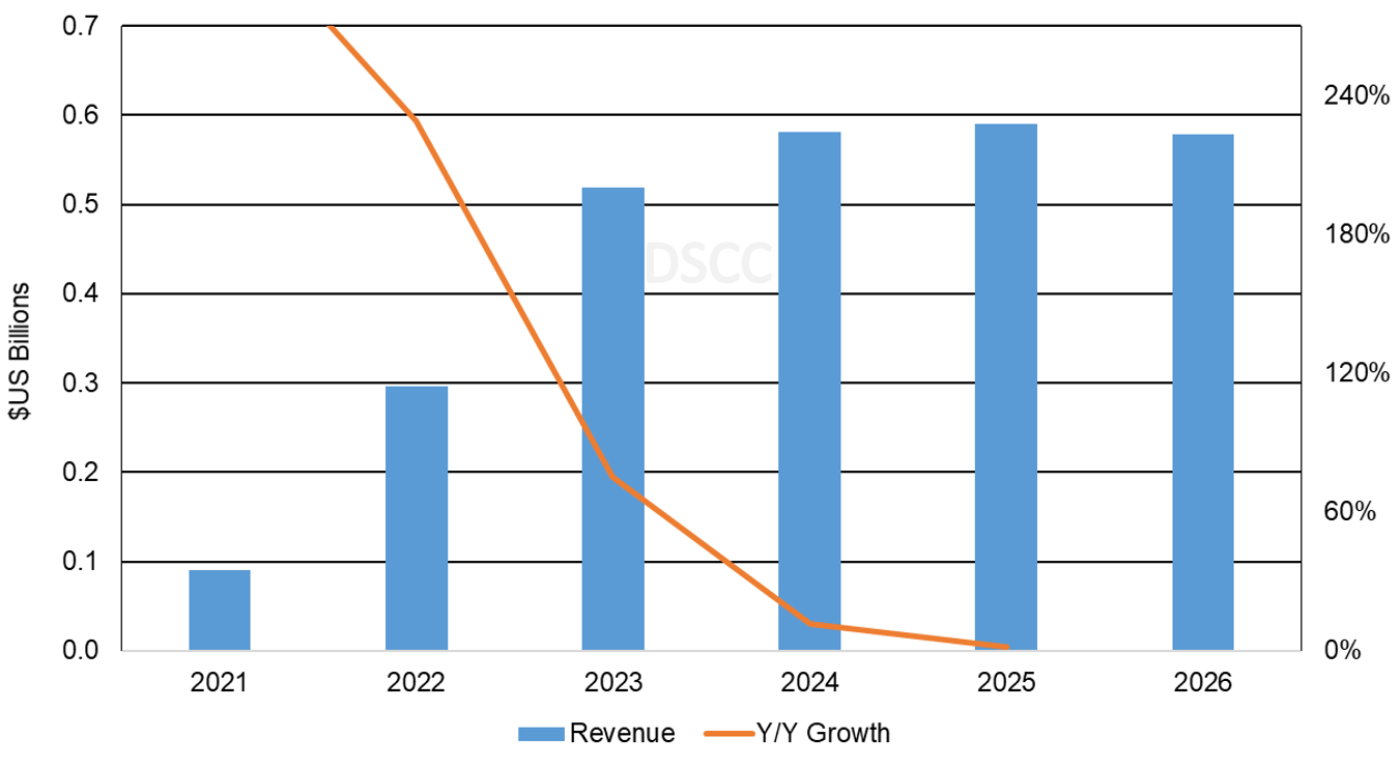

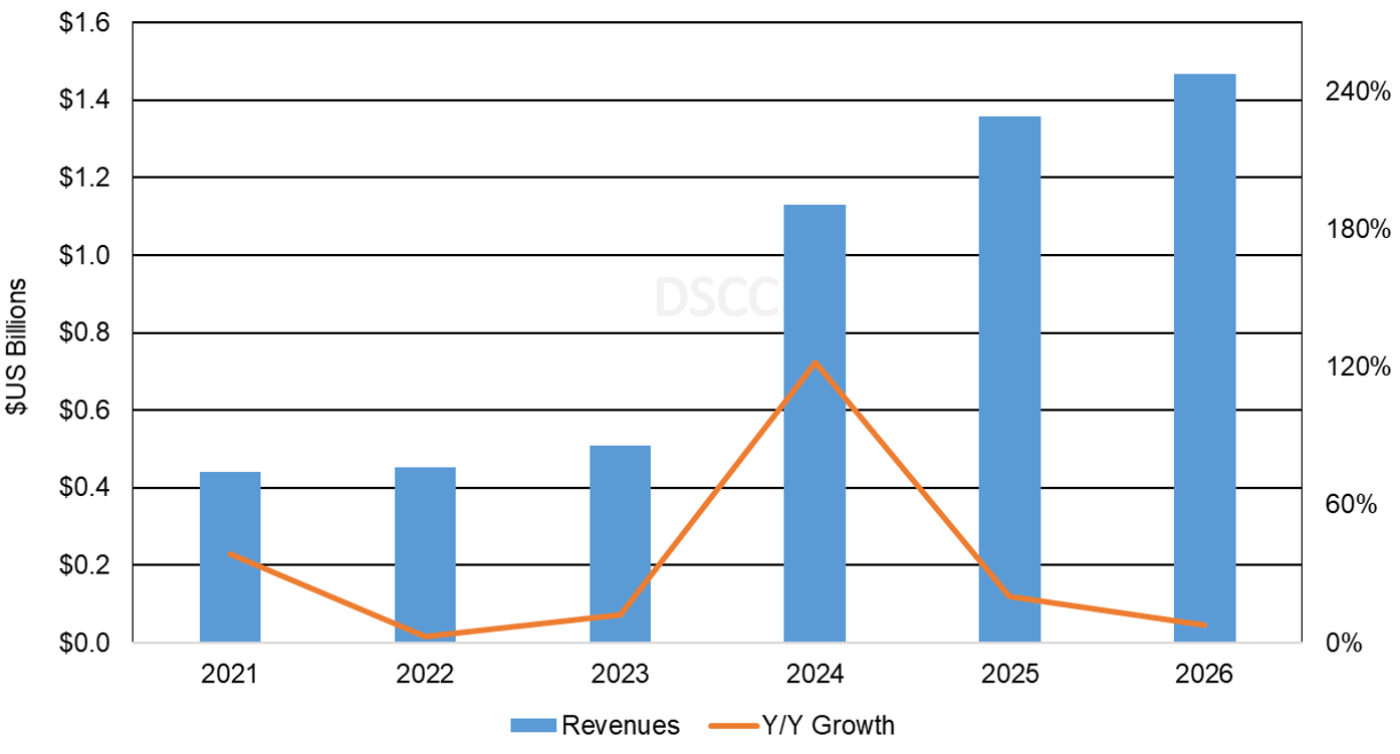

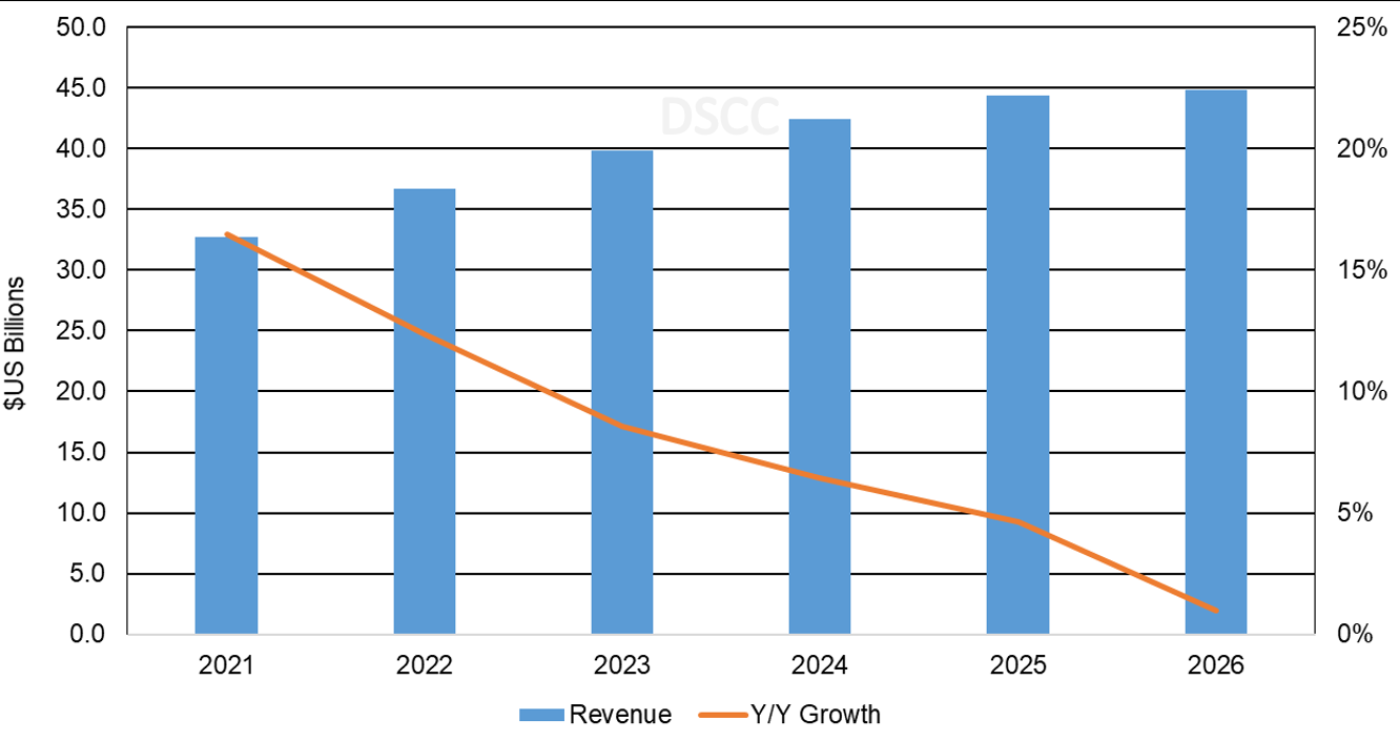

DSCC raised its 2021-2025 OLED revenue forecast for notebook PCs by 17% to $6.3B and $8.2B through the 2026 extended forecast, representing a 26% revenue CAGR. For OLED monitors, DSCC forecasts $2.7B during the forecast period, representing a 45% CAGR, followed by OLED tablets with a 27% revenue CAGR and revenue of $3.9B. Smartphones are expected to achieve a 7% CAGR through the forecast period and $45B in revenue in 2026. In 2021, smartphones are expected to grow 16% Y/Y to $33B.

According to David Naranjo, Senior Director, DSCC “The long-term growth in OLED notebook PCs is driven by lower costs from new optimized fabs as panel suppliers move from G6 LTPS to G8.5 oxide. We estimate there will be a 32% savings in depreciation per 15.6” IT panel as revealed in our recently published Future of OLED Manufacturing Report. We are encouraged by a growing number of OLED notebooks quickly coming to market as SDC develops this space with Asus, Dell, HP, Lenovo, Razer and Samsung with new products on the market with prices from as low as $750.”

For OLED monitors, DSCC updated the forecast to reflect slower shipments in 2021, with faster growth in 2022 and 2023 as SDC’s initial production at its QD-OLED fab is delayed and both SDC and LGD are expected to increase their allocations to OLED monitors. In the case of tablets, DSCC slowed the projected ramp due to the delayed launch of Apple’s OLED iPad. The latest roadmap for Apple’s OLED and MiniLED iPads are revealed in this issue.

In Q2’21, by brand, Samsung was the largest purchaser of OLED panels for smartphones and OLED applications with a 23% unit share and a 19% unit share, respectively. The second largest purchaser of OLED panels was Apple, with an 18% unit share for smartphones and 19% unit share for all OLED applications.

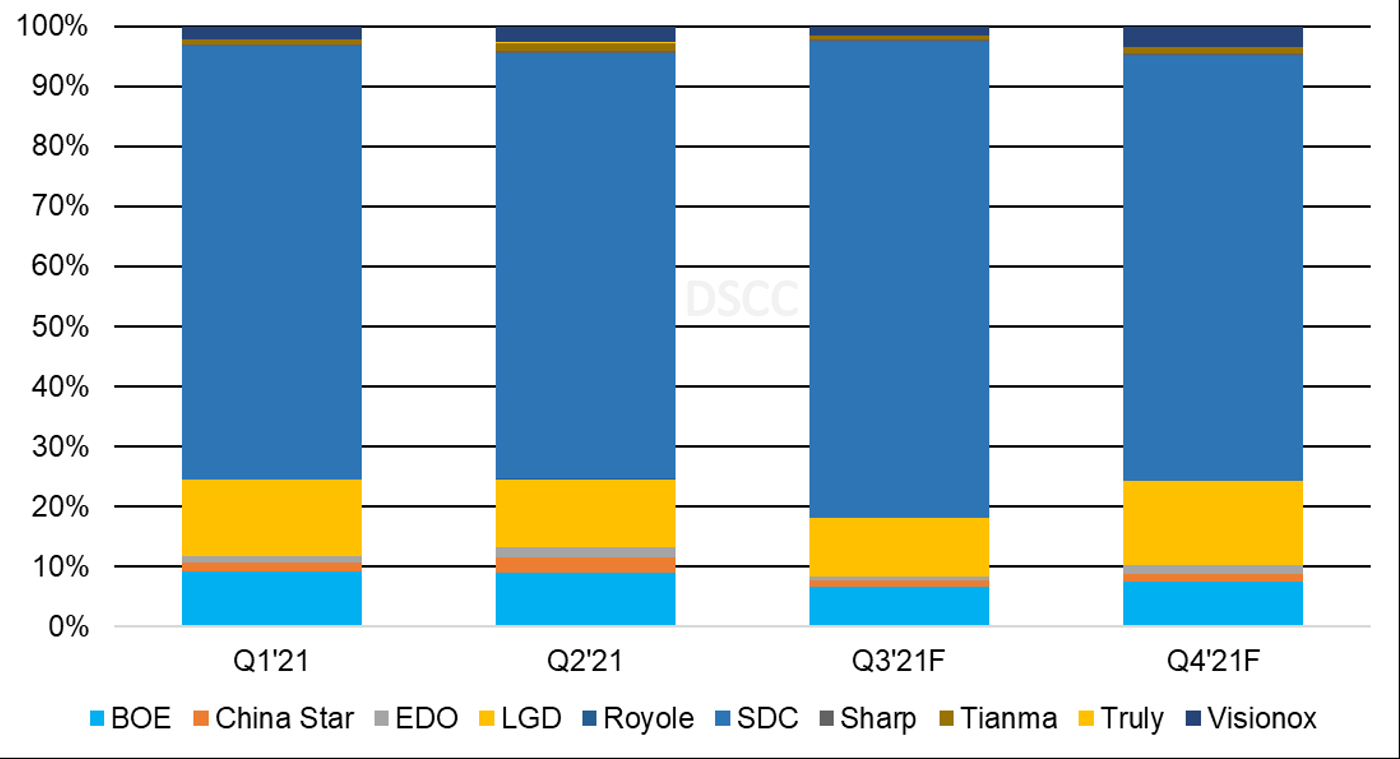

In Q2’21, by smartphone panel supplier, SDC continued to lead with a unit share of 73.5%. BOE was the #2 supplier with a 6.7% unit share, down from 7.4% in Q1’21, followed by LGD with 6.5% unit share, down from 7.9% in Q1’21. DSCC expects LGD to regain the #2 position as it takes share at Apple on the iPhone 13 ramp-up. BOE only recently received conditional approval as a panel supplier for the iPhone 13.

In Q2’21, by smartphone revenue by panel supplier, SDC had a 70.8% revenue share because of 13 new smartphones launching in May and June, with SDC panels. Sharp’s revenue grew by 234% Q/Q in Q2’21 as a result of launching the Aquos R6 smartphone and the design win for the Leica Phone 1 in June. LGD maintained the #2 position in revenue for Q2’21 with an 11.3% revenue share down from 12.7% in Q1’21. For smartphones in 2021, DSCC expects SDC to lead with a 73% unit share and a 74% revenue share followed by LGD with a 9% unit share and a 12% revenue share.

Readers interested in subscribing to DSCC’s Quarterly OLED Shipment Report should contact gerry@displaysupplychain.com.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.