David Naranjo

dave@displaysupplychain.com

FOR IMMEDIATE RELEASE: 10/11/2021

DSCC Reveals Apple Dominates Q3’21 AMOLED Smartphone Panel Procurement, 2nd Best AMOLED Quarter to Date

Austin, TX -

DSCC has released its latest Quarterly Advanced Smartphone Features Report and revealed its preliminary Q3’21 AMOLED smartphone unit and revenue results.

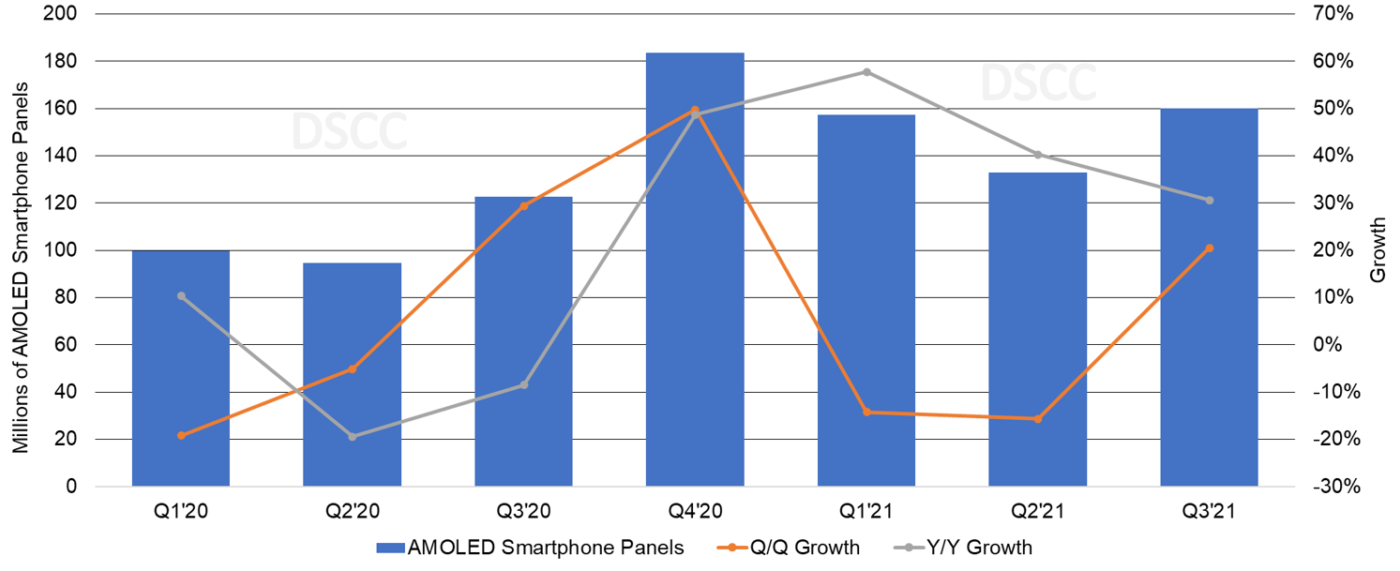

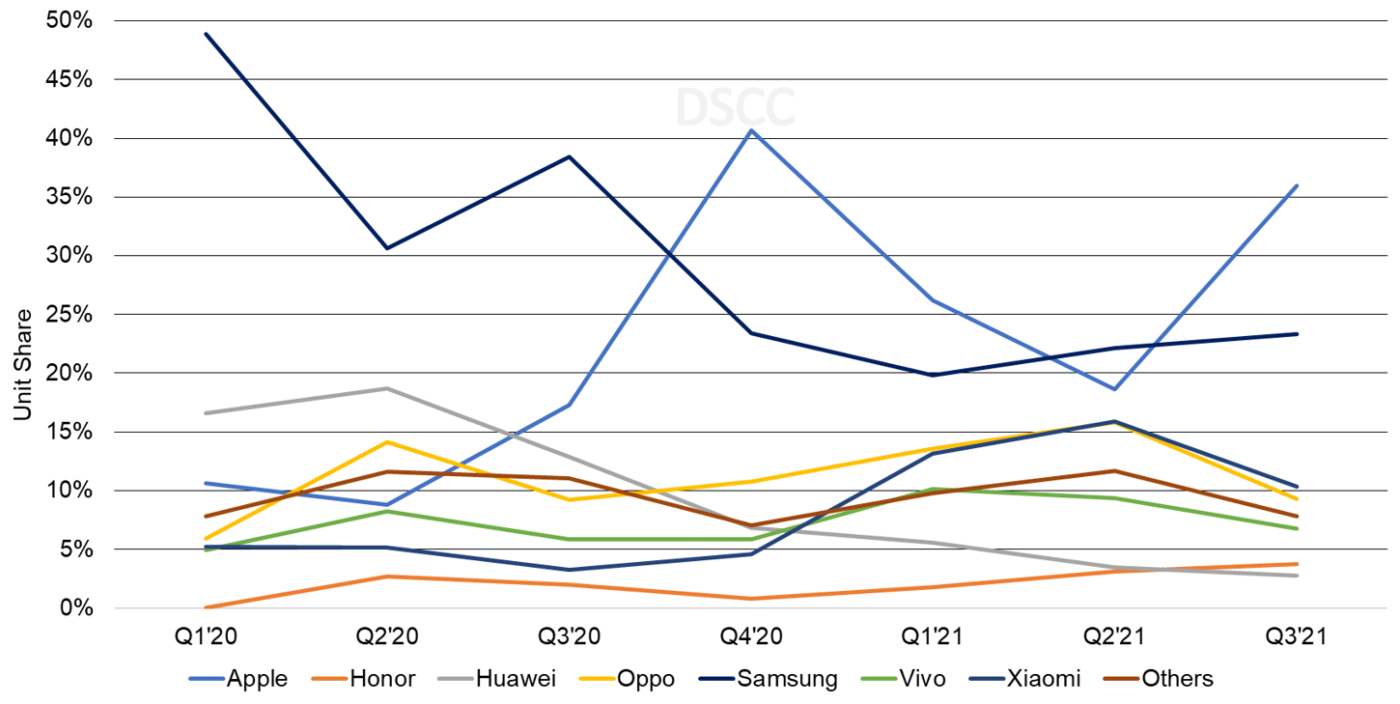

In Q3’21, AMOLED smartphone panels rose 21% Q/Q and 31% Y/Y to 160M panels, the second-best quarterly result to date. The iPhone 13 dominated with a 30% share on a panel shipment timeline. Apple’s AMOLED panel procurement overtook Samsung’s reaching a 36% share, up from 19% in Q2’21, while Samsung’s share rose from 22% to 23%. Xiaomi was #3 in Q3’21 with a 10% share, down from 16%.

According to David Naranjo, DSCC Senior Director, "The double digit Q/Q and Y/Y lift in smartphone AMOLED panel procurement and smartphone device revenues in Q3’21 reflects Apple’s continued focus and dominance on premium products with higher ASPs. Although Apple was not the first smartphone brand with LTPO panels or better cameras, Apple’s fast follower philosophy with a singular focus on great customer experiences and their loyal customer base provides the catalyst for the smartphone AMOLED market to continue to grow and thrive.”

Quarterly AMOLED Smartphone Panels, Q1’20-Q3’21

Quarterly AMOLED Smartphone Panel Procurement by Brand, Q1’20-Q3’21

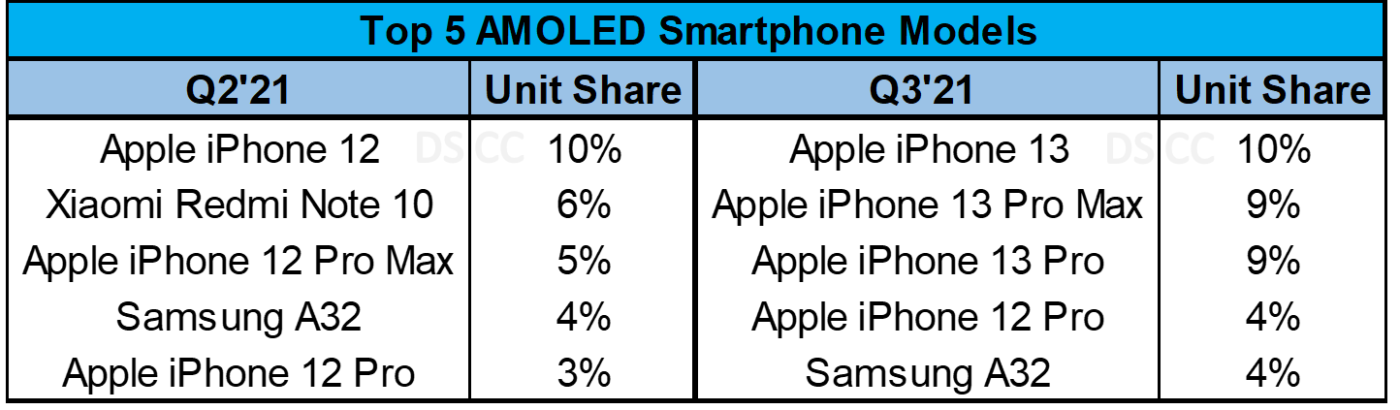

The top five models for Q2’21 and Q3’21 on a panel shipment timeline are shown below. As indicated, Apple accounted for three of the top five models in Q2’21 and four of the top five models in Q3’21 with the iPhone 12 leading in Q2’21 and the iPhone 13 leading in Q3’21. The Pro models are performing better Y/Y due to 2020 delays and excitement around better cameras and LTPO displays with high refresh rates.

Q2’21 and Q3’21 Top 5 AMOLED Smartphone Panel Procurement by Brand

By form factor, flexible AMOLEDs accounted for a 59% unit share, up from 43% in Q2’21 and enjoyed 64% Q/Q and 46% Y/Y growth thanks to Apple’s launch which occurred earlier in 2021 than in 2020. Rigid OLEDs fell 13% Q/Q while rising 13% Y/Y with its share falling from 57% to 41%.

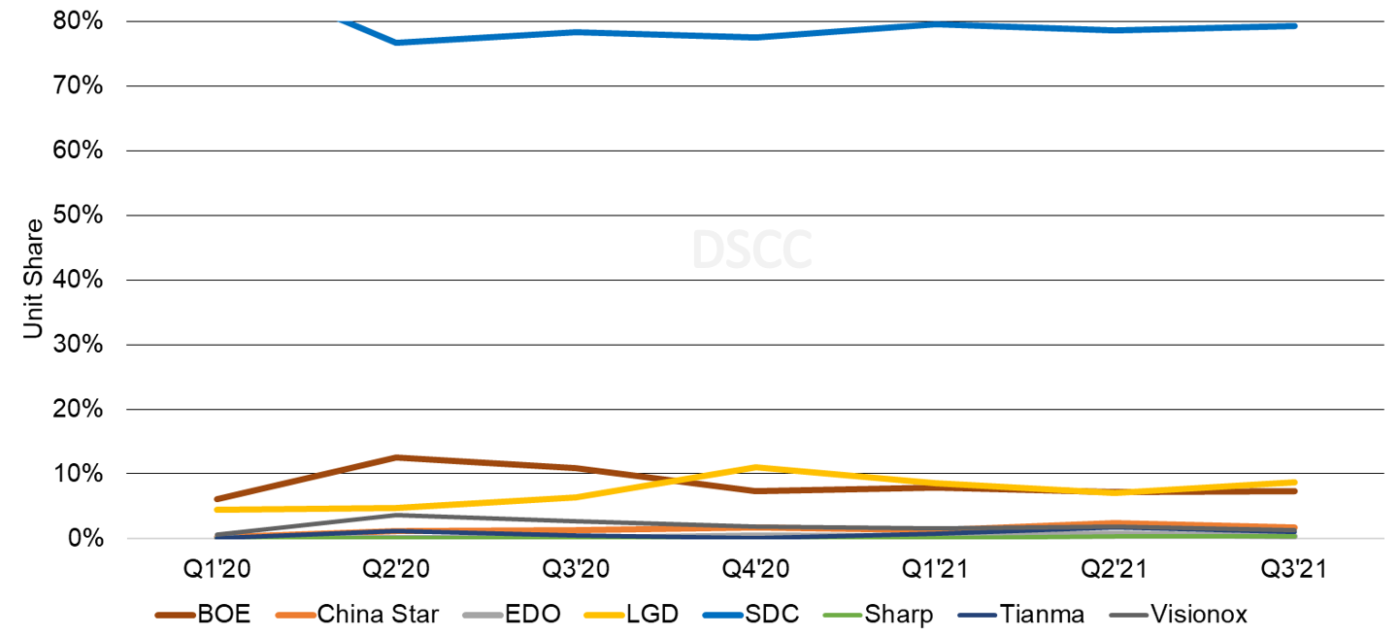

Apple’s panel suppliers also benefited in Q3’21. Samsung Display’s (SDC’s) share rose from 74% in Q2’21 to 76% in Q3’21 while LGD’s share rose from 7% to 8%. LGD overtook BOE for #2 in Q3’21 thanks to Apple and is expected to widen its advantage in Q4’21.

Quarterly AMOLED Smartphone Panel Procurement by Panel Supplier, Q1’20-Q3’21

The report also provides extensive forecasts out to 2026 covering:

- Shipments by:

- Brand

- Model

- Size

- Resolution

- Refresh Rate

- Backplane Technology

- Network type (4G vs. 5G)

- Touch sensor type

- Chipset

- Cover glass

- Fingerprint sensor

- Selfie camera (hole vs. notch vs. UPC, etc.)

- Brand and panel roadmaps

- Technology advances

- And much more.

Readers interested in subscribing to the DSCC Quarterly Advanced Smartphone Features Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.