DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 09/25/2023

DSCC Reports Panel Shipments for the iPhone 15 Series were 23% Higher than the iPhone 14 Series through August

La Jolla, CA -

As we approach the end of September and the iPhone 15 series became available on September 22nd, our latest release of the Monthly Flagship Smartphone Tracker shows that panel shipments for the iPhone 15 series were 23% higher than the iPhone 14 series during the same time period through August.

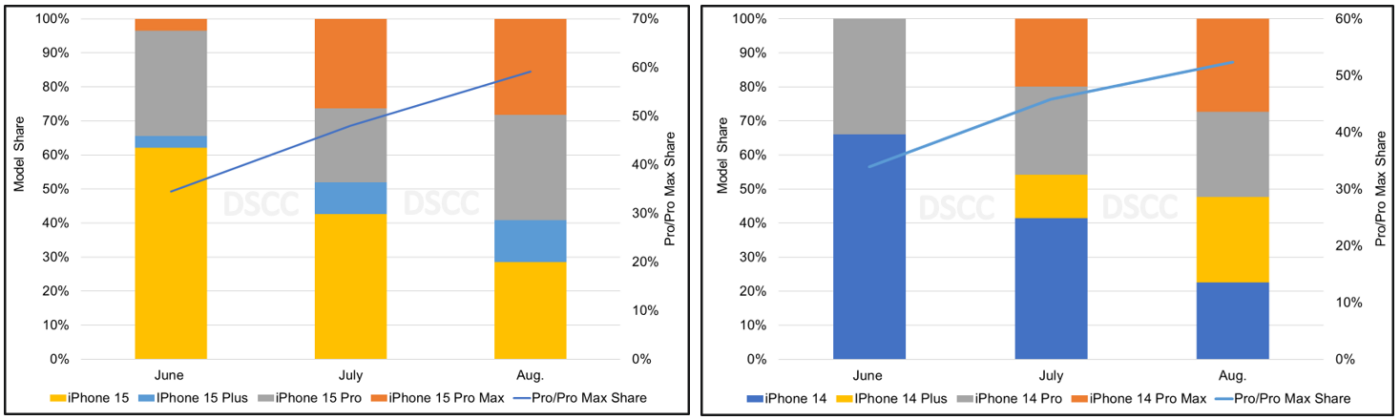

Within the current mix of panel shipments for the iPhone 15 series, the Pro models are accounting for a higher share versus the iPhone 14 Pro models during the June – August time period. From June through August, iPhone 15 Pro models had a 55% share versus 49% share for the iPhone 14 series. In August, the iPhone 15 Pro models had a 59% share. The iPhone 15 series has a number of improvements that include a larger screen size for the iPhone 15 and iPhone 15 Plus of 6.12” and 6.69” respectively, the dynamic island, the A16 Bionic chipset and a USB-C port. The iPhone 15 Pro models use the new 3nm A17 Pro, utilize ultra-thin bezels and have a titanium housing and also have a USB-C port. The iPhone 15, 15 Plus and 15 Pro have the same starting price points as the iPhone 14, iPhone 14 Plus and iPhone Pro 14 when launched at $799, $899 and $999 respectively, while the iPhone 15 Pro Max starts at $1199 with 256GB storage (the price of the iPhone 14 Pro was $1199 with 256GB storage and $1099 with 128GB storage). As a result of the higher share for the 15 Pro models and a higher starting price for the 15 Pro Max, the blended ASPs for the iPhone 15 series were 4% higher than the iPhone 14 series.

In the June to August period for the iPhone 15 series, SDC had a commanding share of 91% (versus an 84% share for the iPhone 14 series during the same period in 2022). SDC’s dominant share is the result of being the only panel supplier for all four models of the iPhone 15 series. LGD also shipped panels for the iPhone 15 Pro starting in August and had a 9% share. In August, SDC had an 87% share with LGD at 13%. LGD supplies panels for the iPhone 15 Pro and iPhone 15 Pro Max (LGD also supplies panels for the iPhone 13, iPhone 13 Mini, iPhone 14 and iPhone 14 Pro Max). We expect BOE to supply panels for the iPhone 15 later this year (BOE also supplies panels for the iPhone 12, iPhone 13 and iPhone 14).

iPhone 15 Series vs. iPhone 14 Series Mix through August 2023 vs. August 2022

To see more of the Monthly Flagship Smartphone Tracker and to learn more about the panel shipment trends for Apple’s new iPhone 15 series and the results for recently launched models such as the Huawei Mate 60 series, Honor V Purse and much more, as well as many other brands and flagship models, readers should contact info@displaysupplychain.com.

The monthly flagship smartphone tracker includes monthly panel shipment results and a rolling two-month forecast for all flexible and foldable OLED smartphones for all of the major smartphone brands and models.

The tracker covers all flagship models and shows monthly panel shipments by:

- Brand

- Model

- Display Size

- Form Factor

- Foldable Form Factor

- Panel Supplier

- TFT Backplane

- Resolution,

- Hole/Notch/UPC

- Refresh Rate

- Color on Encapsulation (CoE)

- Micro-Lens Array (MLA)

- Chipset Supplier

- Chipset

- Typical Brightness

- Peak Brightness

- Device Launch Date

The monthly flagship smartphone tracker serves as an excellent tool for all companies involved in the OLED smartphone supply chain: display material companies and manufacturers, panel suppliers, OEMs, technology developers, brands and telecom companies, financial analysts, etc.; by having the ability to see historical panel shipment results and near-term forecasts by brand, model, panel supplier along with upcoming models to be launched in the near future.

DSCC also provides quarterly panel shipments for all of the major smartphone brands along with detailed model specifications and trends in the Advanced Smartphone Display Shipment and Technology Report. This report includes all DSCC’s smartphone data from covering all OLED smartphone and panel shipments by brand, model, all display and major non-display parameters, panel and device revenues, regional forecasts for select models and forecasts by quarter and by year through 2027. In addition, it provides insights into technology and innovation trends in OLED display technology, which is applicable to smartphones. There are over 1,300 AMOLED smartphone configurations in our database including variations by substrate, TFT backplane, panel supplier, refresh rate, chipset supplier, design rules, 5G networks and much more. If interested, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.