DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 07/24/2023

DSCC Reports Panel Shipments for the iPhone 15 Series to be Higher than the iPhone 14 Series

La Jolla, CA -

As we approach the end of July and with less than two months before Apple announces the iPhone 15 series, our latest release of the Monthly Flagship Smartphone Tracker shows that panel shipments for the iPhone 15 Series are tracking much higher than the iPhone 14 Series during the same time period of June - August. More details are available by subscribing to this monthly tracker.

With the current mix of panel shipments for the iPhone 15 series, the Pro models are expected to account for a higher share versus the iPhone 14 Pro models during the June – August time period. The iPhone 15 series is expected to have a series of improvements that include a larger screen size for the iPhone 15 and iPhone 15 Plus of 6.12” and 6.69” respectively, a dynamic island, the A16 Bionic chipset and a USB-C port. The iPhone 15 Pro models are expected to use the 3nm A17 Bionic chipset, utilize ultra-thin bezels, use a titanium chassis, use battery stacked technology for improved efficiency, Wi-Fi 6E and an increase to RAM. In addition, there is an expectation that Apple will raise the starting prices on the Pro models from $999 to $1099 on the iPhone 15 Pro and from $1099 to $1199 for the iPhone 15 Pro Max. If this were to happen, the blended ASPs for the iPhone 15 series would be much higher than the iPhone 14 during the same period in 2022.

In our July and August forecasts, we are projecting that BOE will begin to ship panels for the iPhone 15 Plus in August. SDC started shipping panels in June and LGD started shipping panels in July. SDC is expected to supply panels for all four iPhone 15 models similar to what they have provided for the iPhone 14 and iPhone 13 and iPhone 12 series. We expect LGD to supply panels for the LTPO OLED iPhone 15 Pro and iPhone 15 Pro Max.

SDC has a commanding share of panel shipments for the iPhone 15 series due to technical issues at BOE and LGD, which include the dynamic island and growing dark spots (GDS). Although several articles have reported that LGD was having technical issues for the narrower bezels on the iPhone 15 Pro models, our supply chain sources have noted that LGD has solved those issues. When the dynamic island was introduced for the iPhone 14 Pro and iPhone 14 Pro Max, an additional process step was reportedly added. Traditionally, holes for the front camera and face ID area use lasers to cut the hole in the active area (HIAA) in the post process (module process). If the thin film encapsulation (TFE) is damaged, the OLED panel is exposed to moisture and oxygen, which can cause dark spots. For the dynamic island, there are two holes (one for the camera and one for the Face ID) that appear merged with the dynamic island form factor. Apple may have been concerned about the scattering and control of the laser particles and possible contamination of the TFE from moisture and oxygen and employed additional steps to better control that issue. For the different approaches to solve this issue, please see our Future of OLED Manufacturing Report.

Detailed panel supplier share for the iPhone 15 series as well as for all flagship smartphone brands can be found by subscribing to the Monthly Flagship Smartphone Tracker.

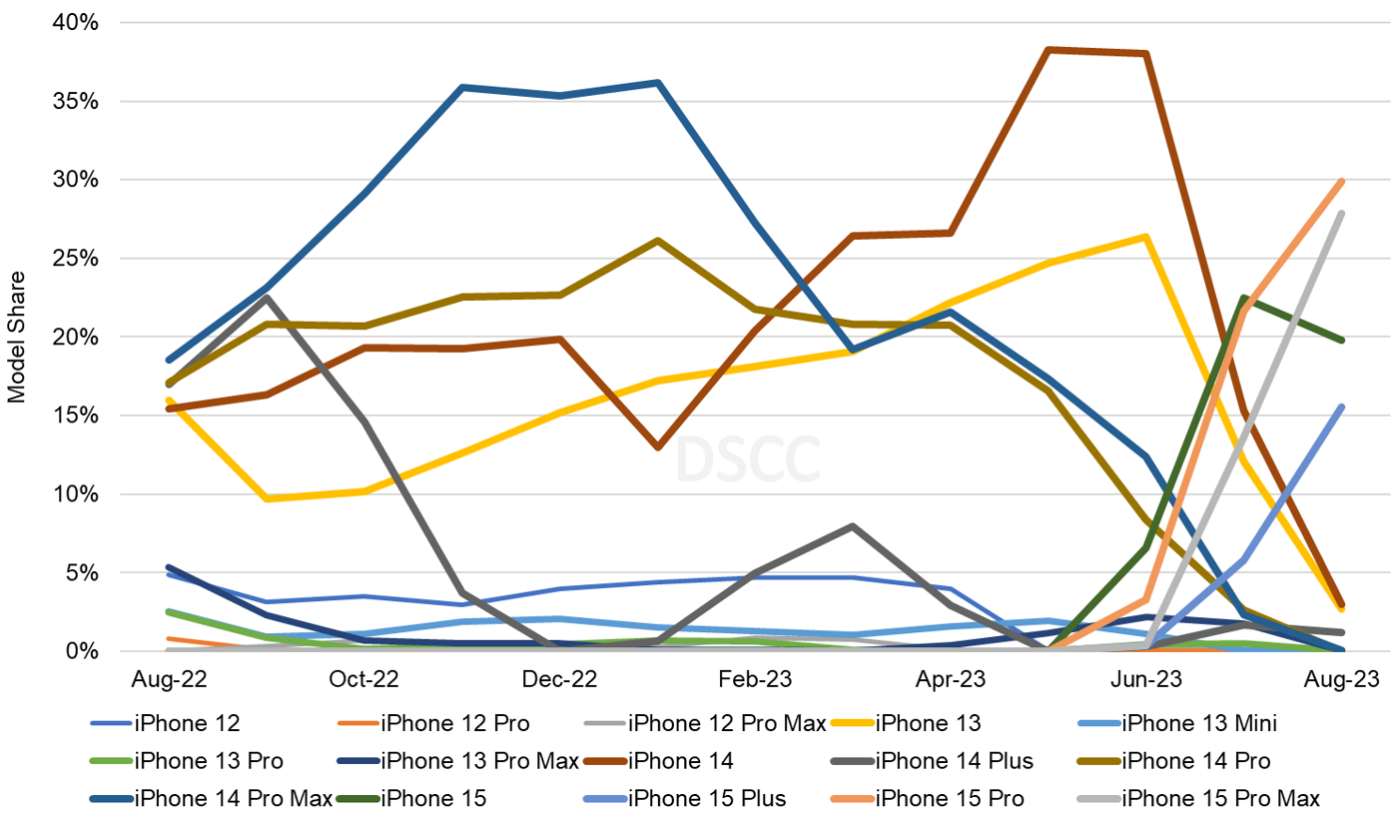

The below chart represents our historical iPhone share by series as well as our estimate for July – August.

iPhone Share by Models – August 2022 – August 2023

To see more of the Monthly Flagship Smartphone Tracker and to learn more about the panel shipment trends for Apple’s new iPhone 15 series launch and the upcoming launch of the Samsung Z Fold 5 and Z Flip 5 as well as many other brands and flagship models, readers should contact info@displaysupplychain.com.

The monthly flagship smartphone tracker includes monthly panel shipment results and a rolling two-month forecast for all flexible and foldable OLED smartphones for all of the major smartphone brands and models.

The tracker covers all flagship models and shows monthly panel shipments by:

- Brand

- Model

- Display Size

- Form Factor

- Foldable Form Factor

- Panel Supplier

- TFT Backplane

- Resolution,

- Hole/Notch/UPC

- Refresh Rate

- Color on Encapsulation (CoE)

- Micro-Lens Array (MLA)

- Chipset Supplier

- Chipset

- Typical Brightness

- Peak Brightness

- Device Launch Date

The monthly flagship smartphone tracker serves as an excellent tool for all companies involved in the OLED smartphone supply chain: display material companies and manufacturers, panel suppliers, OEMs, technology developers, brands and telecom companies, financial analysts, etc.; by having the ability to see historical panel shipment results and near-term forecasts by brand, model, panel supplier along with upcoming models to be launched in the near future.

DSCC also provides quarterly panel shipments for all of the major smartphone brands along with detailed model specifications and trends in the Advanced Smartphone Display Shipment and Technology Report.. This report includes all DSCC’s smartphone data from covering all OLED smartphone and panel shipments by brand, model, all display and major non-display parameters, panel and device revenues, regional forecasts for select models and forecasts by quarter and by year through 2027. In addition, it provides insights into technology and innovation trends in OLED display technology, which is applicable to smartphones. There are over 1,300 AMOLED smartphone configurations in our database including variations by substrate, TFT backplane, panel supplier, refresh rate, chipset supplier, design rules, 5G networks and much more. If interested, please contact info@displaysupplychain.com.

If you're interested in free expert insights, subscribe to our email list here: EXPERT INSIGHTS, FREE DELIVERY.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.