DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 10/25/2023

DSCC Report Reveals MiniLED Penetration Continues to Steadily Increase

La Jolla, CA -

The impact of sluggish global demand continued to influence MiniLED shipments in Q2’23. DSCC’s latest Quarterly MiniLED Backlight Technologies, Cost and Shipment Report reveals that MiniLED shipments fell 5% Q/Q and 32% Y/Y in Q2’23 to 41.3M units, the lowest total since Q3’21. However, the MiniLED market is expected to have rebounded in Q3’23 with inventory approaching normal levels and demand responding, rising 26% Q/Q to 52.1M units, but still down 33% Y/Y. MiniLED backlight shipments fell 1% Q/Q and 15% Y/Y to 3.94M in Q2’23 and are believed to have risen 16% Q/Q while falling 24% Y/Y to 4.6M in Q3’23.

Some product highlights from the latest report include:

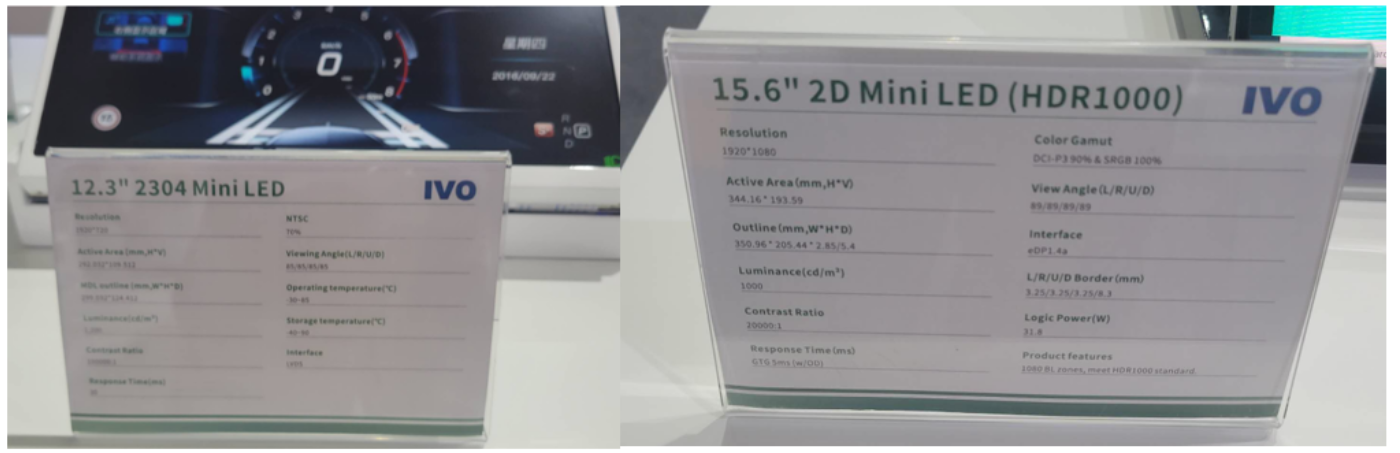

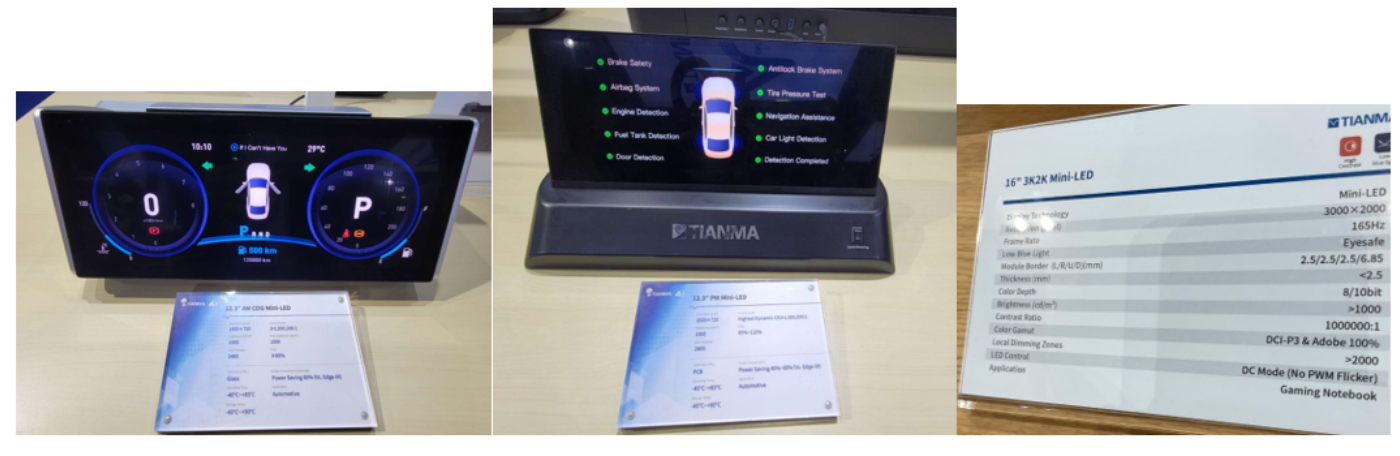

- In 2023, at the DIC Expo, many new MiniLED products were released, especially in automotive applications.

- IVO: 12.3” MiniLED Display & 15.6” MiniLED Display

- BOE: 31.5” 4K MLED embedded with COG AM, 27” Curve 4k MLED, 42” 10k MiniLED for automotive cockpit (same display as shown at SID 2023).

- Tianma: MiniLED automotive displays including a 12.3” driver monitor, 12.3” +35.6” cockpit display, 15.9” freeform CID and 47.5” pillar-to-pillar display.

- Huawei also released a new smart TV, the V5 Pro, embedded with a MiniLED backlight together with the “Eye-catching” Mate 60 Pro in September.

- As expected, Apple still dominated MiniLED shipments. However, MiniLED iPad panel shipments dropped to 300K units and MiniLED MacBook panel shipments fell to 1.8M in Q2’23.

- The efficacy of LED chips in MiniLED has been improved. Brightness is expected to increase under the same driving power in the new version of MiniLED. This means, under the same brightness, the power consumption of MiniLED backlights can be lower.

- The penetration of MiniLED in automotive displays continues to steadily increase. Most key players are very aggressive in adopting MiniLED backlights in interior displays. DSCC expects the penetration of MiniLED to reach 10% in automotive displays in 2025.

In this report, MiniLED Backlight shipments are forecast out to 2027 and quarterly shipments have been updated. DSCC expects:

- MiniLED panel shipments for all applications are expected to reach 23.6M panels in 2027, up from 21.4M panels in 2022.

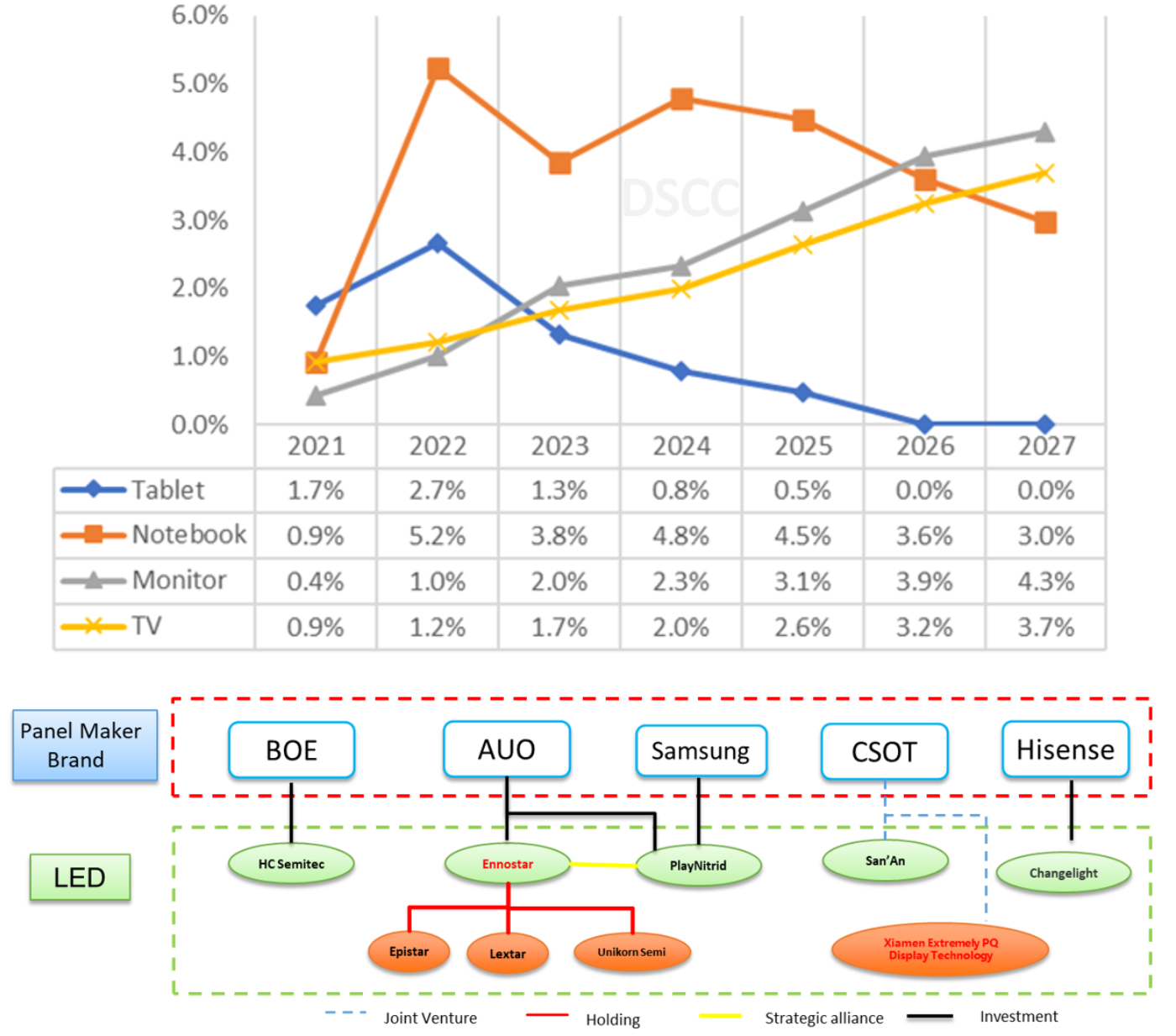

- Notebooks will be the main driving force for MiniLED growth before 2026 and the penetration in notebooks will be 3.8% in 2023 and reach 4.8% in 2024. TV will take over and become the main driving force after 2026. The penetration in TV will continue growing and is expected to be 3.7% in 2027.

- OLED will be adopted in the iPad in 2024 and in the MacBook Pro in 2027. This will have a big impact on MiniLED.

- Apart from IT and TV displays, MiniLED is beginning to penetrate many new applications, such as ARVR, automotive, medical, direct-view displays, etc.

- MiniLEDs are not only being utilized in backlights of displays, but the technology is also widely adopted in fine-pitch direct-view displays.

According to DSCC Director of Taiwan Operations, Leo Liu, “LEDs have become strategic resources for MiniLED and MicroLED development. Panel makers and brands ensure the supply of LEDs through investment or strategic cooperation/alliance with LED makers.”

The latest MiniLED report updates the latest market dynamics and provides a comprehensive analysis of shipments, a technology update, the supply chain and forecast. With this treasure trove of information, subscribers will have a deeper understanding about MiniLED development and its future. Leo Liu will share more valuable insights and findings at DSCC’s upcoming Global Display Supply Chain Dynamics & Technology Outlook Conference happening on November 1st, 2023.

DSCC’s Quarterly MiniLED Backlight Technologies, Cost and Shipment Report includes quarterly data through 2022 and annual data through 2027 by brand, model, panel size, resolution, refresh rate, backplane technology, # LED, dimming zones, etc., and includes panel shipments, supply chain shipments, panel revenues, backlight revenues, panel prices, backlight prices, backlight bill of materials and much more. For more information, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.