DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 09/03/2024

DSCC Report Projects the End of Flat Panel Display Oversupply and Beginning of LCD Shortage

La Jolla, CA -

- DSCC forecasts flat panel display demand CAGR of 5% from 2023-2028, driven mainly by increasing TV screen size.

- While OLED capacity is expected to grow with a 5% CAGR, LCD capacity CAGR from 2022-2028 is less than 1%.

- Rising demand will push LCD fab utilization above pandemic high levels unless more LCD capacity is added.

Capacity additions put in place during the pandemic demand boom have resulted in a systematic oversupply in the display industry that continues in 2024, but that oversupply will eventually turn to a shortage. That turn will happen within the 5-year timeframe of our forecast, according to DSCC’s Quarterly FPD Supply/Demand Report, released last week. Although we expect only modest growth in demand for display products, that persistent growth will fill up capacity and will eventually lead to demand for new or expanded LCD fabs.

The FPD Supply/Demand Report gives a comprehensive view of the display industry because it covers both the demand and supply sides. The demand forecast covers flat panel display shipments across eight different applications, with technology split between LCD and OLED.

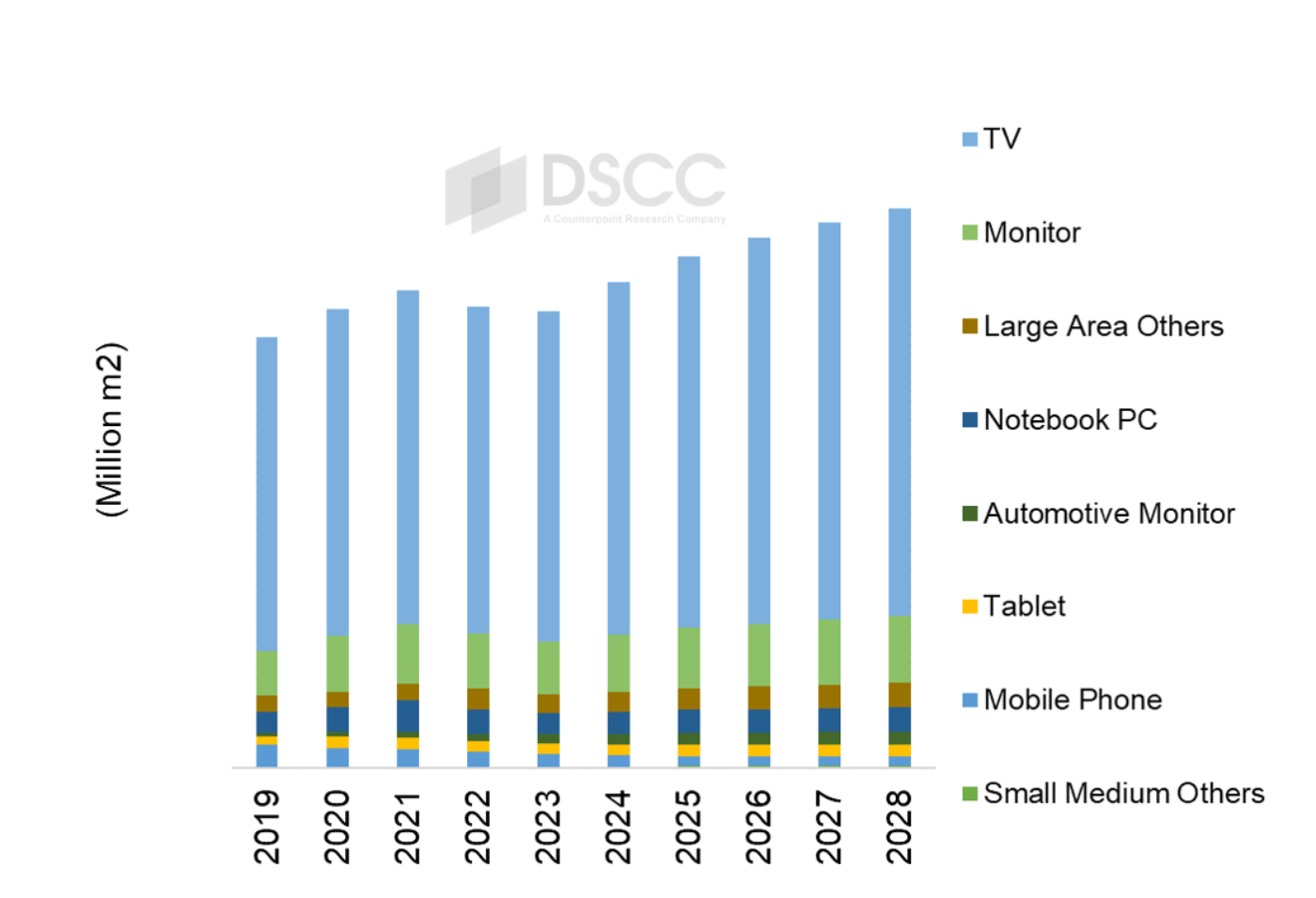

While units and revenue are important to understanding the display industry, the most meaningful metric for supply/demand is area. After two consecutive years of pandemic hangover where FPD demand area decreased in 2022-2023, we are seeing growth resume in 2024 and expect it to continue through 2028 with a 2023-2028 CAGR of 5%.

TVs will continue to represent a dominant share of FPD demand, and area demand for TVs will grow primarily from increasing average screen size along with incremental unit growth. We also expect area growth from IT applications (Monitor, Notebook, Tablet) as the IT market recovers from its post-pandemic slump.

Flat Panel Display Demand Area by Application, 2019 - 2028

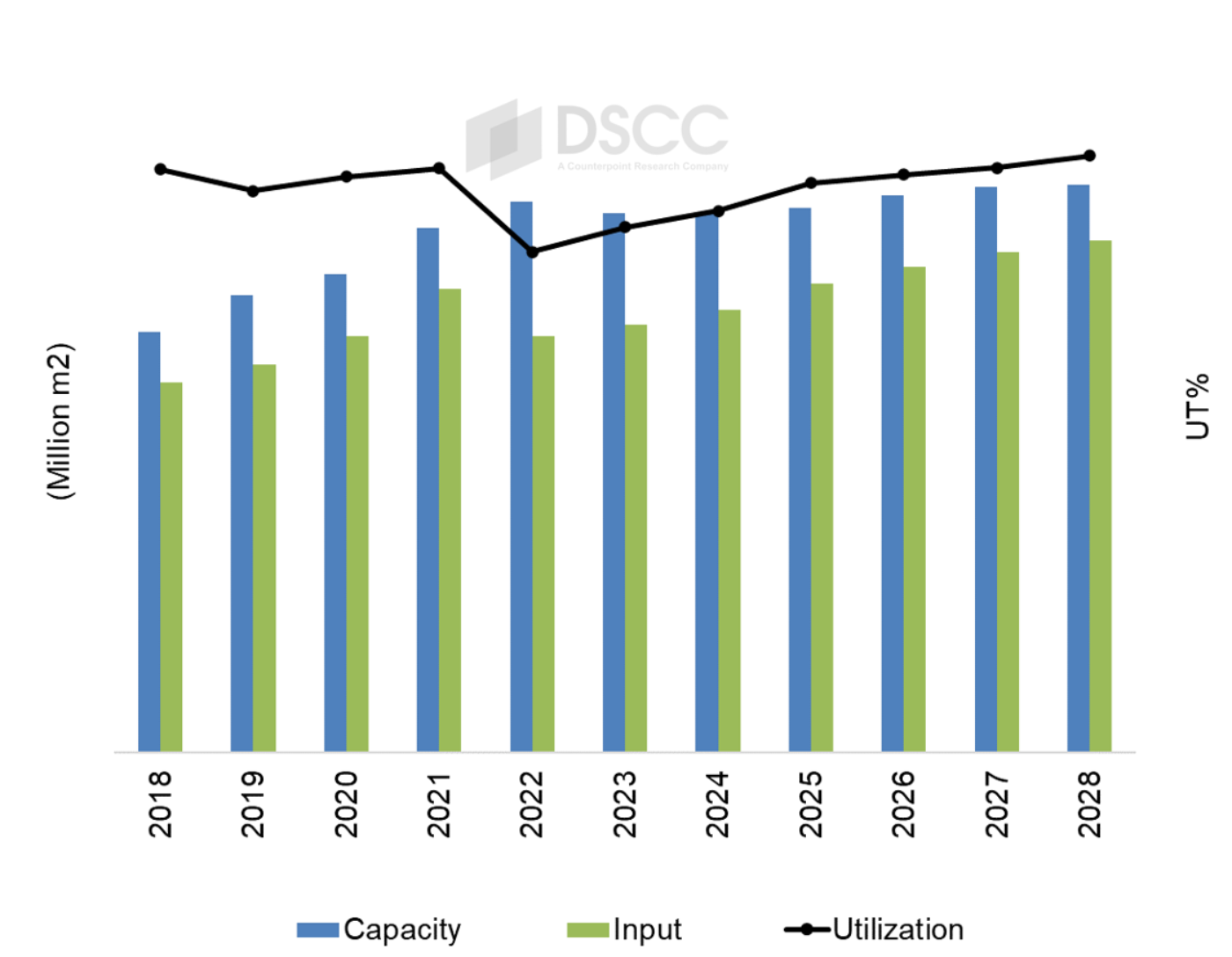

The Quarterly FPD Supply/Demand Report covers DSCC’s detailed capacity forecast, giving views of LCD and OLED capacity by Gen Size, by supplier and by production region. LCD capacity decreased in 2023 by 2% as some smaller fabs shut down.

Overall, we expect that LCD capacity in Gen 7 and smaller fabs will decrease over the span 2022-2028, while capacity in Gen 8.x and larger will grow, with the net result that LCD capacity CAGR from 2022-2028 will be less than 1%.

The LCD industry hit a low point in 2022 following the pandemic high but has improved a bit each year since then. The low utilization in 2022 meant huge operating losses, but 2023 was a little better, and although 2024 is not complete, we expect full-year utilization to come in higher than 2023.

With minimal capacity additions planned and steady demand growth, LCD makers’ profitability is likely to continue to improve in 2025 and 2026. Based on the current supply/demand outlook, we expect utilization in 2027 to be equal to the pandemic peak year UT% in 2021, and UT% to be even higher in 2028. At such utilization levels, LCD panel prices would spike, creating pressure for more supply. Although additional OLED capacity could help meet demand, the expansion plans of OLED makers would need to more than double to fill the gap.

Supply/Demand for LCD Across All Gen Sizes and Applications, 2018 - 2027

As noted above, the DSCC’s Quarterly FPD Supply/Demand Report provides a comprehensive listing of historical panel demand in LCD and OLED for eight different applications, plus a forecast of units, area, and revenues for each application. The report gives a view of industry capacity by display technology, region and gen size, and gives a comparison of supply and demand across segments of the industry. Readers interested in subscribing to this report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.