Guillaume Chansin

guillaume@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/01/2020

DSCC Releases New MicroLED Display Technology and Market Outlook Report

Austin, TX -

Revenues for microLED displays will reach $45 million in 2021, according to the new 312-page MicroLED Display Technology and Market Outlook Report released by DSCC. While the technology is making rapid progress, it is still at an early stage of commercialization. Despite the push by companies such as Apple, Samsung and Facebook, there are challenges to establish a reliable supply chain and lower the manufacturing cost. The report shows that the technical hurdles will depend mostly on the choice of manufacturing technology.

MicroLEDs have garnered a lot of interest because of the potential advantages over other flat-panel display technologies, most notably in high efficiency, high brightness, high color saturation, faster response rate, and longer lifetime. This unique combination of features would make microLED the superior display for many applications, ranging from super large TVs to microdisplays for use in AR/VR headsets. The ability to withstand harsher environmental conditions is also particularly attractive for the automotive industry.

“MicroLEDs have generated a lot of hype, but also a lot of confusion”, said Guillaume Chansin, Director of Display Research at DSCC. “This is because microLED displays can be manufactured in different ways, and each one will bring its own set of challenges and possible applications.”

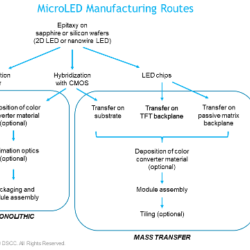

The report describes two general manufacturing methods: monolithic or mass transfer. The monolithic approach is the preferred route to make microdisplays that are below 1-inch in diagonal and with a very high pixel density above 5,000 PPI. These miniature displays are very promising for AR/VR since they can achieve millions of nits in brightness without sacrificing contrast or compactness. However, obtaining a full color display has proven to be a challenge.

The mass transfer approach consists in moving a large number of individual microLEDs on the display substrate. This method can, in theory, produce displays of any size, including large TVs above 100-inch in diagonal. The technique is still not fully mature and there are several mass transfer technologies under consideration.

Samsung has already started selling luxury microLED video walls to consumers. However, the LED chips on these displays are still larger than 100 μm, which is the commonly accepted size definition for a microLED. DSCC expects Samsung to release a new model based on smaller LED chips. This will help reduce the total BoM of the display. However, shrinking the LED chips too much can have an impact on efficiency and affect the performance of the display.

The report covers all these issues in detail and shows the various solutions under development by the microLED industry.

This new DSCC report will be useful to every company in the microLED supply chain: LED manufacturers, panel makers, technology developers, OEMs, assembly houses, and end users.

The report addresses all the important topics on microLEDs, including:

- MicroLED efficiency challenges

- Mass transfer technologies

- Yield and defect management strategies

- Color conversion with quantum dots

- Backplanes and driving schemes

- Monolithic displays

- Cost analysis (epiwafers, backplanes, QD color conversion, transfer costs)

- Supply chain scenarios

- Competitive landscape

- Market forecasts to 2026 (shipments and revenues)

OEMs and suppliers covered in the report include:

- Samsung

- Apple

- PlayNitride

- AUO

- Foxconn

- Glo

- Epistar

- Aledia

- Plessey

- Jade Bird Display

For more information on DSCC’s MicroLED Display Technology and Market Outlook Report, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.