DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 01/29/2024

DSCC Releases Its 2024 Future of OLED Manufacturing Report – Latest Opportunities, Challenges and Solutions Examined for OLEDs in Smartphones, IT, TVs and AR/VR

La Jolla, CA -

DSCC's second Future of OLED Manufacturing Report increases the attention paid to the opportunities, challenges and solutions for OLEDs in IT and AR/VR markets in addition to covering OLED smartphone and TV panel developments in great detail.

Coming in at 445 slides, this report is a tremendous value giving its readers tremendous insight into:

- DSCC’s latest forecasts for the display market on a unit, revenue and area basis by application, factoring in OLEDs, MiniLEDs, LCDs, Micro OLEDs and MicroLEDs and all the major applications.

- The latest OLED and Micro OLED fab schedules and capex forecasts.

- The latest OLED material developments including the status and timing for high efficiency blue at Samsung Display as well as their development and commercialization strategies and if/how it differs between mobile and TVs. In particular, it reveals what the target is for phosphorescent blue lifetime and where UDC’s and SAIT’s materials are today and where they are expected to be before they are commercialized. It also reveals the status and outlook for deuterium adoption in mobile and TV displays and the promise of Plasmonics.

- The large opportunity for OLEDs in IT displays, revealing DSCC’s view on Apple’s roadmap, DSCC’s OLED unit and revenue forecasts as well as how OLED manufacturers are addressing this opportunity. There are changes being made to both the backplane and frontplane lines as they look to scale to G8.7 at lower costs and these changes are being evaluated in terms of promise and risk and each panel manufacturers’ strategies are discussed. A deep dive into the status of high mobility oxide backplanes and alternative OLED patterning approaches is provided as is an IT OLED technology roadmap.

- In smartphones, the latest forecasts are provided as well as the latest power saving developments, new technology advances to reduce costs and boost performance, Apple’s iPhone roadmap, mobile OLED stack and material advances, foldable/rollable developments and outlook, etc.

- In TVs, the latest product and technology roadmaps, forecasts by display technology, OLED material advances, the status of RGB IJP OLED and OVJP development, other emissive display technology candidates, cost forecasts, etc.

- For Micro OLEDs, DSCC covers the latest fab schedules and capacity, performance and design requirements, product and technology roadmaps, different structures being implemented and shipment forecasts.

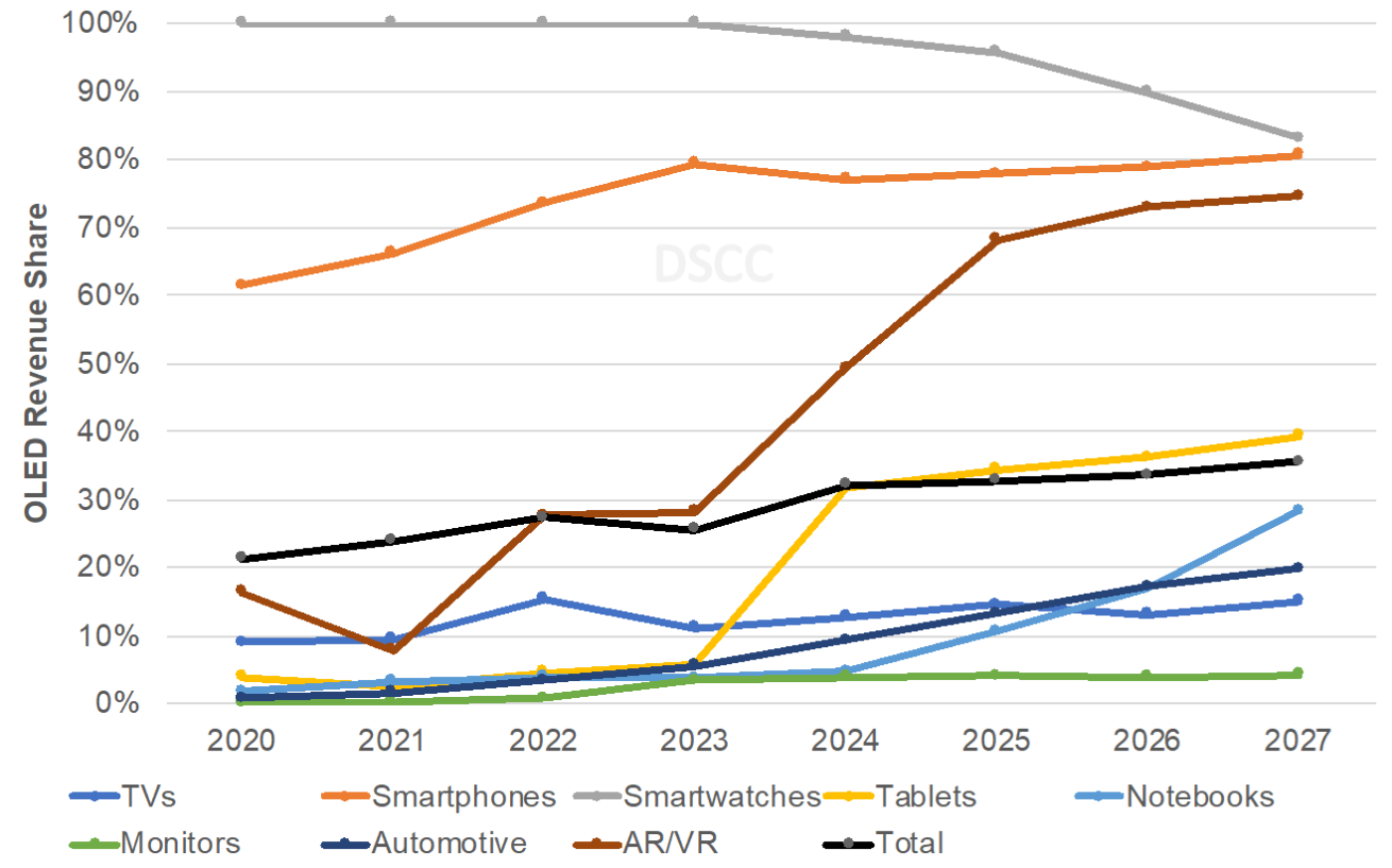

According to DSCC CEO Ross Young, “In terms of the market forecast, we see AMOLEDs plus Micro OLEDs growing at a 5% CAGR to $52B in 2027. Smartphone revenues are expected to fall at a 1% CAGR from 2022-2027, so all the growth will occur in other applications led by AR/VR rising at an 81% CAGR, tablets up 57%, automotive up 56% and notebooks rising at a 44% CAGR. As a result, the smartphone share of the OLED market is expected to fall from 80% in 2023 to 58% in 2027 as OLED manufacturers become increasingly diversified to capture more growth.” As shown in the figure here, DSCC believes OLEDs will gain share in every application except for smartwatches where MicroLEDs are expected to gain share (LCD smartwatches excluded below) and in monitors and TVs where OLED penetration will be flattish with MiniLEDs taking share. The largest share gains vs. LCDs are expected to occur in tablets, automotive, notebooks and AR/VR. For more information on this report, please contact info@displaysupplychain.com.

OLED $US Penetration by Application

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.