DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 12/16/2024

DSCC Reduces OLED Tablet Market Outlook on Weakness at Apple and Delays in Foldable/Slidable Devices

La Jolla, CA -

- 2024 OLED and MiniLED tablet panel volumes are expected to rise 71% Y/Y to over 11M, but down 15% vs. last quarter on lower-than-expected demand for the OLED Apple iPad Pro.

- Apple’s 2024 Advanced Tablet share is expected to reach 51% in 2024, up from 38% in 2023, but below previous expectations of 56%.

- Apple to drive future OLED tablet market growth as it introduces an OLED iPad Mini in 2026 and two new iPad Air models and a foldable model in 2027.

In the latest issue of DSCC’s Quarterly Advanced IT Display Shipment and Technology Report, DSCC lowered its outlook for OLED tablets for 2024 and beyond.

2024 Downgraded on Reduced Apple iPad Pro Volumes

2024 was reduced by 15% vs. last quarter, which still translates to 71% Y/Y growth to over 11M panels. The decline can be attributed to slower OLED iPad Pro volumes than previously expected due to the lack of appetite for tablets this expensive. 2024 Apple iPad Pro panel procurement is now expected to fall below 5.7M vs. original expectations of 8M-10M panels. 11.1” is expected to lead with a 52%/48% advantage over 13” with LGD holding a 60%/40% advantage over SDC. Apple’s 2024 market share is expected to rise from 38% in 2023 to 51% in 2024, down from 56% expected last quarter.

Samsung S10+/Ultra Ramp Going Well So Far

While the OLED iPad Pros ended up falling short vs. expectations, so far, the Samsung S10+ and S10 Ultra are performing better than expected. The S10 Ultra is up 41% over the S9 Ultra in the same period in the previous year with the S10+ up 64%. In addition, the S9 is still shipping at a high volume level.

Apple to Lead in 2024, But Lose Leadership in Q4’24

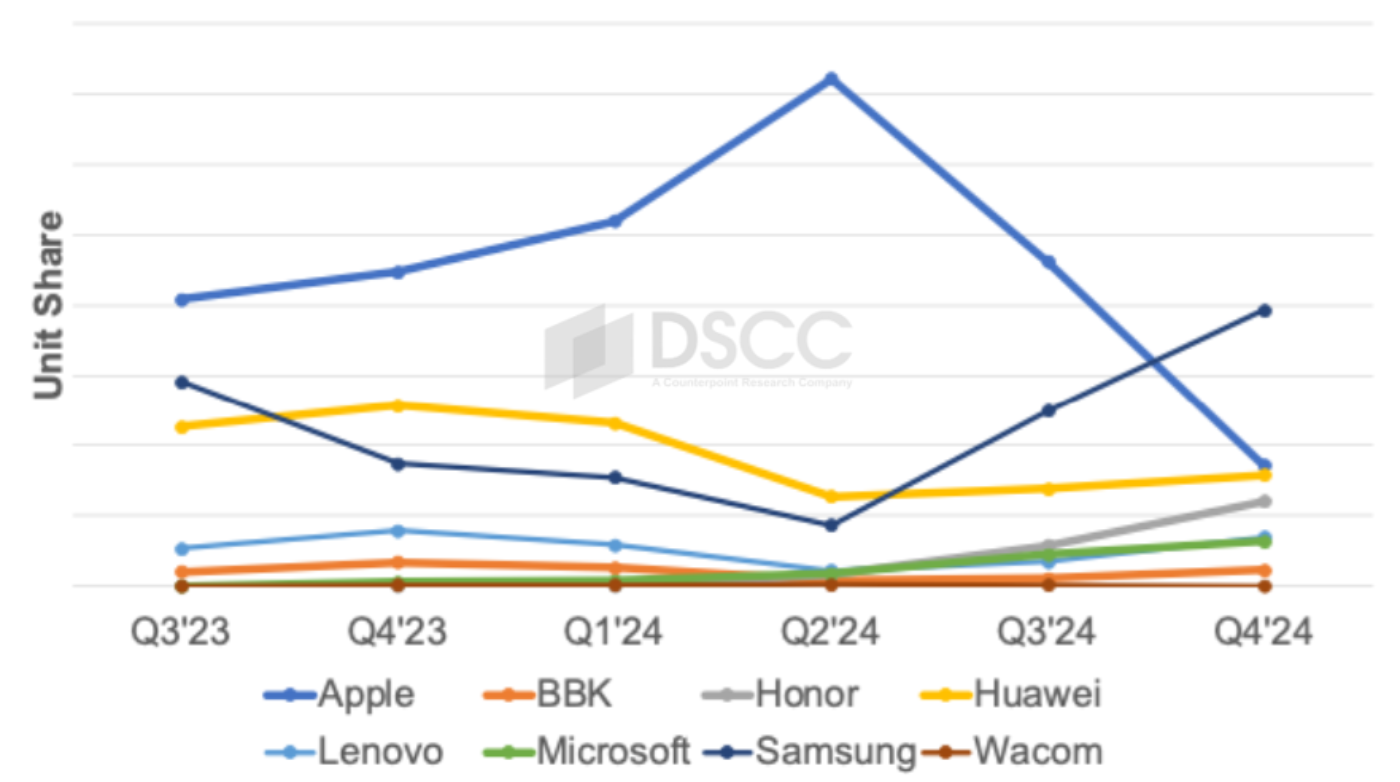

Apple is expected to remain the market leader in 2024 Advanced Tablets with a 51% share in 2024 on over 100% growth. Samsung is expected to remain #2 with a 20% share, down from 29%, on over 20% growth. Huawei is expected to remain #3 with its share falling from 26% to 15%. No other brand is expected to account for more than a 4% share. Apple has led the Advanced Tablet market from Q3’23 to Q3’24 but is expected to be overtaken by Samsung in Q4’24. With Samsung expected to lead in Q4’24 on the ramp of the S10+ and Ultra, MediaTek is expected to lead the advanced tablet processor market.

In Q3’24, the 11.1” OLED iPad Pro led the market in panel procurement with a 30% share followed by the 13” OLED iPad Pro with a 17% share. No other model had more than an 8% share. In Q4’24, the Samsung S10 Ultra is expected to lead with a 17% share closely followed by the S10+ and 11.1” OLED iPad Pro each with a 15% share and the Honor Magic Pad2 with a 12% share.

For all of 2024, the 11.1” iPad Pro will lead with a 26% share with the 13” OLED iPad Pro #2 with a 24% share. The Huawei Mate Pad Pro 11 is expected to edge the Tab S9 for #3.

Advanced Tablet Display Procurement Share

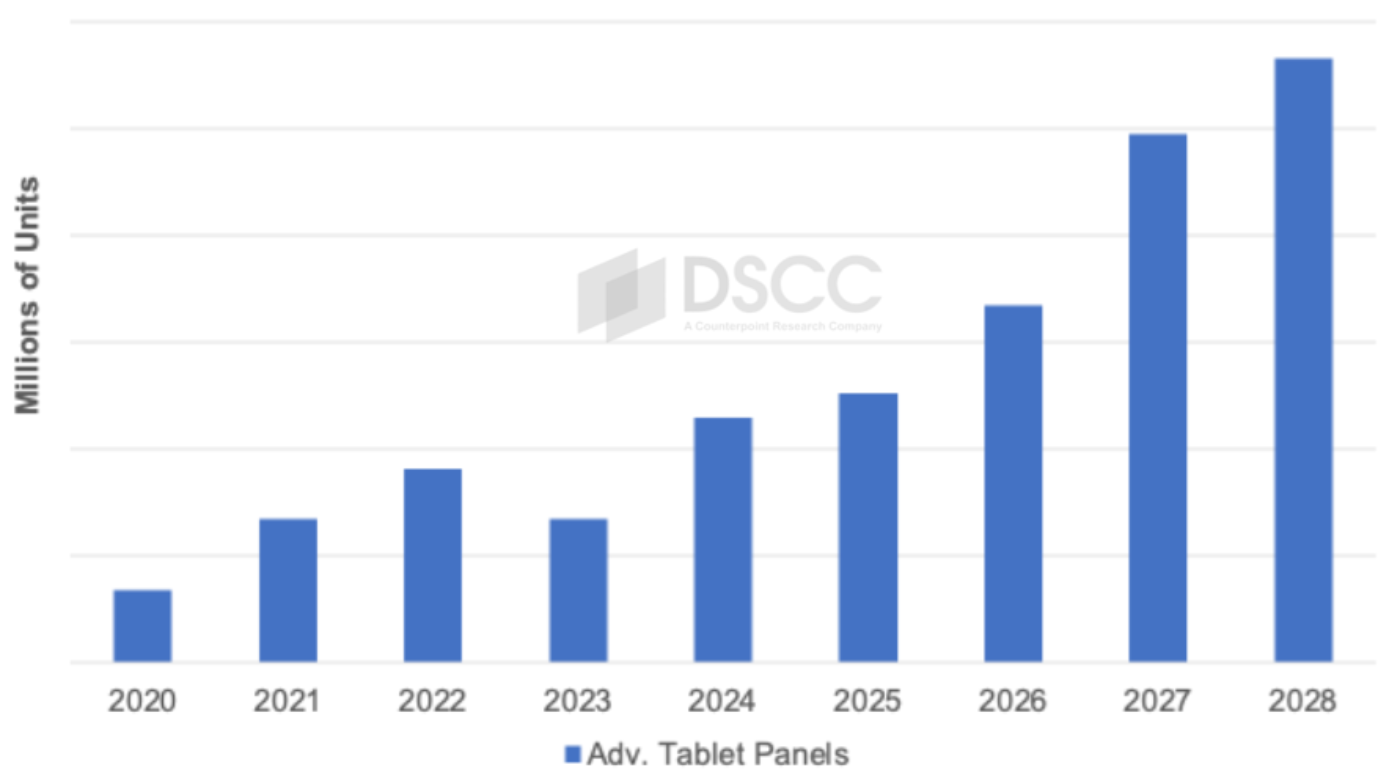

Forecast: Advanced Tablets Still Growing, But Slower

The advanced tablet segment is projected to grow at a 33% CAGR to over 28M panels through 2028, lower than the 39% previously forecasted, but still impressive. The weaker than expected 2024 sales of the OLED iPad Pros points to limitations in the high end of the tablet market and there has been no near term movement in foldable, multi-fold or slidable tablets yet, unlike in smartphones and laptops which restricts the growth outlook.

Advanced Tablet Display Forecast

Catalysts for OLED tablets consist of:

- The introduction of an 8.5” OLED iPad Mini in 2026.

- The introduction of 11” and 13” iPad Airs in 2027.

- The introduction of an 18.8” foldable iPad Pro in 2027.

- More cost effective G8.7 IT OLED fabs bringing down the cost of OLED tablet panels.

- More efficient OLEDs boosting brightness, battery life and lifetime through a number of new technology advances such as phosphorescent blue, CoE, MAX OLED, etc.

With Apple expected to convert more of its LCD tablets to OLEDs from 2026, 2025 should be a year of modest growth with faster growth from 2026 to 2028.

For more information on the OLED tablet market as well as OLED and MiniLED laptops and monitors, please see our Quarterly Advanced IT Display Shipment and Technology Report or contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.