DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 08/05/2024

DSCC Raises Capex Outlook as OLED Manufacturers Respond to Rising Demand with More Capacity

La Jolla, CA -

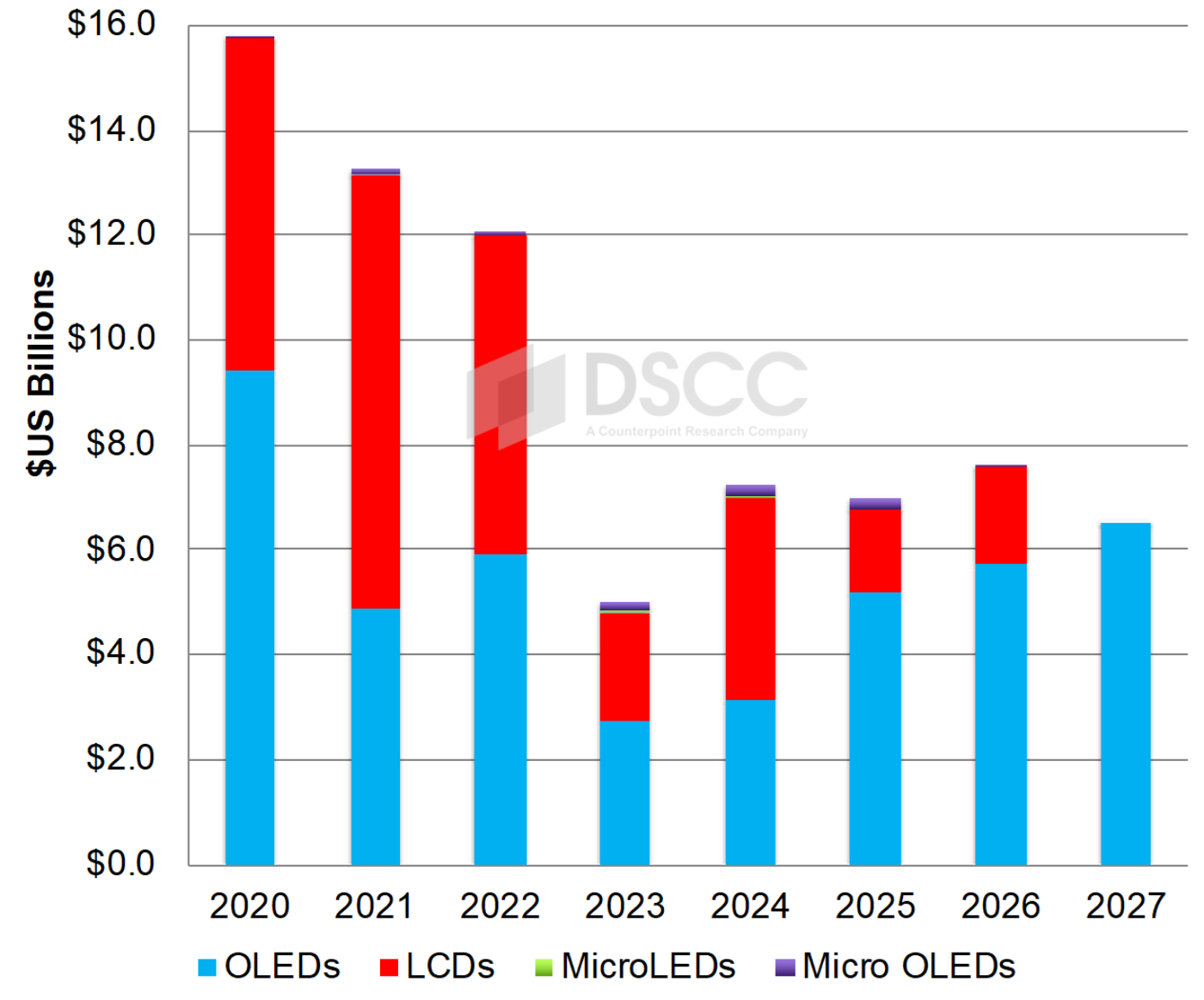

- DSCC raised its 2020-2027 display equipment spending forecast by 8% to $75B due to a 14% increase in OLED spending to $44B as manufacturers respond to rising demand and elevated utilization with additional capacity. LCD, Micro OLED and MicroLED spending held flat.

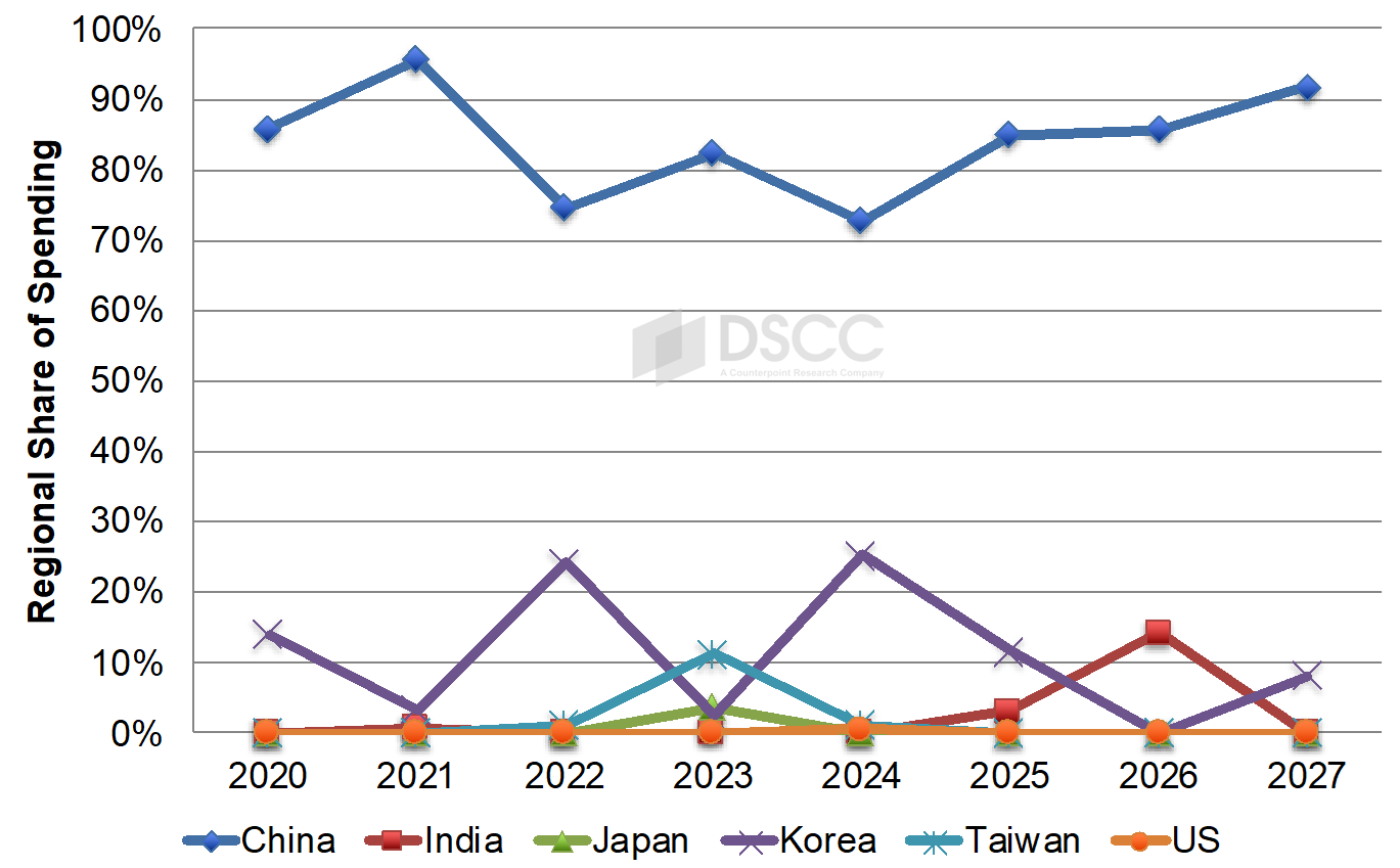

- China is expected to account for 85% of display equipment spending from 2020-2027, leading annually. Its share of LCD spending is 92% with OLEDs at 77% and Micro OLEDs at 80%.

- IT applications expected to account for the highest share of spending. BOE to lead in equipment spending followed by China Star and Tianma. Canon/Tokki to remain the #1 supplier followed by Applied Materials and Nikon.

DSCC raised its display equipment spending forecast from 2020-2027 in its latest Quarterly Display Capex and Equipment Market Share Report by 8% to $75B due to a 14% increase in OLED spending to $44B. LCD spending remained flat at $30B while Micro OLED and MicroLED spending also remained flat.

The OLED increase can primarily be attributed to the addition of three G6 mobile lines, an additional 7.5K expansion at a G8.7 IT OLED line not previously forecasted and the pull-in by a year of another 15K G8.7 IT OLED line. OLED equipment spending is expected to increase each year from 2023 to 2027 reaching $6.5B in 2027 due to increased demand and rising utilization. OLED penetration continues to increase in smartphone, tablet, laptop and other markets with average panel sizes continuing to grow encouraging panel suppliers to add capacity when utilization is forecasted to reach excessive levels. While OLEDs are expected to account for a 58% share of 2020-2027 display equipment spending on rising demand and higher capital intensity than LCDs, LCD fabs are expected to account for a 40% share with just four new LCD fabs currently forecasted to be equipped from 2024-2027.

Display Equipment Spending by Frontplane

By region, China’s share of 2020-2027 spending is projected to be 85%, up from 83%, on $63B spent, with China leading every year. Korea’s share of spending over this period is expected to be 12%, down from 13%, on $9B spent. India is expected to account for a 2% share with Taiwan at 1%. China is also expected to dominate LCD spending with a 92% share over the same period with OLED regional spending with a 77% share and Micro OLED spending with an 80% share.

Display Equipment Spending by Region

By application, IT markets are expected to lead with a 41% share on $30B in spending, up from a 37% share on $25B in spending and leading from 2024-2027. With IT demand still well below 2021 levels, we expect these fabs with more advanced display technology to pressure older a-Si fabs once they come online leading to additional older fab closures. With the addition of three new mobile lines, mobile is expected to be the #2 application with a 30% share on $22B in spending followed by TV/Other with $21B and a 28% share. Mobile led in 2022 and 2023 while TVs led in 2020 and 2021. AR/VR is expected to account for a 1.2% share on less than $1B in spending tracking TFT backplane and OLED frontplane segments.

By panel manufacturer, BOE is expected to lead with a 23% share followed by China Star at 20%, Tianma at 11%, HKC and Visionox at 10% each, SDC at 7% and LGD at 5%. BOE is also expected to lead in OLEDs with a 27% share with China Star leading in LCDs with a 30% share. In Micro OLEDs, Sidtek is expected to lead with a 25% share.

By equipment supplier, Canon/Tokki is expected to remain #1 on 30% growth and a 9.3% share, down from 10.3%. Applied Materials is expected to enjoy 52% growth and gain share from 8.1% to 8.5%. Nikon is expected to remain #3, dominating LCD exposure and splitting the OLED market with Canon. Eight of the top 15 equipment suppliers are expected to enjoy >100% growth. By country within the top 15, there are expected to be eight from Japan, four from Korea, two from China and one from the US.

Equipment revenues are tracked for over 70 different display equipment segments with market share provided for each one. Over 170 different equipment supplies are identified with design wins by segment. For more insights regarding display equipment, capacity and equipment market share, please see our Quarterly Display Capex and Equipment Market Share Report or contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.