DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 04/17/2023

DSCC Launches Monthly Flagship Smartphone Tracker – Top 5 Models from Apple & Samsung Capture a 46% Share for January through March

La Jolla, CA -

This week, DSCC launches its Monthly Flagship Smartphone Tracker. This report includes monthly panel shipment results and a rolling two-month forecast for all flexible and foldable OLED smartphones for all the major smartphone brands and models.

The tracker covers all flagship models and shows monthly panel shipments by:

- Brand

- Model

- Display Size

- Form Factor

- Panel Supplier

- TFT Backplane

- Refresh Rate

- Device Launch Date

Brands include Apple, Fujitsu, Google, Honor, Huawei, Infinix, LGE, Meizu, Motorola, Nothing, OnePlus, Oppo, Realme, Samsung, Sony, TCL, Techno, Vivo, Xiaomi and ZTE. The tracker has over 300 models listed with panel shipment volumes starting from January 2021.

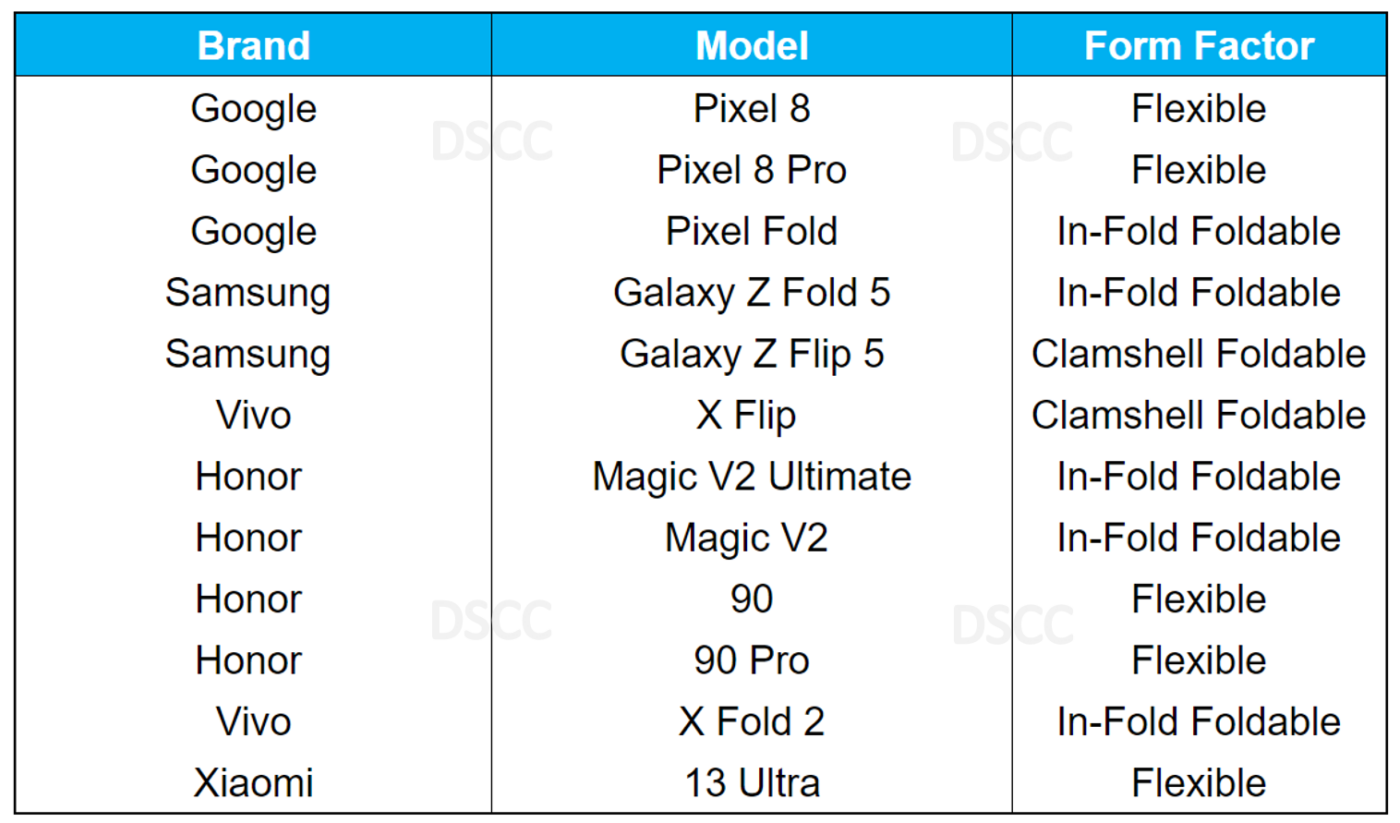

DSCC shows panel shipment volumes for not yet announced new models as shown in the table here.

Sample of Upcoming Flagship Smartphone Models

According to DSCC Senior Director David Naranjo, “The Monthly Flagship Smartphone Tracker serves as an excellent tool for all companies involved in the OLED smartphone supply chain: display material companies and manufacturers, panel suppliers, OEMs, technology developers, brands, telecom companies and financial analysts, etc.; by having the ability to see historical panel shipment results and near-term forecasts by brand, model, panel supplier along with upcoming models to be launched in the near future. A monthly tracker for wearables will soon be available.”

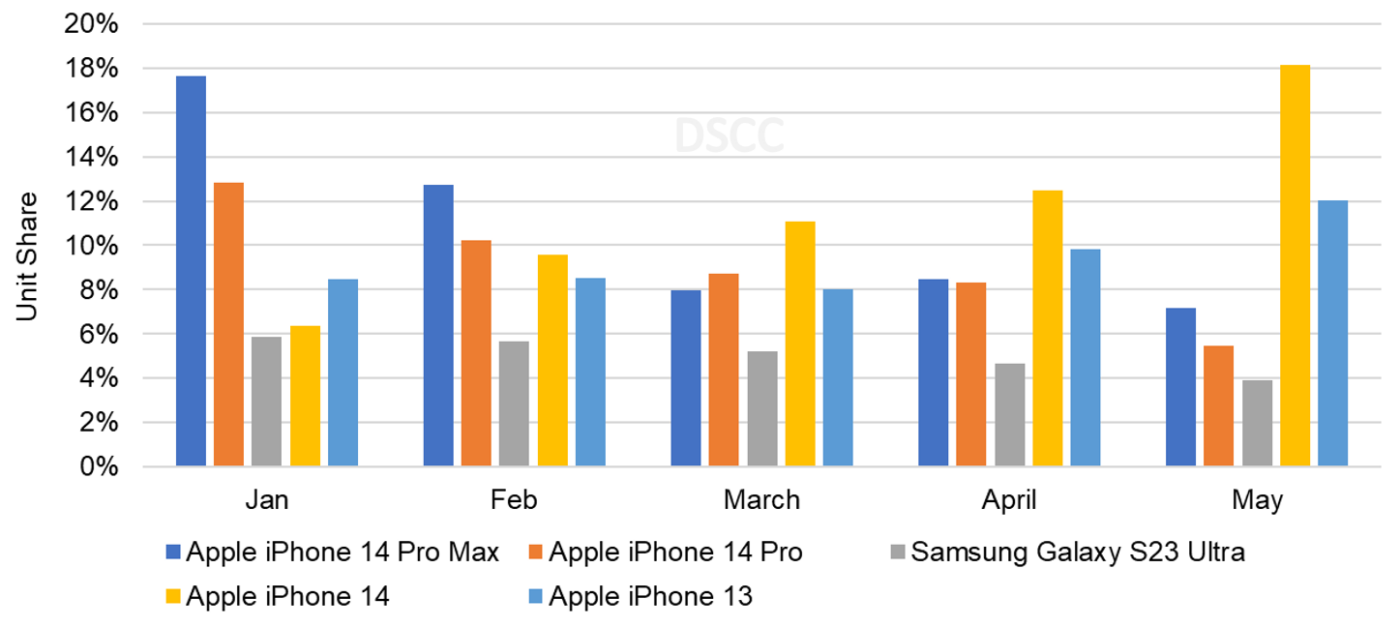

In the case of the top five models for January through March, DSCC shows that Apple and Samsung models captured a combined 46% share in Q1'23. By model, by month, the top five models in January were the Apple iPhone 14 Pro Max with an 18% share, followed by the iPhone 14 Pro, iPhone 13, iPhone 14 and Samsung Galaxy S23 Ultra. These five models consistently made the top five over the last three months. Starting in March however, the top model was the iPhone 14 and DSCC expects the iPhone 14 to be the top model in April and May as a result of early adopters purchasing the Pro models shortly after launch and non-early adopters increasingly purchasing the entry level models later in the launch cycle. DSCC shows an 18% Y/Y increase in Q1'23 volumes as several brands launch new flexible and foldable OLEDs increasing panel shipments to take advantage of lower panel prices and look to increase revenues with premium smartphone offerings.

Top Five OLED Smartphones, January - May 2023

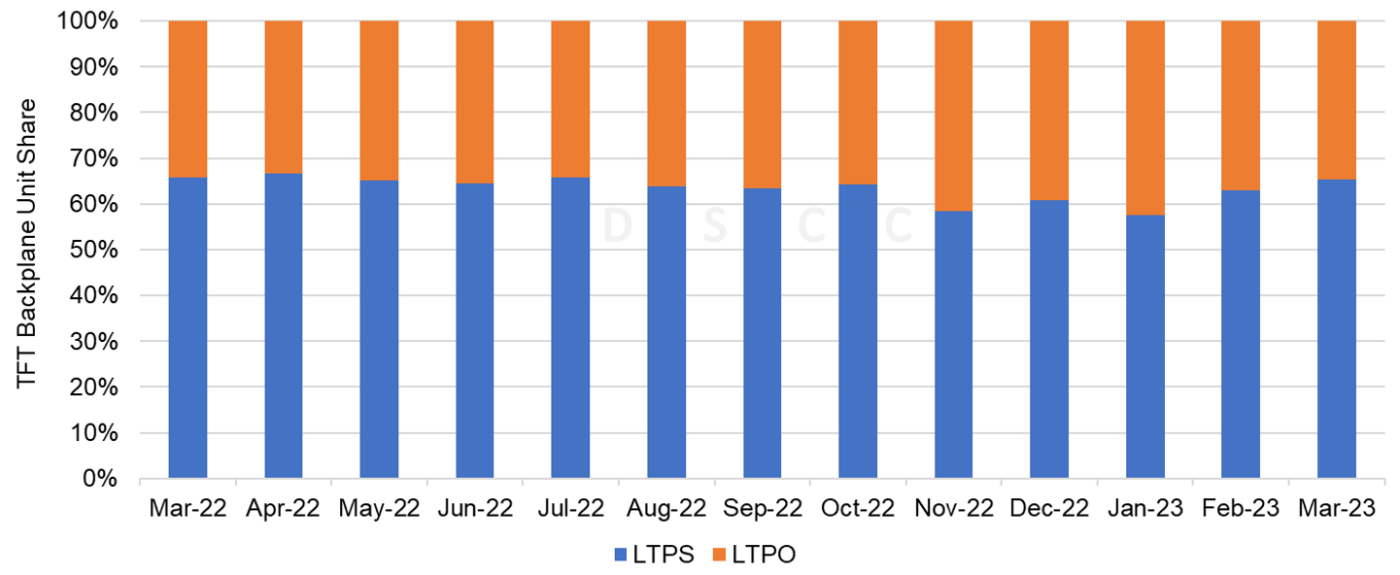

Of the top five models, three models, the iPhone 14 Pro Max, iPhone 14 Pro and Samsung Galaxy S23 Ultra use an LTPO backplane. As indicated in the chart below, LTPO share is between 33% - 42% share with some of the highest share for panel shipments occurring in the months of June and August - February, with new iPhone Pro models and Galaxy S Ultra models launching in September and February.

Monthly LTPS vs. LTPO Unit Share, March 2022 – March 2023

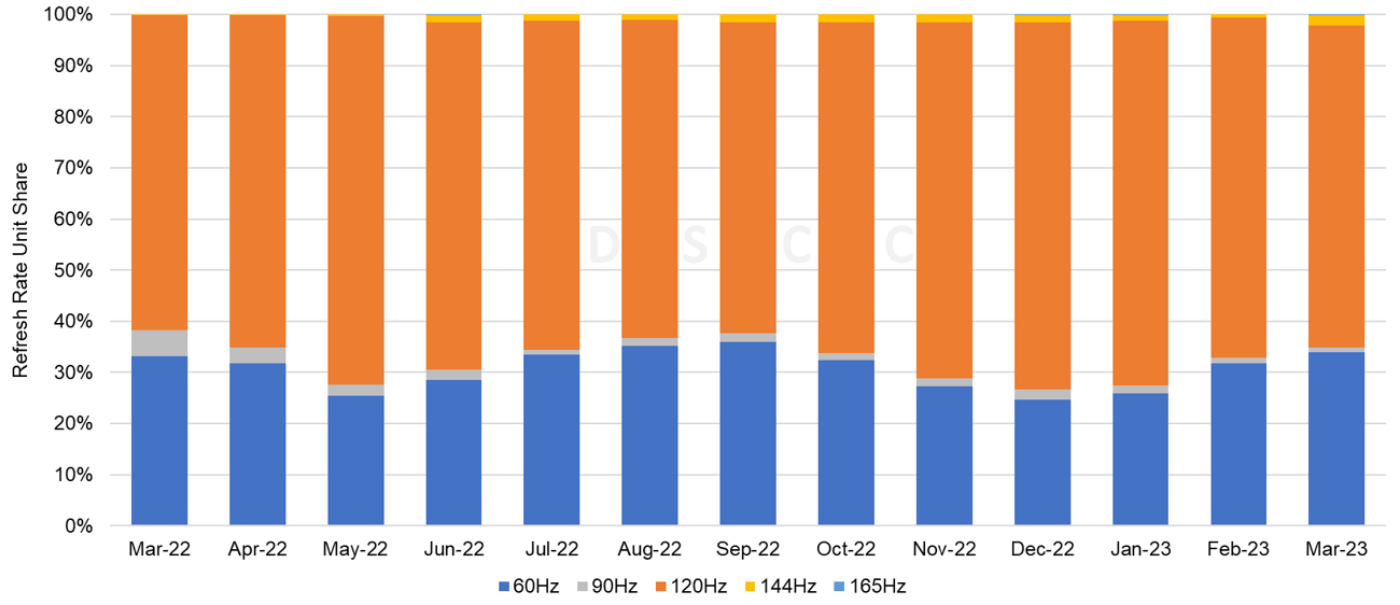

For refresh rates, 120Hz continues to have the majority share as most flagship smartphones start at 120Hz. In March 2023, 120Hz had a 63% share.

Monthly Refresh Rate Unit Share, March 2022 – March 2023

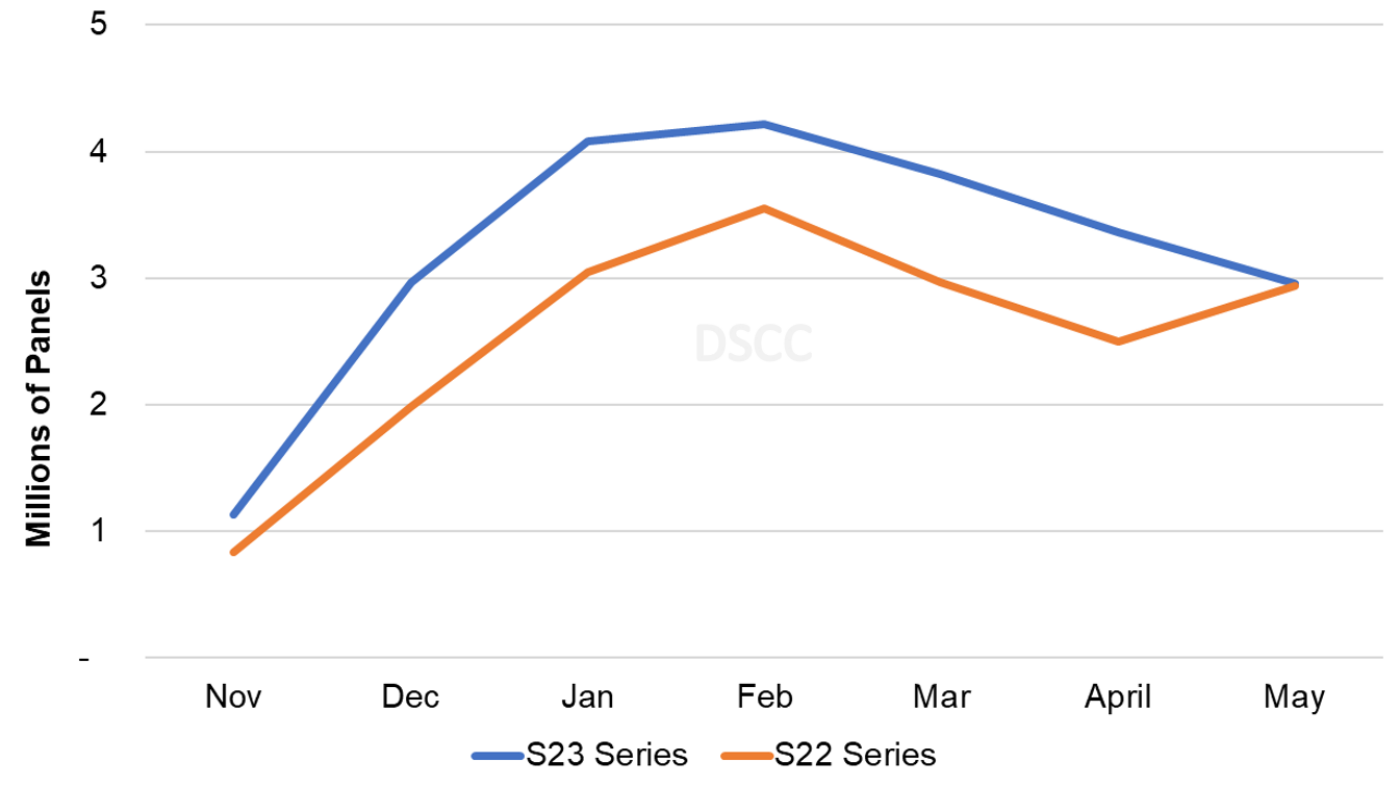

Looking at the S23 series versus the S22 series, you can see the actual monthly panel shipments through March and the rolling two-month forecast through May 2023 where the S22 series in 2021-2022 is compared with the S23 series in 2022-2023. As indicated:

- For the S22 series, volumes were initially lower as a result of supply chain issues and a later availability date of February 25th, 2022. The S23 series became available on February 17th, 2023. The S23 series panel shipments in November 2022 through March 2023 were 31% higher than the S22 series in November 2021 through March 2022 and are expected to be 26% higher through May 2023. In May, the S23 series panel shipments are expected to be 1% higher than the S22 series, and that is a result of a much later ramp up for the S22 series.

Samsung S23 Series vs. S22 Series Panel Shipments Over the First Seven Months

The S23 series panel shipment mix share is a bit different to the S22 series through May with expected increases for the S23 and S23 Ultra. The S23 is expected to have a 36% share versus 32% for the S22, S23+ with 15% versus 16% for the S22+ and the S23 Ultra with 49%, down from 52% for the S22 Ultra.

In comparing the S23 Series vs. the S22 Series through May, DSCC sees the following changes in volumes by model:

- S23: Up 39%;

- S23+: up 19%;

- S23 Ultra: Up 20%.

Readers interested in subscribing to DSCC’s Monthly Flagship Smartphone Tracker should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.