DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 02/19/2024

DSCC Initiates Quarterly Micro OLED Equipment Spending and Fab Schedule Tracking, Added to Highly Popular Report

La Jolla, CA -

Given the popularity of and interest in the Apple Vision Pro headset and the rumored high prices of the Micro OLED panels being used, there has been a surge in activity in this segment. In response to strong interest, DSCC has added quarterly tracking and forecasting of Micro OLED fab schedules and equipment spending to its highly popular Quarterly Display Capex and Equipment Market Share Report. This report now tracks equipment market share in nearly 80 different segments for LCDs, OLEDs, MicroLEDs and now Micro OLEDs as well.

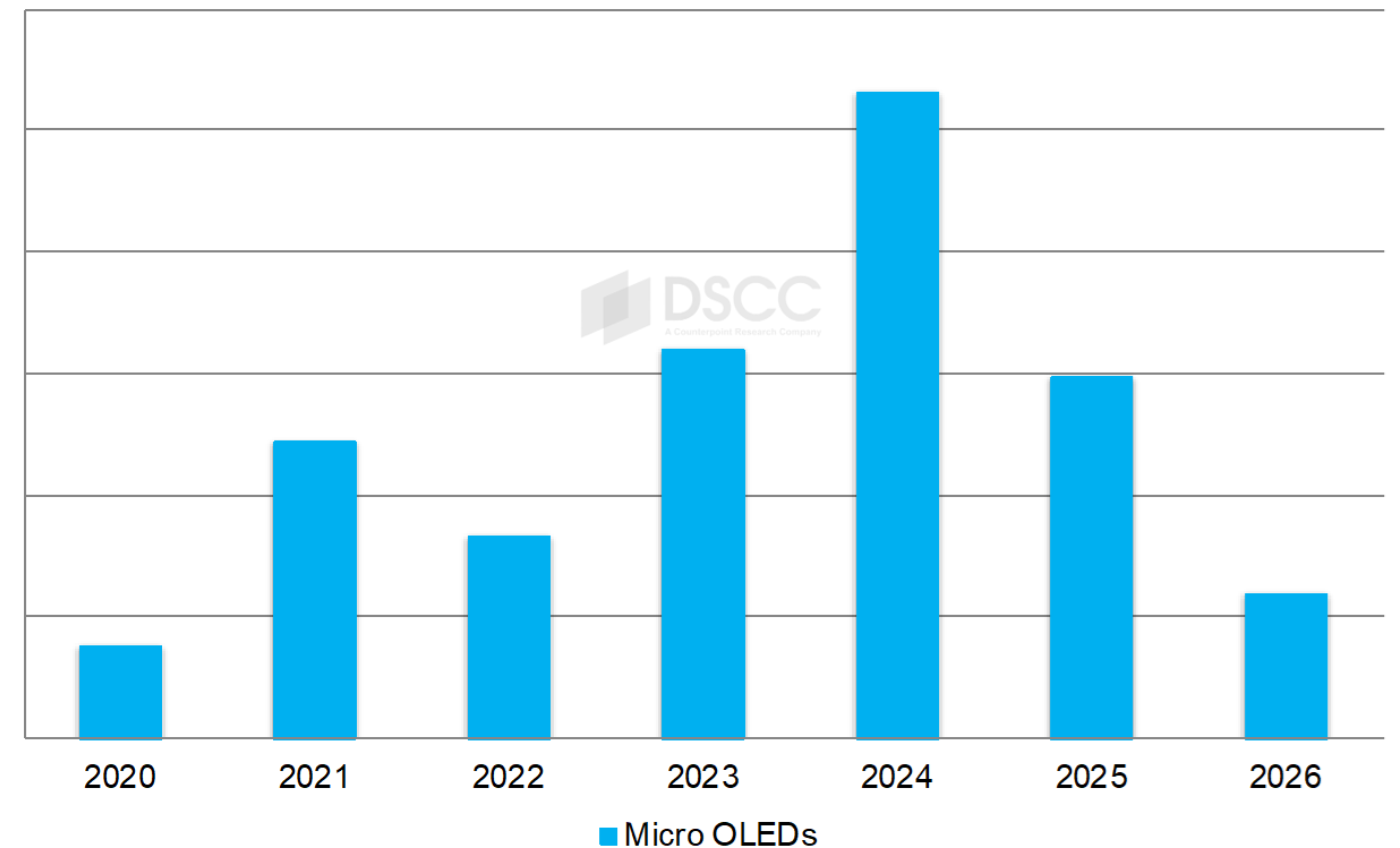

According to DSCC CEO Ross Young, "The latest report shows that 2024 is expected to be the peak year in Micro OLED fab spending in the near term, as shown below, in response to strong demand for more capacity as the market accelerates. In fact, DSCC expects Apple to design in a second panel supplier in 2024 from China around mid-year to boost competition with its current supplier resulting in lower panel prices, lower street prices in the future and higher volumes. China is expected to account for 85% of Micro OLED equipment spending from 2020-2026, ensuring high market share in Micro OLEDs as with other display technologies. The report focuses on equipment purchased by Micro OLED panel suppliers which includes OLED frontplane, color filter and limited backplane equipment with most companies purchasing patterned CMOS wafers from foundries and partners."

Micro OLED Equipment Spending

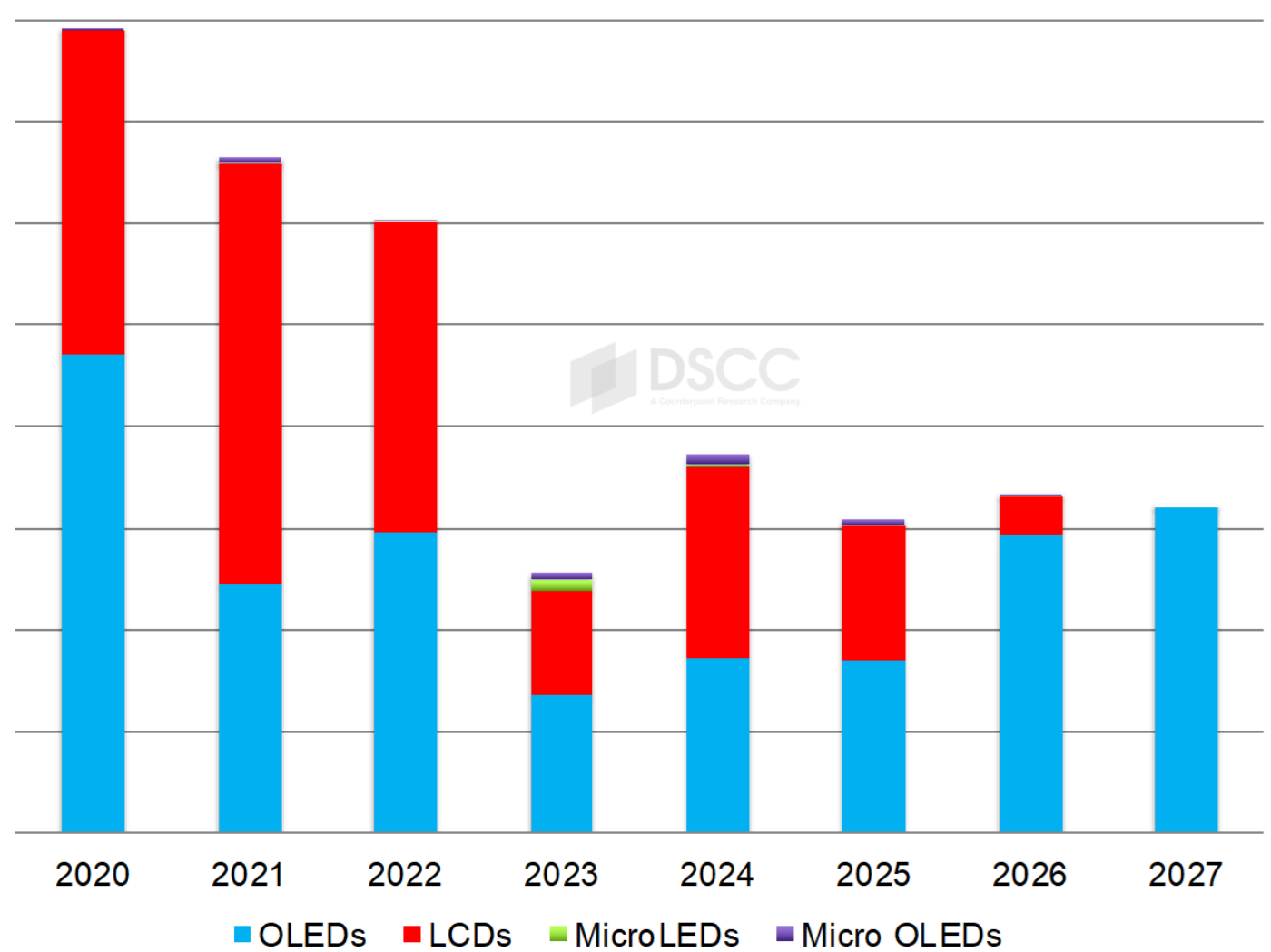

In terms of total display equipment spending from 2020-2026, DSCC has lowered its outlook by 3.5% to $67B due to one cancellation, JDI’s G6 eLEAP OLED fab, and delays at G8.7 IT OLED fabs from BOE, LGD and Visionox, which more than offset 12 new smaller LCD and OLED investments. In 2024, DSCC expects spending to rise 49% to $7.6B before falling 19% in 2025 to $6.2B. The delays have smoothed out the 2024-2027 spending figures which now range between $6B and $8B per year. While OLEDs led 2023 spending with a 54% share, LCDs are actually expected to lead in 2024 with a 50% share with OLEDs at 46% and Micro OLEDs at 4%. OLEDs should reclaim leadership in 2025 at 55% with LCDs at 43%.

DSCC’s Display Equipment Spending Forecast*

By equipment supplier for all segments, the Canon group, which also includes Tokki and Anelva, led with a 10% share followed by Applied Materials at 8% and Nikon at 4%. Of the top 15 suppliers, there were six from Japan, four from China, three from Korea and two from the US. In 2024, DSCC forecasts Canon’s share will rise to 13% with AMAT’s share rising to 9% and Nikon’s share rising to 7%. Seven of the top 15 companies should see at least 100% Y/Y growth and there are expected to be eight companies from Japan in the top 15 with four from Korea, two from China and one from the US.

By panel supplier from 2020-2027, DSCC shows BOE leading with a 24% share followed by China Star at 18%, Tianma at 11%, HKC at 10%, Visionox at 9%, LGD at 8% and SDC at 7%. China Star led in 2022 and 2023, SDC is expected to lead in 2024 and BOE is expected to lead in 2025.

For more information about the Quarterly Display Capex and Equipment Market Share Report, please contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.