Ross Young

Ross.Young@DisplaySupplyChain.com

FOR IMMEDIATE RELEASE: 09/06/2018

DSCC Forecasts Reduced Display Capex from 2019-2021 after Record 2016-2018 Spending Causes Surge in Capacity Growth

Austin, TX -

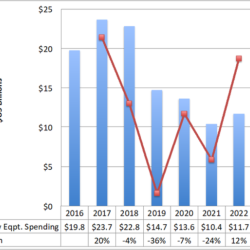

Display Supply Chain Consultants (DSCC) has released its latest LCD and OLED equipment spending, capacity and supplier market share results and forecasts as part of its Quarterly Display Capex and Equipment Service (Q3’18 issue). DSCC expects display equipment spending to slow from 2019-2021 after an unprecedented level of spending the past three years as shown in Figure 1.

While 2016-2018 spending averaged $22 billion per year, 2019-2021 spending is expected to average $13 billion per year. This drop is a result of significant new mobile and TV capacity coming online, saturating those markets and impacting companies’ bottom lines. Total display supply growth is expected to average an unprecedented 10% per year from 2018-2020 which has panel makers concerned given that operating margins fell to just 2% in the second quarter of 2018 with industry-free cash flow at -$2.5 billion.

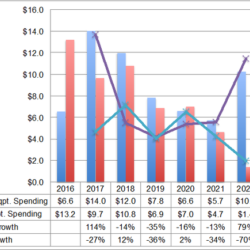

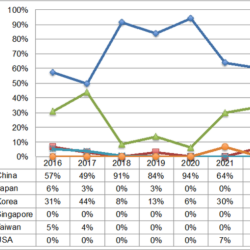

In 2018, based on the latest fab schedules after interviewing equipment companies, materials suppliers, glass suppliers and panel suppliers, display equipment spending is expected to be down just 4% to $22.8 billion – the second best year in the history of the display market. LCD spending targeting 65-inch+ TV panels is expected to rise 12%, offset by OLEDs declining by 14% as shown in Figure 2. OLEDs are expected to account for a 53% share of spending. China is expected to account for a 91% share of spending as shown in Figure 3. Equipment companies stronger in LCD equipment should have a good year.

2019 is expected to fall 36% due to delays in both LCDs and OLEDs as a result of reduced profitability and large surpluses in OLEDs. Both LCD and OLED spending are expected to be weak down 36% and 35%, respectively. China is expected to account for an 84% share with Korea at 13%.

While we previously expected a V-shaped recovery in OLEDs, it now appears to be U-shaped given all the existing capacity already in place to serve the mobile market where LCDs still have a viable position in the market. This will impact 2020 and 2021 equipment spending. 2020 is forecasted to fall 7% with LCDs up 2% and OLEDs down 16%. LCDs are expected to account for 52% of spending, and China is expected to dominate with a 94% share. In 2021, OLEDs are expected to fall another 13% with LCDs down 34%, resulting in a 24% industry decline with China accounting for a 64% share of spending.

In 2022, we expect OLED spending to surge as mobile OLED capacity tightens, helped by larger displays and growing foldable demand causing Samsung, BOE and others to build new fabs in response. OLED spending is expected to rise by 79%, offsetting current weakness forecasted in LCDs. This will result in 12% growth overall. Bookings should rise 32% in 2021 to meet the growth in 2022 spending, which should be a catalyst for equipment stocks.

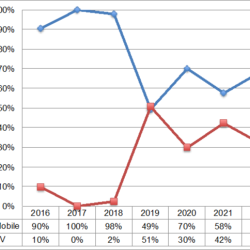

One bright spot over the forecast period is increased spending on OLED and quantum dot (QD) OLED TVs. While mobile applications dominated OLED spending through 2018, DSCC sees strong demand for OLED TVs, accounting for a majority of OLED spending in 2019 and at least a 30% share per year from 2020-2022 as shown in Figure 4. In addition, we have begun separately tracking QD OLED equipment spending as Samsung Display looks to enter the TV market with its own flavor of OLED technology, which has great potential to lower the costs and improve the performance of OLED TVs.

In terms of the latest capacity outlook, DSCC sees:

- 6% lower capacity for 2022 than previously forecasted due to the removal of the Foxconn 10.5G fab, the 8.5G TwinStar India fab and mobile OLED fab delays at BOE, LGD and SDC. Conversions to OLED TV fabs at both LGD and SDC will also reduce industry overall capacity.

- 7.5% CAGR for display capacity in 2022 to 393.5M square meters.

- LCD capacity growing at a 5.9% CAGR with OLEDs growing at a 31% CAGR.

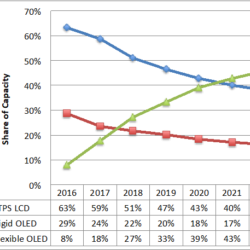

- OLEDs are expected to overtake LTPS/oxide LCDs in mobile capacity in 2021 on 22% CAGR vs. 4% CAGR for LCDs. OLEDs are expected to have a 62% share of advanced mobile capacity in 2022, up from 41% in 2017.

- Flexible OLEDs are expected to overtake rigid OLEDs in 2018 and LTPS LCDs in 2021 as shown in Figure 5. Flexible OLEDs are expected to grow at a 36% CAGR and earn a 46% share in 2022, up from 27% in 2017.

- Rigid OLEDs are expected to grow at a 5% CAGR with LTPS/oxide growing at a 3.5% CAGR.

- China’s share of total display capacity is expected to rise from 36% in 2017 to 53% in 2022 on a 17% CAGR. From 2020, China will have more than a 2X higher share than Korea or Taiwan.

- No other region is expected to have more than 1% CAGR in capacity over this period. Korea’s LCD capacity is expected to shrink at a -4% CAGR.

- China, Japan and Korea are all expected to enjoy impressive growth in OLEDs, growing at 94%, 64% and 19% CAGRs respectively.

- Korea will remain the leading region for OLEDs, but its share is expected to shrink from 93% in 2017 to 57% in 2022. China’s share is expected to surge from 6% in 2017 to 41% in 2022.

- In total OLED capacity, LG Display is expected to overtake Samsung in 2020 with BOE #3.

- In just mobile OLED capacity, Samsung will maintain a dominant position throughout the forecast, with its share not falling below 50% until 2022.

- BOE is expected to overtake LGD for #2 from 2020.

- SDC has the highest share of internal capacity that is OLED. LGD should have an even higher share of internal capacity that is OLED from 2021.

For more information about DSCC’s Quarterly Display Capex and Equipment Service, which also includes an LCD and OLED capacity database/report, weekly PO and equipment awards and analysis of all publicly traded equipment and panel supplier financial results, please visit: displaysupplychain.com/quarterly-capexequipment-service.html

DSCC CEO Ross Young will be presenting the latest outlook for the OLED market at the upcoming OLEDs World Summit 2018 on September 19, 2018 in San Francisco, CA. If you would like to meet with him there, please contact him at ross.young@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.