DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 10/09/2023

DSCC Expects the Advanced TV Market to Decline 1% Y/Y in 2023 – Recovery Expected for 2024

La Jolla, CA -

Advanced TV shipments are expected to decline in both units and revenue in 2023, but units are expected to increase 4% Y/Y to 22M units and increase 6% Y/Y in revenues to $25.4B in 2024, according to the latest update to DSCC’s Quarterly Advanced TV Shipment and Forecast Report. This report covers the worldwide premium TV market, including the most advanced TV technologies: WOLED, QD-OLED, QDEF, MicroLED and MiniLED with 4K and 8K resolution. The report looks at current and future TV shipments and revenues by technology, region, brand, resolution and screen size, and forecasts the growth of all these technologies.

DSCC expects a 1% Y/Y unit decline and 9% Y/Y revenue decline in 2023. OLED TV is expected to decline 19% Y/Y in units and 21% Y/Y in revenues and Advanced LCD TV units to increase 7% Y/Y in units and decrease 6% Y/Y in revenues on 7% Y/Y blended ASP declines.

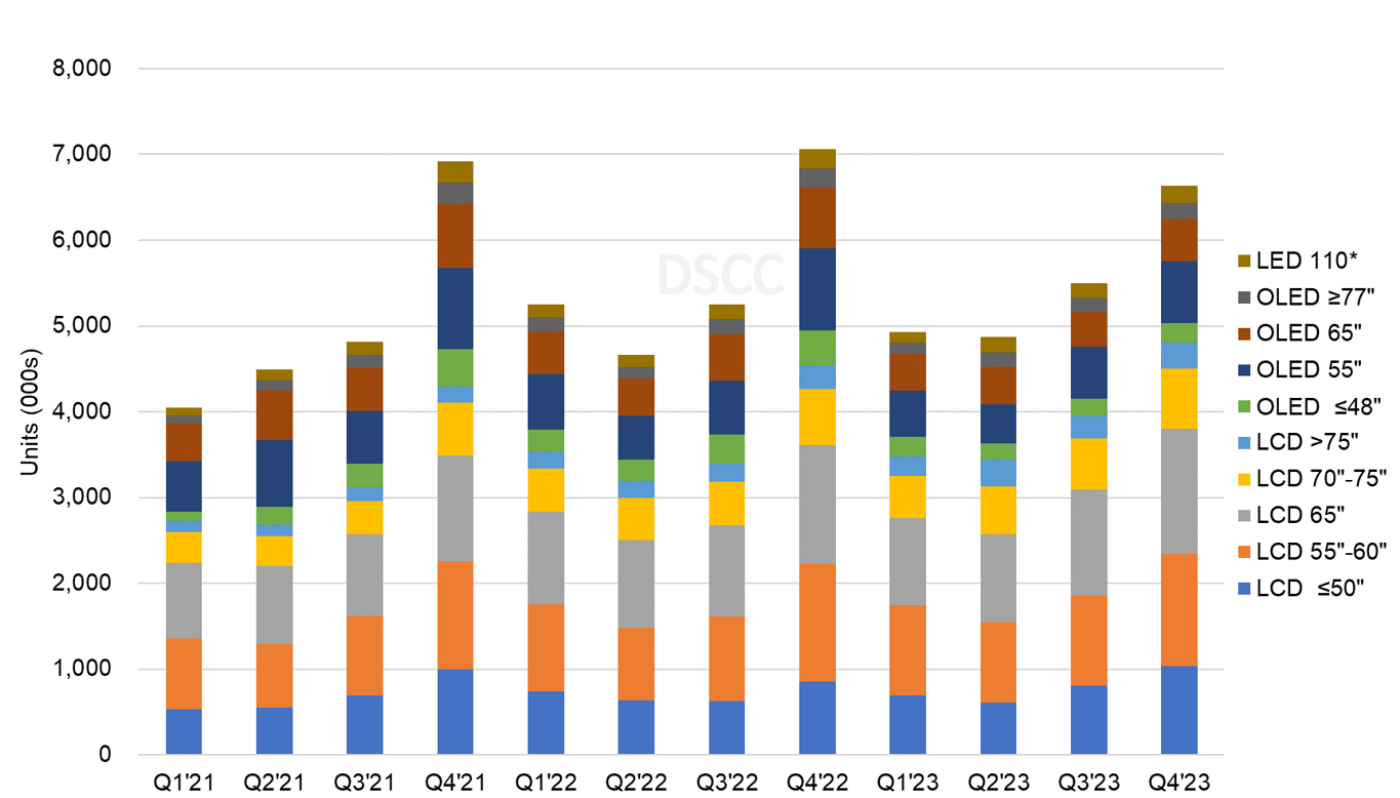

Quarterly Advanced TV Shipments by Screen Size and Technology, Q1’21 to Q4’23

According to DSCC’s Senior Director David Naranjo, “After a 4% Y/Y increase in Q2’23, we expect total Advanced TV shipments to increase 5% Y/Y in Q3’23 and decline 6% Y/Y in Q4’23 on back to school and holiday seasonality. The Y/Y decline in Q4’23 is the result of a tough compare to Q4’22. In Q4’22, brands exceeded the typical volumes estimated for Q4 seasonality in anticipation of China reopening post-pandemic and Chinese New Year’s expected seasonality and promotions.” In Q4’23, DSCC expects brands to take a more cautious approach. OLED TV units are expected to decline 18% Y/Y in Q3’23 and decline 29% Y/Y in Q4’23 on continued price declines and holiday promotions. Advanced LCD TV units are expected to increase 16% Y/Y in Q3’23 and 6% Y/Y on strong seasonality, price promotions and holiday discounts. The Y/Y increase for Advanced LCD TV units is the result of faster ASP declines when compared to OLED TVs. As an example, for 2023, for the larger display sizes of 65” and 75”/77”, DSCC expects ASPs for Advanced LCD TVs to drop 4% Y/Y and 6% Y/Y respectively, while OLED TV ASPs for a 65” is expected to decline 9% Y/Y but increase 14% Y/Y for a 77” OLED TV.

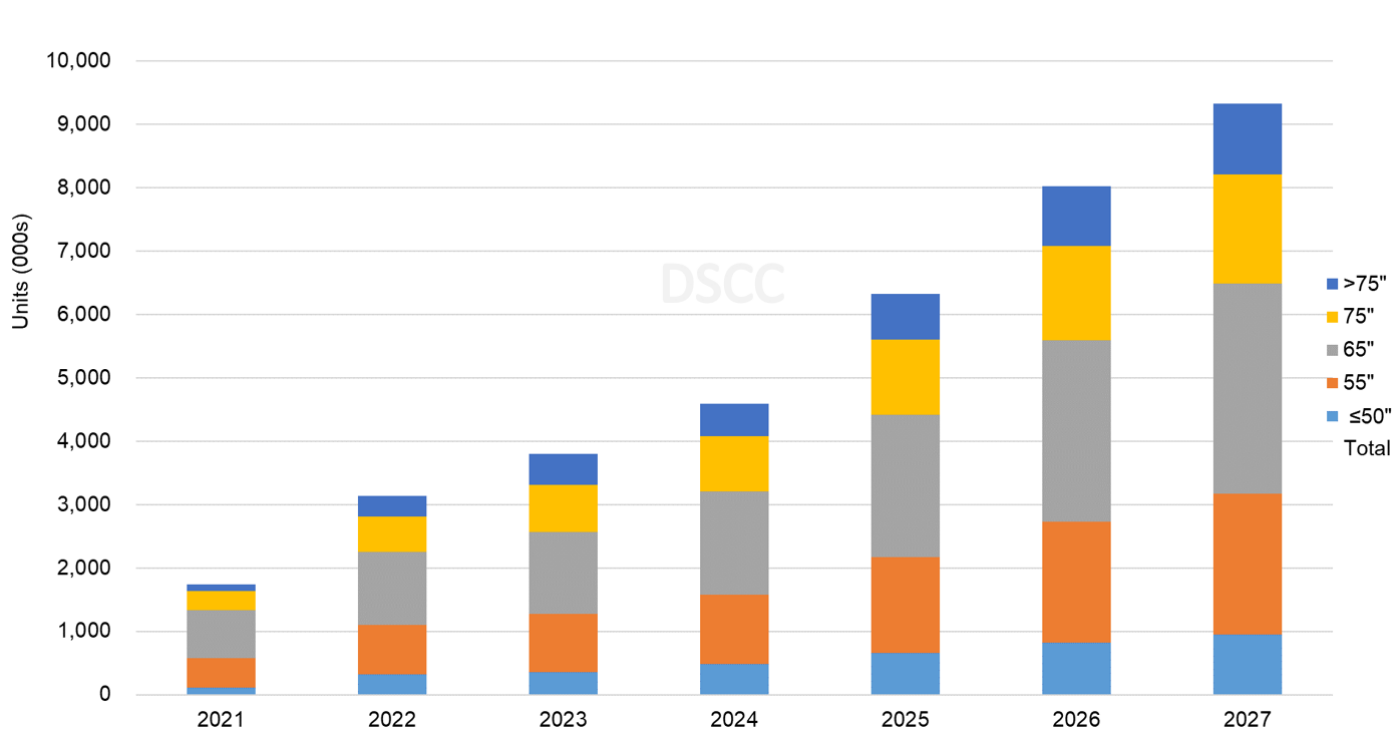

In the updated long-term forecast, total Advanced TV shipments are expected to grow by a 9% CAGR from 2023 to 2027 to 30M units. OLED TV units expected to grow at a 13% CAGR from 2023-2027 to 9.2M units. Advanced LCD TV units expected to grow at an 7% CAGR from 2023-2027 to 20.6M units. Including QD-OLED, OLED TV is expected to achieve a 31% share of Advanced TVs in 2027.

Advanced TV Shipments by Screen Size and Technology, 2019 to 2027

Advanced TV revenues are expected to grow at a 5% CAGR from 2023 to 2027 to $29.3B. OLED TV revenues are expected to grow at a 7% CAGR from 2023 to 2027 to $11.3B. Advanced LCD TV revenues are expected to grow at a 1% CAGR to $16.3B in 2027. The Advanced LCD TV revenue share is expected to decline to 55% in 2027 from 64% in 2023.

The category of Advanced TVs represents only a small fraction of the total TV market in unit terms, but it represents where all “the action” is in the technology battle. The champion for the LCD camp is MiniLED, and the forecast for MiniLED TV sets by screen size is shown in the final chart here. MiniLED TV was introduced by TCL in 2019 but sold only in very small volumes in 2020, but TCL has been followed by most other major brands introducing MiniLED TVs, including Samsung and LG in 2021 and Sony and others in 2022. DSCC expects an ongoing battle between MiniLED, White OLED and QD-OLED for the premium TV market. Because of the Gen 10.5 LCD fabs, DSCC expects that MiniLED will have a cost and price advantage over OLED in the largest screen sizes. MiniLED and big screens will also be the main pathway to 8K TVs; a majority of 8K TVs have employed MiniLED technology starting in 2022.

MiniLED TV Shipments by Screen Size, 2021 to 2027

With continued growth and ample capacity by multiple panel makers, DSCC expects MiniLED LCD TV shipments to exceed OLED TV shipments (including QD-OLED) in 2027, and DSCC expects that LCD TV (both MiniLED and standard backlit models) will continue to maintain >60% unit share of Advanced TVs.

DSCC’s Advanced TV Shipment and Forecast Report includes technical descriptions of all major advanced TV display technologies, plus quarterly shipment history through Q4’23, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs and other metrics. The report includes DSCC’s quarterly forecast out to 2027 across technology, region, resolution and size. Readers interested in subscribing to the DSCC Advanced TV Shipment Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.