DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 10/02/2023

DSCC Expects OLED Smartphone Panel Revenues to Decline 11% Y/Y in 2023 with an Expected Recovery in 2024

La Jolla, CA -

In the recently released Advanced Smartphone Display Shipment and Technology Report, DSCC revealed additional granularity and insights for the smartphone display market. In this issue, a new chapter was added on camera technology and nomenclature as well as Google’s smartphone roadmap through 2024, which shows display sizes increasing for all models.

For 2023, DSCC expects OLED smartphones to decline 0.3% Y/Y to 585M units and decline 11% Y/Y to $29B in panel revenues. This is the result of the slower than expected reopening of China, post-pandemic, elevated inventories during the 1H’23 and the macroeconomic environment.

For 2023, for flexible OLEDs, DSCC expects 14% Y/Y growth with a 9% Y/Y panel revenue decline as a result of blended panel ASPs declining 20%. According to DSCC’s Senior Director David Naranjo, “In the September 25th edition of the DSCC Weekly Review, the lead article highlighted the aggressive flexible OLED panel price cutting environment that started in 2022 by Chinese OLED panel suppliers in order to gain share from SDC’s rigid OLED business. While they did gain share and significantly impacted SDC’s rigid OLED business, they also suffered from very poor financial performance. Flexible OLED prices got so low that they even declined below SDC’s rigid OLED prices which shifted significant volume from rigid to flexible OLEDs. As that article also pointed out, in Q4’23, panel suppliers are looking for around a 5% - 10% increase. This increase may be difficult to achieve in 2023 as a result of existing projects and brands’ bargaining power. However, it may be more achievable in 2024 with demand being higher.”

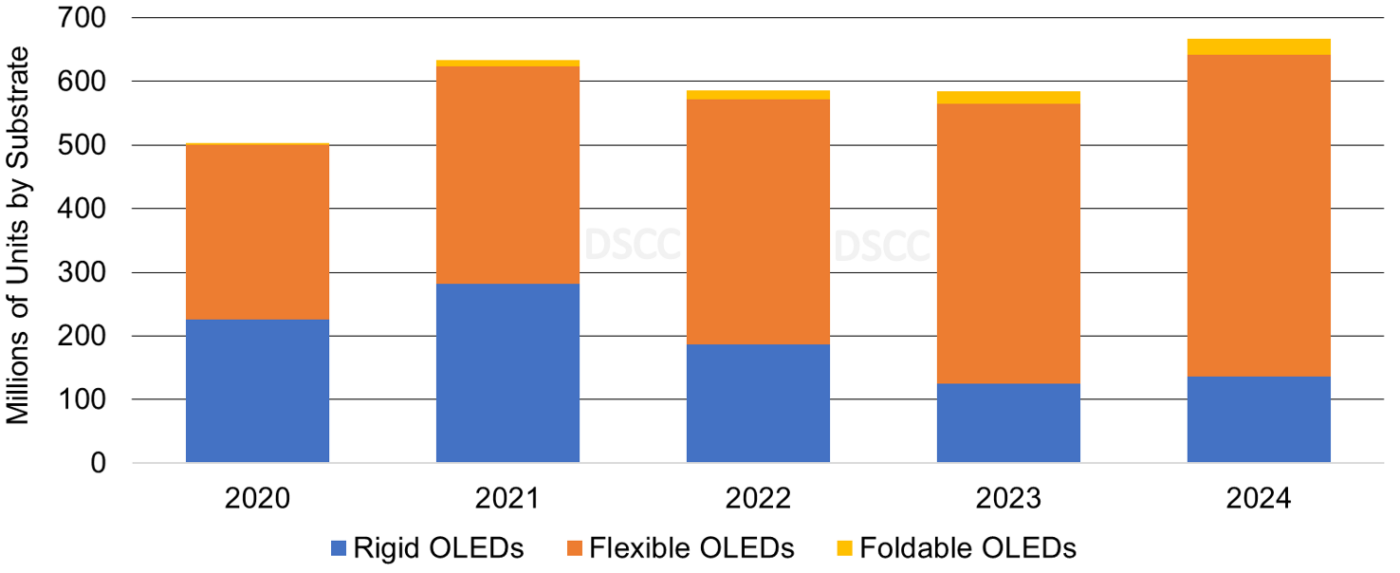

DSCC expects flexible OLED smartphones to continue to gain share and rise from a 66% unit share in 2022 to a 75% unit share in 2023. The flexible OLED revenue share of the OLED smartphone panel market is expected to rise from 80% in 2022 to an 83% share in 2023. In addition, foldable OLEDs are expected to rise from a 2.6% unit share in 2022 to a 3.4% share in 2023 on 20M panels with the foldable panel revenue share rising from 7% to 10%. DSCC expects rigid OLEDs to experience a 33% Y/Y unit decline and 49% Y/Y panel revenue decline in 2023 causing its share to fall from 32% in 2022 to 21% in 2023, with its revenue share falling from 13% in 2022 to 7% in 2023 with ASPs down 24%.

For 2024, DSCC expects flexible OLED smartphone panels to reach a 76% unit share, and an 81% revenue share as a result of double-digit ASP declines and foldable OLED smartphone panels to reach a 4% unit share and an 11% revenue share. Although rigid OLED excess capacity is being used for IT applications, and rigid OLEDs declined in 2023 by 33% Y/Y, DSCC expects rigid OLEDs to have a 9% Y/Y increase in 2024 on 6% Y/Y ASPs (after falling 24% in 2023) as brands look to recover volume lost in 2023 for entry level price points.

Annual OLED Smartphone Panels by Substrate, 2020 -2024

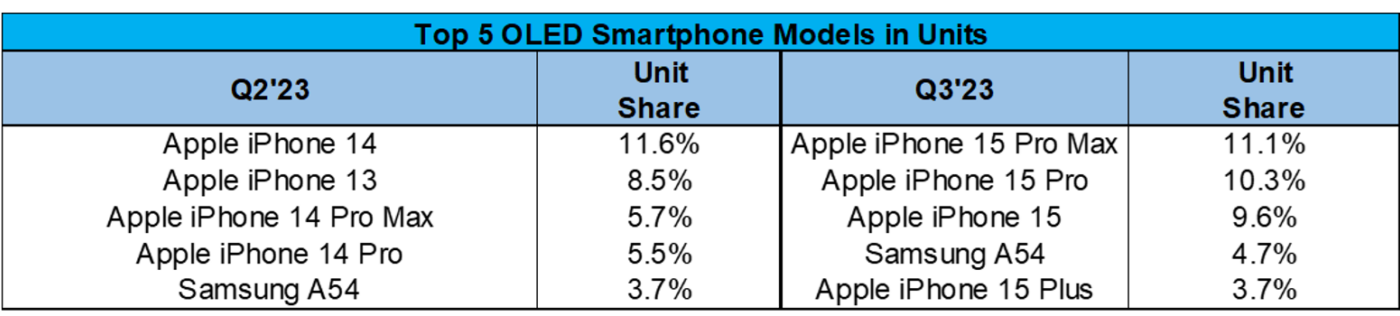

In Q2’23, OLED smartphones were up 6% Q/Q and 4% Y/Y to 138M OLED smartphone panels. The Q/Q and Y/Y increase was the result of the 7% Q/Q increase for flexible OLED panel shipments driven by higher volumes from Honor, Oppo, Vivo and Xiaomi, a 1% Q/Q increase for rigid OLED panels driven by higher volumes from Honor and Vivo and a 60% Q/Q increase for foldable OLED smartphones fueled by Huawei, Samsung, Techno and Xiaomi. In Q2’23, Apple had four of the top five models with the iPhone 14, iPhone 13, iPhone 14 Pro Max and iPhone 14 Pro. The Samsung S23 Ultra was #5. These five models accounted for a 35% unit share and 52% smartphone revenue share.

In Q3’23, DSCC expects a 1% Q/Q and 13% Y/Y increase to 139M panels as a result of significant panel shipments for the iPhone 15 series, triple-digit growth for foldable OLEDs as well as improved inventories and seasonality. In Q3’23, DSCC expects the iPhone 15 Pro Max, iPhone 15 Pro and iPhone 15 to be the top three models accounting for 31% unit share and 47% smartphone revenue share.

Q2’23 and Q3’23 Top 5 Rigid and Flexible OLED Smartphone Panel Procurement by Brand

During the Global Display Supply Chain Dynamics & Technology Outlook Conference on November 1, 2023, DSCC will be presenting additional results and the outlook for the smartphone display market.

David Naranjo will be presenting more insights including the smartphone shipments, additional near term forecasts, cost and price outlook, etc., from other reports including the Monthly Flagship Smartphone Tracker and Smartphone Display Cost Report. He will also highlight which brands and panel suppliers took share in 2023 and are best positioned to gain ground in 2024.

Ross Young will be presenting the latest results and outlook for the foldable and rollable smartphones. He will highlight which brands, models and panel suppliers gained share in 2023 and which are best positioned in 2024. His talk will also examine how the category is likely to evolve, what new products are coming and when Apple is likely to enter the foldable smartphone category.

Rita Li will be presenting and examining the strategy of the Chinese OLED suppliers including technology commercialization plans, capacity, allocation by customer, price trends and cost reduction efforts.

Jeff Fieldhack from Counterpoint Research will examine the latest insights from Counterpoint’s regional smartphone data. Hsi talk will reveal which countries are outperforming and which are underperforming in 2023 and what is expected in 2024. It will also examine other important product and market trends.

Readers interested in subscribing to the Advanced Smartphone Display Shipment and Technology Report should contact info@displaysupplychain.com. This report includes all DSCC’s smartphone data from covering all OLED smartphone and panel shipments by brand, model, all display and major non-display parameters, panel and device revenues and forecasts by quarter and by year through 2027. In addition, it provides insights into technology and innovation trends in OLED display technology, which is applicable to smartphones. There are over 1,300 AMOLED smartphone configurations in our database including variations by substrate, TFT backplane, panel supplier, refresh rate, chipset supplier, 5G networks and much more.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.