DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 07/03/2023

DSCC Expects Apple and Samsung to Account for 74% of OLED Smartphone Panel Revenues on 4% Y/Y Unit Growth in 2023

La Jolla, CA -

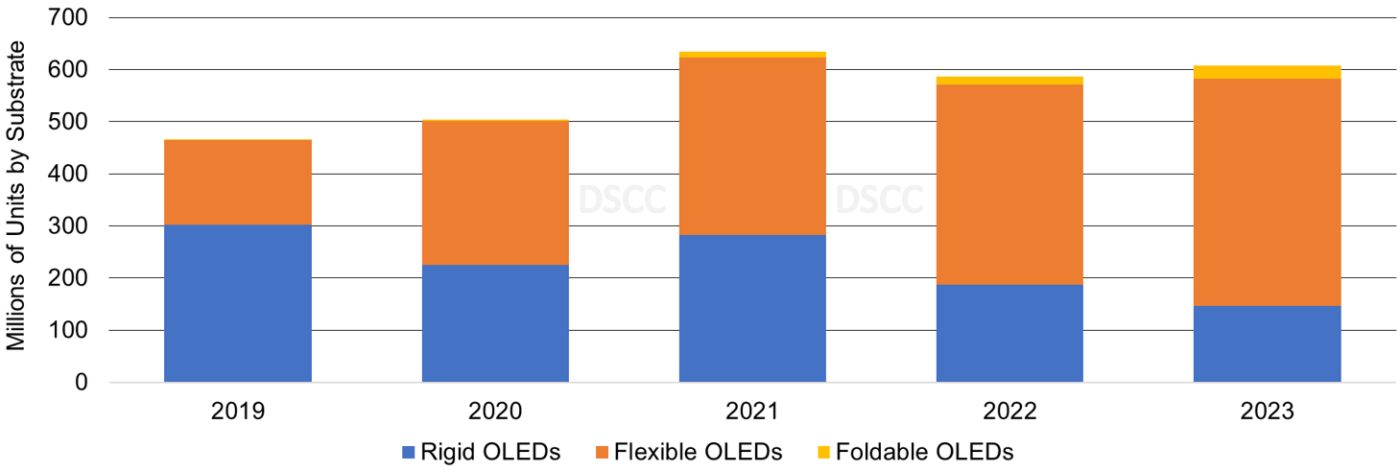

In the recently released Advanced Smartphone Display Shipment and Technology Report, DSCC revealed additional granularity and insights on Q1’23 OLED smartphone results and the latest forecast through 2027. In 2023, OLED smartphone panel shipments are expected to increase 4% Y/Y to 608M panels and panel revenues are expected to decline 5% Y/Y to $30.8B on 16% Y/Y panel ASP declines for flexible OLED panels, 21% Y/Y panel ASP decline for rigid OLED panels and 11% Y/Y panel ASPs declines for foldable OLED panels.

According to David Naranjo, Senior Director at DSCC, “For 2023, we expect flexible OLED smartphone panels to increase by 13% Y/Y for a 72% unit share, up from 66% in 2022, followed by foldable/rollable OLED smartphone panels increasing by 68% Y/Y to a 4% unit share, up from 3% in 2022 and rigid OLED smartphone panels declining by 21% Y/Y for a 24% unit share, down from 32% in 2022.”

Annual OLED Smartphone Panels by Substrate, 2019 -2023

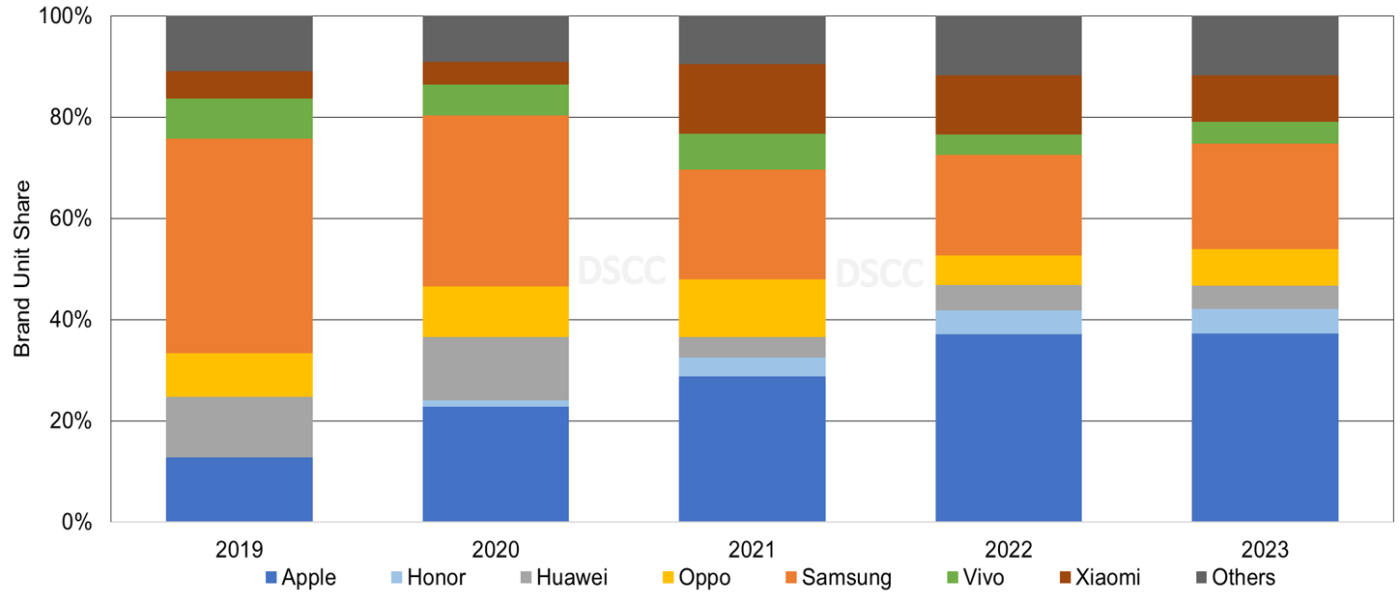

Apple recently achieved a market valuation of $3T and Apple and Samsung are due to announce new flagship smartphones in the next few months. In the report, DSCC shows that for 2023 by brand, it expects Apple to have a 37% unit share and 55% panel revenue share and Samsung to have a 21% unit share and 19% panel revenue share. In Q1’23, Samsung had 38% Q/Q unit overall smartphone growth on 199% Q/Q growth for the flexible OLED S23 series. For Apple, we are seeing the start of panel shipments in Q2’23 and we expect the iPhone 15 series to represent 45% of the panel shipment product mix for Apple in 2023.

Annual OLED Smartphone Panel Shipment Unit Share by Brand, 2019-2023

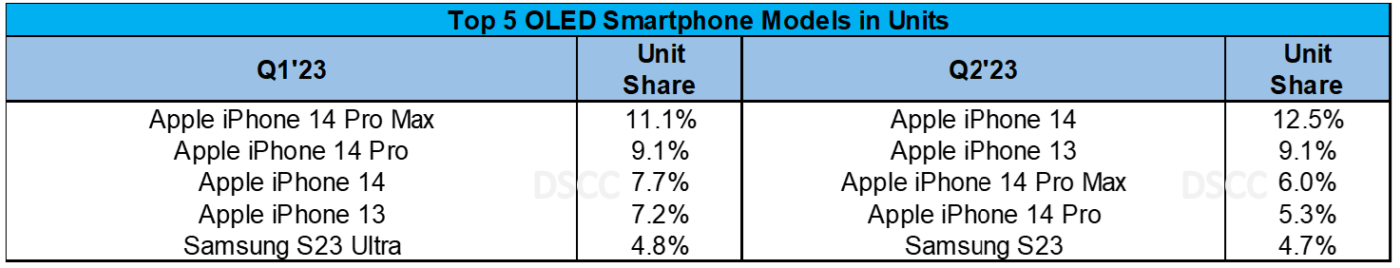

In Q1’23, the Apple iPhone 14 Pro Max, iPhone 14 Pro and the iPhone 14 were the top three models for units. For flexible OLED models, Apple and Samsung models accounted for a combined 64% unit share and 76% smartphone revenue share in Q1’23 on the strength of Apple iPhone 14 series and S22 series.

In Q2’23, on a unit and smartphone revenue basis, the Apple iPhone 14 is expected to be in the #1 position. The iPhone 13 and iPhone 14 series and the start of panel shipments for the iPhone 15 models are expected to account for 48% of all smartphone revenue in Q2’23. Samsung is expected to account for 21% of all smartphone revenue in Q2’23.

Q1’23 and Q2’23 Top Five OLED Smartphones

Readers interested in subscribing to the Advanced Smartphone Display Shipment and Technology Report should contact info@displaysupplychain.com. This report includes all DSCC’s smartphone data for all OLED smartphone and panel shipments by brand, model, all display and major non-display parameters, panel and device revenues, regional forecasts for select models and forecasts by quarter and by year through 2027. In addition, it provides insights into technology and innovation trends in OLED display technology, which is applicable to smartphones. There are over 1,250 AMOLED smartphone configurations in our database including variations by substrate, TFT backplane, panel supplier, refresh rate, chipset supplier, design rules, 5G networks and much more.

If you're interested in free expert insights, subscribe to our email list here: EXPERT INSIGHTS, FREE DELIVERY.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.